Program Mission Statements - Eastern Michigan University

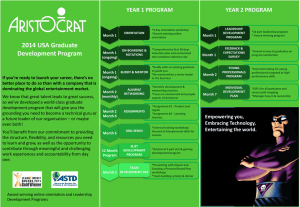

advertisement

Department of Accounting and Finance Programs—Missions Master of Science in Accounting—MSA (ACC- Graduate) The mission of this 30 credit hour graduate program is to develop the knowledge, skills, and attitudes required to successfully enter the public accounting profession, as well as high level accounting positions in other industries. Students receive a balanced broad-based business education and in-depth understanding of the theoretical and practical concepts of accounting. Educational objectives are based on those articulated by the American Institute of Certified Public Accountants (AICPA) Core Competency Framework. Students may follow one of these four tracks in the program: Financial and Professional Services, Accounting Information Systems, Tax & Financial Planning, or Internal Auditing. Graduates will be prepared for careers as public accountants, chief financial officers, accounting managers, internal and external auditors, tax accountants and managers, information systems analysts, controllers, consultants, among others. Successful graduates meet the educational requirements to take professional certification exams, such as a certified public accountant (CPAs licensed by states), information systems auditor (CISA from ISACA), and certified internal auditor (CIA from the IIA), among others. This program serves a diverse group of students from southeastern Michigan, the Midwest, and foreign countries. A six course foundation is provide for students who do not have a business or accounting undergraduate degree. Bachelors in Business Administration—Accounting Major (ACC-Undergrad) The mission of this 124 credit hour undergraduate program is to develop the knowledge, skills, and attitudes required to be successful managerial accountants within manufacturing, retail, and service organizations and to provide the foundation for graduate accounting education. This program serves a diverse group of students from southeastern Michigan, the Midwest, and foreign countries. Graduates will be prepared for careers as controllers, financial managers, cost accountants, budget analysts, internal auditors, operations or general ledger analysts, among others. The program will prepare students for professional certifications, such as certified management accountant (CMA from the IMA), certified internal auditor (CIA from the IIA), certified financial manager (CFM from the IMA), and others. Bachelors in Business Administration—Accounting Information Systems Major (AIS) The mission of this 124 credit hour undergraduate program is to develop the knowledge, skills, and attitudes required to be successful accountants within the information systems field or as external AIS consultants. The program also provides the foundation for graduate accounting education leading to careers in public accounting. Educational objectives are based on those articulated by the Information Systems Audit and Control Association’s (ISACA) Model Curriculum 2004. This program serves a diverse group of students from southeastern Michigan, the Midwest, and foreign countries. Graduates will be prepared for careers as information systems analysts, operations analysts, controllers, financial managers, internal auditors, security professionals, among others. Successful graduates will meet the educational requirements to take professional certifying exams, such as certified information systems auditor (CISA from ISACA) or certified information systems security professional (CISSP from ISC2). 150-hour Master of Science in Accounting (MSA) and BBA-Accounting (ACAC) The mission of this 150-hour combined graduate and undergraduate program is to allow undergraduate students to commit early to a graduate program and efficiently meet the goals and objectives of both a BBA with a major in Accounting and an MSA within a five-year period (if fulltime students). Both degrees are awarded upon completion of the graduate program. Benefits of earning a graduate and undergraduate degree in the combined Accounting at EMU include: graduating with fewer credits (i.e., 150 rather than 154 or more when students change majors) a longer time period to interact with faculty and staff a longer time period to develop working relationships with student colleagues satisfaction of the educational requirement by Michigan (and other states) for licensure as a certified public accountant preferred recruiting status for public accounting employers that only hire graduates who have completed 150 hours of education familiarity with university processes and resources avoidance of costs that arise when relocating for a graduate program at another university Graduates will be prepared for careers as public accountants, chief financial officers, accounting managers, internal and external auditors, tax accountants and managers, information systems analysts, controllers, consultants, among others. Successful graduates meet the educational requirements to take professional certification exams, such as a certified public accountant (CPAs licensed by states), information systems auditor (CISA from ISACA), and certified internal auditor (CIA from the IIA), among others. 150-hour Master of Science in Accounting (MSA) and BBA-Accounting (AIAC) The mission of this 150-hour combined graduate and undergraduate program is to allow undergraduate students to commit early to a graduate program and efficiently meet the goals and objectives of both a BBA with a major in Accounting Information Systems and an MSA within a five-year period (if full-time students). Both degrees are awarded upon completion of the graduate program. Benefits of earning a graduate and undergraduate degree in Accounting at EMU include: graduating with fewer credits (i.e., 150 rather than 154 or more when students change majors) a longer time period to interact with faculty and staff a longer time period to develop working relationships with student colleagues satisfaction of the educational requirement by Michigan (and other states) for licensure as a certified public accountant preferred recruiting status for public accounting employers that only hire graduates who have completed 150 hours of education familiarity with university processes and resources avoidance of costs that arise when relocating for a graduate program at another university Successful graduates meet the educational requirements to take professional certification exams, such as a certified public accountant (CPAs licensed by states), information systems auditor (CISA from ISACA), certified information systems auditor (CISA from ISACA), and certified information systems security professional (CISSP from ISC2). Graduates will be prepared for careers as information systems analysts, operations analysts, controllers, financial managers, internal auditors, security professionals, among others.