Dr Azer Önel

advertisement

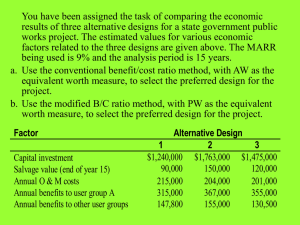

Dr Azer Önel Engineering Economy Review Problems-V 2010 Comparing Mutually Exclusive Alternatives (Note: There may be typographical errors. Check results for all problems!) Study Period ≠ Useful Life • Repeatability Assumption • Study period is a common multiple of the alternatives' lives. • Compare alternatives over the lowest common multiple of lives. Assume identical investmet, costs, revenue, etc. • Compute AW. (Easy!) • Cotermination Assumption • Compare alternatives over the same study period. • Study period > Useful life Cost alternatives: Assuming repeatability, repeat part of the useful life of the original alternative, and then use an estimated MV to truncate it at the end of the study period. Without repeatability, we must purchase/lease the service/asset for the remaining years. Investment alternatives: Assume all cash flows will be reinvested at the MARR to the end of the study period (i.e., calculate FW at end of useful life and move this to the end of the study period using the MARR). • Study period < Useful life Truncate (shorten) the alternative at the end of the study period using an estimated market value. 1) (Prob. 5-24 Sullivan, 12th ed.) Consider the two cost alternatives A & B. Investment cost Annual costs Useful life years Market value @end of useful life A $14,000 14,000 5 8,000 B $65,000 9,000 20 13,000 a) If the study period = 20 years, which alternative is preferred? The MARR is 15%. b) If the study period = 10 years and the estimated market value for alternative B = $25,000 @ EOY 10, which alternative is preferred? Solution: a) Repeatability assumption; study period = 20 years Let’s use PW method: Project A is repeated 4 times, so PWA = -14,000-14,000(P|A,15%,20) + (-14,000+8000=-6,000)(P|F,15%,5)6,000(P|F,15%,10) -6,000(P|F,15%,15)+8,000(P|F,15%,20) =-$106,345 PWB = -65,000 - 9,000(P|A, 15, 20) + 13,000(P|F, 15, 20) = -$120,539 Select A to minimize costs. 1 Also, AWA = -$106,345(A|P, 15%, 20) = -$16,990 AWB = -$120,539(A|P, 15%, 20) = -$19,262 Note: When the study period equals a common multiple of the alternatives' lives, simply compare AW computed over the respective useful lives (assuming repeatability is valid)! So: AWA = AW 1-20 = AW 1-5 = AW 6-10 = AW 11-15 = AW 15-20 = -$16,990 b) Cotermination assumption; study period = 10 years AWA = -$16,990 (Here assume repeatability; so use AW method.) AWB = -65,000(A|P,15%,10) - 9,000 + 25,000(A|F,15%,10) = -$20,722 Alternative A is still preferred. 2) Select the preferred investment alternative from the mutually exclusive pair shown in the following table based on a) the repeatability assumption, b) the coterminated assumption with a four-year study period and the market value of Alternative 2 (at the end of year four) determined using the imputed market value technique, c) the coterminated assumption with an eight-year study period (Alternative 1 would not be repeated). The MARR is 10% per year. End of Year 0 1 2 3 4 5 6 7 8 8 (MV) Alternative 1 Alternative 2 $40,000 $50,000 12,000 12,000 12,000 36,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 40,000 Solution: a) Repeatability assumption; study period = 8 years AW1(10%) = -$40,000 (A/P,10%,4) + $12,000 + $24,000 (A/F,10%,4) = $4,552 AW2(10%) = -$50,000 (A/P,10%,8) + $10,000 + $40,000 (A/F,10%,8) = $4,126 Select Alternative 1 to maximize annual worth. b) Coterminated assumption; study period = 4 years AW1(10%) = $4,552 (from Part a) 2 To calculate AW2, we will use an imputed market (salvage) value estimate at the end of year 4 (MV4) based on the remaining annual capital recovery amount and the market value at end of year 8. Methods for estimating market (salvage) value • Obtain a current estimate from the market place • Estimate salvage value at time t using straight line depreciation Investment cost- Annual depreciation expense*t = $I - ($I/useful life)*t • Market value at time t (PW at the end of year t of remaining CRC) + PW at the end of year t of original market value at end of useful life) MVt = [$I(A/P,i%,n) - $S(A/F,i%,n)] (P/A,i%,t) + S (P/F,i%,t) Remaining CRC PW of CRC PW of S at time t Imputed market value (MV4) for Alternative 2 using the third method: Estimated S 0 t=4 Original S Useful life=8 years MV4 = [$50,000(A/P,10%,8) - $40,000 (A/F,10%,8)] (P/A,10%,4) + 40,000 (P/F,10%,4) CRC PW of CRC PW of S at time t = $45,940 AW2(10%) = - $50,000 (A/P,10%,4) + $10,000 + $45,940 (A/F,10%,4) = $4,125 Select Alternative 1 to maximize annual worth. Notice that AW2 is the same (slight difference due to rounding) in part (b) using the imputed MV concept as it was in part (a) with the repeatability assumption. b) Coterminated assumption; study period = 8 years Since the investment in Alternative 1 will not be repeated, assume that the positive cash flows of Alternative 1 are reinvested at the MARR for the 8-year study period. FW1(10%) = -$40,000 (F/P,10%,8) + [$12,000(F/A,10%,4) + $24,000](F/P,10%,4) = $30,933 FW2(10%)= -$50,000 (F/P,10%,8) + $10,000(F/A,10%,8) + $40,000 = $47,179 Select Alternative 2 to maximize future worth. 3 Comparing Independent, Dependent & Mutually Exclusive Alternatives 1) (Prob. 5-35 Sullivan, 12th ed.) Consider the alternatives below, which are compared over 10 years. A $30,000 8,000 3,000 Capital investment AR-AC Market value B1 $22,000 6,000 2,000 B2 $70,000 14,000 5,000 C $82,000 18,000 7,000 Projects B1 and B2 are mutually exclusive. Project C depends on B2 and A depends upon B1. Capital is limited to $100,000 and MARR is 12%/year. Which bundle (combination) of projects should be selected? Solution: Project Combination 1. DN 2. B1 3. A, B1 4. B2 5. B2, C A B1 B2 C Investment $ Feasible? PW 0 0 1 0 0 0 1 1 0 0 0 0 0 1 1 0 0 0 0 1 0 22,000 52,000 70,000 152,000 yes yes yes yes no 0 $12,545 $28,713 $10,713 Select A and B1 with maximum PW. 2) Consider the following information: Incremental IRR in % when compared with alternative Alternative Initial investment IRR % A B A - 40,000 29 B - 75,000 15 1 C -100,000 16 7 20 D -200,000 14 10 13 C 12 If the alternatives are independent, which should be selected if the company's MARR is 15% per year? a) Only alternative A c) Alternatives A and C b) Alternatives A and B d) Alternatives A, B, and C** If the alternatives are mutually exclusive and the company's MARR is 11% per year, which alternative(s) should be selected? a) A, B, C, and D c) Only D b) Only A** d) Only A and C 4 If the alternatives are mutually exclusive and the company's MARR is 10% per year, which alternative(s) should be selected? a) A, B, C, and D c) Only A b) Only, A, B, and C d) Only D** Depreciation and After-Tax Cash Flows 1) A computer was purchased for $16,000 and $2,000 was spent installing it. It has a life of 4 years. Compute the depreciation deduction (expense) in year 2 and the book value at the end of year 3 using: a) straight-line method b) declining balance method Solution: Straight line rate=1/4=25%; declining balance rate=2/4=50% EOY 0 1 2 3 4 Straight Line Depr. Exp. 0 4,500 4,500 4,500 4,500 Book Value 18,000 13,500 9,000 4,500 0 Declining Balance Depr. Exp. 0 9,000 4,500 2,250 2,250 Book Value 18,000 9,000 4,500 2,250 0 2) Compare the following alternative material handling systems, which provide the same amount of revenue. Which one would you choose? System X System Y First cost $ 80,000 200,000 Estimated useful life, years 20 40 Annual cost, $ 18,000 6,000 Straight line depreciation is used; tax rate is 30%; After-tax MARR is 6%. Solution: System X A EOY BTCF 0 -$80,000 1-20 -$18,000 † B Depr. Exp. --$4,000* C=A+B† Taxable Income --$22,000** D=t*C Tax Paid (40%) -$6,600** E=A-D ATCF -$80,000 -$11,400 † These are annual costs; thus C=A+B. *Straight line rate=1/20 **Since taxable income is negative (-$22,000), you don’t pay taxes; $22,000*0.4=$6,600 are a savings in engineering economic terms! 5 System Y A EOY BTCF 0 -$200,000 1-20 -$6,000 B Depr. Exp. --$5,000 C=A+B Taxable Income --$11,000 D=t*C Tax Paid (40%) -$3,300 E=A-D ATCF -$200,000 -$2,700 AWX= -80,000(A/P,6%,20)-11,400= -$18,360 AWY= -200,000(A/P,6%,40)-2,700= -$16,000. Select Y with minimum cost. Benefit/Cost Ratio Method 1) (Prob. 11-5 Sullivan, 12th ed.) There are 2 alternatives for generating power. Which one should be selected? Capital investment $ Annual power sales $ Annual O&M costs Annual flood-control savings $ Annual irrigation benefits $ Annual recreation benefits $ Ability to attract new industry $ Useful life, years Interest rate: 5% per year A (Coal powered) 20,000,000 1,000,000 200,000 500,000 50 B (Hydroelectric) 30,000,000 800,000 100,000 600,000 200,000 100,000 400,000 50 Solution: B/C ratio= (AW of Benefits - AW of Disbenefits)/ (AW of Inv. Cost+Annual O&M costs) B/C for A: (1,000,000+500,000)/ [20,000,000(A/P,5%,50) +200,000] =1.16>1.0 B/C for B: (800,000+1,300,000)/ [30,000,000(A/P,5%,50)+100,000]=1.20>1.0 Both A and B are acceptable. (Note B/C ratios above are actually ∆ (DN→A) and ∆ (DN→B). Both ratios are greater than 1.0, and so acceptable!) Use incremental analysis. Rank order alternatives from low capital investment to high capital investment: A→B. ∆ (A→B): ∆ Capital investment= $10,000,000 ∆ Annual O&M= $100,000 ∆ Annual power sales= $200,000 ∆ Other benefits= $800,000 ∆B/C: (800,000-200,000)/ [10,000,000(A/P,5%,50)-100,000]=1.34>1.0 Select B. 6 Dealing with Uncertainty 1) (Prob. 10-18 Sullivan, 12th ed.) Suppose for an engineering project the optimistic, most likely, and pessimistic estimates are as shown below. Capital Investment Useful Life Market Value Net Annual Cash Flow MARR Optimistic -$80,000 12 years $30,000 $35,000 12%/yr Most Likely -$95,000 10 years $20,000 $30,000 12%/yr Pessimistic -$120,000 6 years 0 $20,000 12%/yr a) What is the AW for each of the three estimation conditions? b) It is thought the most critical elements are useful life and net annual cash flow. Develop a table showing the AW for all combinations of estimates for these two factors, assuming that all other factors remain at their most likely values. Solution: a) AWO = -80,000(A/P,12%,12)+30,000(A/F,12%,12)+35,000= $23,330 AWML = -95,000(A/P,12%,10)+20,000(A/F,12%,10)+30,000= $14,325 AWP = -120,000(A/P,12%,6)+20,000= -$9,184 b) Summary results O ML P 1 2 3 Net Annual Cash Flow $35,000 $30,000 $20,000 O (12 years) 20,4951 15,495 5,495 Useful Life ML (10 years) 19,325 14,325 4,3252 P (6 years) 14,360 9,360 -6403 AWO = -95,000(A/P,12%,12)+20,000(A/F,12%,12)+35,000= $20,495 AWML = -95,000(A/P,12%,10)+20,000(A/F,12%,10)+20,000= $4,325 AWP = -95,000(A/P,12%,6)+20,000(A/F,12%,6)+20,000= -$640 2) (Prob. 10-18 Sullivan, 12th ed.) A certain potential investment project is critical to a firm. The following are “best” or “most likely” estimates: Investment $100,000 Life 10 yr Salvage value $20,000 Net annual cash flow $30,000 MARR 10% It is desired to show the sensitivity of a measure of merit (net annual worth) to variation, over a range of ±50% of the expected values, in the following elements: (a) life, (b) net annual cash flow, and (c) interest rate. Graph the results. To which element is the decision most sensitive? 7 Solution: If n = project life, i = interest rate, and A = net annual cash flow, we have AW = -$100,000(A/P,i,n) + A + $20,000(A/F,i,n) % change -50% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% Net Annual Worth Life Net Annual MARR Cash Flow $6,896 $(20) $18,640 $9,631 $2,980 $17,931 $11,568 $5,980 $17,210 $13,004 $8,980 $16,478 $14,109 $11,980 $15,734 $14,980 $14,980 $14,980 $15,683 $17,980 $14,216 $16,259 $20,980 $13,441 $16,738 $23,980 $12,657 $17,140 $26,980 $11,863 $17,482 $29,980 $11,060 Net Annual Worth is most sensitive to changes in the net annual cash flow. However, the decision to invest in the project is relatively insensitive to changes in the specified range. $24,980 CF $19,980 $14,980 LIFE MARR $9,980 $4,980 -$20 -50 -30 -10 10 30 50 8