Chapter 26 - Accounting

advertisement

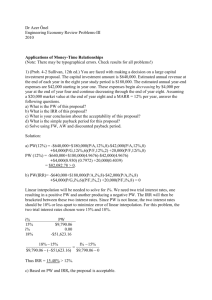

Capital Investment Decisions Chapter 26 Exercises Payback Period • In-Class Exercises (Form groups and work exercises): Exercise No. E26-18 E26-19 Page 1633 Payback Period (Even) 1633 Payback Period (Uneven) Payback Period • In-Class Exercise: Exercise No. E26-18 Page 1633 Payback Period (Even) Payback Period Exercise E26-18: Preston Co. is considering acquiring a manufacturing plant. The purchase price is $1,100,000. The owners believe the plant will generate net cash inflows of $297,000 annually. The plant will have to be replaced in six years. Requirement: Use the payback method to determine whether Preston should purchase this plant. Round answer to one decimal place. Payback Period Payback Period End of Exercise Payback Period • In-Class Exercise: Exercise No. E26-19 Page 1633 Payback Period (Uneven) Payback Period Exercise E26-19: Robinson Hardware is adding a new product line that will require an investment of $1,454,000. Managers estimate that this investment will have a 10-year life. The investment will generate the following net cash flows: Year 1……… $ 300,000 Year 2……… 270,000 Years 3-10… 260,000 (each of the eight years) Requirement: Compute the payback period. Payback Period Payback Period The proposed $1,454,000 investment would be recovered in approximately 5.4 years. Payback Period Fractional year computation Payback Period Fractional year computation Payback Period Fractional year computation Payback Period Fractional year computation Payback Period Fractional year computation Payback Period Fractional year computation Payback Period End of Exercise Accounting Rate of Return • In-Class Exercise (Form groups and work exercise): Exercise No. E26-20 Page 1633 Accounting Rate of Return Accounting Rate of Return Exercise E26-20: Use the information from Exercise E26-19. Assume that the project has no residual value. Therefore, the project’s investment cost of $1,454,000 will be fully depreciated over its useful life. The operating (useful) life is 10 years. Requirement: Compute the Accounting Rate of Return (ARR) for the investment. Round your answer to two decimal places. Accounting Rate of Return Net Cash Outflows from Exercise E26-19 Accounting Rate of Return Formulas for Exercise E26-20 Accounting Rate = of Return Average Investment = Average annual operating Income Average amount invested Asset Cost + Residual Value 2 Accounting Rate of Return Computation of Annual Operating Income From Exercise E26-19 Accounting Rate of Return Computation of Annual Operating Income Accounting Rate of Return First, calculate the average investment. Average Investment = Average Investment = Asset Cost + Residual Value 2 $1,454,000 + $ 0 2 = $727,000 Accounting Rate of Return Next, calculate the accounting rate of return. Accounting Rate = of Return Accounting Rate of Return Average annual operating Income Average amount invested = $119,600 $727,000 = 16.45% Accounting Rate of Return End of Exercise Net Present Value • In-Class Exercise (Form groups and work exercise): Exercise No. E26-24 Page 1635 Net Present Value & Probability Index Net Present Value Exercise E26-24: Use the NPV method to determine whether Kyler Products should invest in the following projects. (1) Project A: Costs $260,000 and offers seven annual net cash inflows of $57,000. Kyler requires an annual return of 16% on investments of this nature. (2) Project B: Costs $375,000 and offers ten annual net cash inflows of $75,000. Kyler demands an annual return of 14% on investments of this nature. Requirements: (1) What is the NPV of each project? Assume neither project has a residual value. Round your answer to two decimal places. (2) What is the maximum acceptable price to pay for each project? (3) What is the profitability index of each project? Round to 2 places. Net Present Value Present value of annuity (Table B-2) (Period 7, 16% column) Net Present Value Net Present Value Present value of annuity (Table B-2) (Period 10, 14% column) Net Present Value Net Present Value Maximum acceptable price Profitability Index Net Present Value End of Exercise Internal Rate of Return • In-Class Exercise (Form groups and work exercise): Exercise No. E26-25 Page 1635 Internal Rate of Return Internal Rate of Return Project A Computation of the IRR using data from Exercise E26-24. Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $260,000 = $57,000 4.561 PV Table B-2 - (PV of an Annuity): 7 Years (12% column) > 4.564 IRR = Approx. 12% Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $260,000 = $57,000 4.561 PV Table B-2 - (PV of an Annuity): 7 Years (12% column) > 4.564 IRR = Approx. 12% Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $260,000 = $57,000 4.561 (Compared to) PV Table B-2 - (PV of an Annuity): 7 Years (12% column) > 4.564 IRR = Approx. 12%+ Since Smart Touch requires a 16% return, the project would not be acceptable. Internal Rate of Return Project B Computation of the IRR using data from Exercise E26-24. Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $375,000 = $75,000 5.000 PV Table B-2 - (PV of an Annuity): 10 Years (15% column) > 5.019 IRR = Approx. 15%+ Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $375,000 = $75,000 5.000 PV Table B-2 - (PV of an Annuity): 10 Years (15% column) > 5.019 IRR = Approx. 15%+ Internal Rate of Return PV Factor Investment Amount Annual Cash Flow = Calculated PV Factor: PV Factor = $375,000 = $75,000 5.000 (Compared to) PV Table B-2 - (PV of an Annuity): 10 Years (15% column) > 5.019 IRR = Approx. 15%+ Since Smart Touch requires a minimum return of 14%, the project is considered acceptable and is the best investment. Internal Rate of Return End of Exercise