Bank Secrecy Act Policy - Banker`s Compliance Consulting

advertisement

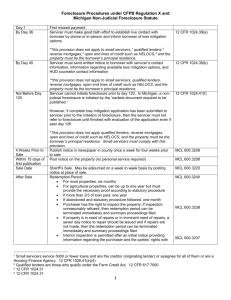

Error Resolution Policy Be it resolved that this is the policy of [INSERT BANK NAME] to maintain maximum compliance with Error Resolution provisions of The Real Estate Settlement Procedures Act (RESPA). Compliance with the RESPA requirements regarding error resolution shall include but will not be limited to: 1. [Accepting error notices at all locations] or [Informing borrowers of a designated address to be used to submit error notices.] 2. Promptly responding to written notifications of alleged errors related to the servicing of closed-end mortgage loans subject to RESPA. 3. Required for large servicers: [Keeping borrowers informed of their rights to submit error notices and the process for doing so.] 4. Required for large servicers: [Communication with borrowers who incorrectly submit an error notice to an address provided in connection with loss mitigation or continuity of contact requirements to notify them of the correct address and process for submitting error notices] and/or, [Forwarding notices incorrectly submitted to an address provided in connection with loss mitigation or continuity of contact requirements to the proper address for receiving error notices]. 5. Required for large servicers: [Informing borrowers who are not satisfied with the resolution of a previously submitted verbal error notice of their rights to submit a written error notice and the process for doing so.] 6. Required for large servicers: [Maintaining records in accordance with regulatory requirements.] This policy was approved by the Board of Directors of [INSERT BANK NAME] on [INSERT DATE]. _________________________________ _____________________________________ Secretary Board Chairman Banker’s Compliance Consulting consultants@bankerscompliance.com 800-847-1653 Error Resolution Procedures General: [INSERT BANK NAME] will: [Include as applicable] 1. [Accept error notices at all locations] or [Inform borrowers of a designated address to be used to submit error notices.] 2. Promptly respond to written notifications of alleged errors related to the servicing of closed-end mortgage loans subject to The Real Estate Settlement Procedures Act (RESPA) including, as applicable: a. A written acknowledgement; b. Correction of the alleged error and/or any different/additional error found; and notification to the borrower; and/or, Conducting an investigation and providing notification to the borrower that no error occurred . c. 3. Required for large servicers: [Keep borrowers informed of their rights to submit error notices and the process for doing so.] 4. Required for large servicers: [Communicate with borrowers who incorrectly submit an error notice to an address provided in connection with loss mitigation or continuity of contact requirements to notify them of the correct address and process for submitting error notices] and/or, [Forward notices incorrectly submitted to an address provided in connection with loss mitigation or continuity of contact requirements to the proper address for receiving error notices]. 5. Required for large servicers: [Inform borrowers who are not satisfied with the resolution of a previously submitted verbal error notice of their rights to submit a written error notice and the process for doing so.] 6. Required for large servicers: [Maintain records for a minimum of one year after a mortgage loan is paid/discharged or servicing is transferred. Any information provided by a borrower should be maintained in a manner that allows it to be provided as part of a servicing file within five days.] Covered Errors: [INSERT BANK NAME] must respond to written notification of a potential error related to any of the following on a closed-end mortgage loan subject to RESPA: 1. Failure to accept a conforming payment. 2. Failure to apply a payment per the terms of the loan or in accordance with applicable law. 3. Failure to credit a payment on the date received as required. 4. Failure to pay property charges in a timely manner or refund an escrow account balance as required. 5. Imposition of an unreasonable fee or charge. 6. Failure to provide an accurate payoff statement in a timely manner. 7. Failure to provide accurate information on potential loss mitigation options and foreclosure, as required. 8. Failure to transfer servicing information to a subsequent servicer in a timely and accurate manner. 9. Making the first required foreclosure notice or filing when prohibited. 10. Moving for foreclosure judgment, order of sale, or conducting a foreclosure sale when prohibited. 11. Other errors related to mortgage loan servicing. Banker’s Compliance Consulting consultants@bankerscompliance.com 800-847-1653 1 Error Resolution Procedures (Continued) Exceptions: These Error Resolution requirements do not apply if the error notice relates to: 1. Loan Origination. 2. Loan Underwriting. 3. The Sale (including the determination to sell, assign or transfer) or Securitization of a loan. These procedures are also not required if an error notice is received on a payment coupon. Customer Notification: [INSERT BANK NAME] will accept notifications of errors at all locations. Promptly upon receipt, notifications should be forwarded to (Department) to ensure proper and timely resolution.] Or [INSERT BANK NAME] has designated a specific address for receiving error notifications. (exclusive address or location), must be disclosed on the following: This address, 1. An initial written notification that includes a statement that the address must be used to notify the bank of any errors; 2. [Any required periodic statement or coupon book]; 3. The bank website; 4. [The 45-day early intervention notice for delinquent borrowers under §1024.39]; and, 5. [Any loss mitigation communication under §1024.41]. Written notification must be provided to borrowers prior to any change in this address. Note: If designating a specific address, the same address must be used for information requests under §1024.36. The dispute notice MUST include: 1. Borrower name; 2. Identity of the loan subject to the notice; and, 3. The error believed to have occurred Required for Large Servicers: [INSERT BANK NAME] will ensure borrowers remain informed of their rights to submit error notices and the process for doing so. Thus, the Bank will provide notification [on the Bank’s website] or [on other notice, mailed or delivered electronically]. (Note: For example, a Bank could include on their periodic statements that borrowers have certain rights under Federal law related to resolving errors and requesting information about their account, and that they may learn more about their rights by contacting the servicer, and a statement directing borrowers to a website that provides a description of the procedures…This requirement may also be satisfied by describing the procedures with the initial notification of an exclusive address.) Required for Large Servicers: [Information on a borrower’s rights to submit an error notice and the process for doing so should also be provided during verbal communications with borrowers who express dissatisfaction with the servicing of their mortgage loan, especially during communication with borrowers dissatisfied with the resolution of a previously submitted verbal error notice.] Banker’s Compliance Consulting consultants@bankerscompliance.com 800-847-1653 2 Error Resolution Procedures (Continued) Required for Large Servicers: [If a notice of error is incorrectly submitted to an address provided to a borrower in connection with loss mitigation or continuity of contact requirements, the bank will [inform the borrower of the proper procedures and correct address for submitting error notices] and/or [forward such notices to the proper address for receiving error notices]. Response Requirements: As applicable, upon receipt of an error notice, [INSERT BANK NAME] must: 1. Provide written acknowledgement of receipt of an error notice to the borrower within five days (excluding Saturdays, Sundays and holidays). However, if an error is corrected and the borrower is notified of the correction within five days (excluding Saturdays, Sundays and holidays) of receipt of the error notice, no separate acknowledgement is required to be provided to the borrower. 2. Correct any error and notify the borrower of the correction in writing, including the effective date of the correction and contact information (including a phone number) for additional assistance 3. Conduct an investigation and provide a written explanation that no error occurred; the reasons for this determination; a statement of the right to request documentation relied upon and information on how to do so; and contact information (including a phone number) for additional assistance; and/or, 4. Correct all errors, even if a different or additional error(s) is found as a result of the investigation. Written notification should be provided to the borrower that describes the identified errors; the action taken to correct the errors; the effective date of the correction; and, contact information (including a phone number) for additional assistance. The bank must generally complete the above requirements no later than 30 days (excluding Saturdays, Sundays and holidays) after receipt of the error notice. This timeframe may be extended an additional 15 days (excluding Saturdays, Sundays and holidays) if the borrower is notified in writing within the first 30 days of the extension and the reasons for it. However, for certain types of errors, special timing requirements apply. These timing requirements cannot be extended: 1. For errors involving a claim that the bank failed to provide an accurate payoff statement within a reasonable time (generally within seven business days of a written request), the bank must complete any investigation, correct any errors, and, provide proper notification no later than seven days (excluding Saturdays, Sundays and holidays) after receipt of the error notice. 2. For errors related to making the first foreclosure notice or filing, moving for foreclosure judgment or sale, or conducting a foreclosure sale when otherwise prohibited, the bank must complete the above requirements prior to any foreclosure sale or within 30 days (excluding Saturdays, Sundays and holidays) of receipt of the error notice, whichever is earlier. However, if the error notice is received no more than seven days before a foreclosure sale, it is only required that the bank make a good faith attempt to respond to the borrower (may be verbally) and correct the error or state why the bank believes no error has occurred. If a borrower requests documentation relied upon in making any determination that an error did not occur, it should generally be provided at no cost within 15 days (excluding Saturdays, Sundays and holidays) of the request. However, if any documents contain confidential, proprietary, or privileged information, the borrower must be notified in writing within 15 days (excluding Saturdays, Sundays and holidays) that such documents will not be provided due to the confidential, proprietary, or privileged content. Banker’s Compliance Consulting consultants@bankerscompliance.com 800-847-1653 3 Error Resolution Procedures (Continued) Restrictions: [INSERT BANK NAME] may not charge any fee or require any payment be made as a condition of responding to an error notice. The bank cannot furnish adverse credit information related to an alleged error to any consumer reporting agency for 60 days after an error notice is received. However, a lender is not restricted from pursuing legal remedies otherwise allowed. This may include initiating foreclosure or proceeding with a foreclosure sale, unless an error notice relates to making the first foreclosure notice or filing, moving for foreclosure judgment or sale, or conducting a foreclosure sale when otherwise prohibited. Documentation may be requested from a borrower to assist with the investigation. However, the bank cannot require the requested items be submitted as a condition of conducting an investigation or determine that no error occurred because the requested documentation was not provided. Duplicative, Overbroad, or Untimely Disputes: [INSERT BANK NAME] is not required to follow these procedures if an error notice is determined to be: 1. Duplicative of a prior error notice that the bank has already responded to, unless new information reasonably likely to change the prior determination is presented. 2. Overbroad in that the bank is unable to determine a specific error which is believed to have occurred. 3. Untimely in that it is received more than one year after servicing is transferred or the loan is paid/discharged. However, if a duplicative, overbroad, or untimely error notice is received, written notification must be provided to the borrower no later than five days (excluding Saturdays, Sundays and holidays) after determining the notice is duplicative, overbroad, or untimely. The notification to the borrower must describe why the error notice is considered duplicative, overbroad, or untimely. Record Retention Required for Large Servicers: [Records shall be maintained for one year after a loan is paid/discharged or servicing is transferred. Any information provided by a borrower shall be maintained in a manner that allows it to be provided as part of a servicing file within five days.] Banker’s Compliance Consulting consultants@bankerscompliance.com 800-847-1653 4