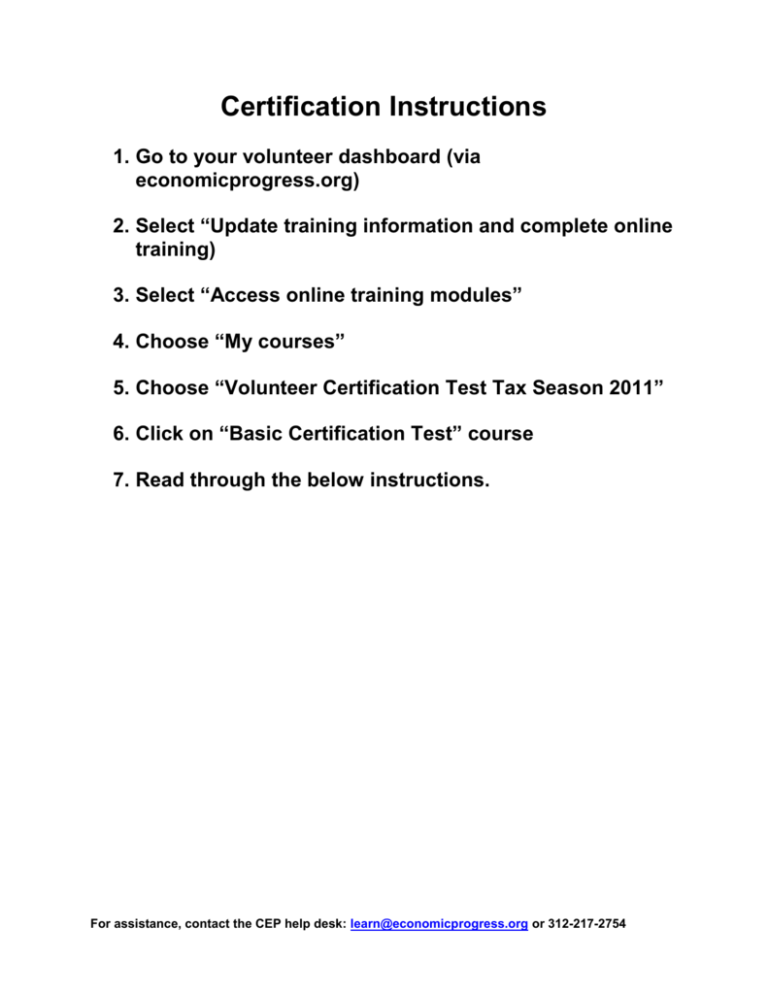

Certification Instructions

advertisement

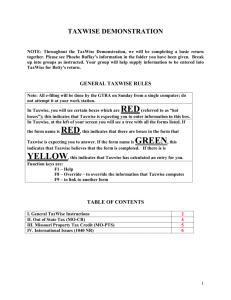

Certification Instructions 1. Go to your volunteer dashboard (via economicprogress.org) 2. Select “Update training information and complete online training) 3. Select “Access online training modules” 4. Choose “My courses” 5. Choose “Volunteer Certification Test Tax Season 2011” 6. Click on “Basic Certification Test” course 7. Read through the below instructions. For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 WARNING! Each time you open any “Certification Online Answer Sheet” it counts as an attempt – your only attempt – even if you don’t answer any questions! You get only one attempt for each test or retest. The actual test/retest questions are in pdf (or printed hard copy) format only. The test/retest questions can be found by clicking on “Basic Certification Test (Scenarios & Questions)” or by going to the “Resources” tab and clicking on the PDF file “Basic Certification Test Questions.” The online test system is an online answer sheet, listed as “Basic Certification Online Answer Sheet”. Use Internet Explorer to access the online answer sheet. For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 Avoid Certification Problems! Before you go online and open any “certification online answer sheet”: Go through all the Certification Test Questions. Take the entire test, and write down all the answers! Make sure that you have time to enter all the answers to all the questions without interruption! For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 CERTIFICATION STEPS: 1, 2, 3! Step 1 Answer the questions for scenarios that do not require tax return preparation. For the Basic test, that is scenarios 1 – 5 and scenario 8. You can find the questions online in the pdf or in the IRS booklet Form 6744, Volunteer Assistor’s Test/Retest. Step 2 Using TaxWise software, prepare the tax returns for scenarios 6 and 7 and answer the questions. TaxWise software can be accessed in either of the following two ways. CEP TaxWise Lab (see instructions at the end of this document) IRS Practice Lab (see instructions at the end of this document) Please Note: Using the TaxWise software is the way for you to get the answers to these scenarios. We will not see the actual work you do in TaxWise; we will only see your answers once you enter them on the “certification online answer sheet.” Step 3 o Once you have completed the entire test and written down all the answers to the questions, go to the “certification online answer sheet” Record your answers online. Get your score. When you pass Basic, print your certificate (optional). If you did not pass, repeat steps 1, 2, 3 to take the retest. For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 What are the test requirements? There are four levels of IRS tests: Basic – topics are taught in CEP’s training for new volunteers Intermediate - topics are taught in IRS link and Learn training Advanced - topics are taught in IRS link and Learn training Schedule C - topics are taught in CEP’s Schedule C class All volunteer tax preparers are required to pass the IRS basic certification exam. Volunteers who do quality review at tax sites are also required to pass the IRS intermediate test. Where can I find the test? The basic intermediate and advanced tests and retests are included in the IRS booklet, Form 6744, Volunteer Assistor’s Test/Retest. New volunteers will receive the hard-copy version of Form 6744 in class. Returning volunteers can access an electronic version of the tests and retests on the Resources tab. To get to the Resources tab, exit this course and go to your training dashboard. How can I practice for the test? Volunteers are encouraged to take the practice test which can be found on the Resources tab. Is the test open book? The test is completely open book and there is no time limit. We encourage you to use your training materials, Publication 4012, Publication 17, and the 1040 instruction book to research test questions. Electronic versions of these training materials can be found on the Resources tab. To get to the Resources tab, exit this course and go to your training dashboard. How do I get to TaxWise software? You will need to use tax software to prepare tax returns as part of the test. You can either use the CEP TaxWise Lab or IRS Practice Lab. CEP TaxWise Lab - This is a remote version of TaxWise Desktop that you will be using at your tax site. Your returns will not be saved in this system. Complete each tax return and answer the relevant questions before leaving the CEP TaxWise Lab. Before using this system, read the complete CEP TaxWise Lab Instructions at the end of this course. IRS Practice Lab - This is the online version of TaxWise software. Your returns will be saved in this system. Testers must use Internet Explorer as the browser to successfully us the practice lab. Before using this system, read the complete IRS Practice Lab Instructions at the end of this course. What tax identification numbers should I use? SSNs (and EINs) are written in the test in this format: 123-XX-XXXX. If preparing the tax returns using CEP TaxWise Lab substitute the Xs with six random digits to create a mock SSN. An example would be 123-45-6789. If preparing the tax returns using the IRS Practice Lab, substitute the Xs with the User ID that is assigned during Practice Lab registration. What do I do with the site identification number? The test problems provide a site identification number. Ignore this while taking the test. How is the test scored? A volunteer must achieve a score of at least 80% correct answers. The test is automatically scored when answers are entered on the online answer sheet. For Basic level, a certificate is provided that the volunteer can print and bring to the tax site. The certificate will remain available to the volunteer online. Printing the certificate is optional. The online system tracks test accomplishments. Volunteers who do not pass the test on the first attempt can take the retest to certify. Only two attempts – the test and the retest - are allowed at each level. See warning on page 1. Any volunteer who does not pass Basic after two tries should contact the volunteer department to discuss other opportunities: Angela Perkins, Volunteer Services Manager 312-630-0244 aperkins@economicprogress.org For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 CEP TAXWISE LAB INSTRUCTIONS First Time Follow these steps the first time you use the CEP TaxWise Lab. 1. After Selecting Basic Certification Test from “My Courses” Go to the Resource tab and click the link for CEP TaxWise Lab. 2. When you get the warning screen, click: Continue to this website (not recommended). 3. If a blocked message appears, click the message line and select: Download File 4. When asked if you want to run or save, select: Run. 5. The download and installation process may not be evident on your screen. To check that the installation process is complete, minimize your browser and look for the TaxWise icon on your desktop. Using the CEP TaxWise Lab 1. Follow these steps each time you use the CEP TaxWise Lab. 2. Double click the TaxWise icon on your desktop. 3. Click the Connect button. 4. Enter your username and password. username: CFEP-“your volunteer username”@redsnt.ds password: cfep2011 For example, Barbara DelBene is a volunteer. When she signs in to her CEP volunteer account, her username is barbara_delbene. When she logs in to the CEP TaxWise Lab she will use: username: CFEP-barbara_delbene@redsnt.ds password: cfep2011 For the CEP TaxWise Lab login, the username cannot be longer than 15 characters, including the little line between the first and last name. If you’re username is longer than 15 characters, just use the first 15. For example, Maximilian Periwinkle is a volunteer. When he signs in to his CEP volunteer account, his username is maximilian_periwinkle. When he logs in to the CEP TaxWise Lab he will use: username: CFEP-maximilian_peri@redsnt.ds password: cfep2011 5. Once you are on the TaxWise screen, click on the username arrow and select the username and enter the password. username: guest password: cfep2011 You are now ready to prepare a tax return! For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 IRS PRACTICE LAB INSTRUCTIONS This information applies only to volunteers who are preparing test returns using the IRS Practice Lab. Access The IRS Practice Lab is an online version of TaxWise software that can be used by volunteers to prepare the tax returns for the IRS certification test, or just to get tax return preparation practice. Go to: www.voltaxprep.com. The password for access to the Practice Lab is: learntwo The first time you visit the site, follow the instructions to register as a Practice Lab user. The system will assign a six-digit User ID. Save your User ID and remember which zip code you used to register. You will need both numbers every time you sign in. My User ID: ________________________________ ZIP Code used: _____________________________ If you lose/forget your User ID, you can register again and get a new one, but you will lose access to returns that you already started. The first page of the Practice Lab offers links to various information sources. “Click here to get started” and “Tips to Linking” are particularly useful and should be reviewed before starting the first return. Quirks There are some differences between the TaxWise Desktop that is used in volunteer training and most Center tax sites, and TaxWise Online that is used by the Practice Lab. TaxWise Online works best with Internet Explorer. Any other web browser may encounter problems that will prevent the program from working properly. TaxWise Online looks different, but most of that is just cosmetic. For example, where TaxWise desktop has red fields, TaxWise online has fields with a red underline. Since it is a web-based program, the speed of the program depends on the speed of the Internet connection. Every SSN, ITIN, and employer identification number that is used to prepare returns must contain the User ID as the last six digits. For example, if the User ID is 123456: A test problem says the taxpayer’s SSN is 130-XX-XXXX, then the SSN entered to start the return is: 130-12-3456. If the employer identification number on a W-2 is 04-2XXXXXX, the number entered would be 04-2123456. Tax returns are not automatically saved and entries do not calculate automatically. The return should be frequently saved (SAVE button) to generate calculated entries and ensure no data is lost. For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754 IRS PRACTICE LAB INSTRUCTIONS continued… Function key actions are different. F3 (TaxWise desktop) = Ctrl and Spacebar (Practice Lab) In TaxWise desktop, the F3 key will make a red field no longer required – not red. It is also used to confirm a “zero” entry. For example, this is used on Form 8880, line 4. F8 (TaxWise desktop) = Ctrl and Enter (Practice Lab) This is used to override a generated entry. See your site manager before using this function. F9 (TaxWise desktop) = the link icon (Practice Lab) This is used to link to another form from a selected location. For example, this would be used to open a W-2 from 1040 line 7. Clicking the link icon leads to a choice of two lists: new forms or existing forms. Choose whichever is appropriate. For example, if you wanted to change a W-2 that you already entered, you would select existing forms. If you want to start a new W-2, you would select new forms. TaxWise Online offers the use of the interview mode (question-directed tax preparation). The Center does not use the interview mode. DO NOT USE INTERVIEW MODE. Always use tax forms mode. You will see an icon at the top to make the selection. The Internet Explorer buttons and shortcuts to move around won’t work for TaxWise Online. Instead use the green arrows “Previous Form” and “Next Form.” To hide the Internet Explorer toolbar – and prevent inadvertent use of the Internet Explorer blue arrows - hit the F11 key. There are two steps to opening either the interest statement or the dividend statement. First link to Schedule B from 1040, line 8 or 9. Then link to the interest or dividend statement from the interest or dividend section of Schedule B. For assistance, contact the CEP help desk: learn@economicprogress.org or 312-217-2754