Part 2

advertisement

Money in the Competitive

Equilibrium Model

Part 2

Explicit Money Demand

Cash-in-Advance Model

Optimal Monetary Policy

Money and Real Ecomomic

Variables

• Neutrality of Money a one-time change in the

level of the nominal money supply has no effect

on real economic variables (only nominal).

• Superneutrality of Money a change in the

growth rate of the money supply has no effect on

real economic variables.

– Sometimes “superneutrality” definition exclued the

real money supply as a “real” economic variable.

• CE model with Ad-Hoc money demand (e.g.

Cagan model) money is neutral and

superneutral.

• An increase in the money growth rate

and e MD R and (M / P)

• Classical dichotomy No change in CE values

of y*,N*,c*, and r*.

• This result may not be true in CE model with

explicit money demand.

• Reminder: Nominal versus Real Interest Rates:

1 Rt

(1 rt )

1 t

or

r=R–

where R = nominal rate

r = real rate

inflation rate = t

(exact)

(approx)

Pt 1 Pt Pt 1

1

Pt

Pt

Explicit Money Demand

• Incorporate use of money as a decision of the

representative household.

• Assumptions:

(A1)

Income yt is exogenous

(A2)

Households make an asset allocation

decision between nominal money (M)

and bonds (B).

(A3)

TO BE ADDED

(A4)

Government directly sets nominal Ms

(A6)

No uncertainty

• Money Supply:

M ts1 M ts X t (1 )M ts

where Xt = transfer of money to public

(“helicopter drop”) and = money growth rate

• Reminder: Real vs Nominal Interest Rates:

(1+r) = (1+R)/(1+) or

r = R – (approx)

where

Pt 1 Pt Pt 1

t

1

Pt

Pt

• Timeline

• Budget Constraint (nominal terms)

Pt yt Bt (1 Rt ) M t X t Pt ct M t 1 Bt 1

Total Sources of Income = Total Uses

• Optimization: Choose {ct, Mt, Bt} to

max t 1u (ct )

t 1

subject to (BC)

(BC)

• State Variables: M t , Bt

Control Variables: c , B

t

t 1

• Bellman Equation:

V ( M t , Bt ) max u (ct ) V ( M t 1 , Bt 1 )

ct , Bt 1

subject to

M t 1 Pt yt Bt (1 Rt ) M t X t Pt ct Bt 1

(transition equation)

• FOC and Envelope conditions contradict unless

R = 0.

• If R > 0 then M = 0. Money is an inferior asset

to bonds and valueless.

• Need another constraint to give money value.

Cash-in-Advance Model

(A3): Consumption must be purchased with cash

carried in advance from previous period.

• New Timeline

• Cash-In-Advance Constraint

M t Pt ct

(CIA)

• State Variables: M t , Bt

Control Variables: c , B

t

t 1

• Bellman Equation:

V ( M t , Bt ) max u (ct ) V ( M t 1 , Bt 1 ) t [ M t Pt ct ]

ct , Bt 1

CIA Constraint

subject to

M t 1 Pt yt Bt (1 Rt ) M t X t Pt ct Bt 1

• FOC & Envelope

MRSct ,ct1

1 Rt

u ' (ct )

u ' (ct 1 ) 1 t

(1 rt )

(1)

• Market-Clearing (MC):

Goods:

ct = yt = y*

Money:

Mt = Mts

Bonds:

Bt = 0

(Note from BC if two of the three markets clear, the third

one will also clear)

• The CE are values for {ct, yt, Bt, rt, m=(M/P), R,

} solving (1), (2) and (MC) conditions.

• CE Values:

c* = y*

(exogenous)

*

r* = (1/ – 1) = r

(M/P)* = c*

(Neutrality)

(1+R) = (1+r*)(1+*) (Fisher Effect)

• One time changes in the level of Ms are neutral.

• Increases in the growth rate of money () leads

to an increase in * and R* while leaving c*, y*,

r* unchanged. (Superneutrality)

• This result comes from exogenous income and

is not general when model is modified.

• Consider adding labor market and firms to the

model.

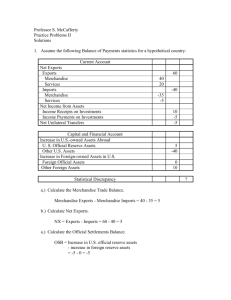

Figure 15.4 Scatter Plot of the Inflation Rate vs.

the Growth Rate in M0 for the United States,

1960–2003

CIA Model with Production

• Cooley and Hansen (1989 – AER)

• Modify to Include Labor and Production

(1) yt = f(Nt)

(2) Utility in each period: U(ct,lt) = u(ct) + u(lt)

(3) Firms demand labor to max P = f(N) - wN

(4) Modify (BC)

Ptwt Nts Bt (1 Rt ) M t X t Pt Pt Pt ct M t 1 Bt 1

(5) (CIA) is the same

(BC)

• Household FOCs

MRSct ,ct1

1 Rt

u ' (ct )

u ' (ct 1 ) 1 t

(1 rt )

u ' (lt )

wt

MRSl ,c

u ' (ct ) 1 Rt

(FOC1)

(FOC2)

• Firm FOC:

wt f ' ( Nt ) MPNt

• Market-Clearing (MC):

Goods:

ct = y t

Money:

Mt = Mts

Bonds:

Bt = 0

Labor:

Nts = Ntd = Nt

• Utility: Assume u(c,l) = ln(c) + ln(l)

(FOC3)

• A steady state equilibrium occurs where N, c, y,

(M/P) are constants (to be determined, NOT

exogenous):

N t N t 1 N *

ct ct 1 c *

yt yt 1 y *

M t M t 1

m*

Pt

Pt 1

• Steady State CE Values:

(s1)

*

(s2)

r* = (1/ – 1) = r

(s3)

(1+R) = (1+r*)(1+*)

(s4)

(s5)

(Fisher Effect)

f ( N *) f ' ( N *)

1 N *

1

c* = y* = f(N*) = (M/P)=m*

• Notice (s4) N* and there will be an inverse

relationship between N* and .

• In CIA model with production money is neutral

but not superneutral.

• Money growth and inflation negatively affects

employment, consumption, output, real

balances.

• Inverse Phillips Curve - relation between

inflation and “unemployment” is upward sloping.

• Inflation “taxes” work and households substitute

towards leisure.

Inflation & Employment: Cross Country

Study [Cooley & Hansen (1989)]

Xass

1976-1985

Austria, Belgium

Demark, Finland

France, Germany

Greece, Ireland, Italy

Netherlands, Norway

Portgual, Spain

Switzerland, UK

Canada, US, Australia

New Zealand, Japan

Chile, Venezuela

Vertical Axis =

employment

Costs of Inflation and Optimal

Monetary Policy

• Recall relation between nominal and real

interest rates:

r* R

(approx)

1 R

(1 r*)

1

(actual)

• CEM (in steady state) r* = r constant.

• increase increases increases R

• High inflation leads to higher costs of conducting

transactions with currency (“shoe-leather” costs).

• Welfare costs of inflation: Lucas (2000,

Econometrica) estimates that reducing US

steady inflation from 10% to 0% is equivalent to

1% gain in real GDP.

• What is the optimal money growth rate * in the

CE/CIA model with production?

• What’s the “optimal” inflation rate in the longrun?

• What value of maximizes utility of the

representative household?

• The best (welfare maximizing) allocation is

the Pareto Optimal allocation:

MRSl,c = w

MRSct,ct+1 = (1+r*)

• Money distorts the optimal decisions of

individuals away from social planner.

• The “Friedman Rule” says that the optimal

monetary policy is to deflate the money supply

and prices at a rate which drives R = 0:

(i) If R = r* + ,

R = 0 * r* < 0

(ii) If (1+R)

= (1+r)(1+) = (1+)/

R = 0

* - 1 < 0

• The Friedman Rule requires deflation at the real

interest rate or rate of time preference.

(M. Friedman – The Optimum Quantity of

Money, 1969)

• Practical Considerations

* Drive the nominal rate on riskless assets

(government bonds) to zero.

* Nominal variables (wages) are downward

rigid.

* There are always temptations to inflate the

money supply (funding G, business cycles).

* Assumes certainty about money/prices.

* Most economists agree that low inflation

(rather than deflation) is more practical.

M1 Money Supply, 2000-2010

Levels

M1 Money Supply, 2000-2010

Growth Rate

• Current monetary policy and the Friedman rule:

– High money growth rate

– Historically Low Nominal Interest Rates

– Moderate/Low Inflation

• Model provides good description of long-run or steady

inflation but lacks “liquidity effects” important for

business cycle analysis.

• Solution? Modify Model or abandon market-clearing

(stick prices, IS-LM?)

• Readings:

Williamson, Ch 10, p 363-368, 377-388, 395-399

Williamson, Ch 15, p 559-575