Define Your Team & Develop Your Plan

advertisement

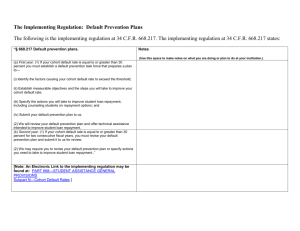

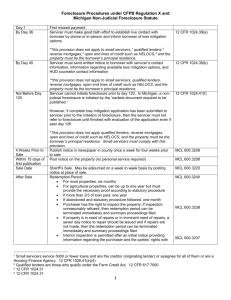

Default Prevention Define Your Team & Develop Your Plan Dana Kelly, Trainer Nelnet Partner Solutions How do you get a handle on default? You need a plan! • Success is achieved when solid plans are developed and executed. • A plan pulls together people and resources toward a common goal. • The plan provides for consistency and allows for data to steer participants toward beneficial outcomes. Define Your Team The job of your Default Prevention team is to: • Determine the source of your default risk • Decide what steps your school will take to reduce default risk • Represent all parts of the institution (including management and students), which will contribute to risk reduction activities • Allocate school resources to default reduction activities • Assess the effectiveness of default reduction activities over time (Are they working?) Team Members Members of the Default Prevention team may include: • Senior school officials • Representatives from various offices – – – – Student Affairs Academics Enrollment Management/Admission Other • Student representatives Define the Rules • Have regularly scheduled meetings – Distribute agenda/minutes, discuss agreed upon assignments – Provide training about default and prevention • Assign specific responsibilities in conjunction with your plan • Evaluate progress and adjust the plan • Celebrate and promote your successes Getting into the Game Conduct a risk analysis first. Why? • Creates understanding of who is defaulting and why • Allows for an increase in effectiveness of default prevention efforts • Reduces waste of time/resources • Provides the right target populations to engage The Data Use data to create a picture of borrowers at-risk of default • Who is not enough. • Why will require input of academic, student affairs, and other professionals. • Knowing why is necessary to create targeted, useful, and measureable interventions. Examples of Who • Never contacted • Excessive debt • Developmental studies • Academic preparedness • Late admits • Academic probation • Early withdrawal • No job in profession • Gradated • Certain majors • License exam • Attendance issues • No exit counseling • Student employment • Unsatisfactory SAP • Late majors Examples of Why • Finances/need • Poor study habits • Relationship issues • Basic skill deficits • Physical & mental health challenges • Feel unwelcome, no campus connection • Dependent-care • First generation, no role models or family support • Transportation • Housing • Language barriers • Transition difficulties Your Results • Your who will be unique. • Your why will also be unique and is vital to understanding your at -risk population. • The team you create will translate the who and why into core strategies that work to promote student success and reduce default. Possible Intervention Opportunities • Enhanced entrance and exit counseling • Financial literacy education • Collect more useful contact information • Early-stage (repayment) assistance • Late-stage (repayment) assistance Borrower Education is Fundamental Instill in borrowers that loan servicers are available to assist them. • Who is their servicer? • What does their servicer do? • When should they contact their servicer? • Where can they find out more about what their servicer offers? • How to determine if they have multiple servicers (FFEL/ED Owned)? Consider When it Makes Sense to Intervene • Borrower education about repayment • Financial literacy • Gain additional or updated contact information • Engage borrowers through social media for increased exposure Consider When it Makes Sense to Intervene • Use social media to promote good loan repayment • Ask borrowers to contact you if they have questions • Reiterate the importance of communicating with their servicer(s) • Validate contact information • Re-enrollment or transfer assistance • Employment counseling and search assistance • Job placement assistance Consider When it Makes Sense to Intervene • Contact borrowers in early-stage delinquency (30-90 days) directly • Contact those in late-stage delinquency (210+ days) – By phone, if possible – Review servicer information and urge servicer contact Borrower engagement is a key factor in successful default prevention! Leverage Points Identify your campus leverage points. Use these to gain active borrower participation. • Admissions • Entrance and exit counseling • Probation/SAP • Registration Tips for In-Repayment Engagement Make phone calls (most effective) – Use a light touch. You are calling to help, not to collect. Mail handwritten notes Send letters and/or e-mails – Hand-address regular envelopes – Use a stamp, not a postage meter – Consider colored envelopes or paper – Personalize the letter and sign it – Postcards can also be effective Student Success Model • Focus on helping borrowers develop a healthy relationship with their education – – – – – Increase program completion rates Decrease program completion time Help non-completers find a job Successful students = successful borrowers Leverage efforts to increase retention, graduation, and employment • This model establishes cooperation campus-wide • Goal is to ensure borrower completion • Targets students at risk of unofficial or official withdrawal Accountability Use what your data tells you. • Identify your at-risk populations • Reach out immediately with targeted campaigns • Help them remain in school • If they’ve already left, help them return – May involve help to overcome obstacles • If they will not return, help them understand their repayment obligations – Some think they do not owe anything because they left • Learn about their experiences – Use this info to help other students stay in school Exercise: Evaluating Where You Are Evaluate your default prevention readiness 1. What was our school’s FY ‘10 CDR? Draft ‘11? Are we likely to hit the 30% sanction level in September 2014? 2. What is the source of our default risk? Why is this an institutional issue? 3. Do we have the right team in place to develop and execute default prevention strategies? If not, who do we need to include on our team? 4. What general approach to default prevention strategies need to be considered in our plan to address the source of default risk? How will they work? Will they focus on measureable strategies? 5. How will the plan be executed, evaluated and adjusted? How/when will we communicate to management? Exercise: Getting To Where You Need to Be Clarify how you will get there 1. My default prevention team includes (who) because (why). 2. The buck stops at (executive/manager name). 3. Our CDR risk profile suggests (what). 4. Our traditional default prevention approaches include (what). 5. Our student-success focused default prevention approaches include (what). 6. Here are the elements we still need to add to our plan. (list). 7. Here are the steps necessary to complete our work. (list; see template in your handout) Leadership Buy-in • Global default risk isn’t going away. It will get worse over the next several years. • While outside servicers can help, reducing specific borrower risk is an inside job. • School leadership must be prepared to devote internal resources (people and time) to solve this problem. Questions or Discussion? Contact Information: Dana Kelly Regional Director/Trainer Nelnet Loan Servicing dana.kelly@nelnet.net 336.848.6441