Introduction to the SNA, advanced

Lesson 9

Quarterly national accounts

and seasonal adjustment

Copyright 2010, The World Bank Group. All Rights Reserved.

1

Background

• Quarterly national accounts (QNA) are an important extension

of the annual national accounts (ANA)

– the QNA may not be as comprehensive as the ANA but they follow the

conceptual framework provided by the System of National Accounts,

2008 (i.e. the “2008 SNA”) in exactly the same way as the ANA

• One important difference between the QNA and the ANA is

that the QNA are usually not as detailed as the ANA

– the difference could be the amount of detail available within one or

more of the accounts or it may relate to not being able to produce a

particular account at all because of incomplete data sets

Copyright 2010, The World Bank Group. All Rights Reserved.

2

Some basic principles

• To the extent possible, the methods used in the QNA should

be identical to those used in the ANA

– if this is not feasible then the aim should be to make them

as consistent as possible

• The QNA must be “data driven” and not simply be based on

econometric projections of the ANA

– it may be necessary to fill minor gaps using econometric

methods but this should be strictly monitored and steps

taken to fill data gaps as soon as practicable

• The QNA must be consistent with the ANA which means that

a benchmarking process is required

– simply pro rating quarterly series to annual series is rarely

a satisfactory method

Copyright 2010, The World Bank Group. All Rights Reserved.

3

Some basic principles (continued)

• It is necessary to establish a process and timetable for revising

the QNA and communicate the timetable to users

– the most common source of revisions will be more up-todate data becoming available (whether annual or

quarterly)

– rebenchmarking the QNA to the ANA as the annual

accounts extend to another year will also result in revisions

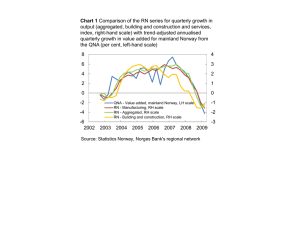

• Seasonal adjustment is a critical part of gaining users’

acceptance of the QNA as a useful source of information on

the economy

– publishing both seasonally adjusted and trend data will

assist users in analysing the accounts

Copyright 2010, The World Bank Group. All Rights Reserved.

4

Some basic principles (continued)

• Producing a consistent time series of national accounts data is

critically important for economic analysts

– discontinuities can be introduced into the accounts if new data are

simply substituted for old data in the single reference period relating

to the new data

– it is necessary to adjust the data in other periods to ensure that they

are consistent with the new data

• The time series QNA covers quarters and years

– it is not useful to estimate cumulative (i.e. “year-to-date”) data as a

means of removing seasonal influences

• The QNA should be seasonally adjusted using a recognised

seasonal adjustment program, such as X-12

– trend estimates can be useful and are available from X-12

Copyright 2010, The World Bank Group. All Rights Reserved.

5

Establishing QNA

• Setting up the QNA is not a trivial exercise and a number of

steps are involved in ensuring that the project runs smoothly

• The first step is to consult potential users about their

requirements

– level of detail, coverage of the QNA compared with the ANA, timing of

release (number of days after the reference quarter)

– it would be useful to have released a document providing some details

of the possibilities beforehand

• Taking users’ requirements into account, the next step is to

document the annual data sources and compilation methods

and check the extent to which the QNA could be compiled

using the same methods as the ANA

Copyright 2010, The World Bank Group. All Rights Reserved.

6

Establishing QNA (continued)

• The systems to be used to compile the QNA have to be chosen

• Ideally, the QNA and the ANA will be compiled using the same

system or, if this is not possible, the QNA system should be

compatible with that used for the ANA

– reconciling the QNA with the annual benchmarks from the

ANA becomes more difficult if different compilation

systems are used

• The correlation between the annual and quarterly source data

must be assessed

– reasons for any differences should be identified to assist in

making adjustments to the source data so that the results

conform to SNA principles

Copyright 2010, The World Bank Group. All Rights Reserved.

7

Quarterly indicator series

• A quarterly indicator series should be as representative as possible

of its annual equivalent

• Inevitably, there will not be a precise match between the indicator

and the annual series so assumptions have to be made to enable

the indicator to be used

– they need to be documented carefully so that their validity can

be monitored as economic conditions evolve

• Indicators can be direct, in that they are specifically related to the

annual series, or indirect, such as hours worked being used as the

quarterly indicator for services outputs

• Another type of indicator is a relationship between series, such as

insurance and freight on exports being a fixed share of exports of

goods

– such indicators should be used only as a last resort

Copyright 2010, The World Bank Group. All Rights Reserved.

8

Data consistency in the QNA

• There are several issues involved in QNA data consistency

– consistency with the ANA benchmarks

– consistency between the various aggregates within a single

period (quarter or year)

– consistency over time

• The ANA provide the benchmarks to which the QNA are adjusted

– examining the behaviour over time of the ratio of the annual

benchmark to the sum of the 4 quarters of each year for each

series provides an indication of the consistency of the quarterly

and annual series

– large changes in this ratio from year to year indicate a need to

improve the data sources (either quarterly or annual or possibly

both)

Copyright 2010, The World Bank Group. All Rights Reserved.

9

Commodity-flow approach

• The commodity-flow approach is based on the identity in the

goods and services account that shows how the total supply

of a product is equal to the total amount used:

Output + imports (i.e. total supply) =

intermediate consumption + final consumption + gross

capital formation + exports (i.e. total uses)

• The commodity-flow method is a useful editing tool when

data on supply are available by detailed product classification

and each of the aggregates in the above equation can be

estimated independently

– this method also can be used to fill data gaps if details are

available for all except one component

Copyright 2010, The World Bank Group. All Rights Reserved.

10

Quarterly volumes

• Adjusting quarterly current values to their annual benchmarks

is a standard type of procedure

– the issues are slightly different with volumes

• Annual volumes are often calculated by taking a simple

average of the monthly prices that go into the price deflator

– the volume obtained this way will differ from the sum of

the quarterly volumes because the quarterly series has a

different weight applied to each quarterly deflator

• Generally, obtaining an annual volume as the sum of the

quarterly ones is preferred because it contains extra

information about the pattern of activity during the year

– operationally it is also an easier approach than

benchmarking to an annual volume

Copyright 2010, The World Bank Group. All Rights Reserved.

11

Basic editing checks

• Editing the QNA is similar to editing the ANA, with standard

types of editing checks that can be applied

• Some additional checks are unique to the QNA

– the sum of quarters equals the annual total

– checking the evolution of the % change between

corresponding quarters of adjoining years and comparing

these with the equivalent seasonally adjusted series

– checking that there is no obvious “step problem” between

the last quarter of one year and the first quarter of the

next

– comparing movements in original and seasonally adjusted

implicit price deflators

Copyright 2010, The World Bank Group. All Rights Reserved.

12

Seasonal adjustment

• A time series is a sequence of data items observed in a number of

successive periods (years, quarters, months) through time

– time series are important because they both measure economic

activity over time and identify turning points in that activity

•

A time series can be broken down into three basic components

– seasonal, which is the variation around the trend attributable to

factors that occur systematically each year (once or more often)

– trend, which measures the underlying, long-term behaviour of the

original series

– irregular, which is what remains after the original series has the effects

of the trend and seasonal influences removed from it

• The basic additive model is O = S + T + I + e

(e is the error term)

– a multiplicative model is commonly used

log O = log S + log T + log I + log e

Copyright 2010, The World Bank Group. All Rights Reserved.

13

Seasonal adjustment (continued)

• In seasonally adjusting a quarterly time series, several

potential influences need to be taken into account:

– calendar-related seasonal events

– trading day influences

– effects of holidays whose timing moves from year to year

– irregular influences

• Removing the effects of the calendar-related seasonal events,

and the influences of trading days and moveable holidays

leaves a combination of the trend and irregular in the time

series

• It is possible to estimate the irregular and also remove it from

the time series to provide a measure of the underlying trend

Copyright 2010, The World Bank Group. All Rights Reserved.

14

Calendar-related seasonality

• The calendar-related seasonal effect is reasonably stable in

terms of annual timing, direction, and magnitude

• Possible causes are weather (such as the effects of summer or

winter), administrative (the timing of tax receipts), social

customs that have the same timing each year, and other

effects that are stable in annual timing (such as public

holidays that are always celebrated on the same date)

• Weather conditions that are abnormal, such as snow in the

summer, would not be considered to be a seasonal influence

– snow in summer would be classified as an irregular event

and so would remain in the seasonally adjusted series

Copyright 2010, The World Bank Group. All Rights Reserved.

15

Trading-day influences

• Trading-day influences are the impact on a time series of

having different numbers of working days in a quarter

– the simplest aspect is that the first quarter of a year has 90

days (91 in leap years), the second quarter has 91 days,

while the third and fourth quarters both have 92 days

• Trading-day influences can be sufficiently large that they

distort the apparent seasonality in a series, which means it is

impossible to seasonally adjust the series with any precision

– a “prior adjustment” is made to an original series to

remove the effects of different numbers of trading days

before a series is analysed for seasonal effects

Copyright 2010, The World Bank Group. All Rights Reserved.

16

Effects of moveable holidays

• Moveable holidays and festivals occur each year but their

timing can change from one to the next

• Some moveable holidays, such as Chinese New Year, are

important when seasonally adjusting monthly time series but

do not affect quarterly series because they always fall into the

same quarter

– Chinese New Year varies between January and February but is always

in the first quarter

• Examples of moveable festivals that affect quarterly series are

Easter, Ramadan and Yom Kippur

– the effects of changing from one quarter to another have to be

estimated using statistical techniques

– the reliability of such assessments depend on the number of

observations that are available for a particular occurrence

Copyright 2010, The World Bank Group. All Rights Reserved.

17

Irregular component

• The irregular is obtained by removing the trend and seasonal

influences from an original series

• An irregular is random and can be large

– a very large irregular is referred to as an outlier

– in some cases it is possible to identify the reason for an

outlier, such as a strike or a change in administrative

arrangements affecting the timing of receipts or payments

by government

– in other cases, statistical techniques can be used to

identify outliers, such as those observations more than 2

standard deviations from the mean

Copyright 2010, The World Bank Group. All Rights Reserved.

18

Q1, 2001

Q2, 2001

Q3, 2001

Q4, 2001

Q1, 2002

Q2, 2002

Q3, 2002

Q4, 2002

Q1, 2003

Q2, 2003

Q3, 2003

Q4, 2003

Q1, 2004

Q2, 2004

Q3, 2004

Q4, 2004

Q1, 2005

Q2, 2005

Q3, 2005

Q4, 2005

Q1, 2006

Q2, 2006

Q3, 2006

Q4, 2006

Q1, 2007

Q2, 2007

Q3, 2007

Q4, 2007

Q1, 2008

Q2, 2008

Q3, 2008

Q4, 2008

Q1, 2009

Q2, 2009

Q3, 2009

Q4, 2009

Q1, 2010

Q2, 2010

Q3, 2010

Household final consumption expenditure ($m)

180,000

170,000

160,000

150,000

140,000

130,000

120,000

110,000

100,000

Seasonally adjusted

Copyright 2010, The World Bank Group. All Rights Reserved.

Original

19

HFCE - Quarterly percentage changes

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

-4.0

-5.0

Seasonally adjusted

Copyright 2010, The World Bank Group. All Rights Reserved.

Q3, 2010

Q1, 2010

Q3, 2009

Q1, 2009

Q3, 2008

Q1, 2008

Q3, 2007

Q1, 2007

Q3, 2006

Q1, 2006

Q3, 2005

Q1, 2005

Q3, 2004

Q1, 2004

Q3, 2003

Q1, 2003

Q3, 2002

Q1, 2002

Q3, 2001

-7.0

Q1, 2001

-6.0

Original

20

Q1, 2001

Q2, 2001

Q3, 2001

Q4, 2001

Q1, 2002

Q2, 2002

Q3, 2002

Q4, 2002

Q1, 2003

Q2, 2003

Q3, 2003

Q4, 2003

Q1, 2004

Q2, 2004

Q3, 2004

Q4, 2004

Q1, 2005

Q2, 2005

Q3, 2005

Q4, 2005

Q1, 2006

Q2, 2006

Q3, 2006

Q4, 2006

Q1, 2007

Q2, 2007

Q3, 2007

Q4, 2007

Q1, 2008

Q2, 2008

Q3, 2008

Q4, 2008

Q1, 2009

Q2, 2009

Q3, 2009

Q4, 2009

Q1, 2010

Q2, 2010

Q3, 2010

HFCE - Seasonal factors

1.060

1.040

1.020

1.000

0.980

0.960

0.940

0.920

Copyright 2010, The World Bank Group. All Rights Reserved.

21

HFCE – Seasonal factors

1.060

1.040

1.020

1.000

0.980

0.960

0.940

0.920

Q1

Copyright 2010, The World Bank Group. All Rights Reserved.

Q2

Q3

Q4

22

References

• Eurostat: Handbook on Quarterly National Accounts

• IMF: Quarterly National Accounts Manual – Concepts, Data

Sources, and Compilation

• OECD: Quarterly national accounts: Sources and methods

used by OECD member countries

• Australian Bureau of Statistics: Information Paper, An

Introductory Course On Time Series Analysis

• Statistics Canada: Seasonal Adjustment and Identifying

Economic Trends

• United States Bureau of the Census: A large number of papers

on seasonal adjustment are available on the website under

the heading Seasonal Adjustment Papers Listed by Year

Copyright 2010, The World Bank Group. All Rights Reserved.

23