Painter Pack - Jeremy Frye

advertisement

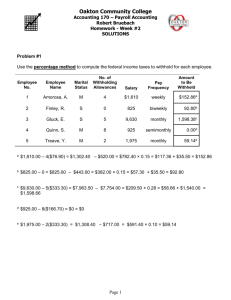

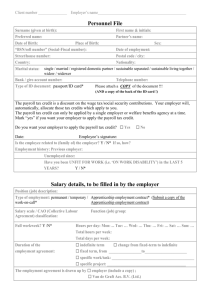

College Pro Painters U.S. Ltd. Employment Package TO BE COMPLETED BY ALL JOB SITE MANAGERS AND PAINTERS Once you have completely filled out the forms contained in this employment package, please return it to your Franchise Manager. He or she will submit this package to the payroll service for entry onto the computerized payroll system. Please read the following instructions to ensure correct completion of the forms. If all forms are not completed properly, this could cause a delay in placing you on the payroll system, so please be THOROUGH and NEAT. INSTRUCTIONS: 1. Painter Profile/W-4: Fill out the information in Section II and the W-4 form. We will send you W-2 to the address noted in the W-2 address section. W-2’s are mailed out by January 31 of the following year. Directions for filling out the W-4 along with a sample have been included on the back for reference. Taxes are withheld according to your marital status, and the number of exemptions you enter in Box 5. If you not enter anything into Box 5, taxes are withheld at the highest rate. YOU MUST SIGN AND DATE THIS FORM IN ORDER TO BE PAID, as per Internal Revenue Service Regulations. 2. Safety and Training Checklist/Employment Agreement: Make sure that you are familiar with all training and safety procedures. It is your responsibility to perform quality work in a safe manner. Also, please be certain to read and understand the terms of your employment. Once this form has been filled out it should be signed and dated by both you and your Franchise Manager. 3. I-9: Read the instructions on the page following the I-9. You must have two forms of identification proving your U.S. Citizenship. Again, this form must be signed and dated. Instructions for completing this form are on the back. Your Franchise Manager should be able to answer any questions you may have regarding the attached forms. In processing your paychecks, your Franchise Manager uses only the information off of the pink time sheets (Job Report Form – JRF’s) which are submitted by your Job Site Manager. It is important that you make sure that your Job Site Manager submits the sign-off time sheets in a timely manner. THANK YOU FOR YOUR ASSISTANCE. Reminder to Franchise Managers: The Painter Profile/W-4 must be received at the National Service Center by Thursday 5:00 P.M. EST for your painter to be eligible for that Sunday’s payroll reporting. EMPLOYMENT AGREEMENT This Employment Agreement made this __________ day of ________, 20____ is entered into by and between ______________________________, of ______________________ (“Employee”) and _____________________________________ (“Employer”). WHEREAS, the Employee wishes to work as a painter for the Employer; and WHEREAS, the Employer wishes to employ the Employee on the terms and conditions set forth below NOW THEREFORE, in consideration of the mutual promises and covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged the parties hereto agree as follows: 1. EMPLOYER OBLIGATIONS The Employer shall: a. Carry full Worker’s Compensation Coverage, Liability Insurance, and maintain a safe working environment; b. Pay the Employee a starting hourly wage of $______/hour; c. Pay the Employee for each cold call generated at a rate of $______/lead; and d. Maintain a payroll processing service and submit all hours worked by the Employee to the Employer’s payroll processing service; Employer shall not, under any circumstances; pay the Employee any compensation for work performed by the Employee without submitting Employee’s hours to Employer’s payroll processing service for such work. 2. EMPLOYEE OBLIGATIONS The Employee shall: a. Work a minimum of 35 hours per week. b. Complete all work in a professional and workmanlike fashion; c. Maintain a good attendance record; d. Wear a College Pro Painter shirt on all jobs; e. Practice safe work habits as outlined in College Pro Painters (U.S.) Ltd.’s Hazard Communication Program; f. Keep tools and equipment in good working order; g. Attend a mandatory painter workshop on ____________________, arriving prepared and having reviewed the College Pro Painters’ manual. h. Accept no compensation for services not processed through the College Pro computerized payroll service. Employee: _________________________ Employer: ______________________ Date: ________________ Date: ________________ College Pro Painters (U.S.) Ltd. Safety and Training Checklist PRE-EMPLOYMENT PROCEDURES: Read Employee Handbook and complete the Employment Package. Read and understand the Painter’s Manual. Attend a Painter Workshop Know starting time, break and lunch policies Wear proper clothing and steel-toed boots.* LADDERS: No use of rigging is allowed.* Understand proper setup, 4:1 ratio* Never use a ladder that is bent, broken, missing rope, etc.* Follow fiberglass ladder policy near all power sources.* EQUIPMENT: Crew kit components (including first aid kit). Types, uses and care of different brushes Differences between latex and alkyd (oil) paint, stain. PREPARATION: Scraping Sanding Puttying Washing Storm Windows Caulking PRIMING AND FINISH COAT: Priming Doors and Windows Soffits Brushing Staining Siding Drop Cloths Signs Areas to do Cut in only once Alkyd and Latex painting Rolling JOB CLEANUP: Paint chips/proper waste disposal Brushes/rollers Spills (different surfaces). JOB SITE MANAGEMENT: Use of goal sheets Good ladder rotation Thinking ahead/rain procedures Customer satisfaction/relations OSHA REGULATIONS: Material Safety Data Sheets OSHA training reviewed Toxic waste disposal Lead paint hazards. ___________________________________HAS BEEN ADEQUATELY TRAINED. ____________________________ EMPLOYEE SIGNATURE **These are important safety areas to follow. ___________________________________ FRANCHISEE SIGNATURE TO: College Pro Painters’ Payroll Office Page ___ of ___ Manager: ___________________________________________Mgr ID#: _____________ Painter Profile Office Use Only Employee File#: ___________________ Division: __________ SECTION 1: General Manager: _________________________________ SECTION 2: Manager: ________________________________________ Employee Name: __________________________________ W-2 Mailing Address: __________________________________________ ____________________________________________________________ Current Phone: ( ) _____-______ Permanent Phone: ( Date of Birth: __ __/__ __/__ __ Starting Wage: $ ______ )_____-______ State where employed: ______ Have you worked for CPP before?: YES NO Email Address: _______________________________________ OMB Nc. 1545-0010 Form W-4 Department of the Treasury Internal Revenue Service Employee’s Withholding Allowance Certificate 2002 >For Privacy Act and Paperwork Reduction Act Notice, see page 2 Type or print your first name and middle initial Last Name 2 Your social security number Home Address (number and street or rural route) 3 ___Single ___Married ___Married ,but withhold at higher Single rate Note:If married, but legally separated, or spouse is a nonresident alien, check the Single box. City or town, state, and ZIP code 4 If your last name differs from that on your social security card, check here and call 1-800-772-1213 for a new card > ______ ______________________________________________________________________________________________________________ 5 Total number of allowances you are claiming (from line H above or from the worksheets on page 2 if they apply) 5 _________ 6 Additional amount, if any, you want withheld from each paycheck 6 _________ I claim exemption from withholding for 1998, and I certify that I meet BOTH of the following conditions for exemption: Last year I had a right to a refund of ALL Federal income tax withheld because I had NO tax liability AND This year I expect a refund of ALL Federal income tax withheld because I expect to have NO tax liability. If you meet both conditions, enter “EXEMPT” here > 7 _________ Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate or entitled to claim exempt status. Employee’s Signature > _____________________________________________________ Date > ____________________, 20_______