HMRC latest tactics and hot topics from the advice line

advertisement

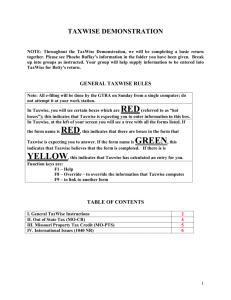

11.45 - 12.25 HMRC latest tactics and hot topics from the advice line Paul Rigney Client Support Manager, Taxwise www.ifa.org.uk Taxwise Services Limited Fee Protection Insurance www.taxwise-online.com Working in partnership with The IFA AGENDA • • • • • • Who are Taxwise? Advice Line – hot topics Claims – HMRC trends Claims – case studies Why offer Fee Protection Insurance Panel Q&A Who are Taxwise? Taxwise are providers of Fee Protection Insurance facilitating insurance to cover professional accountancy fees arising from HMRC enquiries, compliance visits, interventions and disputes. What is Fee Protection Insurance? • • • • • Insurance policy Allows an accountant to defend clients In the event of an HMRC enquiry Policy pays for all of the fees incurred Clients get professional representation and peace of mind Who are Taxwise? Key facts • • • • • • 3,000 accountancy clients £13m premium income 60 staff FCA Authorised (previously FSA) Peninsula Group Irwell Insurance Company Advice Line – hot topics • Tax and VAT advice lines • Free/Unlimited for all accountancy clients • 50,000 advice calls per annum • Brief overview of some of the most frequent questions IHT – estate reduction • Gifting money • How can the gift be IHT exempt? • Annual Exemption limit - £3,000 • Lifetime Transfer of Value IHT – estate reduction Lifetime Transfer criteria: • The gift was part of the donor’s normal expenditure • The gift was made out of after tax income • The donor is left with sufficient income to maintain usual standard of living • A pattern of expenditure has been established by a prior commitment Loans to Directors • Loan to owner Director • Often no intention to pay it back • Often the loan is written off • What are the implications? Loans to Directors • Treated as a dividend for the individual • Treated as earning for National Insurance purposes • The write off is not allowable for Corporation Tax purposes Residency • Who is entitled to Personal Allowances? • Individual becomes non-resident • Investment income in the UK Residency • Individuals not resident in the UK generally have no entitlement to claim UK reliefs or allowances • Previously a claim could be made for personal allowances purely by virtue of being a commonwealth citizen • There is now a limited range of circumstances under which a non-resident can benefit from UK personal allowances Company Cars • Provision of a company car • Employee contributes • Hopes to reduce/extinguish the benefit • How to calculate the correct benefit? Company Cars • The provision of the car has to be included on the P11D • Employee contributions reduce the cash equivalent figure of the benefit • If the contribution is equivalent to the P11D value of the benefit then the benefit is reduced to nil Company passengers! • • • • Employee Own car Up to 45 pence per mile for 10,000 miles Then 20 pence per mile • What about passengers? Company passengers! • HMRC allows 5 pence per mile per passenger • Discretion of the employer • No right to claim via HMRC if employer does not reimburse • No right to claim ‘top up’ if employer pay less than the allowance Claims – HMRC trends • Annual compliance yield • Additional £7bn per annum • Target date – 2014/15 Taxwise claims: 2009/10 – 2,000 claims 2012/13 – 5,000 claims Claims – HMRC trends • • • • • 32% PAYE/VAT Compliance Visits 1% Interventions 1% Cross Tax Enquiries 56% IT and CT aspects 10% Full Enquiries HMRC Activity HMRC income from investigations into personal tax returns Claims – HMRC trends • Enquiries concluding faster • HMRC risk profiling • More enquiries, more focussed • HMRC doing what always done but… …more of it and with more focus! VAT Dispute claim • VAT Assessment £136k raised in 2010 and further adjustment of £259k made to an earlier period. • HMRC argued that fees charged by the client company constituted a taxable supply, but the client countered this by arguing that they qualified for an exemption • The case proceeded to Tribunal where the appeal was upheld, resulting in the Assessment being removed and the adjustment being reversed. • The case was concluded in 2012 after costs of £46k had been reimbursed under the policy (including the costs of an external specialist). Income Tax Enquiry claim • HMRC opened an aspect enquiry in 2011, looking into a claim of £210k for Doubtful Debts. • HMRC argued that because the client had not started legal action to recover the debt and had identified round sum payments from the customer on the bank statements, that the debt was not in fact doubtful, and proposed to disallow 100% of the claim. • Taxwise Services Ltd provided consultancy advice to the accountant, believing that there was merit in arguing the case further. Income Tax Enquiry claim • After reaching an impasse with HMRC, Taxwise recommended following HMRCs Alternative Dispute Resolution (ADR) route, which was ultimately successful, with the claim being allowed in full. • The accountant’s costs, circa £1k, were met in full. • The Taxwise advice was not chargeable to the accountant, fess were recovered from the underwriter. Cross Tax Compliance Check claim • HMRC Enquiry opened into a high profile football agency and promotion’s company in 2009. Each subsequent year’s Return has also been taken up for enquiry. • Due to the complexities of the case the enquiries have become protracted, and although some errors and adjustments have come to light during the course of the enquiries to date, these have been viewed as immaterial and as such, the accountant’s costs have been covered in full. • This claim has now reached the limit of indemnity offered by the policy, £75k. Why offer FPI? • Income generation • Full recovery of fees • Client retention/Client service • Best practice Why offer FPI? • Tax & VAT advice line • Employment Law and H&S advice line • Corporate Recovery advice line • Business Support – legal advice line Why Taxwise? • • • • • • • • Largest provider Underwriting arrangements Taxwise On-line – claims Tailored marketing support Administration support Taxwise Plus policy Innovative SPS (sub 200 clients) All part of the service… • • • • • • • Advice lines E-bulletins Quarterly newsletter Quarterly webinar Consultancy support No policy excesses No policy inner limits QUESTIONS? • Paul Rigney – Client Support Manager • Penny Blight – Business Development Manager • Scott Phillips – Business Development Manager