Fixed Income Asset Management - Analyst Reports

advertisement

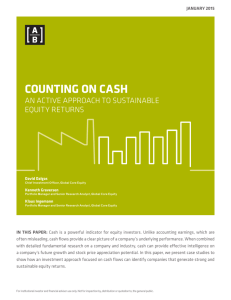

September 16, 2013 Fixed Income Asset Management Presentation at Yale University Ramu Thiagarajan Global Head - Fixed Income Quantitative Research Agenda Issues in Fixed Income Asset Management Size of the Market and Performance of the market Risks in Fixed Income Assets How do you make money in Fixed Income When does quant fail? Security Selection Issues in FI Use of FI in Other Strategies Asset Allocation Issues (depending on time) Q&A AllianceBernstein.com Fixed Income Asset Management 1 Fixed Income Asset Management – Size of the Market Fixed Income Market vs. the Equity * Market Cap: Equity Market 53 Trillion Market Cap: Bond market ? 92 Trillion What are the different type of FI securities FIX BarCap US Agg 32% 22% Treasury 36% Government-Related (Agency, Local Authority…) Corporate (Financials, Utility, Industrial...) Securitized (MBS, ABS, CMBS...) 10% * Source: Bond—BIS consolidated “Debt security statistics”, Equity—WorldBank “Market Capitalization”, as of 2012 AllianceBernstein.com Fixed Income Asset Management 2 AllianceBernstein.com Fixed Income Asset Management 3 Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 Sep-06 May-06 Jan-06 Sep-05 IR=11.5% May-05 BarCap Glb Agg Jan-05 IR=4.1% Sep-04 S&P 500 May-04 230 Jan-04 Sep-03 May-03 Jan-03 Sep-02 May-02 Jan-02 Sep-01 May-01 Jan-01 190 Sep-00 210 May-00 Jan-00 Sep-99 May-99 Jan-99 Performance of Equity vs. Bonds Bond and Equity Index (Jan-99 =100) 170 150 130 110 90 70 50 Fixed Income Asset Management What drives FI returns Role of Systematic Risk vs. Idiosyncratic Risk How do you make money in FI portfolios Tools for Positioning on Systematic Risk Tools for Positioning for Alpha Alpha in Rates Alpha in Credit AllianceBernstein.com Fixed Income Asset Management 4 Fixed Income Asset Management Has its own Lingo CDS Swaptions Spread Duration, Bull Duration, Bear Duration Confusing array of indices BarCap US Aggregate / US Aggregate Intermediate BarCap US High Yield / US High Yield 2% Issuer Cap J.P. Morgan EMBI+ / EMBIG / EMBIG Diversified / GBI-EM / GBI-EM Global… Complex set of derivatives Interest rate swap, futures, FRA; Swaptions, Caps & Floors CDS, CDX, TRS; CLN, CDO AllianceBernstein.com Fixed Income Asset Management 5 Many moving parts in a FI security Yield curve - Duration, Slope and Convexity Spread Risks Mortgages Corporates Municipals TIPS Currency rate movements Volatility and Prepayment Risk – specific to MBS Liquidity Risk AllianceBernstein.com Fixed Income Asset Management 6 What drives risk in fixed income securities Systematic Risk Level, Slope & Curvature Volatility Idiosyncratic Risk Security Specific Risk Argentinian Bonds AllianceBernstein.com Fixed Income Asset Management 7 Beta Explains 90-95% of the Volatility of a Diversified Portfolio US Investment Grade Corporate Index 40 35 Brokerage Reits Excess Return (%) April-Sept 2009 30 Finance Companies 25 Insurance 20 Banking Basic Industry 15 Consumer Cyclical Capital Goods 10 Consumer Non-Cyclical 5 0 0.0 0.5 1.0 1.5 Beta March 31, 2009 2.0 2.5 Historical data to be used for illustrative purposes only. As of: September 30, 2009 Source: Barclays Capital and AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 8 Systematic Risk vs Idiosycratic Risk Systematic Risk in Yield Curve (Litterman and Scheinkman [1991]) 3-factor model(Level, steepness and curvature) explains more than 95% or Variance of excess returns AllianceBernstein.com Fixed Income Asset Management 9 How do you make money when systematic Risk contributes to such a high proportion of variance explained You need to get a feel for the risk regime you are in. Can you forecast risk regimes? Many different methods Regime switching models Hidden Markov models A simpler way of looking at Risk Regime Indicators Supply of Liquidity Demand for Liquidity AllianceBernstein.com Fixed Income Asset Management 10 The Slope of the Yield Curve as a Leading Indicator of Future Real Economic Activity 4 3 Slope 2 1 0 (1) (2) (3) (4) 76 78 81 83 85 87 90 92 94 97 99 01 04 06 08 10 Year NBER Recession Slope As of September 2011 Source: St. Louis Fed Economic Data AllianceBernstein.com Fixed Income Asset Management 11 Unemployment Rate Goes Up When The Curve Is Inverted… Historical data to be used for illustrative purposes only. As of January 2010 Source: Adrian, Estella and Shin (2010), New York Fed AllianceBernstein.com Fixed Income Asset Management 12 …However Slope Is Not a Good Predictor of Future Market Movement 2-10 Slope SPX Avg >Avg <Avg 8.68% 1.70% 14.48% Avg >Avg <Avg 14.85% 16.16% 13.62% Information Ratio Avg >Avg <Avg 0.58 0.11 1.06 Batting Average Avg >Avg <Avg 63.39% 59.82% 65.73% Max Drawdown >Avg <Avg -16.79% -14.46% Return 0.40 0.35 0.30 Vol Density 0.25 0.20 0.15 0.10 0.05 0.00 (14) (11) (8) (5) (2) 1 4 7 10 13 SP500 Return Flat/Inverted Yield Curve Environment Steep Yield Curve Environment Historical data to be used for illustrative purposes only. As of February 2010 Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 13 Capital Markets Lag the Slope of the Yield Curve 1800 3.0 1600 2.5 1400 Get out of the market too early 2.0 1.5 1000 1.0 Slope Index 1200 800 0.5 Enter the market too early 600 0.0 400 200 (0.5) 0 (1.0) 91 93 95 97 99 01 03 05 07 09 11 Year S&P 500 Close Slope As of August 2011, Global Credit Opportunities Portfolio (Michael Weisman:NY) Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 14 VIX Alone Cannot Be Used As Market Regime Indicator The percentage of positive 6-month-forward returns does not decline monotonically as VIX increases across the quintiles Percent Positive Return Q1 – lowest VIX quintile, Q5 – highest VIX quintile VIX Quintiles As of August 31, 2011 Source: Bloomberg and AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 15 Market Cycle Indicator: Identify Current Regime and Regime Trend Our Market Cycle Indicator (MCI) is a proprietary tool we use to identify the macro phase Phase I Phase II Phase III Phase IV 5.5% 5.2% 12/31/2003 2/28/2010 2.3% 2.2% 1.5% 0.9% (0.1)% Q2 2011 (3.8)% (4.7)% (6.6)% (6.7)% (8.9)% 3/31/2007 US IG Corp 19.5% US HY Corp 13.9% S&P EMD 5.1% Currency 1.4% CMBS 4.0% 3.9% 3.3% 0.1%0.5% 2.5% 2.6% 1.1% 10/31/2000 10/31/2008 Historical data to be used for illustrative purposes only. As of February 1, 2010 Green dots are representations of points in time. Returns are annualized monthly excess returns to Treasuries. Currency returns are top five minus bottom five G10 currencies as measured by interest-rate differentials. US HY Corp.: August 31, 1998–February 28, 2010; US IG Corp: August 31, 1998–February 28, 2010; EMD: January 31, 1993– February 28, 2010; Currency: June 30, 1979–February 28, 2010. S&P: June 30, 1979-February 28, 2010. CMBS: June 30, 1999-February 28, 2010. Source: Barclays Capital, Bloomberg and AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 16 Macro Insights: Market Cycle Indicator Identifies Signals Amongst Noise Phase I MCI is above average and increasing Phase II MCI is above average and decreasing Phase III MCI is below average and decreasing Phase IV MCI is below average and increasing Typical Conditions of Market Factors Macro Economy Macro Economy Macro Economy Macro Economy Monetary Policy Monetary Policy Monetary Policy Monetary Policy Liquidity Liquidity Liquidity Liquidity Volatility Volatility Volatility Volatility Typical Market Performance Risk Seeking Income Bias Risk Averse Measured Risk Asset Return Asset Return Asset Return Asset Return Correlation Correlation Correlation Correlation As of February 2010 Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 17 Market Cycle Indicator Market Cycle Indicator Score 6 4 2 0 (2) (4) (6) 50 56 62 68 74 80 86 92 98 04 10 Year MCI Phase MCI As of August 31, 2011 Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 18 Market Cycle Indicator Continues to Diverge by Region AllianceBernstein MCI As of Jul 24, 2013 Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 19 Components of the new Euro Crisis Indicator Market-based Variables: 1. CDS on USD senior 5 year (solvency) 2. Fundamental Variables : 1. Unemployment Rate EURIBOR-OIS (liquidity) 2. PMI 3. 2 year yield in local currency and 3. YoY Private sector credit growth 4. Corporate Credit OAS (risk premium) 4. YoY Government debt growth. Choice of Variables: We picked reasonable proxies ex-ante for the following underlying constructs – Solvency, Liquidity and risk premia. We use the spread between PIIGS country and Germany for the variables. We use the sum of the equally weighted z-scores (4 market and 4 fundamental) as our Euro crisis indicator. AllianceBernstein.com Fixed Income Asset Management 20 Euro-Crisis Indicator Market Indicator Fundamental Indicator 20 8 15 6 4 10 2 5 0 0 -2 -5 -4 -10 -6 AllianceBernstein.com Fixed Income Asset Management 21 A side note on the importance of risk regime indicators for Equity selection strategies Equity stock selection model Valuation Quality Momentum Analyst behavior Size How do those behave in different risk regimes? AllianceBernstein.com Fixed Income Asset Management 22 Equity Factor Returns Under Different Regimes Analyst behavior Earning Momentum Expected Growth Price Reversal Relative Value Percent Valuation Quality Profit Trend Momentum Price Momentum Size As of August 31, 2011 Source: Credit Suisse and AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 23 ALPHA MODELS IN FIXED INCOME AllianceBernstein.com Fixed Income Asset Management 24 Building Factor Models for Fixed Income Deterministic Components of the yield curve 4 Carry Roll down Term Structure (Forward Rate) 3.5 3 C 2.5 Yield B 2 In steep curve environment Point A: invest in short-end and earn 0.2% yield 1.5 Or, buy a bond at Point C and hold for half year, suppose Term Structure stays same, bond will move to point B and earn some yield between Point B & Point C, which is higher than Point A. 1 0.5 A 0 0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 Maturity Stochastic Components of the yield Curve Changes in the yield curve AllianceBernstein.com Fixed Income Asset Management 25 Global Country/Yield Curve Model: Multiple Integrated Elements Term Structure Movement + Carry and Roll Down = Bond Return Mean Reversion Yields tend to mean revert—very low rates stimulate growth and inflation and lead to tighter monetary policy and higher rates in the future; very high rates stifle growth leading to accommodative monetary policy and lower rates in the future Macro Factors Higher levels of economic activity, captured by data such as industrial production and labor markets, are generally associated with higher inflation and higher rates. Low levels of economic activity are associated with lower rates and lower inflation Momentum The movement in yields tend to be persistent over a period of time as changes in economic cycles take time, thus momentum is effective in determining the path of future rates in the short—medium term AllianceBernstein.com Fixed Income Asset Management 26 Global Country/Yield Curve Model: Outputs January 2011 Expected Returns: Point to an Underweight in Canada January 2012 Expected Returns: Point to an Overweight in Canada 5 Composition of Forecast Change in Global “Level” by Factor* 0.15 4.5 EUR 0.10 4 3.5 0.5 USD 3 EUR 1 Percent Percent CAD 2 2.5 CAD JPY 1.5 JPY (0.05) (0.10) (0.15) Globe 0.5 0 Percent 0 Globe (0.20) USD (1) (0.25) Jan Jun Nov Apr Sep Feb Jul 10 10 10 11 11 12 12 R (0.5) 0.25 2 4 6 8 10 Maturity (Years) 0.25 2 4 6 Maturity (Years) 8 10 F Momentum Mean Reversion Economic Total Expected returns are over 6 months, annualized, hedged to USD. *Percentage change over six months Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 27 Global Country/Yield Curve Model: Outputs Maturity Developed Markets North America Yield Roll Convexity Term Local Expected Returns Hedging Cost Hedged Expected Return 2 5 10 0.82% 1.79% 2.73% 0.32% 1.11% 0.95% 0.00% 0.11% 0.37% -0.84% -1.48% -1.66% 0.30% 1.53% 2.40% -0.46% -0.46% -0.46% -0.15% 1.07% 1.94% Europe 2 5 10 0.67% 1.36% 2.19% 0.16% 0.78% 0.74% 0.09% 0.11% 0.28% -0.65% -1.44% -2.18% 0.27% 0.80% 1.02% -0.27% -0.27% -0.27% 0.01% 0.54% 0.75% Asia 2 5 10 1.95% 2.53% 3.13% 0.22% 0.58% 0.46% 0.01% 0.08% 0.34% -0.11% -0.42% -1.39% 2.06% 2.76% 2.54% -1.55% -1.55% -1.55% 0.51% 1.21% 0.99% 2 5 10 6.02% 6.89% 7.36% 0.51% 0.75% 0.13% 0.04% 0.13% 0.29% -0.47% -0.91% -1.86% 6.09% 6.86% 5.92% -5.93% -5.93% -5.93% 0.17% 0.93% -0.01% Eastern Europe 2 5 10 4.21% 4.93% 5.71% 0.28% 0.77% 0.51% 0.01% 0.04% 0.10% -0.54% -1.16% -1.89% 3.96% 4.57% 4.42% -3.24% -3.24% -3.24% 0.72% 1.34% 1.18% Emerging Asia 2 5 10 3.50% 4.01% 4.55% 0.32% 0.55% 0.54% 0.02% 0.06% 0.23% -0.29% -0.67% -1.47% 3.55% 3.95% 3.86% -6.44% -6.44% -6.44% -2.89% -2.50% -2.59% Emerging Markets Latin America AllianceBernstein.com Fixed Income Asset Management 28 Global Credit Model: Multiple Integrated Elements Spread Movement + Carry = Excess Return Mean Reversion (Spreads) Issuers with comparatively wide spreads are attractive Asset Return Momentum Strong equity markets are a positive indicator for corporate bonds Peer Group Momentum Correlation and persistence exist in return patterns among a peer group* Corporate Metrics Leverage, liquidity, profitability *Peer group refers to issuers within the same duration and spread range AllianceBernstein.com Fixed Income Asset Management 29 Global Credit Model: Outputs Expected Excess Returns Suggest Positioning Changes 2.0 1.5 1.0 0.5 0.0 (0.5) 9/30/2011 Utilities Telecom Materials Technology Industrials Healthcare Financials Energy Consumer Staples Consumer Discretionary (1.0) 3/31/2012 Three-month forward expected excess returns for intermediate maturities, derived from AllianceBernstein quantitative forecasts Source: AllianceBernstein AllianceBernstein.com Fixed Income Asset Management 30 Risks in Corporate Bonds Corporate Bonds carry a lot of Idiosyncratic Risk If Spreads widen on a bond, it will take 20 winners to over that loss Example: Enron Bonds AllianceBernstein.com Fixed Income Asset Management 31 Fundamental Credit Model Framework Drivers of excess return Valuation Risk-Return Trade-off AllianceBernstein.com Fundamentals Balance Sheet Income Statement Market Metrics Cashflow Statement Equity Return Consensus Fixed Income Asset Management 32 Model Framework • OAS per leverage Valuation • Cash flow accruals • Non-current asset accruals • Management discretion Fundamental Market • Equity momentum • Analyst revision AllianceBernstein.com Fixed Income Asset Management 33 Correlation of Factors AllianceBernstein.com Fixed Income Asset Management 34 Factor Performance Source: AB Research, Barclays, Compustat, FactSet AllianceBernstein.com Fixed Income Asset Management 35 Our Fundamental Alpha Score is a strong predictor of forward returns that has worked well over time. Source: AB Research, Barclays, Compustat, FactSet AllianceBernstein.com Fixed Income Asset Management 36 Batting Average 70.0% 60.0% 59.7% 57.6% 56.7% 50.0% 45.8% 45.0% 44.9% 40.0% 30.0% 20.0% 10.0% 0.0% 3 Tricile 5 Quintile Top AllianceBernstein.com 10 Decile Bottom Fixed Income Asset Management 37 Staying in Low Composite Group is More Likely to Suffer Blow-up Looking at the data from 2008 to 2010, names in Quintile One is more likely to suffer the blowup in spread We define blow-up as spread widens more than two standard deviation from the mean spread movement at the same period of time AllianceBernstein.com Fixed Income Asset Management 38 Fundamental Model Live Performance (2012- 2013) AllianceBernstein.com Fixed Income Asset Management 39 What have we done so far? Built Built Risk Regime Models – To get beta positioning right Built Alpha Models - To get security level positioning right Build Risk Models – To monitor risk in portfolios AllianceBernstein.com Fixed Income Asset Management 40 Fundamental vs Quant Failure of Quant Models: Why Do quant models fail? Failure of Risk Regime Models A steep slope is an environment for risk taking, but our FED has engineered a steep slope and has not be necessarily been a great environment for risk taking Failure of Alpha Models Mean reversion factor in the country-to-slope model – failed during crisis Failure of Fundamental Credit Models Event Risk BOTTOM LINE – WATCHING MONEY FLOWS IS IMPORTANT IN FI MANDATES COMBINING QUANT AND FUNDAMENTAL SIGNALS IS VERY IMPORTANT AllianceBernstein.com Fixed Income Asset Management 41 Yield Curve Model failure during crisis -- Total Return Barclays 7-10Y Total Return Ranked using Total Return Forecast:2000-2013 160 Top Bracket Bottom Bracket Spread Ranking 12 DM countries: 140 We rank the countries based on Total Return Forecast and put highest 1/3 in the top bracket and the lowest 1/3 in the top bracket. 120 100 80 For each of the brackets, we add the average of the 6 month forward total return. (divided by 6 in this monthly plot) for the countries in the bracket. 60 40 20 0 -20 Jan00 May01 AllianceBernstein.com Oct02 Feb04 Jul05 Nov06 Apr08 Aug09 Dec10 May12 Sep13 Fixed Income Asset Management 42 FCM Model Risk Potential high turnover and related transaction cost can eat up the excess return High turnover from equity return and earning revision OAS is not a clean credit risk measure, hence valuation can be misleading due to: Risk aversion, driven by macro-environment and investor sentiment Liquidity premium, which is driven by supply and demand and institutional preference The model works at the portfolio level and it should be used with great caution when picking one or two names rather than a basket of names simply based on the composite score AllianceBernstein.com Fixed Income Asset Management 43 FCM Model Failure Examples AMGN: It was a low score name because of negative contribution from cash accruals factor. However, it didn’t consider the nature of its one time litigation cash payment. Stripping away that component, it will make the name more favorable DELL: Event risk (LBO). Dell was a high score name driven by attractive spread and positive equity performance. However, the bonds failed to perform because the spread is priced in the forward-looking increase of leverage and the company was transferring the wealth from debt holder to equity holder AllianceBernstein.com Fixed Income Asset Management 44 AllianceBernstein.com Fixed Income Asset Management Sep-13 Aug-13 Jul-13 5Y Jun-13 May-13 Apr-13 Mar-13 Feb-13 Jan-13 Dec-12 Nov-12 Oct-12 Sep-12 Aug-12 Jul-12 Jun-12 May-12 Apr-12 Mar-12 Feb-12 Jan-12 Dec-11 Nov-11 Oct-11 145 Sep-11 Aug-11 Jul-11 Jun-11 May-11 Apr-11 Mar-11 Feb-11 Jan-11 Dec-10 Nov-10 Oct-10 Sep-10 Managing Risks in FI Portfolios – Rate Volatility is important USD Swaption Implied Vol (3M 5Y&10Y) 10Y 125 105 85 65 45 25 Source: Bloomberg. Unit: bps, annual implied Vol 45 Managing Risk in FI Portfolios -- Scenario Analysis When volatility spikes, historical correlations fail and even small exposures can be hurtful Factor Name Loading Unit AUD GBP SGD Total MW MW MW SGD YC Level Net Loading Scenario Factors 8/27/2013 US Rates sell-off Scenario Aug Actual Returns Factors 8/27/2013 8 -1 -6 24 -1 -7 0 Actual Returns -11 -10 4 -8 6 -1 1 -24 -3 -26 OAD (Yr) -0.16 77 1.3 210 3 GBP YC Level OAD (Yr) -1.19 106 12.6 237 28 GBP YC Slope JPY YC Level Long-Short KRDs (Yr) OAD (Yr) 0.52 -7.98 80 19 -4.1 15.4 158 -57 -8 -45 JPY YC Slope Long-Short KRDs (Yr) -0.68 34 2.3 -54 -4 USD YC Level OAD (Yr) 1.73 133 -23.1 133 -23 USD YC Slope Long-Short KRDs (Yr) 0.34 131 -4.4 86 -3 EUR YC Level OAD (Yr) 0.66 105 -6.9 177 -12 EUR YC Slope Long-Short KRDs (Yr) -1.48 61 9 91 13 AUD YC Level Total YC Total Total OAD (Yr) 1.2 137 -16.1 -14 -14 207 -24 -74 -100 Note:Sample portfolio, for illustration only, may not reflect real portfolio performance and risk. AllianceBernstein.com Fixed Income Asset Management 46 What Happens when Both Fundamental and Quant Fails Pray… AllianceBernstein.com Fixed Income Asset Management 47 Asset Allocation and Risk Parity What is Risk Parity? Ways to Accomplish Risk Parity Lessons from Studies in Risk Parity Applications of Risk Parity AllianceBernstein.com Fixed Income Asset Management 48 Introduction Magic of Portfolio diversification Return Year One Return Year Two Asset A 100% -50% Asset B -50% 100% Portfolio composed of two risky assets with 50% allocation to each (rebalanced) delivers high return zero volatility (in this case) 50/50 Portfolio Return Year One Return Year Two 25% 25% Diversification is only free lunch? AllianceBernstein.com Fixed Income Asset Management 49 Different Approaches to Diversification Assets provide returns and risks Returns are hard to measure Perhaps the focus should be on risk Hence Risk Parity provides diversification of risk by spreading it over different risky assets AllianceBernstein.com Fixed Income Asset Management 50 Introduction What is Risk Parity? risk contribution from all assets is equal Consider two assets: stocks and bonds Expected Excess Return Expected volatility Stocks Bonds 5.25% 1.75% 15% 5% Compose two portfolios: Risk Contribution From Stocks Risk Contribution From Bonds 60/40 portfolio 92% 8% 25/75 portfolio 50% 50% 25/75 is a risk parity portfolio AllianceBernstein.com Fixed Income Asset Management 51 Risk Parity and Mean Variance Frontier Risk Parity Line and Traditional Frontier Risk Parity Line and Traditional Frontier 8% Risk Parity Line 7% 6% Return Risk Parity 9.6% 5% 60/40 4% 25/75 Risk Parity 3% 2% 1% 0% 2% 4% 6% 8% 10% 12% 14% 16% Risk AllianceBernstein.com Fixed Income Asset Management 52 Discussion Advantages of Risk Parity Need not rely on Expected Returns Need not rely on MVO Disadvantages of Risk Parity Need leverage May not beat 60/40 all the time AllianceBernstein.com Fixed Income Asset Management 53 Active Risk Parity In Active Risk Parity, Bhansali [2012] uses data from January 1990 to March 2012 (Source Bloomberg) Uses Monthly Close price for index, and target 10% total Portfolio volatility First iteration uses dynamic correlation with look-back period of 12 months Volatility proxy indices used: Equity Bond Proxy used for Volatility VIX MOVE Vol. contribution Beta * VIX Rate Vol * Duration(BAGG) AllianceBernstein.com Fixed Income Asset Management 54 Active Risk Parity Exhibit 1: Relative performance of a 60/40 vs. Hypothetical Optimal Two-Factor Risk Parity Portfolio AllianceBernstein.com Exhibit 2: Comparison of a 60/40 vs. Dynamic Factor Risk Parity Portfolio Fixed Income Asset Management 55 Inferences from Research on Risk Parity Risk Parity is a useful concept Could be a fruitful portfolio implementation tool May not outdo 60/40 all the time Certainly should be used a trojan horse Outperformance of RP is a function of Time Period Instruments Chosen Correlations between stocks and Bonds can be unstable Spikes in correlations can hurt levered RP funds AllianceBernstein.com Fixed Income Asset Management 56 Issues with Risk Parity No theoretical basis for RP Cannot completely ignore expected return estimates Sharpe Ratios are not necessarily equal amongst asset classes Levering Bonds may not be optimal in all scenarios When leverage is used, expected return cannot be totally ignored! AllianceBernstein.com Fixed Income Asset Management 57 Application of Risk Parity Risk parity can increase bond return preserving information ratio Cumulative returns 2.5 2 1.5 RP 60/40 1 S&P B Glob T 0.5 Aug-12 Aug-10 Aug-08 Aug-06 Aug-04 Aug-02 Aug-00 Aug-98 Aug-96 Aug-94 Aug-92 Aug-90 -0.5 Aug-88 0 Risk Parity 60/40 S&P Barclay Global Treasury 1.90 0.96 0.68 2.08 STD 3.9% 9.1% 14.9% 3.1% mean 7.4% 8.7% 10.2% 6.5% IR AllianceBernstein.com Fixed Income Asset Management 58 Can we construct a RP portfolio using mutual funds? Risk parity can achieve equity like return with FI only Cumulative returns 3 2.5 2 RP 1.5 USG Idur US HI AB EM Debt 1 60/40 0.5 US Gov Int duration 1.34 1.68 STD 6.3% mean 8.4% US HI Jul-12 Jul-11 Jul-10 Jul-09 Jul-08 Jul-07 Jul-06 Jul-05 Jul-04 Jul-03 Jul-02 Jul-01 Jul-00 Jul-99 Jul-98 RP IR AllianceBernstein.com Jul-97 -0.5 Jul-96 0 AB EM Debt 60/40 0.84 0.93 0.77 3.8% 16.0% 16.1% 10.0% 6.4% 13.5% 14.9% 7.7% Fixed Income Asset Management 59 Issues with Risk Parity When can RP fail When equities rally Other reasons RP and Tail Risk RP does not explicitly account for tail risk concerns AllianceBernstein.com Fixed Income Asset Management 60 Thank you AllianceBernstein.com Fixed Income Asset Management 61 Appendix 1-- Risk Parity in terms of risk factors In Risk Parity for the Masses by Steiner [2012], Portfolio’s variance can be expressed as Introduce the covariance Divide by AllianceBernstein.com , , Fixed Income Asset Management Appendix 1-- Risk Parity in terms of risk factors (contd) Take partial derivative, Therefore, can be decomposed to: Define rci as: s.t. The risk parity portfolio is defined as a portfolio in which all assets have equal contribution to volatility: AllianceBernstein.com Fixed Income Asset Management 63