Project Cash Flows

advertisement

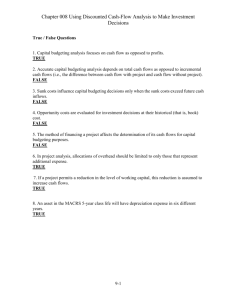

FIN 650: Project Appraisal Lecture 1 Introduction Course Overview Prerequisites Bus635 and/or EMB 510 Requirements and Grading 1 Paper (40%) One Midterm Examination (20%) Final Examination (40%) Class Materials 2 Web-page: http://fkk.weebly.com Office: NAC 751 Office hours: Tuesday, 5pm-6:30 pm Activity Schedule: FIN650 Class Date Exams Paper 1 24 May 2 31 May 3 7 June 4 14 June 5 21 June Guest Lecturer Lab class 6 28 June Guest Lecturer Lab class 7 5 July Mid 1 8 12 July 9 19 July 10 26 July 11 9 Aug 12 16 Aug Guest Lecturer 13 13 Aug-23 Aug. Final Paper Project Appraisal Nature of project appraisal Given the limitation of resources, choices must be made among the competing uses, and project appraisal is one method of evaluating alternatives in a convenient and comprehensive fashion Project appraisal assesses the benefits and cost of a project and reduces them to a common yardstick. If benefits exceed costs, the project is acceptable; if not the project should be rejected Society’s objective Growth: to increase total national income Equity: to improve the distribution of national income Projects should be assessed in relation to their net contribution to both of these objectives Project and Program Appraisal Project and program sometimes used interchangeably Project: Jamuna Bridge Project, Square Pharmaceuticals Program: Literacy Program Analysis by whom? Private Investor Lender Government Public-private partnership Donor agency agency Tools for analysis will vary Private investor-capital budgeting Government/donor agency- cost benefit analysis CBA and Capital Budgeting Cost-Benefit Analysis Cost benefit analysis is a program/project assessment method that quantifies in monetary terms the value, net social benefits, of all program /project consequences for all members of the society Capital Budgeting Is the process of evaluating and selecting long-term investments consistent with the firm’s goal of owner wealth maximization Major Steps in CBA Specify the set of alternative projects Decide whose benefits and costs counts(standing) Catalogue the impacts and select measurement indicators (units) Predict the impacts quantitatively over the life of the project Monetize (attach dollar/taka values to) all impacts Discount benefits and costs to obtain present values Compute the NPV of each alternative Perform sensitivity analysis Make a recommendation based on the NPV and sensitivity analysis 7 Capital Budgeting Capital budgeting is primarily concerned with sizeable investments in long-term assets. Different from recurring expenditure in two aspects: Tangible: property, plant or equipment Intangible: R&D, Patents or trademarks Projects are significantly large Long-lived projects with their benefits or cash flows spreading over many years. Capital budgeting decisions have significant impact on firm’s performance and they are critical to the firms success or failure Capital Budgeting Capital budgeting is one of the most significant financial activity of the firm. Capital budgeting determines the core activities of the firm over a long term future. Capital budgeting decisions must be made carefully and rationally. Capital Budgeting Within the Firm The Position of Capital Budgeting Financial Goal of the Firm: Wealth Maximisation Investment Decison Long Term Assets Capital Budgeting Short Term Assets Financing Decision Dividend Decision Debt/Equity Mix Dividend Payout Ratio Examples of “Long Term Assets” • Real Estates • Aircrafts, Ships • Forest • Plant and Machineries Aspects of Capital Budgeting Capital Budgeting involves: Committing significant resources. Planning for the long term: 5 to 50 years. Decision making by senior management. Forecasting long term cash flows. Estimating long term discount rates. Analyzing risk. Aspects of Capital Budgeting Capital Budgeting: • Emphasizes the firm’s goal of wealth maximization, which is expressed as maximizing an investment’s Net Present Value • Requires calculation of a project’s relevant cash flows Aspects of Capital Budgeting Capital Budgeting Uses: • Sophisticated forecasting techniques:- • Time series analysis by the application of simple and multiple regression, and moving averages •Qualitative forecasting by the application of various techniques, such as the Delphi method Aspects of Capital Budgeting Capital Budgeting requires: Application of time value of money formulae. Application of NPV analysis to forecasted cash flows. Risk Analysis – Risk Adjusted Discount Rate(RADR) and Certainty Equivalent Application of Sensitivity and Break Even analyses to analyze risk. Aspects of Capital Budgeting •Application of Simulation and Monte Carlo Analysis as extra risk analysis. •Application of long term forecasting and risk analysis to projects with very long lives. •Application of optimization techniques to projects which have constrained resources. •Development and application of generic and specific financial models •Application of cash flow forecasting, and NPV analysis to all aspects of property investment projects. •Application of NPV analysis under the additional risks associated with international investments Shareholder Wealth Maximization and NPV • The shareholder wealth maximization goal requires that management should endeavor to maximize net present value (NPV) of expected future cash flows to the shareholders of the firm. •NPV represents discounted sum of the expected net cash flows. •Cash outflows: capital outlays •Cash inflows: proceeds from sales • Net cash flows are determined by subtracting a given period’s cash outflows from that period’s cash inflows. Shareholder Wealth Maximization and NPV •The discount rate takes into account the timing and risk of the future cash flows resulting from the investment. •The longer it takes to receive a cash flow, the lower the present value to the investor. •The greater the risk associated with receiving a future cash flow, the lower the value investors place on that cash flow. •Shareholder wealth depends on magnitude, timing and risk associated with the cash flows expected to be received in future by the shareholders Class Exercise Project Alpha requires an initial capital outlay of Tk. 45,000 and will have net cash inflows of Tk. 15,000, Tk. 20,000 and Tk. 30,000 at the end of years 1,2, and 3 respectively. The discount rate is 8% per annum. How much project Alpha will add to the firm’s value? 19 Classification of Investment Projects An independent project is one the acceptance or rejection of which does not directly eliminate other projects from consideration or affect likelihood of their selection Mutually exclusive projects- cannot be pursued simultaneously-the acceptance of one prevents the acceptance of the alternative proposal A contingent project is one the acceptance or rejection of which is dependent on the decision to accept or reject one or more other projects Complementary projects, pharmacy and doctor’s clinic Substitute projects, Thai or Chinese restaurant 20 The Capital Budgeting Process Corporate goal Strategic planning Identification of investment opportunities Preliminary screening of projects Financial appraisal of projects Qualitative factors in project evaluation The accept/reject decision Project implementation and monitoring Post-implementation audit 21 The Capital Budgeting Process ` Corporate goal Strategic Planning Investment opportunities Preliminary Screening Financial Appraisal Qualitative factors, Judgments Accept/Reject Decision on the project Accept Reject Implementation Monitoring Post implementation audit 22 Why Cash Flows? Cash flows, and not accounting estimates, are used in project analysis because: They measure actual economic wealth. They occur at identifiable time points. They have identifiable directional flow: inflow and outflow. They are free of accounting definitional problems. 23 The Meaning of RELEVANT Cash Flows. A relevant cash flow is one which will change as a direct result of the decision about a project. A relevant cash flow is one which will occur in the future. A cash flow incurred in the past is irrelevant. It is sunk. A relevant cash flow is the difference in the firm’s cash flows with the project, and without the project. 24 Cash Flows: A Rose by Any Other Name Is Just as Sweet. Relevant cash flows are also known as: Marginal cash flows. Incremental cash flows. Changing cash flows. Project cash flows. 25 Categories of Cash Flows Project cash flows may be separated into two categories: Capital cash flows The initial investment Outflows, purchasing assets and initial working capital Additional middle-way investments such as upgrades and increases in working capital investments Terminal cash flows Inflows, proceeds from sale, salvage value of the asset net of tax, recovery of remaining working capital Outflows, cost of asset disposal, environmental rehabilitation, redundancy payment to employees Operating cash flows: cash inflows from sales, cash outflows for marketing and advertising, payments for wages, utilities, raw materials 26 Essentials in Cash Flow Identification Principle of the stand-alone project Indirect of synergistic effects Evaluation of the proposed project purely on its own merits, in isolation from any other activities or the projects of the firm Negative effects, new model of car, lower sales of existing model, must be deducted from future cash flows Positive effects, pharmacy adjacent to doctor’s clinic, favorable impact on clinics cash flows to be added to pharmacy project’s cash flows Opportunity cost principle: the most valuable alternative that is given up if the proposed investment project is undertaken Use of existing resources, space, building, rental value, market value 27 Essentials in Cash Flow Identification Sunk cost, is an amount spent in the past in relation to the project, but which cannot now be recovered or offset by the current decision Overhead costs Past consulting expenses Utilities, executive salaries With or without the project, incremental costs to be included Treatment of working capital Current assets (inventories, accounts receivables) minus current liabilities (accounts, wages payable) Increases in working capital is treated as cash outflows even though there is no actual cash outflow, opportunity cost Capital flows, not operational flows, it is a fund 28 Essentials in Cash Flow Identification After-tax cash flows Must be accounted for as a cash outflow, not based on net cash flow but on taxable income Treatment of depreciation Is not a cash flow In project appraisal, what is relevant is not the accounting depreciation but tax allowable depreciation to measure the tax effect Investment allowance, enhances NPV Financing flows, excluded. double counting, included in the discount rate 29 Essentials in Cash Flow Identification Within-year timing of cash flows Occurs at various points of time in a year Standard practice is to assume that capital expenditure occur at the beginning of the year and all other cash flows occur at the end of the year Points in cash flow timing is are set at the end of each year. An initial outlay of Tk. 50,000 at the start of year 1will be timed as occurring at the end of year zero. Inflation and consistent treatment of cash flows and discount rates Nominal returns, incorporating the inflationary effect is preferred over cash flow forecasts in real terms, excluding the inflationary effects Fisher effect Consistency, cash flow in nominal terms- use nominal discount rate; cash flow in real terms- use real discount rate 30 Project Cash Flows: Yes and No. YES:- these are relevant cash flows: Incremental future sales revenue. Incremental initial outlay. Incremental future salvage value. Incremental working capital outlay. Incremental future taxes. 31 Project Cash Flows: Yes and No. NO:- these are not relevant cash flows: Changed future depreciation. Reallocated overhead costs. Adjusted future accounting profit. The cost of unused idle capacity. Outlays incurred in the past. 32 Cash Flows and Depreciation: Always a Problem. Depreciation is NOT a cash flow. Depreciation is simply the accounting amortization of an initial capital cost. Depreciation amounts are only accounting journal entries. Depreciation is measured in project analysis only because it reduces taxes. 33 Other Cash Flow Issues. Tax payable: if the project changes tax liabilities, those changed taxes are a flow of the project. Investment allowance: if a taxing authority offers this ‘extra depreciation’ concession, then its tax savings are included. Financing flows: interest paid on debt, and dividends paid on equity, are NOT cash flows of the project. 34 Other Cash Flow Issues. In property investment, ‘property’ cash flows may be distinguished from ‘equity’ cash flows. In project analysis, cash inflows are timed as at the end of a year, and capital outlays are timed as at the start of a year. Forecast inflated cash flows must be discounted at the nominal discount rate, not the real discount rate. 35 Using Cash Flows All relevant project cash flows are set out in a table. The cash flow table usually reads across in End of Years, starting at EOY 0 (now) and ending at the project’s last year. The cash flow table usually reads down in cash flow elements, resulting in a Net Annual Cash Flow. This flow will have a positive or negative sign. 36 Delta Project Cash Flows Project start date 2001 Capital outlay in year 1 is $ 1 million; year 3 is $0.5 million Economic life 8 years Working capital Y0-2000; Y1-2500; Y2-3100; Y33600; Y4-4000; Y5-4300;Y6-4500; Y7-3000, Y80. Salvage value in Y8: $16,000 Depreciation on initial investment is 12.5% p.a. upgrade depreciates @$100,000 for years 4-8. Sales forecasts After tax salvage value Accounting income Workbook 2.1 37 Asset expansion project cash flows Initial investment Net operating cash flows Initial investment in plants and working capital Add back depreciation Exclude depreciation from costs Add tax shield of depreciation (tax rate x depreciation) Terminal cash flows Proceeds from sale of assets minus taxes on sale of an assets plus recovery of working capital 38 Asset replacement project cash flows Initial investment Incremental operating cash flows Initial investment in plants and working capital minus proceeds from sale of old asset plus taxes on sale of old assets Operating cash flow of new assets minus operating cash flow of old assets Terminal cash flow Proceeds from sale of new asset- proceeds from sale of old asset - taxes on sale of old assets- taxes on sale of an assets-taxes on sale of old assets plus recovery of working capital 39 Project Cash Flows: Summary Only future, incremental, cash flows are Relevant. Relevant Cash Flows are entered into a yearly cash flow table. Net Annual Cash Flows are discounted to give the project’s Net Present Value. 40 Project Cash Flows: Summary Overarching principles: We only need to estimate cash flows that change as a result of accepting the project (incremental cash flows). The amount of, and the timing of the cash flow must be estimated, not the accounting profit/loss by ordinary accounting methods. 41 Project Cash Flows: Summary There are generally three kinds of cash flows that can be affected by a capital budgeting project: 1) Initial period cash flow 2) Operating cash flow 3) Terminal year cash flow 42 Since taxes are cash flows, we must include taxes in our cash flow estimates. All estimated cash flows should be after-tax cash flow estimates! 43 Cash flow type #1: Initial period cash flows These are simply any cash flows that occur in the initial period of the project’s life (period 0). For example, assume that a new investment project would require spending $20 million for new capital machines, plus $3 million for additions to working capital (increases in cash balances, inventory, and accounts receivable). The initial period cash flow = -$20 + -$3 = -$23 million. 44 Cash flow type #2: Operating cash flow Accounting income for a period could be a measure of cash flow, except that depreciation (an expense, but not a cash flow) was subtracted in calculating it. Operating cash flow equals Net Income + Depreciation 45 Operating cash flow Operating cash flow will be affected whenever a revenue or expense is changed on the income statement. For example, operating cash flow is increased/decreased if a project results in increased/decreased sales revenues. Operating cash flow is decreased/increased if a project results in increased/decreased expense of some kind. 46 Continuing with the example project: Assume the business currently has sales of $95 million and cash operating expenses of $65 million, plus $15 million of depreciation expense. Assume the tax rate = 30%. Net income = ($95 - $65 - $15) x (1 - .3) = $10.5 million. Operating cash flow = Net income + depreciation = $10.5 + $15 = $25.5 million per year. 47 Class exercise Assume that accepting the new investment project would increase the business sales by $10 million, and increase the operating costs by $4 million, plus increase depreciation expense by $2 million. What is the incremental operating cash flow for the project? 48 Answer Operating cash flow with the new project = ($105 - $69 - $17) x (1.3) + $17 = $30.3 million. The incremental operating cash flow for the project equals the change in cash flows from before accepting the project to after accepting it = $30.3 $25.5 = $4.8 million per year. (Assume these benefits continue the same each year for 10 years.) 49 An alternative way It is usually easiest to compute this incremental cash flow by just using the incremental numbers themselves. Thus, The relevant incremental operating cash flow for the example project = + Inc. in sales revenue ……… $10 million - Inc. in op. costs (expenses) ….. 4 million - Inc. in depreciation expense … 2 million = Inc. in EBT …………………. 4 million - Inc. in taxes (@ 30%) …..…... 1.2 million = Inc. in EAT …………….….. 2.8 million + Inc. in depreciation expense … 2 million = Inc. in operating cash flow ….. $ 4.8 million 50 Operating cash flow Notice that this method of calculating the incremental operating cash flow requires you to simply identify every item in the company’s income statement that changes, and then to calculate the change in net income that results. Finally, the operating cash flow equals the change in net income plus the change in depreciation. 51 Cash flow type #3: Terminal year cash flows These cash flows consist of any residual values (salvage values) recovered from the project at the end of its useful life. For our example, assume that at the end of the project’s life, the machines could be sold to net $100,000 after taxes, and that the working capital ($3 million) is recovered in full. Thus, the terminal year cash flow (year 10) for the project = $3.1 million. 52 Total cash flows The complete cash flows for the example project are: Periods: 0 1-10 10 - $23 + $ 4.8 + $ 3.1 Assume that the cost of capital for the project equals 10%, the NPV is calculated to be $7.69 million. 53 What to do with the project? Since the NPV > 0 we know the project is a good one. We could alternatively have made the decision using the IRR method. IRR of the project can be calculated to be 17%. Since this is > the 10% cost of capital, the project should be accepted. We could also have (alternatively) made the decision using the PI method. PI = 1.33, which is > 1.00. 54 Class Exercise 2 Consider another example: Assume the Widget Company is considering an investment to replace a production machine with a more efficient one. Assume the new machine costs $100,000, and the old machine has a book value of $15,000 and a current salvage value of $25,000. Assume the tax rate is 30%. What are the relevant cash flows for the project analysis, and should the replacement be accepted? 55 Initial period cash flows First, determine the initial period cash flows: The $100,000 purchase price of the new machine is an immediate cash outflow. The $25,000 salvage value of the old asset would be an immediate cash inflow. Taxes on the gain from sale of the old asset is also an immediate cash outflow. Taxes = 30% x (SV-BV) = .3 x (25,000-15,000) = $3,000. 56 Initial period cash flows The total initial period (period 0) incremental cash flows for the replacement project are: -$100,000 + $25,000 - $3,000 = $78,000. 57 Operating cash flows Next, we calculate the operating cash flows: Assume the new machine would reduce operating costs by $35,000 per year for the next 8 years, compared to using the old machine. Depreciation expense would also increase by $12,500 per year for 8 years. Net income will increase by ($35,000 12,500) x (1-.3) = $15,750. Op. CF = Net Income + Depreciation = $15,750 + $12,500 = $28,250 per year, for 8 years. Note that this is an annuity of benefits. 58 Calculation of Taxes Assume that both the old machine and the new one would be fully depreciated after 8 years. With the new machine, sale in year 8 for $5,000 => taxable gain on the sale equal to the salvage value minus the book value = ($5,000 – 0) = $5,000. Tax on this gain = $5,000 x .3 = $1,500. With the old machine, sale in year 8 for $500 => taxable gain on the sale equal to the salvage value minus the book value = ($500 – 0) = $500.Tax on this gain = $500 x .3 = $150. 59 Terminal year cash flows Altogether, then, the total terminal year cash flow equals = incremental salvage value of $4,500 incremental taxes of $1,350 = $4,500 - $1,350 = $3,150. This cash flow in year 8 is in addition to the regular $28,250 operating cash flow of that year (already computed). 60 Important: While in general, any cash flow affected by a project is relevant, we do not include any cash flows that are financing costs. For example, we do not include interest expense or lease payments. The reason for this is that all financial cash flows are implicitly included in the cost of capital used to find NPV (or used to compare to IRR). To include the financial cash flows and then discount them to PV would be to double count their impact. 61