Q2 2014 Presentation - SodaStream InvestorRoom

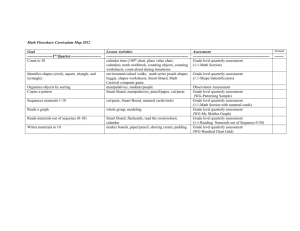

advertisement

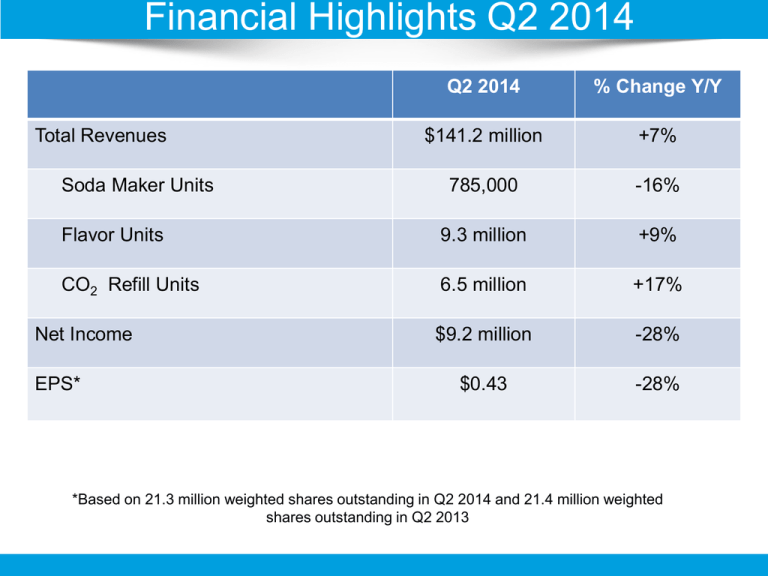

Financial Highlights Q2 2014 Q2 2014 % Change Y/Y $141.2 million +7% 785,000 -16% Flavor Units 9.3 million +9% CO2 Refill Units 6.5 million +17% $9.2 million -28% $0.43 -28% Total Revenues Soda Maker Units Net Income EPS* *Based on 21.3 million weighted shares outstanding in Q2 2014 and 21.4 million weighted shares outstanding in Q2 2013 Quarterly Revenue Growth Quarterly Revenue 2009 - 2014 (in $ Million) 180.0 168.1 160.0 144.6 141.2 132.4 140.0 132.9 118.2 117.6 120.0 112.5 2009 103.0 2010 100.0 87.9 85.7 69.1 58.5 60.0 40.0 2012 75.7 80.0 39.1 2014 40.9 35.9 31.6 27.9 2013 64.9 54.5 50.0 20.0 Q1 Q2 2011 Q3 Q4 Quarterly Soda Maker Units Growth Quarterly Soda Maker Unit Sales 2009-2014 (in thousands) 1,800 1,600 1,542 1,400 1,196 1,200 1,111 2009 1,000 2010 940 935 2011 776 800 764 683 592 600 200 767 717 634 604 712 2013 449 385 297 285 203 184 Q1 2012 2014 463 400 785 Q2 Q3 Q4 Quarterly CO2 Refill Units Growth Quarterly Refill Unit Sales 2009-2014 (in millions) 7.0 6.5 5.8 6.0 5.8 5.5 5.0 5.4 4.8 4.3 4.2 4.0 4.3 2009 3.7 2010 3.6 3.4 3.4 2.9 3.0 1.9 2013 2.3 2.2 2.1 2012 2.7 2.5 2.3 2.0 2.8 2014 1.0 Q1 Q2 Q3 2011 Q4 Quarterly Flavor Units Growth Quarterly Flavor Unit Sales 2009-2014 (in millions) 12.0 9.8 10.0 9.3 8.5 8.4 8.3 7.7 7.7 8.0 7.4 7.2 2010 6.1 5.8 6.0 2009 2011 2012 4.4 4.1 3.8 4.0 3.1 2.2 2.0 1.4 1.7 0.0 Q1 Q2 Q3 2013 2014 3.7 3.0 2.0 4.6 Q4 Fiscal 2014 Guidance Update Based on second quarter results and current projections for the remainder of the year, the Company is revising its outlook: • • • The Company now expects full year 2014 revenue to increase approximately 5% over 2013 revenue of $562.7 million,. The Company now expects full year 2014 EBITDA to increase approximately 5% over 2013 EBITDA of $62.2 million. Excluding changes in foreign currency exchange rates compared to 2013, the Company expects 2014 EBITDA to increase approximately 17% over 2013. The Company now expects full year 2014 net income to decrease approximately 5% over 2013 net income of $42.0 million. Consolidated Statements of Operations Q2-2014 vs. Q1-2013 Consolidated Statements of Operations In thousands (other than per share amounts) Revenue Cost of revenue $ Gross profit For the six months ended June 30, 2013 2014 (Unaudited) 250,029 $ 259,343 114,006 126,240 For the three months ended June 30, 2013 2014 (Unaudited) $ 132,390 $ 141,171 60,452 69,914 136,023 133,103 71,938 71,257 82,498 25,226 93,087 26,427 43,639 13,617 46,941 13,072 107,724 119,514 57,256 60,013 28,299 13,589 14,682 11,244 Interest expense, net Other financial expense, net 154 792 333 792 129 582 286 620 Total financial expense, net 946 1,125 711 906 27,353 12,464 13,971 10,338 2,406 1,443 1,108 1,095 Operating expenses Sales and marketing General and administrative Total operating expenses Operating income Income before income taxes Income tax expense Net income for the period $ 24,947 $ 11,021 $ 12,863 $ 9,243 Net income per share Basic Diluted $ $ 1.20 1.17 $ $ 0.53 0.52 $ $ 0.62 0.60 $ $ 0.44 0.43 Weighted average number of shares Basic Diluted 20,719 21,318 20,933 21,274 20,756 21,416 20,958 21,271 SodaStream “Free” all Natural • Less sugar: Lightly sweetened low calorie 17kcal per 100 ml • Natural: Fruit flavors. Free from artificial flavors, colors, sweeteners, preservatives New Lehavim Plant – Plastics Factory Lehavim – Assembly & Warehouse Lehavim – Warehouse Lehavim – First Assembly Line Lehavim – First Assembly Line