document - Michigan Foreclosure Response Toolkit

advertisement

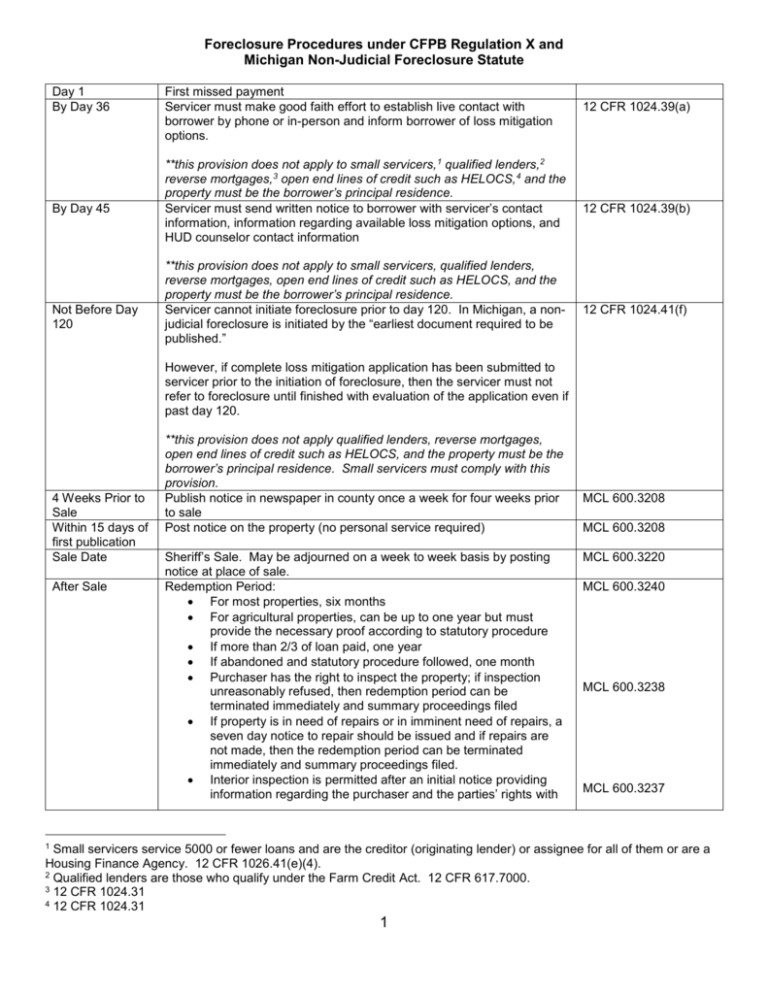

Foreclosure Procedures under CFPB Regulation X and Michigan Non-Judicial Foreclosure Statute Day 1 By Day 36 By Day 45 Not Before Day 120 First missed payment Servicer must make good faith effort to establish live contact with borrower by phone or in-person and inform borrower of loss mitigation options. **this provision does not apply to small servicers, 1 qualified lenders,2 reverse mortgages,3 open end lines of credit such as HELOCS, 4 and the property must be the borrower’s principal residence. Servicer must send written notice to borrower with servicer’s contact information, information regarding available loss mitigation options, and HUD counselor contact information **this provision does not apply to small servicers, qualified lenders, reverse mortgages, open end lines of credit such as HELOCS, and the property must be the borrower’s principal residence. Servicer cannot initiate foreclosure prior to day 120. In Michigan, a nonjudicial foreclosure is initiated by the “earliest document required to be published.” 12 CFR 1024.39(a) 12 CFR 1024.39(b) 12 CFR 1024.41(f) However, if complete loss mitigation application has been submitted to servicer prior to the initiation of foreclosure, then the servicer must not refer to foreclosure until finished with evaluation of the application even if past day 120. 4 Weeks Prior to Sale Within 15 days of first publication Sale Date After Sale **this provision does not apply qualified lenders, reverse mortgages, open end lines of credit such as HELOCS, and the property must be the borrower’s principal residence. Small servicers must comply with this provision. Publish notice in newspaper in county once a week for four weeks prior to sale Post notice on the property (no personal service required) Sheriff’s Sale. May be adjourned on a week to week basis by posting notice at place of sale. Redemption Period: For most properties, six months For agricultural properties, can be up to one year but must provide the necessary proof according to statutory procedure If more than 2/3 of loan paid, one year If abandoned and statutory procedure followed, one month Purchaser has the right to inspect the property; if inspection unreasonably refused, then redemption period can be terminated immediately and summary proceedings filed If property is in need of repairs or in imminent need of repairs, a seven day notice to repair should be issued and if repairs are not made, then the redemption period can be terminated immediately and summary proceedings filed. Interior inspection is permitted after an initial notice providing information regarding the purchaser and the parties’ rights with 1 MCL 600.3208 MCL 600.3208 MCL 600.3220 MCL 600.3240 MCL 600.3238 MCL 600.3237 Small servicers service 5000 or fewer loans and are the creditor (originating lender) or assignee for all of them or are a Housing Finance Agency. 12 CFR 1026.41(e)(4). 2 Qualified lenders are those who qualify under the Farm Credit Act. 12 CFR 617.7000. 3 12 CFR 1024.31 4 12 CFR 1024.31 1 72 hours notice; may request additional information after initial inspection When owner/occupant moves out of the property, if the purchaser provided the interior inspection information notice under MCL 600.3237 then the owner/occupant must provide a ten day notice to the purchaser of their move out date or risk additional liability for damages to the property occurring during the redemption period. MCL 600.3278 If Loss Mitigation Application Submitted Prior to Sale: **this provision does not apply to small servicers, qualified lenders, reverse mortgages, open end lines of credit such as HELOCS, and the property must be the borrower’s principal residence. Within 5 days of If packet is submitted more than 45 days before sheriff’s sale, Servicer 12 CFR submission must give notice that packet is complete, or if packet is incomplete what 1024.41(b)(2)(i)(B) additional information is required with a reasonable deadline for submitting Within 30 days of If at least 37 days before sale date, servicer must evaluate for available 12 CFR 1024.41(c) complete packet loss mitigation options and provide written decision to borrower submission regarding eligibility for those options. When borrower must accept or reject loss mit offer If application submitted during 120 day pre-foreclosure period and/or at least 90 days before sale date, borrower must be provided with information regarding appeal rights and an opportunity to appeal. If no foreclosure sale has been scheduled as of the date a complete loss mitigation application has been received, the application is considered to have been received more than 90 days prior to sale date. If submitted 90 days prior to sale: borrower must be given 14 days to accept or reject offer If submitted within 90 days of sale but at least 37 days before sale: borrower must be given seven days to accept or reject offer If borrower appeals: must have 14 days to accept or reject after appeal decision notice sent If borrower disputes account or requires additional information regarding account **this provision does not apply open end lines of credit such as HELOCS Borrower may send to designated address (not attorney or payment address): 1. Qualified Written Request (QWR) 2. Error Resolution Notice (NOE) 3. Request for Information (RFI) Within 5 days Servicer must acknowledge receipt of QWR/NOE/RFI Within 30/45 Servicer must respond to most QWR/NOE/RFIs within 30 days but may days request an extension of up to 15 days in some situations. If NOE is sent up to seven days before foreclosure sale, servicer must respond prior to the foreclosure sale. 12 CFR 1024.35(f)(2). If NOE disputes payoff statement, servicer has seven days to respond. If loan owner information requested, servicer must respond within ten days. 12 CFR 1024.41(e) QWR: NOE: 12 CFR 1024.35 RFI: 12 CFR 1024.36 ** Prepared by Karen Merrill Tjapkes, LAWM June 2014 2