Instructors Outline

advertisement

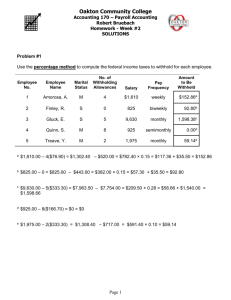

MASTERING PAYROLL INSTRUCTOR’S LECTURE OUTLINE This lecture outline follows the 10 sections of the workbook, Mastering Payroll. Section 1: Employees v. nonemployees Section 2: Federal and state wage-hour law Section 3: Paying employees under federal law Section 4: Employment records and payroll recordkeeping Section 5: Employee data: Form W-4 and state withholding allowance certificates Section 6: How employers withhold and deposit federal taxes Section 7: Federal employment reporting forms and due dates Section 8: When wages become taxable Section 9: Other reporting rules Section 10: Payroll entries Lecture notes format The lecture notes for each section of the workbook are divided into four to five parts: Workbook section covered. The section number and title of the workbook covered. PowerPoint slides. The numbers of the slides used to cover this section of the workbook. Note: Because the PowerPoint presentation includes animation to enhance learning, it is designed to be shown in “Slide Presentation” mode. When the slideset is shown in Slide Presentation, the numbers on the sides will not appear. Topics covered. An outline of the topics covered in the PowerPoint slide presentation. These can also be used if you choose to print handouts using PowerPoint’s Handout Master. Where appropriate, slide numbers are given for specific topics. Key teaching points. These appear only in those sections where in-class experience has shown the need to emphasize some point. Optional points of emphasis. Topics that generally should be stressed, depending on the makeup of your class. In-class activities. Suggested selections from the Homework Exercises portion of the teaching guide to work through in class. There are enough Homework Exercises for both in-class activities and homework assignments. © American Institute of Professional Bookkeepers, 2010 Instructor’s Lecture Outline 1 Mastering Payroll Section 1EMPLOYEES V. NONEMPLOYEES (Slides 211) Topics covered A list of employment taxes, such as FITW, FICA and FUTA and which ones apply to different categories of workers—statutory employee, statutory nonemployee. etc. (Slide 2) General definitions of FICA, FUTA and SUI (Slide 3) Teaching tips: Even though employer FICA is 7.65% of each employee’s wages, the employer is liable for the full 15.3%—a powerful incentive to properly withhold FICA. Also, self-employed individuals must pay the full 15.3% on their earnings. The employer can also be held liable for FITW that it failed to withhold and should have or that it underwithheld. The purpose: To discourage the practice of misclassifying employees as independent contractors to avoid employer taxes on employees (such as FUTA, employer FICA and other federal and state taxes. The 6 categories of workers—each mouse click brings up the definition (Slide 4) Additional details on the six categories of workers, and the employer’s payroll-tax responsibilities for each (Slides 511) Job categories of statutory employees v. statutory nonemployees. Teaching tip: Depending on the makeup of your class, you may elaborate on the definitions of direct seller, companion sitter, etc. Common-law and statutory employees are both the company’s employees—temps and leased employees are the referring agency’s employees Statutory employees’ wages are subject to the one-half share of FICA (7.65%) and FUTA—statutory nonemployees are subject to both halves of FICA (15.3%), but no FUTA Key teaching points Because temps and leased workers are the agency’s employees, the company does not withhold taxes from their pay When introducing Form SS-8 (Slide 5), stress that if in an employer is in doubt about a worker’s employment status, the IRS requires that the employer treat the worker as an employee In-class activities Homework Exercises for Section 1, any problems from 27 Instructor’s Lecture Outline 2 Mastering Payroll Section 2FEDERAL AND STATE WAGE-HOUR LAW (Slides 12–21) Topics covered Virtually all businesses are covered by federal wage-hour law (FLSA), which governs employer/employee relationships. Many states have similar laws (Slides 12 and 13) The rare employer exemption to FLSA is determined by the “enterprise test” mom and pop shops Tipped employees have their own minimum wage Illustrative examples with computations (Slides 15 and 16) Categories of employees exempt from the minimum wage—such as outside salespersons (Slide 17) State (not federal) law governs how often employees must be paid, method of payment, final paychecks and unclaimed wages (Slide 18) When the federal and state minimum wages conflict, the employer must use the one most favorable to the employee Illustrative examples of federal v. state minimum wage conflicts (Slides 19–21) Key teaching points Employer exceptions to the federal minimum wage are rare Employee exceptions to the federal minimum wage are well defined Employees must be paid the higher of the federal v. state minimum wage In-class activities Homework Exercises for Section 2, Problems 2 and 3 Instructor’s Lecture Outline 3 Mastering Payroll Section 3PAYING EMPLOYEES UNDER FEDERAL LAW (Slides 22–33) Topics covered Hours for which employees must be paid (Slides 22–26) Paid travel time with illustrative examples Under FLSA overtime, or premium pay, is required only for each hour actually worked over 40 hours in the workweek (Slides 27–32) A workweek is any consecutive 7-day period (or 168 hours) and need not be MondayFriday Employees must be informed of the employer’s workweek, which cannot be changed to avoid paying overtime Illustrative examples of overtime pay calculations Jobs exempt from overtime pay—executives, certain salespersons, etc. (Slide 33) Key teaching points Employees are due travel pay only for travel time during “normal working hours.” For example, an employee whose normal work hours are 8 to 5 must be paid travel time only for hours of travel after 8 a.m. and before 5 p.m. regardless of the day of the week—i.e., even for travel on nonwork days (e.g., Saturdays and Sundays) and holidays For overtime pay, include only hours actually worked. Extra example (not on slides): Say that Jane works 32 hours, Monday–Thursday, is out Friday sick or for a holiday but is paid for 8 hours for the day, then works Saturday for 8 hours. She is not entitled to overtime pay For the few employers that pay for hours commuting; these hours are not included as “hours worked” for overtime purposes In-class activities To reinforce overtime pay rules, refer to Homework Exercises for Section 3, Problems 2 and 3 Instructor’s Lecture Outline 4 Mastering Payroll Section 4EMPLOYMENT RECORDS AND PAYROLL RECORDKEEPING (Slides 34–37) Topics covered New-hire documents an employer must obtain from an employee (Slide 34) Form I-9 is used to verify a new employee’s (Slide 35): identity and authorization to work in the U.S. List A—single documents that verify both (Slide 36) or one document each from List B (identity) and List C (right to work in the U.S.) (Slide 37) Section 5FORM W-4 AND STATE WITHHOLDING ALLOWANCE CERTIFICATES (Slides 38–41) Topics covered Form W-4 (Slide 38) How to handle request to withhold a flat amount of FIT v. additional FIT above the correct amount When employers must refuse a W-4 (Slide 39) How long an employer has to implement a new W-4 (Slide 40). Teaching tip: Unless the employee gets married, divorced or has children, there is no need to submit a new W-4 in future years How to handle a W-4 on which a worker claims exempt from FIT (Slide 41) An employee who claims exempt from FIT must submit a new W-4 the next year by February 15—or the employer is required to withhold FIT as though the employee is single with zero exemptions Instructor’s Lecture Outline 5 Mastering Payroll Section 6HOW EMPLOYERS WITHHOLD AND DEPOSIT FEDERAL TAXES (Slides 42–66) Topics covered FICA tax consists of Social Security tax (OASDI) and Medicare tax (HI)—(Slide 42) The SS portion paid by the employee is withheld at 6.2% of pay up to a ceiling The SS portion paid by the employer is 6.2% of the employee’s pay up to a ceiling; the HI portion paid by the employer is 1.45% of the employee’s pay with no ceiling. The HI portion is paid by the employee is withheld at 2.45% of pay—no ceiling Employees who overpay OASDI get a refund—but employers who overpay do not Employees who are FICA-exempt (Slide 43) Using the W-4 to determine FITW for each employee’s paycheck (Slide 44) Teaching tip: This is a good place to explain how the withholding tables work using workbook pages 88 and 89 (marrieds, paid weekly) and page 9192 (singles, paid every two weeks). Remitting 941 taxes (FICA withheld + employer FICA + FITW)—(Slides 45–47) Total 941 liability amounts determine whether an employer must remit FITW and FICA quarterly v. annually When employers must file Form 941 and 941 taxes electronically v. on paper When employers are monthly depositors v. semiweekly depositors of 941 liabilities (Slide 48) The lookback period and how it determines an employer’s deposit status (Slide 49) Monthly depositor rules—illustrative examples (Slides 50–53) Semiweekly depositor rules and the Wednesday-Friday rule (taxes must be deposited on Wednesday or Friday based on when they are collected)—illustrative examples (Slides 54–61). Teaching tip: Students may be referred to the workbook for this rule, page 96. Monthly v. semiweekly depositor shortfalls—illustrative examples (Slides 62–64) The one-banking-day deposit rule (Slide 65) Form 941 recap (Slide 66) In-class activities For using the IRS withholding tables, Homework Exercises for Section 6, Problem 3 For practice figuring out if an employer is a monthly v. semiweekly depositor, Homework Exercises for Section 6, Problem 7 For practice on deposit due dates, Homework Exercises for Section 6, Problem 8 Instructor’s Lecture Outline 6 Mastering Payroll Section 7FEDERAL EMPLOYMENT REPORTING FORMS AND DUE DATES (Slides 67–78) Topics covered Which employers pay FUTA tax (Slide 67) Computing FUTA tax (Slide 68) If all SUI taxes are paid in for the year, the FUTA rate drops from 6.2% to .8% When FUTA taxes are due—quarterly v. annually (Slide 69) When electronic filing of Form 940 is required (Slide 70) Form 945 for FITW on nonpayroll payments to various workers (Slides 7173) Form 945 illustrative example Form W-2 defined (Slide 74) When the W-2 is due to employees v. the SSA (Slide 75) Form W-3—how it is used (Slides 76) How long to retain various forms and documents (Slides 77 and 78). Teaching tip: Although the workbook summarized how long records must be retained in earlier sections, now that students have seen the forms, the rules on these slides have meaning, so a review can be helpful In-class activities Computing FUTA, Homework Exercises for Section 7, Problems 1 and 2 Determining FUTA due dates, Homework Exercises for Section 7, Problem 3 Section 8WHEN WAGES BECOME TAXABLE (Slides 79 and 80) Topics covered When employees have constructive receipt of the pay—that is, are made available to them (Slide 79) Special situations (Slide 80): Postponing paychecks is generally illegal Salary advances and repayments Instructor’s Lecture Outline 7 Mastering Payroll Section 9OTHER REPORTING RULES (Slides 81–84) Topics covered State reporting rules (Slides 81 and 82) SUI State income tax (SIT) and state W-2s Various Forms 1099 (Slide 83) Forms 1099 due dates to individuals v. to the IRS (Slide 84): Paper v. electronic filing Form 1096 for transmittal In-class activities State reporting rules, Homework Exercises for Section 9, Problems 13 are a review Section 10PAYROLL ENTRIES (Slides 85–92) Topics covered Payroll register details (Slide 85). Teaching tip: to discuss the payroll register, have students open their workbooks to page 166 to see examples of both a payroll register and an individual employee’s payment history. The two journal entries recorded for each pay period (Slides 86–92) : First journal entry basic format—employee payroll expense Illustrative example Second journal entry basic format—employer payroll tax expense Illustrative example Journal entry to record remittance of withheld taxes, employer taxes and payments to vendors, unions and others—basic format In-class activities Workbook Section 10: Quiz 1, Problem I, Questions 10 and 11 (pages 173); or, Quiz 2, Problem I, Questions 6 and 7 (page 177). Payroll journal entries, Homework Exercises for Section 10, Problems 13 Instructor’s Lecture Outline 8