Asymmetric GARCH

advertisement

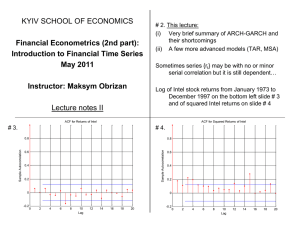

General Autoregressive Conditional Heteroskedastistic Model (GARCH) This model differs to the ARCH model in that it incorporates squared conditional variance terms as additional explanatory variables. This allows the conditional variance to follow an ARMA process. If we write the residual as: ut vt t2 vt ht Where t is written as ht and vt has a zero mean and variance of one. We can them write the conditional variance as: 2 q ht 0 i 1 2 i ut i p i ht i i 1 For instance a GARCH(1,1) process would be: hˆt 0.7 0.3ut21 0.5ht 1 T-statistics and the usual diagnostic tests could also be added to this model. If there was only the one lag on the h variable, we would have a GARCH(1,0) process which is the same as an ARCH(1) process. Model Restrictions The principal restriction of this model is that all the explanatory variables in a GARCH and therefore ARCH model must be positive, this is known as the nonnegativity constraint, clearly it is impossible to have a negative variance, as it consists of squared variables. Advantages of GARCH models compared to ARCH models The main problem with an ARCH model is that it requires a large number of lags to catch the nature of the volatility, this can be problematic as it is difficult to decide how many lags to include and produces a non-parsimonious model where the nonnegativity constraint could be failed. The GARCH model is usually much more parsimonious and often a GARCH(1,1) model is sufficient, this is because the GARCH model incorporates much of the information that a much larger ARCH model with large numbers of lags would contain. ML Estimation of ARCH models in practice: 1. Specify the model and its likelihood function 2. Use OLS regression to get initial estimates (starting values) for β1 , β1 etc. 3. Choose initial estimates for the parameters of the conditional variance function. Microfit (and other software) offers you zeros as starting values for these. In practice it is better to choose small positive values. 4. Specify a convergence criteria (usually the software has a default value for this). 5. Maximise the likelihood by iteration until no further improvement in the model coefficients can be obtained (and the convergence criteria in step 4 is met). Asymmetric GARCH The GARCH model can be extended to include any number of lags on the squared error term and conditional variance term. The GARCH (p,q) model has p lags on the conditional variance term and q on the squared error term. However in general a GARCH(1,1) model is sufficient. Asymmetric GARCH models due to the leverage effect with asset prices, where a positive shock has less effect on the conditional variance compared to a negative shock. This can be incorporated into the GARCH model using a dummy variable. This was introduced by Glosten, Jangathann and Runkle (GJR), and showed that asymmetric adjustment was an important consideration with asset prices. The model is of the form: t2 0 1ut21 t21 ut21 I t 1 Where I is a dummy variable that takes the value of 1 when the shock is less than 0 (negative) and 0 otherwise. To determine if there is asymmetric adjustment, depends on the significance of the last term, which can be determined using the t-statistic. Given the following set of results: t2 0.5 0.7ut21 0.2 t21 0.17ut21 I t 1 If we assume that t21 =0.7 and uˆt 1 0.5 , when the shock is positive, t2 =( 0.5+ 0.175+0.14)= 0.815, if the shock is negative t2 =(0.5+0.175+0.14 +0.0425)=0.8575. The alternative to the above model is to use EGARCH, which has a number of advantages over the basic GARCH model, as the non-negativity constraint does not need to be imposed and the asymmetries are also allowed for using this model: ln( t2 ) ln( t21 ) ut 1 t21 [ ut 1 t21 2 ] GARCH-in-mean In this class of models, the conditional variance enters into the conditional mean equation as well as the usual error variance part. yt t 1 ut t2 0 1ut21 t21 If yt is assumed to be an asset return, then in effect the first equation suggests that the mean return is dependent on the risk, if the parameter δ is positive and significant, then it means that the mean return increases when there is greater risk, in effect δ can be interpreted as a risk premium.