Homework - Week #2 - Oakton Community College

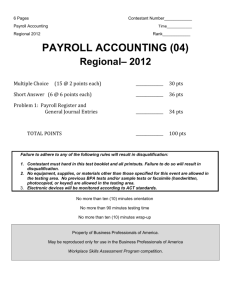

advertisement

Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #2 SOLUTIONS Problem #1 Use the percentage method to compute the federal income taxes to withhold for each employee. Employee No. Employee Name Marital Status No. of Withholding Allowances Salary Pay Frequency Amount to Be Withheld 1 Amorosa, A. M 4 $1,610 weekly 2 Finley, R. S 0 825 biweekly 92.80b 3 Gluck, E. S 5 9,630 monthly 1,598.38c 4 Quinn, S. M 8 925 semimonthly 0.00d 5 Treave, Y. M 2 1,975 monthly 59.14e $152.86a a $1,610.00 – 4($76.90) = $1,302.40 – $520.00 = $782.40 × 0.15 = $117.36 + $35.50 = $152.86 b $825.00 – 0 = $825.00 – $443.00 = $382.00 × 0.15 = $57.30 + $35.50 = $92.80 c $9,630.00 – 5($333.30) = $7,963.50 – $7,754.00 = $209.50 × 0.28 = $58.66 + $1,540.00 = $1,598.66 d $925.00 – 8($166.70) = $0 = $0 e $1,975.00 – 2($333.30) = $1,308.40 – $717.00 = $591.40 × 0.10 = $59.14 Page 1 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #2 SOLUTIONS Problem #2 Use the percentage method and wage bracket method to compute the federal income taxes to withhold for each employee. Employee No. of Marital Withholding Status Allowances Gross Wage or Salary Pay Frequency Amount to Be Withheld WagePercentage Bracket Method Method Corn, A. S 2 $ 675 weekly $ 62.68 $ 63.00 Fogge, P. S 1 1,960 weekly 381.70 N/A Felps, S. M 6 1,775 biweekly 52.12 52.00 Carson, W. M 4 2,480 semimonthly 179.83 181.00 Helm, M. M 9 5,380 semimonthly 529.88 N/A Page 2 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #2 SOLUTIONS Problem #3 Following is a payroll register for the Royster Company located in Illinois. Employees have been paid the same amount on a weekly basis for all year. Complete the payroll register for the pay period ending December 18th, the 51st pay period of the year. Complete the payroll register. Use the wage bracket method, when able, when calculating federal income tax (FIT) and calculate state income tax (SIT) using the Weekly Illinois Tax Table provided on the class website. For Period Ending December 19th Employee Name Green, Tom Marital Status M No. of No. of Illinois Fed. W/H (Line 1) W/H Allowances Allowances 3 3 Weekly Earnings $2,375.00 Deductions (a) FICA (b) OASDI HI FIT $ 0.00* $34.44 $332.98** (c) SIT $ 84.41 (e) Net Pay $1,923.17 Morris, Maive S 1 1 400.00 24.80 5.80 34.00 13.49 $321.91 Schmidt, Beth M 0 0 490.00 30.38 7.11 33.00 18.41 $401.10 Carr, Herman S 2 3 1,000.00 62.00 14.50 121.00 32.85 $769.65 Wilson, Ronda S 1 1 470.50 29.17 6.82 44.00 16.11 $374.40 Gleason, Wendy M 3 2 880.00 54.56 12.76 56.00 29.90 $726.78 $5,615.50 $200.91 $81.43 $620.98 $195.17 $4,517.01 Totals Compute the employer’s FICA taxes for the pay period ending December 19. OASDI Taxes OASDI taxable earnings OASDI taxes HI Taxes HI taxable earnings HI taxes $3,240.50 $ 200.91 $5,615.50 $ 81.43 * Passed FICA–OASDI limit: December 19th 51st pay period of the year. Tom Green: FICA-OASDI No tax due. Why? $2,375 * 51 pay periods = $121,125 exceeds $118,500 Cumulative pay prior to 51st $2,375 * 50 pay periods = $118,750 …so, he reached the $118,500 maximum prior to the 51st pay period) ** Must use percentage method Tom Green: FIT must use percentage method to calculate $2,375 – (3 x $76.90) = $2,144.30 - 1,606 = $538.30 x 25% = $134.58 + $198.40 = $332.98 Page 3 Oakton Community College Accounting 170 – Payroll Accounting Robert Bruebach Homework - Week #2 SOLUTIONS Question #1 T / F On August 3rd, Jason filed an amended Form W-4 with his employer. Jason’s employer is required put the new withholding allowance certificate into effect before the next weekly payday, which is on August 4th. Answer: False – the employer has 30 days to implement the new W-4. Also, the payroll for August 4th was probably calculated/entered prior to August 3rd, so even the best intentioned employer wouldn’t be able to implement the W-4 until the next payroll after August 4th. Question #2 T / F The employer is required to forward all Form W-4’s to the IRS on a quarterly basis. Answer: False – the employer retains the W-4 in the employee’s records. The IRS will notify the employer if they need a copy of the employee’s W-4. Question #3 T / F If an employer is filing ten (10) Form W-2’s, the employer must use magnetic media or electronic filing rather than paper Forms W-2. Answer: False – the employer is require to use magnetic media or electronic filing if they are filing in excess of 250 Form W-2’s . Page 4