Default Prevention Task Force

Why is Default Management Everybody’s

Business and Why a Plan?

2

In This Session

Section 1: Regulations

Section 2: Default Management Task Force

Section 3: Identifying Default

Section 4: NSLDS Reports

Section 5: Developing a Plan

Section 6: Federal Loan Servicers

Section 7: Resources

3

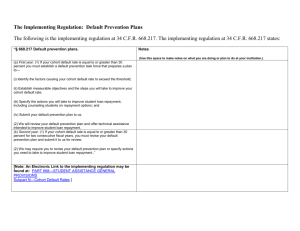

SECTION 1

Regulations

4

Regulations

34 CFR § 668.14(b)(15)

Schools participating for the first time or that have undergone a change in ownership that resulted in a change of control are required to use a default prevention and management plan to participate in Title IV programs.

34 CFR § 668.217

Institutions that have a 3-Year Cohort Default Rate of 30 percent or greater for any one federal fiscal year is required to establish a Default Prevention

Task Force to reduce defaults and prevent the loss of institutional eligibility.

5

ED Recommendation

The Department recommends that every school implement a default prevention and management plan consistent with § 668.217 to:

• Promote student and school success;

• Achieve low CDR; and

• Save students from the consequences of default.

6

SECTION 2

The Default Management Task Force

7

“Student Success” Approach

Focus is on helping borrowers to develop a healthy relationship with their education (student success

solutions) and include:

• Increasing program completion rates;

• Decreasing program completion time; and

• Helping non-completers find a job.

8

School-Based Default Prevention

1) Form a Default Prevention Team, set measurable goals and develop or adopt a default prevention plan.

2) Organize a Default Prevention Task Force.

• The Default Prevention Task Force will drive your default prevention process:

→ Assess the resources you have available;

→ Team participants SHOULD be across campus;

→ Identify the purpose of the task force; and

→ Detail responsibilities of determining risk.

9

Default Prevention Task Force

Task Force members should include:

• Senior school official(s);

• Representatives from various offices (Enrollment

Management, Academics, Student Affairs, IT and

Institutional Advancement);

• Career Services; and

• Student representative (Student Government, Pan-

Hellenic Council).

10

Activities for the Task Force

•

•

•

•

Study your student population.

→ Identify any common characteristics of your defaulters and non-defaults, and borrowers and non-borrowers.

Build on Early Intervention strategies already in existence.

Review all of your borrower education materials

Discuss your current strategies and determine what works and what may need some improvement

CONTINUED

11

Activities for the Task Force (cont.)

•

•

•

•

Work closely with your servicers.

Find out what type of services are available from your servicers.

Fine-tune your Loan Servicing procedures for the period while the borrower is at your school, in grace and repayment.

Have clear and precise procedures with a timeline of dates to take appropriate actions.

Default Management Strategy

Organize Task Force

Establish

Objectives

Define Default

Risk

Outline Actions

Submit Plan

(optional for some schools)

Organize a Default Prevention

Task Force

Assess resources for team

Identify members

Set Purpose

Detail Responsibility

Set Objectives:

Establish Objectives

Identify steps needed to achieve goal

Define and Identify Risk

Determine who is defaulting and why

Analyze data

Submit Plan

FSA’s Default Prevention Team to assist schools with:

Establishing their default prevention goals

Developing, refining and reviewing your default prevention plan.

Outline Actions

Specify actions needed to achieve your goal

Ensure actions are measureable

12

13

SECTION 3

Identifying Default:

Risks, Interventions, Strategies and Using The Data

14

Who are your Students?

• ?% students received GED

• ?% first generation college students

• ?% receive financial aid

• ?% of Pell recipients have Zero EFC

• ?% students in a particular major

• ?% students place into developmental Math or English

• ?% are part-time students

• ?% retention Spring to Fall – ?% retention Fall to Fall

• ?% team sports players

Steps to Identify Default Risk

Conduct Risk Analysis:

• You will need data! And someone to work the data!

→ Academic data: Program completion rates; retention rates; and data at the student level.

• Review combined NSLDS (default and delinquency) data and school data about defaulters and non-defaulters.

• Servicer data

Use data to create a picture of borrowers at-risk of default, e.g., who defaulted and why?

• ‘Who’ is not enough.

• ‘Why’ will require input of academic, student affairs and other professionals.

→ Knowing ‘why’ is necessary to create targeted, useful and measureable interventions.

15

16

DM Task Force Responsibility

The responsibility of your DM Task Force:

• Determine the source of your default risk;

• Determine what steps your school will take to reduce default risk;

• Represent all parts of the institution (including management), which will contribute to risk reduction activities;

• Allocate school resources to default reduction activities; and

• Assess the effectiveness of default reduction activities over time.

→ Are they working?

17

Reducing Default

Risk Interventions

Two ways to think about reducing default risk:

1) Assisting borrowers by enhancing their knowledge of loan responsibilities and processes and strengthening their relationship with their loan servicer; and

2) Assisting borrowers by enhancing educational and employment outcomes.

Examples:

→ Increase Student Success;

→ Reduce Program Completion Time;

→ Strengthen Relationship with Potential Employers; and

→ Career Placement for both Graduates and Non-Graduates.

18

Reducing Default

Risk Strategic

Create interventions based upon your data:

• Targeted vs. ‘best practices’ interventions;

• Most efforts are targeted at identified risk;

• Utilizing Intervention Opportunities;

• Utilizing ‘leverage’ where it exists; and

• Adding general best practices to targeted efforts .

Reducing Default Risk

Plan Considerations

Specific Intervention Examples:

• Targeted Additional Loan Counseling;

• Targeted Existing Students;

• Success Efforts for At-Risk Borrowers;

• Review Policies and Procedures;

• Collect Detailed Contact Information;

• Financial Literacy Training;

• Tracking and Projections;

• Early Stage Delinquency Assistance;

• Late Stage Delinquency Assistance; and

• Promoting Loan Rehab for Defaulters.

19

Food for Thought:Post College Risk Factors

• Income

• Highest Income Earned

• Occupation

• Indebtedness

→ Other More Important Loans to Pay

• Marital Status, basic skill needs

• Number of Dependents

• Filing for Unemployment Insurance

• Dissatisfaction with Educational Program

20

21

SECTION 4

NSLDS Reports for Default and

Delinquency Prevention

22

NSLDS Reports for Schools

Reports for Data Accuracy:

•

•

Date Entered Repayment Report;

School Repayment Info Loan Detail;

•

•

School Cohort Default Rate History; and

Enrollment Reporting Summary.

Reports for Default Prevention:

• School Loan Portfolio Report;

•

•

Date Entered Repayment Report;

Borrower Default Summary;

•

•

Exit Counseling; and

Delinquent Borrower Report.

23

NSLDS Reports

School Loan Portfolio (SCHPR1)

• The School Portfolio Report provides details on borrowers and loans in your current loan portfolio.

• The report is based on loan repayment begin date.

• If your school has merged, previous school codes are included in the report.

• Report is available in Extract only.

Delinquent Borrower Data (DELQ01)

• Use the Delinquent Borrower Report (DELQ01) to assist with default prevention.

• Use Web Page under Aid tab “Delinquent Borrowers” for current up-to-date data.

24

SECTION 5

Developing a Default

Prevention Plan

Involuntary DP Plan?

34 CFR § 668.217

Cohort default rate regulation requires that schools which have a cohort default rate equal to or greater than 30% must develop a default prevention plan that requires identifying at-risk borrowers.

25

Default Prevention Plan

• Success is achieved when solid plans are developed and executed;

• A plan pulls together people and resources toward a common goal;

• The plan provides for consistency;

• ED Default Management sample plan in Dear Colleague Letter GEN-

05-14 issued September 2005 (Revised Plan out soon); and

• Revise and adjust you plan as needed to maximize your success.

26

Administrative Concerns

• What did your FY 09 and FY 10 rates look like and what will your FY 11 CDR look like?

→ If you have not looked at your rates, are you likely to hit 30% in

September 2014?

• Who are members of or a part of your DP team?

• What are the sources of your default risk?

• What ‘traditional’ strategies are included in your DP plan?

CONTINUED

26

27

Administrative Concerns (cont.)

• Have you leveraged knowledge about default risk?

• What ‘student success-focused’ strategies are included in your DP plan? Have you leveraged knowledge about your default risk?

• Are your strategies measureable? How will you know if you are succeeding?

• Is your plan 34 CFR § 668.217 compliant?

27

28

SECTION 6

Federal Loan Servicers

29

Federal Loan Servicers

Federal Loan Servicers:

• Educate and inform borrowers regarding the tools and options available to assist in the management of their student loans;

• Offer multiple repayment options tailored to borrower preferences

(i.e. online payments, ACH, check, etc.);

• Provide self-service tools for borrowers and options to receive bills and/or correspondence electronically;

• Offer dedicated services to schools to help manage cohort default rates; and

• Comply with legislative regulatory requirements and provide unique services.

30

Servicer Repayment Counseling

During the grace period a loan servicer:

• Establishes a relationship with the borrower;

• Ensures the correct repayment status;

• Discusses the appropriate repayment plan;

• Promotes self-service through the web;

• Updates and enhances borrower contact information; and

• Discusses consolidation options.

31

Communication Channels for Borrowers

•

All servicers have toll free numbers for borrowers to contact (phone, fax, and e-mail).

• All servicers use IVR (integrated voice response) systems.

→ Allow self service-for those that prefer

→ Make payments over the phone

• All servicers includes option to speak to a representative.

• All servicers have a dedicated staff to assist borrowers.

• All servicers offer financial literacy (budgeting, credit tips, etc.).

32

Servicer Tools for Borrowers

Websites designed to assist the borrower:

• Understand the various repayment plans and options; and

• Understanding Options (examples).

→ Deferments

→ Forbearances

→ Discharges

→ Forgiveness Programs

→ Loan Consolidation

School

Servicer Partnership

All servicers work to gather feedback and opinions from schools and find ways to partner with schools on default prevention, via:

• Face to face meeting on school campuses;

• Financial aid conference attendance;

• Presentations at conferences;

• Proactive phone calls; and

• E-mail communications.

Partner with the servicers!

33

34

SECTION 7

Resources

35

Financial Awareness Counseling

Financial Awareness Counseling on StudentLoans.gov

was developed to:

• Provide a centralized, online source of financial literacy information for students;

• Assist borrowers in making informed postsecondary funding decisions;

• Provide schools with educational resources about federal student aid; and

• Support the government-wide efforts to improve financial capability in the U.S. through the Financial Literacy Education Commission.

36

FAC: StudentLoans.gov

for 2013-2014

StudentLoans.gov has brought ALL FSA loan counseling tools together on one website:

• Entrance Counseling;

→ Subsidized & Unsubsidized and GradPLUS

• Exit Counseling; and

→ NSLDS will continue to provide detailed Exit Counseling reports and you’ll continue to obtain demographic and reference information from that website as you do today

• Financial Awareness Counseling.

37

FAC: StudentLoans.gov

for 2013-2014

New features for signed-in students:

• New landing page with guidance to help the student select the right type of counseling;

• Select schools to notify from a list of associated schools;

• Add new schools to notify;

• Select preferred repayment plan in Exit Counseling; and

• Send notifications of previously completed counseling sessions.

→ Entrance Counseling

→ Financial Awareness Counseling

38

FAC: StudentLoans.gov for 2013-2014

StudentLoans.gov

has added a new Repayment Estimator to the website.

•

• The repayment estimator is on the “My Preferences” screen

An authenticated users will see loan data from NSLDS, eligibility of each loan for a particular repayment plan, and estimate the payment for a particular plan based on several factors including:

→ Loan type;

→ Loan balance;

→ Income;

→ Family size; and

→ Where you live.

39

FAC: StudentLoans.gov

for 2013-2014

FAC: StudentLoans.gov

for 2013-2014

New entrance and exit counseling response functionality on ‘Options’ screen in COD.

Entrance Counseling

• Participation

• Response frequency

(Daily or On-Demand)

Exit & Financial

Awareness Counseling

• Response frequency

(Daily or On-Demand)

40

41

Cohort Default Rate Guide

42

Web Links

Cohort Default Rate

• The Cohort Default Rate Guide

→ http://www.ifap.ed.gov/drmaterials/finalcdrg.html

Delinquency and Default Management

• Electronic Announcement – Delinquency Prevention Activities

→ http://www.ifap.ed.gov/eannouncements/060310LoanServicingyInfoDelinqPrevent

Act.html

General Servicing Information

• Electronic Announcement (EA) – Loan Servicing Information

→ http://www.ifap.ed.gov/eannouncements/032610LoanServicingInfoFedOwn.html

Assessments

• FSA Assessments

→ http://ifap.ed.gov/qamodule/DefaultManagement/DefaultManagement.html

43

Additional Resource

Operations Performance Management Service Group

CDR calculations and data challenges

Main Line: 202-377-4258

Hotline: 202-377-4259

Email: http://fsa.schools.default.management@ed.gov

Web: http://ifap.ed.gov/DefaultManagement/DefaultManagement.html

Financial Literacy Resources

44

Lenders and Guarantors

• Counseling Resources

Jump$tart Coalition For Personal Financial Literacy

• http://www.jumpstart.org/

FDIC Financial Education Literacy

• http://www.fdic.gov/consumers/consumer/moneysmart/index.html

Mapping Your Future

• http://www.mapping-your-future.org

National Endowment for Financial Education

• http://www.nefe.org/tabid/183/default.aspx

IF WE DON’T MANAGE HIGH DEFAULT RATES

45

WHAT DOES THE FUTURE HOLD FOR OUR STUDENTS?

46

3 Take-a-ways from this Session

1) Working with the New Default Prevention Team

2) Identifying Default Risks

3) Default Prevention Plans

47

FSA Contact Information

Larry Eadie

Larry.Eadie@ed.gov

ET Winzer

Etienna.Winzer@ed.gov

We appreciate your feedback and comments!

47