PowerPoint ****

advertisement

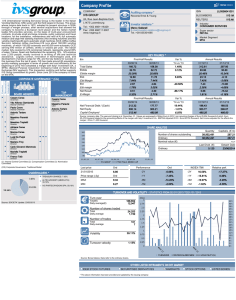

The dynamics of retail real estate market in Hong Kong Sun Zhuo Xiao · Chau Kwong Wing Content • • • • • Background Development of Hypothesis The methodology Data characteristics and sources Empirical results The importance of retail sector in Hong Kong • By the end of 2013, retail trade industry offers 9.8% job positions and makes 5.0% contribution to the GDP. 450000 6.0% 400000 5.0% 350000 300000 4.0% 250000 3.0% 200000 150000 2.0% 100000 1.0% 50000 0 0.0% 1999 2000 2001 2002 2003 2004 retail sales(HK$million) 2005 2006 2007 2008 GDP in wholesale and retail trade 2009 2010 2011 The importance of the retail property sector In the aspect of factor of production, in year 2012, the real estate sector contributes 5.8% to the total GDP. In the stock market, the market share of the real estate sector is even larger, they occupy 14% of the total market value in September of 2013.(Hong Kong Exchange – HKEx). What might be the driven force behind it? 450.0 The retail property price index 400.0 350.0 300.0 250.0 200.0 150.0 100.0 50.0 0.0 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Individual Visit Scheme First introduced in four Guangdong cities on 28 July 2003 Under the Scheme, around 270 million Mainland residents in the 49 cities who have permanent residence identity are eligible to apply for it. According to the statistics released by the Immigration Department, the ratio of mainland travelers under the scheme accounts for 35% of the total mainland travelers in year 2004,and the ratio continues rising up to 67.1% in the first seven months of 2013. Till July of 2013, the number of travellers under the scheme reached 116.8 million since the scheme was launched. The performance of the tourism sector Yearly tourist capacities for mainland visitors and non-mainland visitors 350,000,000 31% 40% 54% 57% 54% 55% 55% 57% 61% 63% 67% 71% Tourist spending from mainland China and other areas of the world 300000 33% 40% 51% 65% 58% 56% 56% 58% 62% 69% 69% 71% 75% 250000 300,000,000 250,000,000 200000 200,000,000 150000 150,000,000 100000 100,000,000 50000 50,000,000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Mainland visitors Non-mainland visitors The mainland of China South&Southeast Asia North Asia The Americas Europe,Africa&the Middle East Taiwan Australia,New Zealand&Souht Pacific Macao Development of Hypotheses • With the increasing travellers from mainland China, the demand for retail business increases, therefore, the demand for the retail space increases correspondingly. At the same time, the supply of retail property space is sticky because the construction work takes time. In the framework of the demand and supply mechanism, the retail property price will increase subsequently. Hypothesis1 IVS has a positive impact on the retail property price in Hong Kong. Development of Hypotheses • The expensive locations for retail property not only exhibit good locations, but also represent convenient transportation, centralized luxury items and brand name shops, abundant subsidiary facilities and well-known reputation. The expensive locations can simply attract more travellers than the cheap locations. It is reasonable to propose that the impact of the IVS policy will be distinct in expensive locations compared with the cheap locations. • Hong Kong Island and Kowloon districts are classified into the expensive locations and New Territories is classified into cheap location. Hypothesis 2 IVS has a differential impact on the retail property in the expensive locations and the cheap locations. Development of Hypotheses It is reasonable that the purchasing power of the travelers coming at the initial stage of the IVS is higher than the subsequent visitors. In addition, the first beneficiaries of IVS from mainland China are wealthier residents compared with the second and third-tier cities. Their affordability and the probability of buying luxury items are much higher. The luxury items and brand name shops are basically located in the expensive locations of the retail property area. • Hypothesis 2a IVS has a stronger impact on prices of street level shops in expensive locations compared with those in cheaper locations. Development of Hypotheses The time table of IVS implementation Time City Jul 28th, 2003 Dongguan, Foshan, Zhongshan, Jiangmen Aug 20th, 2003 Guangzhou, Shenzhen, Zhuhai, Huizhou Sep 1st, 2003 Shanghai, Beijing Jan 1st, 2004 Shantou, Chaozhou, Meizhou, Zhaoqing, Qingyuan, Yunfu May 1st, 2004 Shanwei, Maoming, Zhanjiang, Shaoguan, Jieyang, Heyuan, Yangjiang Jul Nanjing, Suzhou, Wuxi, Hangzhou, Ningbo, Taizhou, Fuzhou 1st, 2004 Mar 1st, 2005 Tianjin, Chongqing Nov 1st, 2005 Chengdu, Jinan, Dalian, Shenyang May 1st, 2006 Nanchang, Changsha, Nanning, Haikou, Guiyang, Kunming Jan 1st, 2007 Shijiazhuang, Zhengzhou, Changchun, Hefei, Wuhan Development of Hypotheses • With the spread of the IVS policy, less travellers from first-tier cities come and more travellers from second and third tier cities come who are generally less wealthier. The attraction of expensive locations becomes weak and the impact of the policy declines faster in expensive locations. • Hypothesis 2b The effect of IVS declines more slowly in cheaper locations than expensive locations. The methodology to conduct the study • Ordinary least squares regression analysis in the preliminary process OLS is an approach for estimating the unknown coefficients in a linear regression model. Assume there is a single linear relationship among the variables 𝑥1𝑡, 𝑥2𝑡 , … 𝑥𝑘𝑡 in the form of • 𝑥1𝑡 =a+ 𝑘 𝑗=2 𝑏1𝑗 𝑥𝑗𝑡 + 𝑢𝑡 Data characteristics and sources Variable Description Definition Data Source P Price Rating and valuation department RRS Real Retail Sales Price for retail property in HK and three districts of Hong Kong Retail sales value in Hong Kong divided by CPI SPA Newly Completely Space IVS IVS*@trend Individual Visit Scheme Dummy variable EXC Effective Exchange rate Index HIBOR3M IS Hong Kong Monthly digest of Statistics by Census and Statistics Department Completions based on the issue of an occupation Hong Kong Property Review by Rating and Valuation permit Department Launched in July of 2003 Government Policy Equal to 0 before 2003, and equal to 1 thereafter The time trend of IVS The effective exchange rate index (EERI) for the Hong Kong Monthly digest of Statistics HKD is an index which measures movements in the weighted average of the exchange rate of the HKD against the currencies of major trading partners of Hong Kong. Hong Kong Interbank Offered As a proxy for interest rate Hong Kong Monetary Authority Rate 3 month Income to space ratio Income to space ratio is calculated as GDP divided by Hong Kong GDP : Hong Kong yearly digest of Statistics the retail stock at the year end. Stock completed at the yearend: Hong Kong Property Review V Vacancy rate Vacancy rate at year end ST Stock Stock at year end Hong Kong Property Review by Rating and Valuation Department Rating and Valuation deparetment Empirical model • ∆ ln P = λ0 + λ1 ∆ ln RRS(−1) + λ2 ∆ ln SPA(3) + λ3 IVS + λ4 IVS ∗ Trend + λ5 EXC + λ6 HIBOR3M + λ7 IS + λ8 V + MA 1 + ε (1) H1 • ∆ ln HKIP = α0 + α1 ∆ ln RRS + α2 ∆ ln HKISPA(10) + α3 IVS + α4 IVS ∗ Trend + α5 EXC + α6HIBOR3M + MA 1 + AR 1 + ε H2 (2) • ∆ ln KLP = β0 + β1 ∆ ln RRS + β2 ∆ ln KLSPA(10) + β3 IVS + β4 IVS ∗ Trend + β5 EXC + β6 HIBOR3M + AR 1 + MA(1) + ε (3) • ∆ ln NTP = δ0 + δ1 ∆ ln RRS + δ2 ∆ ln NTSPA(10) + δ3 IVS + δ4 IVS ∗ Trend + δ5 EXC + δ6 HIBOR3M + AR 1 + MA 1 + ε (4) Empirical model • The second step is to differentiate the price equation of the Hong Kong Island with the New Territories and the price equation of Kowloon with New Territories. • The two equations are achieved as • ∆ ln HKIP − ∆ ln NTP = γ0 + γ1 ∆ ln RRS + γ2 ∆ ln HKISPA 10 − ∆ ln NTSPA 10 γ6 HIBOR3M + AR 1 + MA 1 + ε + γ3 IVS + γ4 IVS ∗ Trend + γ5 EXC + (5) • ∆ ln KLP − ∆ ln NTP = ϕ0 + ϕ1 ∆ ln RRS + ϕ2 (∆ ln KLSPA 10 − ∆ ln NTSPA 10 ) + ϕ3 IVS + ϕ4 IVS ∗ Trend + ϕ5 EXC + ϕ6 HIBOR3M + AR 1 + MA(1) + ε (6) Empirical result for Hypothesis 1 Variable Intercept ∆lnRRS(-1) ∆lnSPA(3) IVS Exchange IVS*@TREND IS V ∆lnHibor3M MA(1) Adjusted R-squared Coefficient 0.945386 0.783715 -0.098693 2.664560 -0.011434 -0.108621 0.045353 -2.433189 -0.011186 -0.999791 0.8468 Prob. 0.0000 0.0308 0.0491 0.0000 0.0147 0.0000 0.0456 0.0708 0.0672 0.0126 Empirical result for Hypothesis 2 Hong Kong Island Intercept Kowloon 0.313590*** Intercept (0.0000) ∆lnRRS 0.662637** -0.087118*** ∆lnRRS 0.352727*** ∆lnKLSPA -0.004780*** IVS -0.002845*** IVS*@trend -0.106405*** Exchange 0.308840*** ∆lnHibor3M -0.978014*** (0.0000) 0.530759*** -0.007462*** -0.002757*** -0.129705*** AR(1) 0.475426*** IVS -0.999946*** (0.0000) 0.002263 (0.9858) IVS*@trend -0.000174 (0.9196) Exchange -0.001259* (0.0529) ∆lnHibor3M -0.002496 (0.9488) AR(1) (0.0000) MA(1) -0.007407 (0.8414) (0.0009) (0.0063) MA(1) ∆lnNTSPA (0.0051) (0.0006) AR(1) -0.048317 0.962337*** (0.0195) (0.0000) (0.0000) ∆lnHibor3M ∆lnRRS (0.0000) (0.0010) Exchange 0.800022*** 0.148141*** (0.0372) (0.1138) (0.0008) IVS*@trend Intercept (0.0310) (0.0047) IVS 0.304739*** (0.0049) (0.0463) ∆lnHKISPA New Territories 0.401008*** (0.0001) MA(1) -0.999925*** (0.0000) Empirical results for Hypotheses 2a and 2b Variable Coefficient Prob. Variable Coefficient Prob. C 0.059429 0.1715 C 0.117761 0.0429 DLOG(RRS) 0.274711 0.3756 DLOG(RRS) -0.002603 0.9944 0.3599 DLOG(KLSPA(10 0.002606 0.8890 DLOG(HKISPA(10 -0.015488 ))- ))- DLOG(NTSPA(10) DLOG(NTSPA(10 ) )) IVS 0.148877* 0.0789 IVS 0.354036*** 0.0005 IVS*@TREND -0.001996* 0.0832 IVS*@TREND -0.004981*** 0.0002 EXCHANGE -0.000560 0.1645 EXCHANGE -0.001090 0.0421 DLOG(HIBOR3M -0.049470 0.0482 DLOG(HIBOR3 -0.080765 0.0128 M) ) AR(1) 0.028711 0.8121 AR(1) 0.118123 0.3467 MA(1) -0.970422 0.0000 MA(1) -0.999840 0.0000 Conclusions • IVS has a positive impact on the retail property price in Hong Kong Conclusions • IVS has a differential impact on retail property price in the expensive locations and cheap locations • The impact is stronger in expensive locations • The impact declines slowly in cheap locations Thank you & Questions?