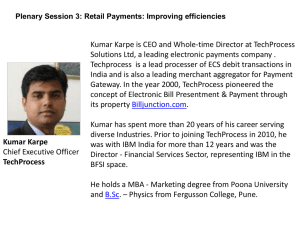

Chapter16 - Dr V Kumar

advertisement

Chapter 16: Applications of CRM in B2B and B2C Scenarios (Part 2) Topics Discussed Optimal Resource Allocation across Marketing and Communication Strategies Purchase Sequences Analysis Link between Acquisition, Retention, and Profitability Preventing Customer Churn Customer Brand Value Customer Referral Value V. Kumar and W. Reinartz – Customer Relationship Management 2 Optimal Resource Allocation Customer Equity: Aggregation of expected lifetime values of a firm’s entire base of existing customers and the expected future value of newly acquired customers The NPV objective function required to maximize the Customer Equity of a firm is related to The cash flow from each customer The expected Inter-purchase time The cost and frequency of marketing/communication strategies employed V. Kumar and W. Reinartz – Customer Relationship Management 3 Optimal Resource Allocation (2) The NPV objective function required to maximize Customer Equity of a firm is based on 3 elements: A probability based model that predicts the inter-purchase time of each customer A panel data model that predicts the cash flows from each individual customer An optimization algorithm that maximizes the profits from each individual customer V. Kumar and W. Reinartz – Customer Relationship Management 4 Real World Industry Application of Optimal Resource Allocation By applying an optimization model, a manager can know: The extent to which face-to-face meetings should be decreased and frequency of direct sales increased or vice-versa How to maximize profits across various customer segments Two-step approach: Develop model and check predictive accuracy Examine the improvements in profits V. Kumar and W. Reinartz – Customer Relationship Management 5 Effect of Firm and Market Variable on the Value of a Lost Customer Example: Actually Bought in the next 12 months Actually did not buy in the next 12months Total Expected to buy in the next 12 months as per the model N = 225 N = 21 246 Not expected to buy in the next 12 months as per the model N = 12 N = 66 78 Total 324 Hit Rate = 225+66/324 = 90% V. Kumar and W. Reinartz – Customer Relationship Management 6 Duration of Association Approach Comparison of average profits: Duration of Customer-Firm Association Average Profit per customer Short Long $29,235 (n = 170) $141,655 (n = 154) Cross analysis of Duration of Relationship and Customer Value obtained on the basis of the NPV maximization objective function indicates that: Not all the short duration customers deliver lower profits, and not all the long duration customers deliver higher profits Some of the profitable customers had escaped the firm’s attention Firm was allocating disproportionately higher resources to some Long duration customers in the mistaken belief that the duration of their association with the firm was indicative of their profitability V. Kumar and W. Reinartz – Customer Relationship Management 7 Customer Value Based Approach Low Customer Value High Customer Value Shorter Duration Longer Duration Cell I Cell III N = 78 Average Profit = $ 1,387 N = 82 Average Profit = $ 1,245 Cell II Cell IV N = 92 Average Profit = $ 52,976 N = 72 Average Profit = $ 302,542 The observations in cell III indicate that more than 50 % of the customers that the firm was chasing in the long duration segment were actually low value customers The observations in cell II indicate that the firm was ignoring a sizable set of customers by classifying them as short duration customers, when indeed they were contributing significantly to profits V. Kumar and W. Reinartz – Customer Relationship Management 8 Reallocation of Resources Based on Customer Value Customer Value High Low Low Low/ High High/ High Face to Face Meetings: -Currently meets once every 4 months -Optimal meeting frequency is once every month Face to Face Meetings: -Currently meets once every 6 months -Optimal meeting frequency is 4 months Direct Mail/Telesales: Current Interval is 21 days Optimal Interval is 13 days Direct Mail/Telesales: Current Interval is 13 days Optimal Interval is 4 days Low/ Low High/ Low Face to Face Meetings: -Currently meets once every 6 months -Optimal meeting frequency is once every 14 months Face to Face Meetings: -Currently meets once every 3 months -Optimal meeting frequency is once every 4 months Direct Mail/Telesales: Current Interval is 27 days Optimal Interval is 26 days Direct Mail/Telesales: Current Interval is 10 days Optimal Interval is 19 days Duration of Relationship V. Kumar and W. Reinartz – Customer Relationship Management High 9 Purchase Sequence Analysis It is important to understand which product in the portfolio is likely to be needed next by a customer Purchase Sequence Model addresses: What is the sequence in which a customer is likely to buy multiple products or product categories? When is the customer expected to buy each product? What is the expected revenue from that customer? Other attributes of the model include: The model captures the differences in the durations between purchases for different product categories The interdependence in purchase propensities across products is modeled by incorporating cross-product category variables An individual customer level profit function is developed to predict Customer Value V. Kumar and W. Reinartz – Customer Relationship Management 10 Purchase Sequence Analysis (contd.) Example: Model developed for hardware products of a firm Test group of sales people adopted strategies based on the model for a year Comparison made between previous year and current year for test group and with control group for current year alone Test group performs better Change between current year and previous year Revenue ($) Cost of Communication ($) # of Attempts Before Purchase Profits ($) Return on Investment (%) Test Group Control Group Difference 1,050 (18,130) 1,033 (17,610) 537 -750 (3,625) 75 (4,580) -1,780 -4 (15) 1 (18) -8 3,000 (9080) 637 (6,275) 5,168 5,4 (3,7) 2,2 (2) 4,9 Customer value approach improves the quality of marketing decisions V. Kumar and W. Reinartz – Customer Relationship Management 11 Linking Customer Acquisition, Relationship Duration, and Customer Profitability Relationship Duration Acquired Customers Customer Profitability Prospects Non-acquired Customers Acquisition Process Retention Process - Firm actions - Customer actions - Competitor actions - Customer characteristics V. Kumar and W. Reinartz – Customer Relationship Management 12 Balancing Acquisition and Retention Resources The amount of investment in a customer and how it is invested has an impact on acquisition, retention and customer profitability Investments in customer acquisition and retention have diminishing marginal returns The relative effectiveness of highly personalized communication channels is much greater than the less personalized communication channels Under spending in acquisition and retention is more detrimental and results in smaller ROIs than overspending A suboptimal allocation of retention expenditures will have a larger detrimental impact on long-term customer profitability than suboptimal acquisition expenditures The customer communication strategy that maximizes long-term customer profitability maximizes neither the acquisition rate nor the relationship duration V. Kumar and W. Reinartz – Customer Relationship Management 13 Preventing Customer Churn Impacts of Customer Churn on a firm Incurs a loss of revenue from the customers who have defected Loses the opportunity to recover the acquisition cost incurred on the defected customers Loses the opportunity to up-sell/cross-sell to the defected customers Loses social effects Influencing other customers on product/service adoption Potential negative word-of-mouth Invests additional resources to replace the lost customers with new customers Customer churn drains the firm’s performance level and resources V. Kumar and W. Reinartz – Customer Relationship Management 14 Preventing Customer Churn (2) Analytical models (ex: dynamic churn models) Analytical tools to prevent customer churns Used to predict future customer behavior Help firms decide which customer/distributor is likely to quit at what time Key questions managers consider to prevent customer churn Should we intervene? Which customer should we intervene? When do we intervene? Through which channel do we intervene? What do we offer them? Build Propensity-to-Quit models and integrate them with the CLV based models V. Kumar and W. Reinartz – Customer Relationship Management 15 Predicting Propensity to Quit 1. Identify the need to intervene 2. Decide which customer to intervene 3. Pick the appropriate time to intervene Customer B and C should be targeted with intervention offers Propensity to Quit Strong tendency to quit from early on C B A Increase in propensity to quit from Jan 2010 Does not intend to quit Time V. Kumar and W. Reinartz – Customer Relationship Management 16 Proactive Intervention Strategy Propensity to Quit Intervention Points I2 I1 C B A Time Decision on the channel of intervention and type of intervention offer is based on individual customer characteristics The amount of resources to be spent on each customer is directly linked to the Customer Lifetime Value V. Kumar and W. Reinartz – Customer Relationship Management 17 Preventing Customer Churn (2) Churn models help firms to identify the customers who are likely to quit The Intervention strategy based on CLV helps to effectively intervene to retain valuable customers Accurate customer profiling analysis helps firms to target profitable prospects and implement a solid marketing strategy Firms should apply the knowledge gained about the new customer across the entire organization by: Cultivating customers Synchronizing departments Approaching customers on the one-to-one basis Providing solutions to customers’ needs and wants V. Kumar and W. Reinartz – Customer Relationship Management 18 Customer Brand Value (CBV) Important roles of Brands Draw new customers to the firm Remind existing customers about the products/services it offers Forge an emotional attachment with its consumers Customer Brand Value (CBV) Brand Knowledge – Brand Awareness and Brand Image Brand Attitude – Brand Trust and Brand Affect Brand Behavior Attention – Purchase Intention Brand Behavior – Brand Loyalty, Brand Advocacy, and Brand Premium Behavior Customers with greater CBV are more likely to engage in activities that increase in CLV V. Kumar and W. Reinartz – Customer Relationship Management 19 Customer Brand Value (2) Linking CBV to CLV Established using customer-level data and advanced modeling techniques Compute CLV from customer transaction database Compute CBV from CBV survey results CLV High Low Managerial Benefits of Linking CBV to CLV High Monitor the overall performance of CBV Identify the weak components in the individual brand values and develop Poor Patrons True Loyalties Strangers Acquaintance CBV different strategies Manage brand at the segment level Manage brand at the individual level Low Personalized marketing actions can be performed to send the right message at the right time to simultaneously maximize the the individual CLV and CBV V. Kumar and W. Reinartz – Customer Relationship Management 20 Customer Referral Value (CRV) Customer Referral Value Customer’s expected future referral value with the firm Enables managers to measure and manage each customer based on his/her ability to generate indirect profit to the firm CRVi Valueof custom erswho joinedbecauseof referral Discountrate Valueof custom erswho would join anyway Discountrate T n1 CRVi t 1 y 1 Where ( Aty aty M ty ACQ1ty ) (1 r )t T n2 t 1 y n1 ( ACQ2ty ) (1 r )t T = the number of periods that will be predicted into the future (e.g. quarters, years) Aty = the gross margin contributed by customer ‘y’ who otherwise would not have bought the product aty = the cost of the referral for customer ‘y’ 1 to n1 = the number of customers who would not join without the referral n2 – n1 = the number of customers who would have joined anyway Mty = the marketing costs needed to retain the referred customers ACQ1ty = the savings in acquisition cost from customers who would not join without the referral ACQ2ty = the savings in acquisition cost from customers who would have joined anyway V. Kumar and W. Reinartz – Customer Relationship Management 21 Customer Referral Value – Example (1/2) Tom is a customer from a financial services company. Calculate the Tom’s customer referral value (CRV) Number of referrals per period (n2) 4 Marketing cost per period (Mty) $18 Average gross margin (Aty) $98 Cost of referral (aty) $40 Acquisition cost savings (ACQ1ty and ACQ2ty) $5 Number of referrals that would have joined anyway (n2 – n1) 2 Yearly discount rate (r) V. Kumar and W. Reinartz – Customer Relationship Management 15% 22 Customer Referral Value – Example (2/2) Tom is a customer from a financial services company. Calculate the Tom’s customer referral value (CRV) 1. Determine the number of customers who would have made purchases anyway (n2 – n1) = 4-2 = 2 2. Predict future value of each referred customers (Aty – Mty – aty + ACQ1ty)/ (1+r)t = (98-18-40+5) / (1.15)t 3. Predict number of referrals generated (4 referrals per period) * (2 periods in a year) = 8 referrals per year 4. Predict the timing of customer referrals Since Tom has 8 referrals per year, assume 4 referrals each in first and second half of the year V. Kumar and W. Reinartz – Customer Relationship Management 23 Customer Referral Value – Example Tom is a customer from a financial services company. Calculate the Tom’s customer referral value (CRV) Period 1: n1 CRV1 y 1 Period 2: ( A1 y a1 y M1 y ACQ11 y ) (1 r )1 n2 y n11 ( ACQ21 y ) (1 r )1 ($98 $40 $18 $5) 4 ($5) CRV1 $93 1 1 ( 1 0 . 075 ) ( 1 0 . 075 ) y 1 y 3 n1 CRV2 y 1 ( A2 y M 2 y ) (1 r ) 2 n1 y 1 ( A2 y a2 y M 2 y ACQ12 y ) (1 r ) 2 n2 y n11 ( ACQ22 y ) (1 r ) 2 2 ($98 $18) 2 ($98 $40 $18 $5) 4 ($5) 225 2 2 2 (1 0.075) y 1 (1 0.075) y 1 y 3 (1 0.075) 2 CRV2 TotalCRV CRV1 CRV2 318 Impact of CRV grows as time progresses, because of the growth of the new customer base due to referrals in each period In period 2, there were 6 new customer base because of 2 customers from period 1 who bought only because of the referral. V. Kumar and W. Reinartz – Customer Relationship Management 24 Customer Referral Value (2) Linking CRV to CLV Measure CLV: Value provided by the actual purchases made by the customer Measure CRV: Influence the customer has on other people (CRV) Managers need to market to customers based on the various combinations of whether the customer is low or high CLV Marketing studies found that customers with high CRV are not the most valuable Deciles customers (ranked by CLV) 1 2 3 4 5 6 7 8 9 10 CLV ($) (high(1 CLV) year) 1,933 1,067 633 360 313 230 190 160 137 120 CRV ($) (1 year) 40 52 90 750 930 1,020 870 96 65 46 V. Kumar and W. Reinartz – Customer Relationship Management Top 30% CLV customers have no overlap with the top 30% CRV customers Managers need to consider both the concepts of CRV and CLV to avoid decrease in customer growth and negative WOM 25 Customer Referral Value (3) Managerial Benefits of Linking CRV and CLV High CLV and high CRV customers are distinct sets of customers Customers in each cell should be evaluated differently with respect to their total value to the company and then be approach with different types of marketing offers to get the greatest overall value CRV High Low High Affluents 29% of customers CLV (1yr) = $1,219 CRV (1yr) = $49 CLV Misers Low 21% of customers CLV (1yr) = $130 CRV (1yr) = $64 V. Kumar and W. Reinartz – Customer Relationship Management Champions 21% of customers CLV (1yr) = $370 CRV (1yr) = $590 Advocates 29% of customers CLV (1yr) = $180 CRV (1yr) = $670 26 Customer Referral Value (4) Customer Referral Value (CRV) or Customer Lifetime Value (CLV)? Firms should measure both CLV and CRV to implement marketing campaigns that focus on customers based on both dimensions Marketing campaign focusing on both metrics will allow firms to increase both the customer profitability and the positive WOM However focus on either one depending on the campaign goal: CLV campaign: Encourage users to buy more within/across category Usually occurs in a competitive market, when difficult to acquire new customers CRV campaign: Acquire more customers/prospects through current customers Necessarily if the current customer is already spending majority of their spending budget on the company V. Kumar and W. Reinartz – Customer Relationship Management 27 Summary The NPV objective function required to maximize customer equity of a firm, is related to cash flow from each customer, expected inter-purchase time and cost and frequency of the marketing/communication strategies employed Cross analysis of duration of relationship and customer value indicates that not all short duration customers deliver lower profits and not all long duration customers deliver higher profits By linking acquisition and retention process, it is possible to see a complete and unbiased picture of the drivers behind customer selection/acquisition, relationship duration, and customer profitability When firms understand the link between CBV and CLV, they can efficiently allocate resources to maximize value Customers should be evaluated and approached with different types of marketing offers catering to maximizing CLV and/or CRV V. Kumar and W. Reinartz – Customer Relationship Management 28