LTV

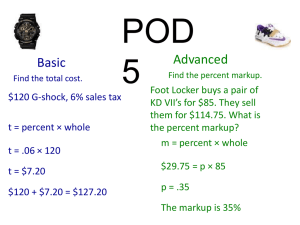

advertisement

Business Intelligence/ Decision Models Week 4 Lifetime Value Review Week 2: Data organization in RDBMS, SQL Queries Week 3: Importing data into SPSS and Data Transformation in preparation for analytics Week 4: Customers’ Lifetime value CLV Spreadsheets SPSS Life Tables and Means Estimating CLV from SPSS and into Excel How Lifetime Value is used for acquisition and retention We need to know the value (the equity) of our customers, so as to properly target our sales and retention efforts We need to discriminate among our customers to acquire and retain the best More specifically, how much money should be spent on Acquisitions Retention What is lifetime value? Net present value of the profit to be realized on the average new customer during a given number of years. To compute it, you must be able to track customers from year to year. Customer Lifetime Value n CLV = [NPV Σi=1(Pri X Inci)] – AC0 where Pr is the survival probability for period i Pr X Inc. is the expected income for period I n is the number of time periods NPV is the net present value AC is the acquisition cost LTV Spreadsheet Life tables (SPSS) Simple CLV Spreadsheet Customers Retention Rate Orders per Year Avg Order Size Total Revenue Acquisition Year 100,000 60% 1.8 $90 $16,200,000 Second Year Third Year 60,000 70% 2.5 $95 $14,250,000 42,000 80% 3 $100 $12,600,000 70% $11,340,000 $55 $5,500,000 $16,840,000 65% $9,262,500 $20 $1,200,000 $10,462,500 65% $8,190,000 $20 $840,000 $9,030,000 Gross Profit Discount Factor Net Present Value -$640,000 1 -$640,000 $3,787,500 1.16 $3,265,086 $3,570,000 1.35 $2,644,444 Cumulative NPV Profit Customer LTV -$640,000 -$6 $2,625,086 $26 $5,269,531 $53 Costs Cost of Sales Acquisition/Mkt. Cost Marketing Costs Total Costs Discount Factor = (1 + (.08 x 2))2 or D = (1.16)2 = 1.35. http://www.dbmarketing.com/articles/Art251a.htm How much to invest in retention? During Year 2 Pr. of cancelling = 30% Replacement Cost: $35.00 * 30% = $10.50 Gross profit if surviving: $3,787,500/60,000 = $63.13 Opportunity Cost if cancelled: $63.13 x 30% = $18.94 Total Expected Cost: $18.94 + $10.50 = $29.44 If 100% sure to salvage, investment < $29.44 If only 10% probability of salvage, investment < $2.94 NPV (Corrected) $1 @ 10% = $1.10 (after 1 yr) $1.10 @ 10% = $1.21 (after 2 yrs) $1 x (1.10)3 = $1.33 (after 3 yrs) FV = PV x (1 + r) n PV = FV/(1 + r) n Discount Rate First year (0): (1+.06)0 = 1.0 Second year : (1+.06)1 = 1.060 Third year : (1+.06)2 = 1.124 _________________________________ PV = FV in p0 $100/1 = $100 PV = FV in p1 $100/1.06 = $94 PV = FV in p2 $100/1.124 = $89 NPV over all three years =$283 Excel for discounting factor Discount Rate = (1 + r)^n Discount Rate = POWER((1+r),n) Discount Rate http://en.wikipedia.org/wiki/Discounting Discount Rate for period 1 (r): Interest Rate (e.g. 10%) Cost of Capital (e.g. 15%) Hurdle Rate (e.g. ROI = 20%) Simple CLV Spreadsheet Starting Parametres Period Year Acquisitions Retention Oders per year Avg Oder Size Margin Accquisition Cost Marketing Cost Annual Discount Rate 0 1 2 1 2 3 100,000 60% 1.8 $90 70% $35 $20 16% 70% 2.5 $95 65% 80% 3 $100 65% $20 16% $20 16% Tutorial 1. 2. Program a CLV Worksheet (See Excel sheet) Use SPSS to Estimate CLV a) b) c) Use Survival/Life table to estimate cumulative survival rate by time period and customer segment Use Compare Means to estimate annual purchases Transfer data into your CLV spreadsheet