Slide 1

advertisement

KYIV SCHOOL OF ECONOMICS

Financial Econometrics (2nd part):

Introduction to Financial Time Series

May 2011

Instructor: Maksym Obrizan

# 2. This lecture:

(i) Very brief summary of ARCH-GARCH and

their shortcomings

(ii) A few more advanced models (TAR, MSA)

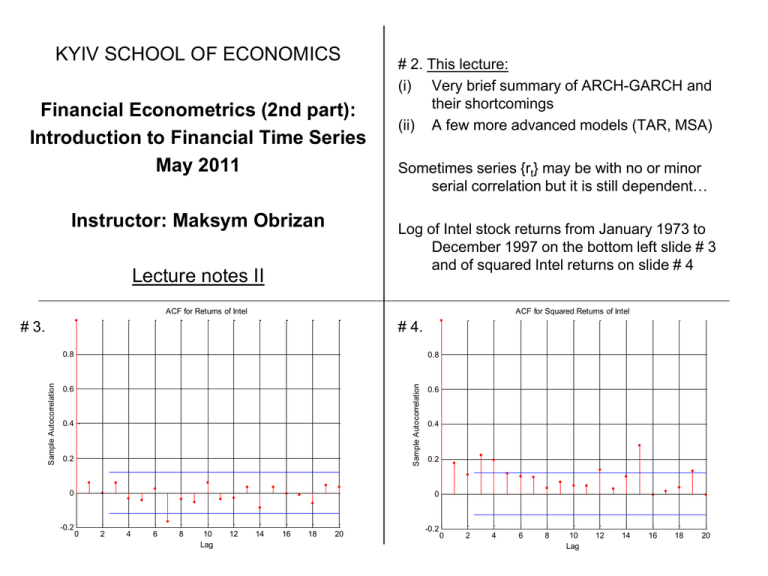

Sometimes series {rt} may be with no or minor

serial correlation but it is still dependent…

Log of Intel stock returns from January 1973 to

December 1997 on the bottom left slide # 3

and of squared Intel returns on slide # 4

Lecture notes II

ACF for Returns of Intel

ACF for Squared Returns of Intel

# 3.

# 4.

0.8

Sample Autocorrelation

Sample Autocorrelation

0.8

0.6

0.4

0.2

0

-0.2

0.6

0.4

0.2

0

0

2

4

6

8

10

Lag

12

14

16

18

20

-0.2

0

2

4

6

8

10

Lag

12

14

16

18

20

ACF for Modulus Returns of Intel

# 5.

# 6. Series are uncorrelated but dependent:

volatility models attempt to capture such

dependence

Sample Autocorrelation

0.8

0.6

Define shock or mean-corrected return

0.4

0.2

0

-0.2

0

2

4

6

8

10

Lag

12

14

16

18

# 7. Then ARCH(m) model assumes

20

# 8. Practical way of building an ARCH model

(i) Build an ARMA model for the return series

to remove any linear dependence in data

If the residual series indicates possible ARCH

effects – proceed to (ii) and (iii)

(ii)

In practice, the error term is assumed to follow

the standard normal of a standardized

Student-t distribution

Specify the ARCH order and perform

estimation

(iii) Check the fitted ARCH model for necessary

refinements

# 9. Fitting an ARCH Model:

# 10. Shortcomings of ARCH model

(i) Positive and negative shocks have the

same effects on volatility

Model Checking:

Obtain standardized shocks

(ii)

Use kurtosis, skewness and QQ-plot of to

check if normal distribution is applicable

MOTIVATION FOR TAR, MSA MODELS!

ARCH model is restrictive – parameters are

constrained by certain intervals for finite

moments etc

(iii) Sometimes not parsimonious models: use

GARCH

# 11. GARCH model:

# 12. NOTES

Then use Ljung-Box statistic on

to check the

adequacy of the mean equation and on

to check the validity of the volatility equation.

Weaknesses of GARCH model are similar to

those of ARCH: symmetric response to

negative and positive shocks etc

# 13. Application: daily log returns of IBM stock

from July 3, 1962 to December 31, 1999

# 14. In addition, the Ljung-Box statistics of the

standardized residuals is Q(10) = 11.31 (pvalue of 0.33) and of the squared

standardized residuals is Q(10) = 11.86 (pvalue of 0.29)

All the estimates (except the coefficient of rt-2)

are highly significant

# 15. The unconditional mean of rt in this model

is

while in the sample it is only 0.045.

What if the model is misspecified?

Motivation for nonlinear models such as

TAR and MSA

# 16. Threshold Autoregressive (TAR) model

Simulated 2-regime TAR(1) series

6

# 17. Consider a simple two-regime TAR model

5

# 18.

4

3

2

1

0

-1

-2

-3

# 19. Observe that this model has coefficient -1.5

0

20

40

60

80

100

120

140

160

# 20. Model behavior depends on xt -1:

When it is negative then

However, despite this fact it is stationary and

geomertically ergodic if

When it is positive then

Ergodic theorem – statistical theorem showing

that the sample mean of xt converges to the

mean of xt

Question: Which regime will have more

observations?

180

200

# 21. In addition, TAR model has non-zero mean

even though the constant terms are zero

(think of an AR(m) model with zero constant

for a comparison)

# 22. AR(2)-TAR-GARCH(1,1) of IBM stock

Re-consider slide # 15 with AR(2)-GARCH(1,1)

model of IBM stock: the unconditional mean

of 0.065 overpredicted the sample mean of

0.045

Estimate AR(2)-TAR-GARCH(1,1) model and

refine it (remove insignificant term in

volatility equation)

# 23. Model fit

All coefficients are significant at 5%

The unconditional mean?

The Ljung-Box statistics applied to standardized

residuals does not indicate serial

correlations or conditional heteroscedasticity

# 24. NOTES:

# 25. Convenient to re-write TAR-GARCH(1,1):

# 26. Recall the integrated GARCH model

(IGARCH is a unit-root GARCH model)

For example, IGARCH(1,1) is defined as

The unconditional variance of at, and thus of rt, is

not defined

Meaning: Occasional level shifts in volatility?

IGARCH(1,1) with

is used in

RiskMetrics (Value at Risk calculating)

# 27. Thus, under nonpositive deviation the

volatility follows an IGARCH(1,1) model

without a drift

With positive deviation, the volatility has a

persistent parameter 0.046+0.885=0.931

which is <1 giving rise to GARCH(1,1)

Conclusion:

# 28. NOTES:

# 29. Markov Switching Model

# 30. Application to the US quarterly real GNP

# 31. Cont’d

# 32. Notes

# 33. Nonlinearity tests: Parametric tests

# 34. Apply F statistic

The RESET Test for a linear AR(p) model

with g and T-p-g degrees of freedom

Basic idea: if a linear AR(p) model is adequate

then a1 and a2 should be zero.

# 35. Nonlinearity tests: Nonparametric tests

Q-statistic of Squared Residuals

The null hypothesis of the statistic is

# 36. NOTES

# 37. Application to the US quarterly civilian

unemployment from 1948 to 1993 based on

Montgomery, Zarnowitz, Tsay and Tiao

(1998)

# 38. TAR model

# 39. MSA model

# 40. NOTES