Comparing Alternatives Using ROR Method

advertisement

Chapter 8: Rate of Return Analysis – Multiple Alternatives

For a single project, ROR or i* is determined by PW or AW method. We either solve for i* in

0 = - PWD + PWR

or

0 = -AWD + AWR

where D: disbursements (costs) and R: revenue (income).

i* can only be calculated if we have disbursements and revenue.

If i* MARR, the project is economically acceptable. If i* < MARR, it is not.

Comparing Alternatives Using ROR Method

We can again use PW or AW methods. We have two types of selections:

i) If projects are independent – Here we select all projects that have i* equal or greater than

MARR. We, therefore, determine for each project whether or not i* MARR. All those with

i* MARR are selected.

These choices can only be among projects with revenue and cost. If there is no revenue, it

means we cannot calculate i* individually and hence no independent selection.

To determine whether or not i* MARR, substitute i* = MARR in the PW or AW equation.

If positive, then i* MARR.

ii) If projects are mutually exclusive – Here we must select only ONE best one. For these

comparisons, we must use incremental analysis.

If alternatives have revenue, then the problem will state whether they are mutually exclusive

(select only ONE) or not. If alternatives have only costs, then, it automatically indicates that

they are mutually exclusive and, therefore, only ONE shall be selected.

Incremental analysis must be carried out over the same period. Therefore, if project lives are

different, the cash flow for each project must be extended to LCM years.

Example. Consider two alternatives A and B. Cash flows are as follows. Determine which

should be selected if MARR is 15% per year.

Initial cost

Annual cost

SV

Life, years

A

B

-8000

-3500

0

10

-13000

-1600

2000

5

Note: Only costs are involved. Therefore, we automatically select the one that is best.

Here lives are 10 and 5 years. Analysis must be over LCM years which is 10 years. We must

now write down the incremental cash flow. We always order projects with lower initial cost

first. (In multiple projects, lowest to highest ordering is done).

1

Year

Cash flow A

0

1–5

5

-8000

-3500

-

6 – 10

10

-3500

-

Cash flow B

Incremental cash flow (B – A)

-13000

-1600

{+2000

-13000}

-1600

+2000

-5000

+1900

-11000

+1900

+2000

Using PW method:

0 = -5000 + 1900.(P/A,i*,10) – 11000.(P/F, i*,5) + 2000. (P/F,i*,10)

[i* is used for the cash flow (B – A) to distinguish it from iA* or iB* ]

If we substitute i* = 15%, in the above

= -5000 + 1900.(5.0188) – 11000.(0.4972) + 2000.(0.2472) = -439.08

It is negative, therefore i* < MARR (=15%)

Therefore, extra investment for B is not justified. Select A.

We can also solve using AW method. Here, we have two options.

1. Use incremental cash flow. Then, we must use cash flow up to LCM. For the cash flow

for 10 years,

0 = -5000.(A/P,i*,10) + 1900 – 11000.(P/F,i*,5).(A/P,i*,10) + 2000.(A/F,i*,10)

Substituting i* = MARR (=15%), we get -87.488 which is negative.

Therefore, i* < MARR.

B is not justified; we select A.

2. Use AW of each project for one cycle only.

We write,

AWA for one cycle, which is for 10 years,

and

Then,

AWB for one cycle, which is for 5 years.

0 = AWB – AWA

Hence,

0 = -13000.(A/P,i*,5) – 1600 + 2000.(A/F,i*,5) – [-8000.(A/P,i*,10) – 3500]

For i* = 15%, the value of above = -87.3

Therefore, i* < 15% (MARR)

B is not justified; we select A.

2

ROR Analysis: Multiple Alternatives

The procedure will be demonstrated by means of solved problems.

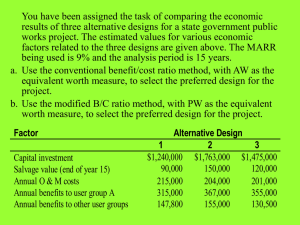

Problem 1.

We are evaluating five alternatives for which the cash flows are shown below. The MARR is

18% per year and all the alternatives are expected to have a life of 8 years.

(a) If the proposals are independent, which should be selected?

(b) If the proposals are mutually exclusive, determine which one should be selected using the

incremental-rate-of-return method.

A

B

C

D

E

-10000

-12000

-18000

-24000

-33000

AOC

-5000

-5500

-7000

-11000

-16000

SV

2000

2500

3000

3500

4500

Annual income

9000

10000

10500

12500

14500

Initial investment

a) If proposals are independent, we select every alternative that has i* MARR or i* 18%.

Using PW,

For A: 0 = -10000 – 5000.(P/A,i*,8) + 2000.(P/F,i*,8) + 9000.(P/A,i*,8)

To see if i* 18%, we substitute i* = 18% in this equation:

= -10000 – 5000x4.0776 + 2000x0.266 + 9000x4.0776 = 6842.4

Since it is positive, it means i* > MARR or i* > 18%.

Therefore, we select A.

We repeat the above for B, C, D, and E:

We find that, for B: i* > 18%, therefore, we select B also.

For C:

i* < 18%, therefore, we do not select C.

For D:

i* < 18%, therefore, we do not select D.

For E:

i* < 18%, therefore, we do not select E.

For independent alternatives we select A and B and reject C, D, and E.

b) For mutually exclusive selection, since we have already shown that C, D, and E have ROR,

i.e. i*, less than MARR, we do not consider them for further calculations. To find which is

best, we need to compare A and B only (Note that we do not have to consider DO Nothing,

i.e. ‘DN’, here since i* greater than MARR for A and B already tells us that A and B are

better than DN). For A and B, we do an incremental analysis to see which is better. We put

the lower cost alternative first.

A

B

-10000

-12000

AOC

-5000

-5500

SV

2000

2500

Annual income

9000

10000

Initial investment

3

Alternatives compared: B to A

Incremental investment

-2000

Incremental AOC

-500

Incremental SV

500

Incremental income

1000

PW method: 0 = -2000 –500.(P/A, i*,8) + 500.(P/F, i*,8) + 1000.(P/A, i*,8)

For i* = 18%,

= -2000 – 500x4.0776 + 500x0.266 + 1000x4.0776 = 171.8

Therefore, i* > 18% or MARR

We select B.

Note that in this problem the alternatives have revenue (income, receipts, etc.). It is because of

this that we can calculate i* for each alternative and it is because of this fact that we can

evaluate them as independent alternatives.

Problem 2.

Determine which one of the following projects should be selected using the incremental-rateof-return method. All the projects are expected to have a 10-year life and MARR is 15% per

year.

First cost

Annual income

A

B

C

D

E

-15000

-18000

-35000

-25000

-52000

5000

6000

9000

7000

12000

Problem indicates only ONE, best one, to be selected, i.e. mutually exclusive. Here, the

alternatives have revenue or income as well. We can do the selection by either one of the

following two methods:

i) Determine, individually, which alternatives have i* MARR. Then, select those with

i* MARR for incremental analysis to select the best one (as in Problem 1), or

ii) Start with the first alternative as challenger to “Do Nothing” (DN). Depending on the

outcome (if i* MARR, select first alternative as defender to be challenged by the second

one. If i* < MARR, reject first alternative and go to second alternative as challenger against

DN, and so on).

We’ll follow (ii) as i* values are not available as in Problem 1.

To start the process, we line up the alternatives with increasing first costs.

A

First cost

Annual income

B

D

C

E

-15000

-18000

-25000

-35000

-52000

5000

6000

7000

9000

12000

Alternative compared: A to DN

0 = -15000 + 5000.(P/A,i*,10)

or (P/A,i*,10) = 3

(From the Table for i = 15%, if (P/A,i*,10) 5.018, then i* MARR or 15%)

4

Therefore, i* > MARR

We, therefore, eliminate DN, select A as defender and B as challenger.

B – A: 0 = -3000 + 1000.(P/A,i*,10)

or (P/A,i*,10) = 3

Again, based on the Table for i=15%, i*>MARR; select B as defender, and eliminate A.

D – B: 0 = -7000 + 1000.(P/A,i*,10)

or (P/A,i*,10) = 7

Therefore, i*<MARR; eliminate D, B is still defender.

C – B: 0 = -17000 + 3000.(P/A,i*,10)

or (P/A,i*,10) = 17/3 = 5.667

Therefore, i*<MARR; eliminate C, B is still defender.

E – B: 0 = -34000 + 6000.(P/A,i*,10)

or (P/A,i*,10) = 5.667

Therefore, i*<MARR; eliminate E also.

Select B.

Problem 3.

Determine which of the following projects should be selected using the incremental-rate-ofreturn method. All the projects are expected to have a 10-year life and MARR is 18% per

year.

A

B

C

D

E

First cost

-28000

-33000

-22000

-51000

-46000

AOC

-20000

-18000

-25000

-12000

-14000

Here, we do not have any revenue (income). We must, therefore, choose ONE, best one, using

incremental method. (There cannot be comparison to DN or calculation for i* for each

alternative).

We start by ordering alternatives with increasing costs.

C

A

B

E

D

First cost

-22000

-28000

-33000

-46000

-51000

AOC

-25000

-20000

-18000

-14000

-12000

We start with the first one (C) as defender and the second one (A) as the challenger.

A – C: 0 = -6000 + 5000.(P/A,i*,10) or (P/A,i*,10) = 1.2

(From the Table for i = 18%, if (P/A,i*,10) 4.494, then i* MARR or 18%)

Therefore, i* > MARR, eliminate C.

B – A: 0 = -5000 + 2000.(P/A,i*,10)

or (P/A,i*,10) = 2.5

Therefore, i* > MARR, eliminate A.

E – B: 0 = -13000 + 4000.(P/A,i*,10)

or (P/A,i*,10) = 3.25

Therefore, i* > MARR, eliminate B.

D – E: 0 = -5000 + 2000.(P/A,i*,10)

or (P/A,i*,10) = 2.5

Therefore, i* > MARR, eliminate E.

Select D.

5

Problem 4.

A company is considering the projects shown below, all of which can be considered to last

forever. If the company MARR is 18% per year, use rate-of-return analysis to determine

which should be selected

a) If the alternatives are independent, and

b) If the alternatives are mutually exclusive.

A

First cost

Annual income

B

C

D

E

-10000

-20000

-15000

-70000

-50000

2000

4000

2950

10000

6000

a) For infinite lives,

P = A/i

Then ROR for A:

2000 / i* = 10000; or i* = 0.2, i.e. 20%

Similarly for B, i* = 20%; for C, i* = 19.6%; for D, i* = 14.3%; and E, i* = 12%.

Since MARR is 18%, we select A, B, and C.

b) Since D and E have i* < MARR, we do not have to consider them for further calculations.

Ordering A, B, and C in increasing costs:

A

First cost

Annual income

C

B

-10000

-15000

-20000

2000

2950

4000

We have already determined that i* for A is greater than MARR. This means it is better than

Do Nothing. After stating this fact, proceed to compare A and C incrementally.

A vs. DN:

Select A as already shown that i* > MARR

C – A:

0 = -5000 + 950/i* or i* = 0.19 (19% which is greater than MARR)

Therefore, eliminate A and select C.

B – C:

0 = -5000 + 1150/i* or i* = 0.23 (23% which is greater than MARR)

Therefore, eliminate C and select B.

6

Problem 5.

A metal plating company is considering four different methods of recovering by-product

heavy metals from manufacturing site’s liquid waste. The investment costs and incomes

associated with each method have been estimated. All methods have a 10-year life. The

MARR is 12% per year.

a) If the methods are independent, because they can be implemented at different plants, which

ones are acceptable?

b) If the methods are mutually exclusive, determine which one method can be selected using

ROR evaluation.

Method

First Cost

SV

Annual Income

A

-15000

1000

4000

B

-18000

2000

5000

C

-25000

-500

6000

D

-35000

-700

8000

a) Using PW method:

Method A:

0 = -15000 + 4000.(P/A,i*,10) + 1000.(P/F,i*,10)

Substituting MARR(=12%) for i*, the RHS is positive (=7922.8), hence i*>MARR

Therefore, select A.

Method B:

0 = -18000 + 5000.(P/A,i*,10) + 2000.(P/F,i*,10)

Substituting MARR(=12%) for i*, the RHS is positive (=10895), hence i*>MARR

Therefore, select B also.

Method C:

0 = -25000 + 6000.(P/A,i*,10) - 500.(P/F,i*,10)

Substituting MARR(=12%) for i*, the RHS is positive (=8740.2), hence i*>MARR

Therefore, select C as well.

Method D:

0 = -35000 + 8000.(P/A,i*,10) - 700.(P/F,i*,10)

Substituting MARR(=12%) for i*, the RHS is positive (=9976.2), hence i*>MARR

Therefore, select D too

Hence, we select A, B, C and D.

Alternatively, we could have used AW method. Then,

Method A:

0 = -15000.(A/P,i*,10) + 1000.(A/F,i*,10) + 4000

At 12%, the value to right hand side (RHS) = 1402.28. Hence, i* > MARR

We select A.

Similar analysis for B, C, and D also show that i* > MARR for all of these methods.

Hence, we select A, B, C and D.

7

b) A – DN: It is already shown in (a) that i* for Method A > MARR. Therefore, A is selected

over DN. Alternatively, we can write (using PW method):

0 = -15000 + 4000.(P/A,i*,10) + 1000.(P/F,i*,10)

i* > MARR, select A

B – A:

0 = -3000 + 1000.(P/A,i*,10) + 1000.(P/F,i*,10)

It can be shown that i* > 12% (RHS is positive). Therefore, select B

C – B:

0 = -7000 + 1000.(P/A,i*,10) - 2500.(P/F,i*,10)

With i* = 12%, RHS is negative; Hence, i* < MARR (=12%). Therefore, select B again.

D – B:

0 = -17000 + 3000.(P/A,i*,10) - 2700.(P/F,i*,10)

Here, again i* < MARR.

Therefore, B is still the selection. Select B.

Problem 6.

Company X is designing a processing facility. Two options are being considered with the

following cash flows:

Capital investment

Annual expenses:

Operation

Maintenance

Salvage value

Useful life, years

A

$66400

B

$95200

$4330

$2200 in year 1,

and increasing

$1000/yr thereafter

0

5

$3440

$1000 in year 4,

and increasing

$200/yr thereafter

$10000

9

The MARR is 20% per year. Using the rate of return method, determine which option

should be selected?

In this example if we wish to use either of the equations:

0 = -AWD – AWR

or

0 = - PWD - PWR

we have to determine the incremental cash flow for LCM of years, i.e. 45 years in this case.

Incremental cash flow will be obtained by considering 9 cycles of A and 5 cycles of B. This

makes it a laborious exercise. It is, therefore, better to use AW formula,

0 = AWB – AWA

where AW’s of A and B for one cycle only is used. (Note that if we wish to use PWA and

PWB values, then we have to calculate the values over LCM of years).

0 = -95200(A/P,i*,9) + 10000(A/F,i*,9) – 3440

- [1000(P/A,i*,6) + 200(P/G,i*,6)](P/F,i*,3)(A/P,i*,9)

- {-66400(A/P,i*,5) – 4330 – [2200 + 1000.(A/G,i*,5)]}

Substituting i* = 20%,

RHS = 3130. Hence i* > 20%.

Select B.

8

Problem 7.

The four alternatives described below are being evaluated.

a) If the proposals are independent, which should be selected when MARR = 18% per year?

b) If the proposals are mutually exclusive, which one should be selected when MARR=9.5%

per year?

Incremental ROR,%, When compared

with alternative

Alternative

Init. Investment

ROR,%

A

B

A

-40000

29

B

-75000

15

1

C

-100000

16

7

20

D

-200000

14

10

13

a) Only alternative A has a ROR > 18%.

Select A

b) A to DN:

i* = 29% > 9.5%, eliminate DN.

B to A:

i* = 1% < 9.5%, eliminate B.

C to A:

i* = 7% < 9.5%, eliminate C.

D to A:

i* = 10% > 9.5%, eliminate A.

Therefore, select alternative D.

9

C

12