(a) Retail Inventory Method The Harmes Company is a

advertisement

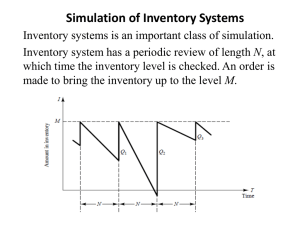

Solutions Guide: Please reword the answers to essay type parts so as to guarantee that your answer is an original. Do not submit as your own. (a) Retail Inventory Method The Harmes Company is a clothing store that uses the retail inventory method. The following information relates to its operations during 2010: Cost Retail Inventory, January 1 $28,400 $40,200 Purchases 65,200 100,000 Markups (net) — 1,900 Markdowns (net) — 400 Sales — 80,000 Required: Compute the ending inventory by the retail inventory method for the following cost flow assumptions: 1. FIFO 3. LIFO 2. Average cost 4. Lower of cost or market (based on average cost) 1. Cost Purchases Markups (net) Markdowns (net) $65,200 $65,200 Cost-to-retail ratio: 2. Cost Beginning inventory Purchases Markups (net) Markdowns (net) Goods available for sale $28,400 65,200 $93,600 Cost Beginning inventory 40,200 $141,700 (80,000) $ 61,700 $39,611 Retail $ 40,200 100,000 1,900 (400) $141,700 $ 93,600 0.661 $141,700 Less: Sales Ending inventory at retail Ending inventory at cost ($61,700 x 0.661) 3. $100,000 1,900 (400) $101,500 $ 65,200 0.642 $101,500 Add: Beginning inventory 28,400 Goods available for sale $93,600 Less: Sales Ending inventory at retail Ending inventory at cost ($61,700 x 0.642) Cost-to-retail ratio: Retail $28,400 (80,000) $ 61,700 $40,784 Retail $ 40,200 Cost-to-retail ratio: $ 28,400 0.706 $ 40,200 Purchases Markups (net) Markdowns (net) Cost-to-retail ratio: 65,200 100,000 1,900 (400) $101,500 $ 65,200 0.642 $101,500 Goods available for sale $93,600 Less: Sales Ending inventory at retail Ending inventory at LIFO cost [$40,200 x 0.706 (beginning layer)] $28,400* [$21,500 x 0.642 (new layer)] 13,803 Total $42,203 $141,700 (80,000) $ 61,700 *Adjusted for rounding error to original cost. 4. Cost Beginning inventory Purchases Markups (net) Retail $28,400 65,200 $93,600 Cost-to-retail ratio: $ 40,200 100,000 1,900 $142,100 $ 93,600 0.659 $142,100 Less: Markdowns (net) Sales Ending inventory at retail Ending inventory at LCM ($61,700 x 0.659) (400) (80,000) $ 61,700 $40,660 (b) Dollar-Value LIFO Retail On December 31, 2009, Davison Company adopted the dollarvalue LIFO retail inventory method. Inventory data for 2010 are as follows: LIFO Cost Retail Inventory, 12/31/09 $360,000 $500,000 Inventory, 12/31/10 ? 660,000 Increase in price level for 2010 10% Cost-to-retail ratio for 2010 70% Ending inventory converted to base-year prices = $660,000 x 100 = $600,000 110 There is a $100,000 increase in retail inventory in base year prices ($600,000 - $500,000) Ending inventory at retail consists of: $500, 000 100 $500, 000 100 $100, 000 110 $110, 000 100 $610,000 Ending inventory at cost: Beginning inventory = $360,000 $110,000 x 0.70 = 77,000 $437,000 (c) Lower of Cost or Market The Palmquist Company has five different inventory items that it values by the lower of cost or market method. The normal markup on all items is 20% of cost. The following information is obtained from the company’s records: Item Units Cost Replacement Cost Net Realizable Value 1 500 $10.00 $ 9.10 $ 9.20 2 400 8.00 8.10 7.80 3 300 15.00 13.50 14.00 4 200 18.00 12.00 17.00 5 100 25.00 25.50 25.30 Required 1. Compute the lower of cost or market value for each item. 2. Compute the total inventory value if the lower of cost or market is applied to (a) each individual item and (b) the inventory as a whole. Explain the reason for the difference between the two values. 3. Compute the lower of cost or market value for each item if the Palmquist Company uses IFRS. 1. Item 1 2 3 4 5 a 2. Cost $10.00 8.00 15.00 18.00 25.00 Replacement $ 9.10a 8.10 13.50a 12.00 25.50 NRV $ 9.20 7.80a 14.00 17.00 25.30a NRV Less Markup $ 7.20 6.20 11.00 13.40a 20.30 Designated as market a. If lower of cost or market is applied to individual items Item 1 2 3 4 Units 500 400 300 200 Valuation $ 9.10 7.80 13.50 13.40 Total $ 4,550 3,120 4,050 2,680 Lower of Cost or Market $ 9.10 7.80 13.50 13.40 25.00 5 100 25.00 Total inventory valuation 2,500 $16,900 b. If lower of cost or market is applied to whole inventory Item 1 2 3 4 5 Units 500 400 300 200 100 Total value Cost $ 5,000 3,200 4,500 3,600 2,500 $18,800 Market $ 4,550 3,120 4,050 2,680 2,530 $16,930 Lower of cost or market on inventory as a whole $16,930 The difference of $30 between the two values is caused by item 5. When the items were taken individually, the market values for items 1-4 were used whereas the cost of item 5 was used. Then, when the LCM was applied to the inventory as a whole the total market value of all items was used. Thus, the difference of $30 is accounted for as follows: 100 units x ($25.00 cost - $25.30 market) = $30. 3. Case Cost 1 2 3 4 5 $10.00 $ 8.00 $15.00 $18.00 $25.00 Net Lower Realizable of Cost Value or Market $ 9.20 $ 7.80 $14.00 $17.00 $25.30 $ 9.20 $ 7.80 $14.00 $17.00 $25.00 NRV NRV NRV NRV cost (d) Retail Inventory Method The Weber Corporation uses the retail inventory method to estimate its inventory balances. The following information is available on June 30: Cost Retail Cost Retail Inventory, January 1 $25,000 $60,000 Markdowns — $7,000 Purchases 75,000 180,000 Additional markups — 3,000 Sales — 210,000 Markdown cancellations — 2,000 Purchases returns 2,000 5,000 Markup cancellations — 1,000 Sales returns — 5,000 Required: 1. Compute the inventory on June 30 using the “normal” retail inventory method (lower of average cost or market). 2. Independent of Requirement 1, assume that the June 30 inventory was $80,000 at retail and that the cost-to-retail ratio is 50%. If the price level of the inventory has risen by 5% during the period, compute the cost of the June 30 inventory under the dollar-value retail LIFO method, assuming that the company adopted the method at the beginning of the year. 1. Beginning inventory Net purchases ($75,000 - $2,000; $180,000 - $5,000) Net markups ($3,000 - $1,000) Cost $ 25,000 Retail $ 60,000 73,000 175,000 2,000 $237,000 $ 98,000 Cost-to-retail ratio: $98,000 0.414 $237,000 Less: Net sales ($210,000 - $5,000) Net markdowns ($7,000 - $2,000) Ending inventory at retail Ending inventory at cost ($27,000 x 0.414) (205,000) (5,000) $ 27,000 $ 11,178 2. Ending inventory at retail: $80,000 Ending inventory at retail in base-year prices: $80,000 1.05 = $76,190 Beginning inventory at retail in base-year prices: $60,000 Increase in inventory at retail in base-year prices: $16,190 Increase in inventory at retail in current-year prices: $16,190 x 1.05 = $17,000 Increase in inventory at cost in current-year prices: $17,000 x 0.50 = $8,500 Ending inventory at cost--base: $25,000 --addition: 8,500 Ending inventory, total cost $33,500

![Winter 2010 Quiz 2 Ch 9 10[1]](http://s3.studylib.net/store/data/005849740_1-93a37338ab62849607e52f87564e2567-300x300.png)