Step 4: Using TaxWise…

advertisement

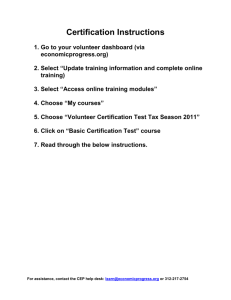

Guide to Using TaxWise to Complete Basic VITA Certification By Stephanie Beckett 1/23/11 Step 1: Create Testing Account Go to http://linklearn.webtechteam.com/login.aspx? ReturnUrl=%2fdefault.aspx Click “Create an Account” Fill out all required fields For “Group” select “1 – VITA Volunteer” Step 2: Login to Testing Account and Start Test With newly created account, login to http://linklearn.webtechteam.com/login.aspx? ReturnUrl=%2fdefault.aspx Select the “Basic” tab and then click “Basic Test” Step 3: Complete Parts of Test Not Requiring Completion of Tax Return These portions of the test can be accomplished primarily through reference to IRS Publication 17, available at http://www.irs.gov/publications/p17/index.html Step 4: Use TaxWise to Complete Parts of Test Requiring Tax Return Preparation To complete a return, login to the TaxWise practice site: https://twonline.taxwise.com/training/User/Lo gin.aspx?ReturnUrl=%2ftraining%2fAjax%2fV iewReturn.aspx%3fid%3d5926f69d-ebc3414e-ad97-08fa64e7eeb8 If you don’t have a username yet, email taxhelp@mail.law.harvard.edu, saying you want a TaxWise account and providing your first and last name Step 4: Using TaxWise… Your username is your first initial and last name. The first time you login, your password is the same as your username in lowercase letters. So, Stephanie Beckett’s username would be sbeckett, and initial password would be sbeckett The Client ID is 796235 Step 4: Using TaxWise… Tip: If the site doesn’t look right after you’ve logged in, trying to zoom in or out in the browser window (I don’t know why it gets messed up in the first place, but pressing Ctrl and using the mouse’s scroll button works for me…) Once you’ve logged in, select “New Return” from the top menu Step 4: Using TaxWise… Now you need to make up a social security number, which feels sketchy but it’s ok because it’s just a practice site. Use whatever first 5 numbers you want… But, the last 4 numbers must be 0449 And you need to type the number in twice So, a valid number would be 111-11-0449 Step 4: Using TaxWise… Tip: If, after making up an SSN, you end up with a textbox saying the number’s in use, go back and pick a different number (that one was made up by someone else) Tip: If, after making up an SSN, you end up with a textbox saying that you can restore a return that had used that same number, click “Create New Return” instead of restoring the return Step 4: Using TaxWise… Tip: After typing in the SSN, click “Go to Interview; the TaxWise interview tool is really helpful For purposes of the practice/test, you also need to make up social security numbers for dependents, spouses, etc., the same way as you did for the taxpayer (i.e., any number but must end in 0449) Also fill out all birthdays, because some automatic breaks for children or seniors can be found that way Step 4: Using TaxWise… Tip: But, for the purposes of the test, you don’t need to fill out address info or phone number info or any employer info (employer IDs, etc) Just filling out the bare minimum financial info’s probably the way to go, if possible, to save time (Except for SSNs, birthdays, and names, which you should fill out if only to help you out) Step 4: Using TaxWise… Tip: Generally, the interview’s quite thorough in helping you determine everything EXCEPT the filing status and some of the dependant information Filing Status Interview Question Help The status is usually easy to figure out BUT, Head of Household status can be tricky. So, if someone can’t file as Married Filing Jointly, ALWAYS be sure to check Pub. 17 or another IRS reference to see if he/she can file as Head of Household – they’ll save lots of money that way Step 4: Using TaxWise… Dependent Information Interview Question Help If you think someone qualifies as a dependent, check whether that’s the case by Pub. 17 If there are dependents, on the “Dependents” interview tab, say, “Yes,” there are dependents Then you can add dependent info on the interview. To do so, press “Edit” and enter a first and last name and birth date. Step 4: Using TaxWise… Dependent Information Interview Question Help, Cont’d The rest is pretty straightforward, but always check the box “Check if this child qualifies for EIC” (this will produce forms on the TaxWise software to let you check for that) Remember to save the changes you make when you add a dependent!!! Tip: Be sure to use the drop-down menu to say the relationship to the taxpayer; this menu’s easy to miss, Step 4: Using TaxWise… Types of Income Interview Question Help Check all the boxes on types of income that the scenario’s person has… And, put in the info requested for W2s, unemployment compensation, or interest/dividends at the bottom of the form Now, go through the rest of the questions… Don’t choose to make a state return… Finally, click “Finish” on the interview (you can always go back to the interview by pressing the top menu button “Switch to Interview”) Step 4: Using TaxWise… Now, on your left sidebar, you should see a bunch of forms. The ones that are red require your additional attention. Click on these forms and scroll through to see red underlines showing you where you need to put in additional info Like I said, for the purposes of the test, you don’t have to fill out addresses and other personal info, and, again for the purposes of the test, you don’t have to fill out any of the “Main Information” at the top. But, otherwise, any red line or red dot needs to be taken care of Step 4: Using TaxWise… Also, ALWAYS, ALWAYS, ALWAYS check every W2 to make sure all of the financial info’s exactly the same as the W2 the taxpayer brings with him/her This makes a particular difference if the taxpayer is paying into a retirement account or something, in which case his/her income for income tax purposes is different from his/her income for social security and Medicare tax purposes Also check any unemployment comp and interest/dividend documentation, again to make sure all the financial info’s accurate Step 4: Using TaxWise… That’s about all Really, the easiest way to learn to use TaxWise is to practice using it, which doing the certification test should force you to do And, when in doubt about the actual tax law, be sure to check Pub. 17 or some similar IRS-produced document Questions? If you have questions (other than asking for answers to the tests), please contact taxhelp@mail.law.harvard.edu