Topic 1 - M. Fouzul Kabir Khan,Ph.D.

advertisement

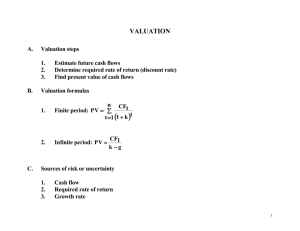

Dr. M. Fouzul Kabir Khan Professor of Economics and Finance North South University Requirements and Grading 2 Midterm examination (30%) Paper (30%) Final examination (40%) Class Materials ◦ “Cost-Benefit Analysis: Concepts and Practice,” 2nd Edition, by Anthony E. Boardman, David H. Greenberg, Aidan R. Vining and David L. Weimer, Prentice Hall, 2001[BGV] ◦ “Capital Budgeting: Financial Appraisal of Investment Projects,” by Don Dayananda, Richard Irons, Steve Harrison, John Herbohn and Patrick Rowland, Cambridge University Press, 2008 [DIH]. ◦ Guidelines for the Economic Analysis of Projects, Asian Development Bank, 1997 [ADB] ◦ সরকারী খাতে উন্নয়ন প্রকল্প প্রনয়ন, প্রক্রিয়াকরন, অনুত াদন ও সংত াধন পদ্ধক্রে, গণপ্রজােন্ত্রী বাংলাতদ সরকার। ◦ Web-page: http://fkk.weebly.com Office: NAC 751 Office hours: Saturday, 2pm – 3pm, 6-7pm ; Wednesday, 5pm-6:30 pm Class Date Exams 1 26th Jan 2 2nd February 3 9th February 4 16th February 5 23rd February 6 2nd March 7 9th March 8 16th March 9 23rd March 10 30th March 11 6th April 12 13th April Paper Presentation 13 18th April -28th April Final Mid 1 Mid 2 • • • There will be only one make-up for all examinations (mid-terms, final etc.) towards the end of the course to accommodate force majeure. All examination dates are pre-announced. Please make necessary arrangements with your office. Historically, the performance of students taking make-up examinations were always poorer compared to students taking examinations on schedule. I hope you will appreciate that it is not practical to offer a customized course for any or group of individual student(s). • • • • • • • Nature of project appraisal Overview of cost benefit analysis and capital budgeting Aspects of capital budgeting Shareholder wealth maximization and NPV The capital budgeting process Essentials in cash flow identification Calculating project cash flows Investment decisions are important both for private and public entities. Goals are different. Capital budgeting Concerned with sizeable investment in long-term assets by firms Various investment criteria Choice between projects with different life span, Tax and depreciation issues. Cost benefit analysis ◦ Measurement of economic benefits and cost ◦ Shadow prices To correct for distortions in the market prices or put a price on non-marketed goods ◦ Social discount rate Financial appraisal Economic appraisal Environmental appraisal •Nature of project appraisal Given the limitation of resources, choices must be made among the competing uses, and project appraisal is one method of evaluating alternatives in a convenient and comprehensive fashion •Project appraisal assesses the benefits and cost of a project and reduces them to a common yardstick. If benefits exceed costs, the project is acceptable; if not the project should be rejected • Society’s objective –Growth: to increase total national income –Equity: to improve the distribution of national income • Projects should be assessed in relation to their net contribution to both of these objectives Project and program sometimes used interchangeably Project: Bridge project, Pharmaceuticals industry Program: Literacy program Analysis by whom? Private Investor Lender Government agency Public-private partnership Donor agency Tools for analysis will vary Private investor-capital budgeting Government/donor agency- cost benefit analysis Cost-benefit analysis Cost benefit analysis is a program/project assessment method that quantifies in monetary terms the value, net social benefits, of all program /project consequences for all members of the society Capital budgeting Is the process of evaluating and selecting long-term investments consistent with the firm’s goal of shareholders wealth maximization Specify the set of alternative projects Decide whose benefits and costs counts (standing) Catalogue the impacts and select measurement indicators (units) Predict the impacts quantitatively over the life of the project Monetize (attach dollar/taka values to) all impacts Discount benefits and costs to obtain present values Compute the NPV of each alternative Perform sensitivity analysis Make a recommendation based on the NPV and sensitivity analysis Capital budgeting is primarily concerned with sizeable investments in long-term assets. ◦ Tangible: Property, Plant or equipment ◦ Intangible: R&D, Patents or trademarks Different from recurring expenditure in two aspects: ◦ Projects are significantly large ◦ Long-lived projects with their benefits or cash flows spreading over many years. Capital budgeting is one of the most significant financial activity of the firm. Capital budgeting determines the core activities of the firm over a long term future. Capital budgeting decisions must be made carefully and rationally. The Position of Capital Budgeting Financial Goal of the Firm : W ealth Maximisation Investm ent Decison Long Term Assets Capital Budgeting Short Term Assets Financing Decision Dividend Decision Debt/Equity Mix Dividend Payout Ratio Capital budgeting involves: Committing significant resources. Planning for the long term: 5 to 50 years. Decision making by senior management. Forecasting long term cash flows. Estimating long term discount rates. Analyzing risk. Emphasizes the firm’s goal of wealth maximization, which is expressed as maximizing an investment’s Net Present Value Requires calculation of a project’s relevant cash flows Capital budgeting uses • Sophisticated forecasting techniques:• Time series analysis by the application of simple and multiple regression, and moving averages • Qualitative forecasting by the application of various techniques, such as the Delphi method Capital budgeting requires: Application of time value of money formulae. Application of NPV analysis to forecasted cash flows. Risk analysis – Risk Adjusted Discount Rate(RADR) and certainty equivalent Application of sensitivity and break even analyses to analyze risk. • Application of: • simulation and Monte Carlo Analysis as extra risk analysis. • long term forecasting and risk analysis to projects with very long lives. • optimization techniques to projects which have constrained resources. • application of generic and specific financial models • cash flow forecasting, and NPV analysis to all aspects of property investment projects. • NPV analysis under the additional risks associated with international investments The goal of allocative, or Pareto efficiency provides the conceptual basis for economic analysis/appraisal of projects Recall that, allocation of goods is Pareto efficient if no alternative allocation can make at least one person better off without making anyone else worse off Net benefits and Pareto efficiency: If a policy or a project has positive net benefits, then it is possible to find a set of transfers, or side payments, that makes at least one person better off without making anyone else worse off As long as analysts value all benefits in terms of willingness to pay and all costs in terms of opportunity costs, then the positive net benefits indicate the potential for compensation to make the policy Pareto efficient The Kaldor criterion A Kaldor improvement is a change from a given output mix distributed in a given way to another output-mix which would enable the gainers to compensate the losers while continuing to gain themselves. Since compensation need only be hypothetical, a Kaldor improvement offers only a potential Pareto improvement Critique of the Kaldor criterion Scitovsky criterion Actual compensation is not necessary! The economic analysis of projects is similar to financial analysis: ◦ Both appraise the profit of an investment ◦ Financial analysis is about profit for project entity ◦ Economic analysis is for the national government or the economy The economic analysis looks at any investment decision from the perspective of improving welfare of its citizens For a project to be economically viable, it must be financially sustainable, because if project is not financially sustainable, economic benefits will not be realized. Financial analysis and economic analysis are therefore two sides of the same coin and complementary Economic analysis needs to be undertaken prior to financing of projects, but should also be carried out for all stages of project cycle◦ ◦ ◦ ◦ Design and financing, ex-ante Implementation- in medias res Evaluation-ex-post Comparison of ex-ante and ex-post, or ex-ante and in medias res Over people, is Tk 1000 cost to a wealthy person to be considered equally Tk. 1000 cost to a poor person? How to compare benefits to criminals and children? How do we compare benefits to people alive and the unborn Over goods, costs (concrete for a dam) in one form with benefits in another (electricity)? ◦ It is easier when there are markets for the goods, harder when there aren’t Over time, How to compare costs now with benefits in the future? Discount rate Aggregation over the sates of the world: How to deal with uncertainty and risk? Who has standing in relation to the project? ◦ Whose benefits and costs should be counted? Geographical jurisdiction, foreigners Legal, security system for Baridhara Future generation Flora and fauna, mosquito eradication Only willingness-to-pay of humans count ◦ A person who does not have standing will not have their costs and benefit recognized in the analysis Transfers A transfer from a person with standing to another person with standing is neither a cost nor a benefit ◦ Taxes, except in case of negative externality • The shareholder wealth maximization goal requires that management should endeavor to maximize net present value (NPV) of expected future cash flows to the shareholders of the firm. • NPV represents discounted sum of the expected net cash flows. • Cash outflows: capital outlays • Cash inflows: proceeds from sales • Net cash flows are determined by subtracting a given period’s cash outflows from that period’s cash inflows. • The discount rate takes into account the timing and risk of the future cash flows resulting from the investment. • The longer it takes to receive a cash flow, the lower the present value to the investor. • The greater the risk associated with receiving a future cash flow, the lower the value investors place on that cash flow. • Shareholder wealth depends on magnitude, timing and risk associated with the cash flows expected to be received in future by the shareholders Project Alpha requires an initial capital outlay of Tk. 45,000 and will have net cash inflows of Tk. 15,000, Tk. 20,000 and Tk. 30,000 at the end of years 1,2, and 3 respectively. The discount rate is 8% per annum. How much project Alpha will add to the firm’s value? An independent project is one the acceptance or rejection of which does not directly eliminate other projects from consideration or affect likelihood of their selection Mutually exclusive projects- cannot be pursued simultaneously-the acceptance of one prevents the acceptance of the alternative proposal A contingent project is one the acceptance or rejection of which is dependent on the decision to accept or reject one or more other projects ◦ Complementary projects, pharmacy and doctor’s clinic ◦ Substitute projects, Thai or Fast-food restaurant 1. Project rationale ◦ What is the rationale for public sector involvement? ◦ What is the rationale of the project: what market or government failure does it address? ◦ What is the main alternative to the project? 2. Macroeconomic and sectoral context ◦ How does the project relate to the overall development strategy? ◦ What is the policy environment for the project: taxes and subsidies, trade controls, exchange rate and interest rate policy? ◦ How does the project relate to sectoral strategy? ◦ What is the sectoral policy context in terms of market structure and regulation? ◦ Is the project a priority public investment? 3. Project alternatives ◦ Have project alternatives been considered in terms of location, scale, timing? ◦ How has the best alternative been chosen? ◦ Has the least cost alternative been identified for the project or major subprojects? ◦ Real options Options to defer Option to scale up and down Option to abandon ◦ Is it possible to import services? 4. Demand analysis ◦ What is the basis for projecting the demand for project output? ◦ How will demand be affected by income growth? ◦ What other sources of supply are there for meeting the demand? ◦ How will demand be affected by an increase in price or user charge? 5. Identification of costs and benefits ◦ Have the without and with project situations both been described? ◦ Have all project costs, comparing the with and without project situations, been identified? ◦ Have all project benefits, comparing the with and without project situations, been identified? 6. Use of shadow prices ◦ Which numeraire has been used in the application of shadow prices? Has it been used consistently? ◦ Have project outputs been identified as nonincremental*? ◦ Have benefits and especially costs been broken down into traded and non-traded items? ◦ What value of the SERF/SCF has been used: has it been correctly applied? ◦ Have more specific conversion factors been used for some items: how were they derived? ◦ What discount rate has been used: to choose between alternatives, and to assess economic viability? A project would supply additional 50MW of power. Graphically show incremental and nonincremental output of the project. Incremental output is additional output produced by a project over and above what would be available and demanded in the without project situation. Incremental inputs are inputs that are supplied from an increase in production of the input over and above what would be produced and supplied in the without project situation Incremental Nonincremental Source: Guidelines for the Economic Analysis of Projects, ADB 7. Financial and fiscal sustainability ◦ Has the FIRR for the project been calculated? ◦ Have the financial returns to different project participants been calculated? ◦ What is the level of charges for goods and services? Is the economic analysis related to the charge level? ◦ What is the difference between the FIRR and EIRR, and what accounts for the difference? ◦ Have the average incremental financial and economic costs been calculated? 7. Financial and fiscal sustainability (continued) ◦ What is the level of cost recovery? ◦ Is there any explicit or implicit subsidy to the project? What is the justification for the subsidy? ◦ Has the fiscal impact on the capital and recurrent budget been calculated? ◦ What will be the source of funds to meet net fiscal requirements: extra taxation, extra borrowing, or a reallocation of expenditure? 8. Environmental sustainability ◦ Have the environmental effects of the project been identified: costs and benefits? ◦ How have they been quantified and valued? ◦ Are they expressed in the same numeraire as the basic economic analysis? ◦ Have they been integrated into the economic analysis: for choosing between project alternatives; for assessing economic viability? ◦ Have required mitigatory and monitoring expenditures been identified and included in economic costs? 9. Benefit monitoring and evaluation ◦ What are the key variables necessary to identify project impact during implementation & operation? ◦ Does this include key performance variables, physical or financial, for the implementing agency? ◦ Is a system in place to collect data on all the key variables? 10. Distribution analysis ◦ Has a distribution analysis been undertaken for the project? ◦ Has the effect of different levels of charges for goods and services been assessed for operators, customers and government? ◦ Has the distribution of costs, especially on the poor, been identified? ◦ Has the distribution of benefits, especially to the poor, been identified? 10. Distribution analysis (continued) ◦ What proportion of net benefits will go to poor people? ◦ Is the distribution of costs and benefits analyzed by gender? ◦ Is there a substantial foreign involvement in investment and operation? ◦ Has the proportion of incomes and revenues going to foreign investors, lenders and workers been identified? Have the major conclusions of the economic analysis been clearly spelt out? Does the project incorporate the best alternative? Is the project economically viable? Are any policy changes necessary to complement project implementation? Are any capacity building measures necessary: to provide incentives or training to the executing agency and other participants? What type of sensitivity analysis has been applied? Does it relate to underlying benefit and cost variables? Have the key variables been identified? Have switching values been calculated? What measures are proposed to monitor the key variables? Is there a quantitative risk analysis? Have probabilities been attached to any of the key sensitivity variables? Have institutional risks been assessed? Are there sufficient incentives for government participants in the project? What measures have been proposed for reducing project risks? Identification and measurement of consumers surplus Assume a linear demand curve and a price without the project Pwo and a lower price with Pw with the project. Identify and measure consumers surplus from incremental and non-incremental output Graphically show gross benefits of the project Figure 1. Estimating Gross Benefits PWO a d b c PW D QN QWO QW QP Gross Revenue = (b + c) Consumer Surplus = (a + d) Gross Benefits = (a + b + c + d) Defining project objectives and economic rationale; Forecasting effective demand for project outputs; Choosing the least-cost design for meeting demand or the most cost-effective way of attaining the project objectives; Determining whether economic benefits exceed economic costs; Assessing whether the project's net benefits will be sustainable throughout the life of the project; Testing for risks associated with the project; Identifying the distributional effects of the project on each participating country; Enumerating the non-quantifiable effects of the project that may influence project design and the investment decision. Bureaucratic and political lenses ◦ Guardians, revenue-expenditure analysis, ignores nonfinancial social benefits ◦ Spenders, favor large, irreversible, capital intensive projects, treats expenditure as benefits, use low discount rates ◦ Disingenuous or strategic errors resulting from self interest, overestimation of benefits and underestimate costs Omission errors Forecasting errors Measurement errors, Valuation errors, shadow prices Cash flows, and not accounting estimates, are used in project analysis because: ◦ They measure actual economic wealth. ◦ They occur at identifiable time points. ◦ They have identifiable directional flow: inflow and outflow. ◦ They are free of accounting definitional problems. • • • A relevant cash flow is one which will change as a direct result of the decision about a project. A relevant cash flow is one which will occur in the future. A cash flow incurred in the past is irrelevant. It is sunk. A relevant cash flow is the difference in the firm’s cash flows with the project, and without the project. Project cash flows may be separated into two categories: Capital cash flows The initial investment Outflows, purchasing assets and initial working capital Additional middle-way investments such as upgrades and increases in working capital investments Terminal cash flows Inflows, proceeds from sale, salvage value of the asset net of tax, recovery of remaining working capital Outflows, cost of asset disposal, environmental rehabilitation, redundancy payment to employees Operating cash flows: cash inflows from sales, cash outflows for marketing and advertising, payments for wages, utilities, raw materials Principle of the stand-alone project ◦ Evaluation of the proposed project purely on its own merits, in isolation from any other activities or the projects of the firm Indirect of synergistic effects ◦ Negative effects, new model of car, lower sales of existing model, must be deducted from future cash flows ◦ Positive effects, pharmacy adjacent to doctor’s clinic, favorable impact on clinics cash flows to be added to pharmacy project’s cash flows • • • Opportunity cost principle: the most valuable alternative that is given up if the proposed investment project is undertaken – Use of existing resources, space, building, rental value, market value Sunk cost, is an amount spent in the past in relation to the project, but which cannot now be recovered or offset by the current decision – Past consulting expenses Overhead costs – Utilities, executive salaries – With or without the project, incremental costs to be included Treatment of working capital ◦ Current assets (inventories, accounts receivables) minus current liabilities (accounts, wages payable) ◦ Increases in working capital is treated as cash outflows even though there is no actual cash outflow, opportunity cost ◦ Capital flows, not operational flows, it is a fund After-tax cash flows ◦ Must be accounted for as a cash outflow, not based on net cash flow but on taxable income Treatment of depreciation ◦ Is not a cash flow ◦ In project appraisal, what is relevant is not the accounting depreciation but tax allowable depreciation to measure the tax effect Investment allowance, enhances NPV Financing flows, excluded. double counting, included in the discount rate Within-year timing of cash flows ◦ Occurs at various points of time in a year ◦ Standard practice is to assume that capital expenditure occur at the beginning of the year and all other cash flows occur at the end of the year ◦ Points in cash flow timing is are set at the end of each year. An initial outlay of Tk. 50,000 at the start of year 1will be timed as occurring at the end of year zero. Inflation and consistent treatment of cash flows and discount rates ◦ Nominal returns, incorporating the inflationary effect is preferred over cash flow forecasts in real terms, excluding the inflationary effects ◦ Fisher effect ◦ Consistency, cash flow in nominal terms- use nominal discount rate; cash flow in real terms- use real discount rate YES:- these are relevant cash flows: Incremental future sales revenue. Incremental initial outlay. Incremental future salvage value. Incremental working capital outlay. Incremental future taxes. NO:- these are not relevant cash flows: Changed future depreciation. Reallocated overhead costs. Adjusted future accounting profit. The cost of unused idle capacity. Outlays incurred in the past. Depreciation is NOT a cash flow. Depreciation is simply the accounting amortization of an initial capital cost. Depreciation amounts are only accounting journal entries. Depreciation is measured in project analysis only because it reduces taxes. • • • Tax payable: if the project changes tax liabilities, those changed taxes are a flow of the project. Investment allowance: if a taxing authority offers this ‘extra depreciation’ concession, then its tax savings are included. Financing flows: interest paid on debt, and dividends paid on equity, are NOT cash flows of the project. In property investment, ‘property’ cash flows may be distinguished from ‘equity’ cash flows. In project analysis, cash inflows are timed as at the end of a year, and capital outlays are timed as at the start of a year. Forecast inflated cash flows must be discounted at the nominal discount rate, not the real discount rate. All relevant project cash flows are set out in a table. The cash flow table usually reads across in End of Years, starting at EOY 0 (now) and ending at the project’s last year. The cash flow table usually reads down in cash flow elements, resulting in a Net Annual Cash Flow. This flow will have a positive or negative sign. Project start date 2001 Capital outlay in year 1 is $ 1 million; year 3 is $0.5 million Economic life 8 years Working capital Y0-2000; Y1-2500; Y2-3100; Y33600; Y4-4000; Y5-4300;Y6-4500; Y7-3000, Y8-0. Salvage value in Y8: $16,000 Depreciation on initial investment is 12.5% p.a. upgrade depreciates @$100,000 for years 4-8. Sales forecasts After tax salvage value Accounting income Workbook 2.1 • Initial investment – Initial investment in plants and working capital • Net operating cash flows – Add back depreciation – Exclude depreciation from costs – Add tax shield of depreciation (tax rate x depreciation) • Terminal cash flows – Proceeds from sale of assets minus taxes on sale of an assets plus recovery of working capital • Initial investment – Initial investment in plants and working capital minus proceeds from sale of old asset plus taxes on sale of old assets • Incremental operating cash flows • Terminal cash flow – Operating cash flow of new assets minus operating cash flow of old assets – Proceeds from sale of new asset- proceeds from sale of old asset - taxes on sale of old assetstaxes on sale of an assets-taxes on sale of old assets plus recovery of working capital Only future, incremental, cash flows are Relevant. Relevant Cash Flows are entered into a yearly cash flow table. Net Annual Cash Flows are discounted to give the project’s Net Present Value. We only need to estimate cash flows that change as a result of accepting the project (incremental cash flows). The amount of, and the timing of the cash flow must be estimated, not the accounting profit/loss by ordinary accounting methods. There are generally three kinds of cash flows that can be affected by a capital budgeting project 1) Initial period cash flow 2) Operating cash flow 3) Terminal year cash flow Since taxes are cash flows, we must include taxes in our cash flow estimates. All estimated cash flows should be after-tax cash flow estimates! These are simply any cash flows that occur in the initial period of the project’s life (period 0). For example, assume that a new investment project would require spending $20 million for new capital machines, plus $3 million for additions to working capital (increases in cash balances, inventory, and accounts receivable). The initial period cash flow = -$20 + -$3 = -$23 million. Accounting income for a period could be a measure of cash flow, except that depreciation (an expense, but not a cash flow) was subtracted in calculating it. Operating cash flow equals Net Income + Depreciation Operating cash flow will be affected whenever a revenue or expense is changed on the income statement. For example, operating cash flow is increased/decreased if a project results in increased/decreased sales revenues. Operating cash flow is decreased/increased if a project results in increased/decreased expense of some kind. Assume the business currently has sales of $95 million and cash operating expenses of $65 million, plus $15 million of depreciation expense. Assume the tax rate = 30%. Net income = ($95 - $65 - $15) x (1 - .3) = $10.5 million. Operating cash flow = Net income + depreciation = $10.5 + $15 = $25.5 million per year. Assume that accepting the new investment project would increase the business sales by $10 million, and increase the operating costs by $4 million, plus increase depreciation expense by $2 million. What is the incremental operating cash flow for the project? Operating cash flow with the new project = ($105 $69 - $17) x (1-.3) + $17 = $30.3 million. The incremental operating cash flow for the project equals the change in cash flows from before accepting the project to after accepting it = $30.3 - $25.5 = $4.8 million per year. (Assume these benefits continue the same each year for 10 years.) It is usually easiest to compute this incremental cash flow by just using the incremental numbers themselves. Thus, The relevant incremental operating cash flow for the example project = + Inc. in sales revenue ……… $10 million - Inc. in op. costs (expenses) ….. 4 million - Inc. in depreciation expense … 2 million = Inc. in EBT …………………. 4 million - Inc. in taxes (@ 30%) …..…... 1.2 million = Inc. in EAT …………….….. 2.8 million + Inc. in depreciation expense … 2 million = Inc. in operating cash flow ….. $ 4.8 million Notice that this method of calculating the incremental operating cash flow requires you to simply identify every item in the company’s income statement that changes, and then to calculate the change in net income that results. Finally, the operating cash flow equals the change in net income plus the change in depreciation. • • • These cash flows consist of any residual values (salvage values) recovered from the project at the end of its useful life. For our example, assume that at the end of the project’s life, the machines could be sold to net $100,000 after taxes, and that the working capital ($3 million) is recovered in full. Thus, the terminal year cash flow (year 10) for the project = $3.1 million. The complete cash flows for the example project are: Periods: 0 - $23 1-10 + $ 4.8 10 + $ 3.1 Assume that the cost of capital for the project equals 10%, the NPV is calculated to be $7.69 million. Since the NPV > 0 we know the project is a good one We could alternatively have made the decision using the IRR method. IRR of the project can be calculated to be 17%. Since this is > the 10% cost of capital, the project should be accepted. We could also have (alternatively) made the decision using the PI method. PI = 1.33, which is > 1.00. Assume the Widget Company is considering an investment to replace a production machine with a more efficient one. Assume the new machine costs $100,000, and the old machine has a book value of $15,000 and a current salvage value of $25,000. Assume the tax rate is 30%. What are the relevant cash flows for the project analysis, and should the replacement be accepted? The total initial period (period 0) incremental cash flows for the replacement project are: -$100,000 + $25,000 - $3,000 = -$78,000. Next, we calculate the operating cash flows: Assume the new machine would reduce operating costs by $35,000 per year for the next 8 years, compared to using the old machine. Depreciation expense would also increase by $12,500 per year for 8 years. Net income will increase by ($35,000 - 12,500) x (1-.3) = $15,750. Op. CF = Net Income + Depreciation = $15,750 + $12,500 = $28,250 per year, for 8 years. Note that this is an annuity of benefits. Assume that both the old machine and the new one would be fully depreciated after 8 years. With the new machine, sale in year 8 for $5,000 => taxable gain on the sale equal to the salvage value minus the book value = ($5,000 – 0) = $5,000. Tax on this gain = $5,000 x .3 = $1,500. With the old machine, sale in year 8 for $500 => taxable gain on the sale equal to the salvage value minus the book value = ($500 – 0) = $500.Tax on this gain = $500 x .3 = $150. Altogether, then, the total terminal year cash flow equals = incremental salvage value of $4,500 incremental taxes of $1,350 = $4,500 - $1,350 = $3,150. This cash flow in year 8 is in addition to the regular $28,250 operating cash flow of that year (already computed). • • • While in general, any cash flow affected by a project is relevant, we do not include any cash flows that are financing costs. For example, we do not include interest expense or lease payments. The reason for this is that all financial cash flows are implicitly included in the cost of capital used to find NPV (or used to compare to IRR). To include the financial cash flows and then discount them to PV would be to double count their impact.