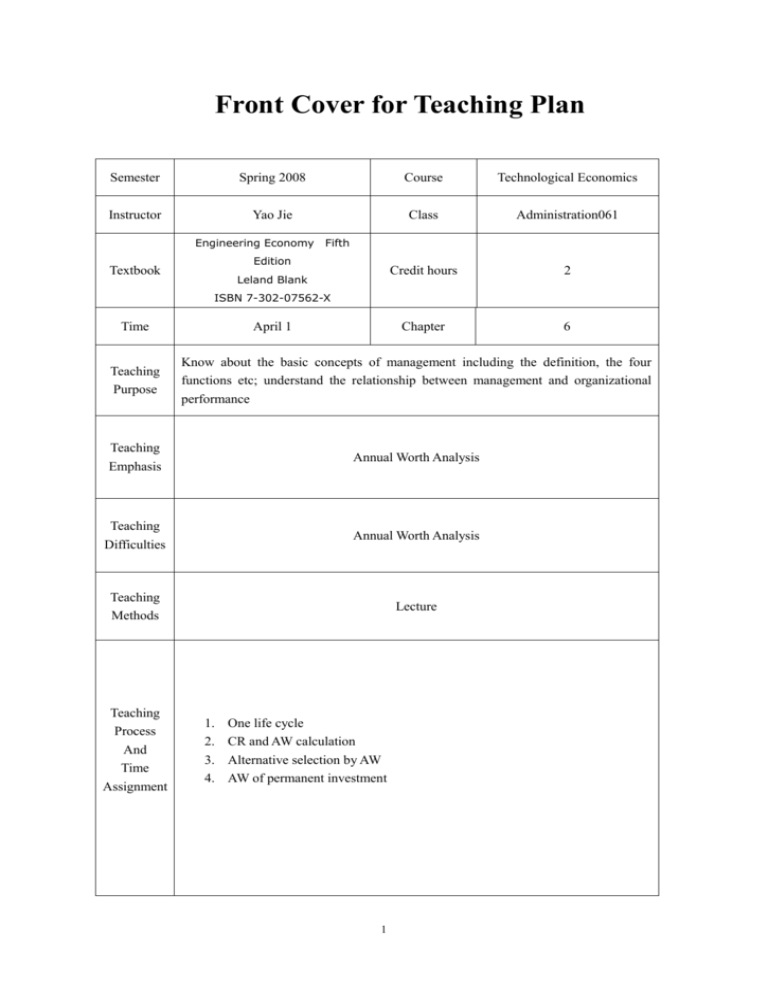

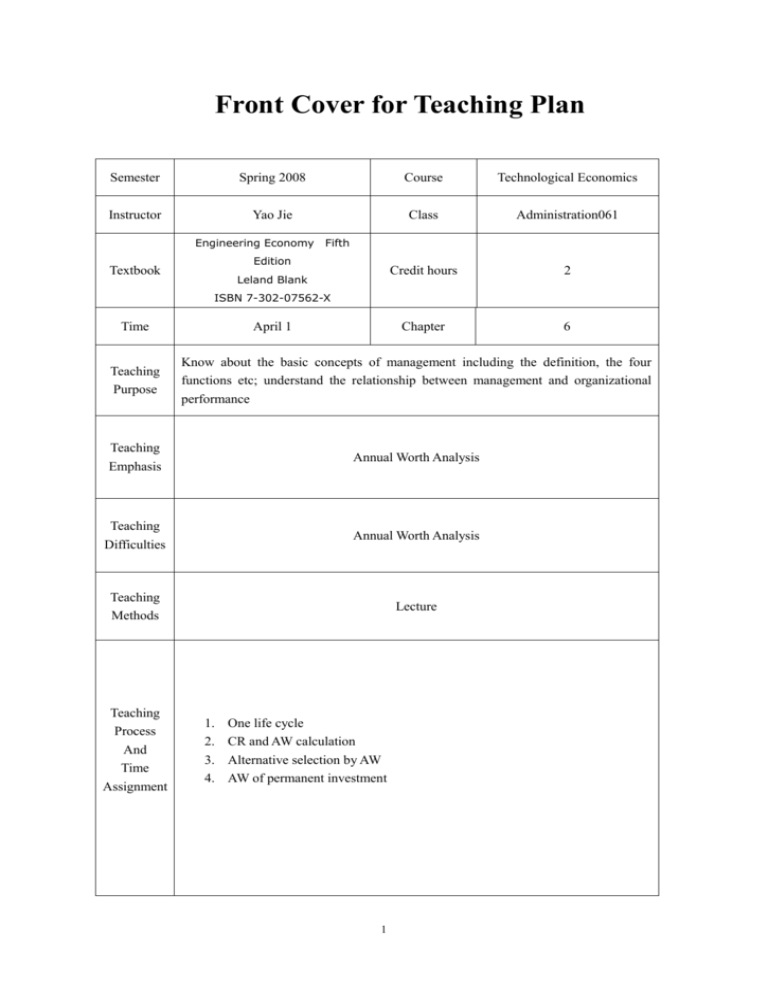

Front Cover for Teaching Plan

Semester

Spring 2008

Course

Technological Economics

Instructor

Yao Jie

Class

Administration061

Credit hours

2

Chapter

6

Engineering Economy

Fifth

Edition

Textbook

Leland Blank

ISBN 7-302-07562-X

Time

April 1

Teaching

Purpose

Know about the basic concepts of management including the definition, the four

functions etc; understand the relationship between management and organizational

performance

Teaching

Emphasis

Annual Worth Analysis

Teaching

Difficulties

Annual Worth Analysis

Teaching

Methods

Lecture

Teaching

Process

And

Time

Assignment

1.

2.

3.

4.

One life cycle

CR and AW calculation

Alternative selection by AW

AW of permanent investment

1

Teaching Plan

Content

Remark

Section 6.1 Advantages and Uses of Annual Worth

Popular analysis technique

Easily understood -- results are reported in $ per time period, usually $ per year

Eliminates the LCM problem associated with the present worth method

Only have to evaluate one life cycle

AW Calculation from PW or FW

Computation from PW or FW

AW = PW(A/P,i%,n) or

AW = FW(A/F,i%,n)

If AW determined for alternative comparison, equal service assumption requires

that

n = LCM number of years

AW converts all cash flows to their end of period equivalent amounts in $ per year

AW Value from Cash Flows

AW values can be calculated directly from cash flows for only one life cycle

Not necessary to consider the LCM of lives as is in PW or FW analysis

For alternative comparison, select the alternative with the best AW value

AW and Repeatability Assumption

If two or more alternatives have unequal life estimates, only evaluate the AW for

one life cycle of each alternative; The annual worth of one cycle is the same as

the annual worth of all future cycles (from repeatability assumption)

Repeatability Assumption:

1. The services provided are needed forever

2. The first cycle of cash flows is repeated for all successive cycles in the same

manner

3. All cash flows will have exactly the same estimated values in every life cycle.

Note: The third assumption may be unrealistic in many problems encountered in

industry

2

One or More Cycles

AW assumes repeatability of cash flows

Cycle 1

Cycle 2

…

Cycle k

Find the annual worth

of any given cycle

($/period)

Annualize any one of the cycles

Slide Sets to accompany Blank & Tarquin, Engineering

Economy, 6th Edition, 2005

6-8

© 2005 by McGraw-Hill, New York, N.Y All Rights Reserved

Ex 6.1 -- 6 Year & 9 Year Alternatives

For PW or FW analysis, need an 18 year study period. Means a lot of calculation

effort!

3 life cycles of the 6 year project

2 life cycles of the 9 year project

Using AW Analysis

If the cash flow patterns are assumed to remain the same for the 6 and 9 year

projects for future cycles, then for AW method

Advantages/Applications of AW:

Applicable to a variety of engineering economy studies such as:

Asset replacement

Breakeven analysis

Make-or-Buy decisions

Studies dealing with manufacturing costs

Economic value added (EVA) analysis

Section 6.2 Calculating Capital Recovery and AW

An economic alternative should have the following cash flow estimates made

Initial investment -- P

Estimated future salvage value -- S

Estimated life -- n

Interest rate -- i% (this is usually the MARR)

Estimated annual operating costs – AOC

Capital Recovery (CR) is the annualized equivalent of the initial investment P and

the future salvage value S for n years at i%

Capital recovery cost

3

It is important to know the equivalent annual cost of owning an asset

This cost is called “Capital Recovery” or CR, CR is determined using {P, S, i, and

n}

Comparing capital recovery with AW

AW = - CR – AOC

where AOC itself is an annual equivalent amount (same each year).

Capital Recovery Calculations

Method 1

Compute equivalent annual cost of the investment P and subtract the equivalent

annual savings of the salvage value S. This is

P(A/P,i,n) - S(A/F,i,n)

Determine CR as the negative (cost) of this relation

CR = -[P(A/P,i,n) - S(A/F,i,n)]

Method 2

Subtract salvage value S from original cost P and calculate the equivalent annual

cost of (P-S)

Add to that the interest which the salvage value would return each year, S(i)

CR = -[(P - S)(A/P,i,n) + S(i)]

Excel can be used to find CR= PMT(i%,n,P,-S)

CR Amount: What It Means

CR is the annual cost associated with owning a productive asset over n time periods

at interest rate i% per period.

Equivalently, CR may be interpreted as the minimum amount of money an

investment must earn each of n years to recover the initial cost at a return of i%.

Example 6.2: P = $12.46 million, S = $0.5 million, n = 8 years, i = 12%, AOC =

$0.9 million per year

CR by method 2:

CR = -[(12.46-0.5)(A/P,12%,8)+ 0.5(0.12)]

= $-2.47 million per year

AW = CR – AOC = - 2.47 - 0.9 = $ - 3.37 million per year

Section 6.3 Evaluating Alternatives Using AW

For mutually exclusive alternatives, select one with lowest AW of costs(service) or

highest AW of net incomes (revenue).

This means, select the numerically largest AW alternative.

If AW < 0 at MARR, the (revenue) alternative is not economically justifiable, since

initial investment P is not recovered over n years at the required rate of MARR

= i% per year.

4

Example 6.4(a):

Alternative A has two components with n values of 8 and 12 years; Alternative B

has n = 24 years

Selection using AW chooses B with the lower equivalent annual costs

Alternative

Lives

CR

AW

A

8 & 12

$-24,424

$-36,724

B

24

$-27,146

$-29,646

Only one life cycle of each asset was considered

PW analysis would require using LCM of 24 years

Example 6.4(b):

Specified study period of only 6 years reduces time to recover investment, so AW

values of costs go up

Alternative Study Period

CR over 6 years

AW over 6 years

A

6

$-26,382

$-38,682

B

6

$-43,386

$-45,886

Now, select A since it has lower AW of costs

Bigger impact on CR for B since recovery time is reduced from 24 to only 6 years

Check out the computer solution for this example

Special Cases for AW Analysis

If cash flow repeatability assumption can’t be made, specify a study period of n

years and perform analysis with this n in all computations (Example 6.4(b) did

this)

If projects are independent, select all with AW > 0 at i = MARR, provided no

budget limit is defined. If budget limited, use techniques of chapter 12

Section 6.4 AW of a Permanent Investment

If an investment has no finite cycle (or a very long estimated life), it is called a

perpetual or permanent investment

If “P” is the present worth of the cost of the investment, then the AW value is P

times i

AW =A = P(i)

AW is actually the amount of interest P would earn each year, forever

Remember: P = A/i

See Examples 6.5 and 6.6 for illustrations

5