Wills, Trusts, & Estates - Robert H. McKinney School of Law

advertisement

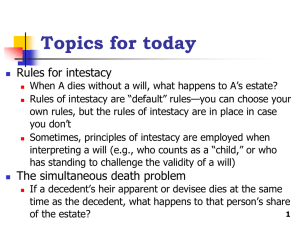

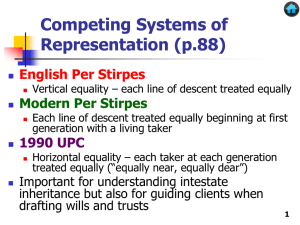

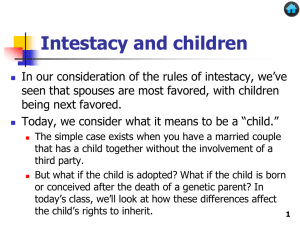

Topics for today Rules for intestacy When A dies without a will, what happens to A’s estate? Rules of intestacy are “default” rules—you can choose your own rules, but the rules of intestacy are in place in case you don’t Sometimes, principles of intestacy are employed when interpreting a will (e.g., who counts as a “child,” or who has standing to challenge the validity of a will) The simultaneous death problem If a decedent’s heir apparent or devisee dies at the same time as the decedent, what happens to that person’s share 1 of the estate? Intestacy as default rules (pp.71-72) Testacy Intestacy Decedent leaves a will that provides for the disposition of property at death (also allows testator to select guardians for minor children and an executor for the estate) Decedent leaves no will. The probate estate passes by intestacy. Partial Intestacy Decedent leaves a will that disposes of only part of the probate estate; the part of the estate not disposed of by the will passes by intestacy. 2 UPC intestacy rules (p.73) Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 3 UPC-Indiana comparison If no living parents or descendants, spouse receives entire estate under UPC and in IN If the decedent has living descendants only through the spouse, spouse still receives entire estate under UPC but first $25,000 plus half of the remaining estate in IN (with rest to descendants) If no living descendants but a living parent, spouse receives first $300,000 plus ¾ of the remainder under UPC or first $25,000 plus ¾ of the remainder under IN (with rest to parents) Ind. Code §§ 29-1-2-1 and 29-1-4-1 4 UPC-Indiana comparison UPC and IN include grandparents and descendants of grandparents in their list of potential heirs (i.e., aunts and uncles and their descendants), but neither includes more distant relatives. UPC turns to step-children if the list of blood relatives is exhausted and the spouse is deceased (2-103(b)), but IN does not. 5 UPC §2-102: Share of spouse Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 6 UPC-Indiana comparison UPC reduces spouse’s share if either decedent or spouse has a child from a previous marriage (2-102(3)-(4)) IN reduces spouse’s share if decedent had a child from a previous marriage, but only when the spouse and decedent had no children together (29-1-2-1(c)) 7 Howard and Wendy Brown problem 1, page 77 Howard Sarah Brown First Husband Wendy Steph. Brown Michael Walker 8 Problem 1, page 77 If Howard dies before Wendy, his survivors are Wendy, two children through Wendy, and a stepchild through Wendy UPC 2-102(3) governs—Wendy takes $225,000 plus ½ of the remainder of the estate, and Howard’s children share the other ½ (with a stepchild in the picture, decedent probably would not want to leave everything to the spouse) In Indiana, Wendy takes $25,000 plus ½ of the remainder of the estate and Howard’s children share the other ½ If Wendy dies before Howard, her survivors are Howard, two children through Howard and a child with another spouse UPC 2-102(4) governs—Howard takes $150,000 plus ½ of the remainder of the estate, with Wendy’s children sharing the other ½ In Indiana, Howard takes $25,000 plus ½ and Wendy’s children share9 the other ½ Problem 1, page 77 If Howard dies before Wendy, Wendy takes $225,000 plus ½ of the remainder of the estate If Wendy dies before Howard, Howard takes $150,000 plus ½ of the remainder of the estate Why is Howard’s initial take of $150,000 lower than Wendy’s initial take of $225,000? Howard is left with a stepchild while Wendy is left with her children only Wendy would be worried whether Howard would look out for all of her children, while Howard needn’t worry whether Wendy would look out for all of his children 10 Problem 1, page 77 What about the possibility of the surviving spouse remarrying and having more children? Let’s say the only children are the two children that Wendy and Howard had together If Howard dies, Wendy takes the entire estate even though she might have children later with a new husband Thus, Howard’s genetic children are protected if Wendy had another child with a previous husband, but not if she has another child with a later husband Trying to anticipate later children would make for a much more complicated statute—this is an example where the law sacrifices some accuracy to avoid complexity 11 Problem 2, page 77 Brother H W After one year of marriage, H dies. What is W’s share? W takes the entire estate under rules of intestacy, regardless of how long they’ve been married (under UPC and in IN) With the forced share, length of marriage matters, on the theory that in longer marriages, the couple has had more time to generate a joint estate 12 Legal Recognition of Same-Sex Couples (August 2013) WA MT ME ND VT MN OR NH ID WI SD NY WY RI CT MI PA IA NE NV OH IL UT MD WV KS MO VA KY NC TN AZ OK NM NJ DE IN CO CA MA AR SC MS AL GA Same-Sex Marriage TX Civil Union/Domestic Partnership LA FL AK HI (p. 78) 13 The simultaneous death problem A is the heir apparent of spouse B, and A and B die at the same time (e.g., in an automobile accident) Does A inherit B’s estate (and then A’s heirs take), or is A presumed to predecease B (and then B’s heirs take)? Not an issue just for intestacy, but it tends to come up much more in the setting of intestacy because a welldrafted will deals with the problem The issue comes up especially in the context of spouses 14 What were the facts in Janus (p.80)? Stanley and Theresa Janus died after taking Tylenol pills that had been laced with cyanide. Stanley was pronounced dead shortly after admission to the hospital, while Theresa was not pronounced dead until two days later. Stanley had named Theresa the primary beneficiary on his life insurance policy and his mother the contingent beneficiary Should the proceeds of the insurance policy go to Theresa’s estate or to Stanley’s mother? 15 Janus v. v. Tarasewicz Tarasewicz, Janus 482 N.E.2d 418 (Ill. App. 1985) Jan Alojza Stanley Theresa 16 Disposition of Stanley’s life insurance proceeds If the proceeds went to Theresa’s estate, who would actually receive them under the UPC? Theresa’s parents Under Indiana’s intestacy statute, Theresa’s estate would be divided among her parents and siblings (Ind. Code § 29-1-2-1(d)(3) ) 17 Simultaneous death (p.80) Uniform Simultaneous Death Act (1940, rev. 1953): If “there is no sufficient evidence” of survivorship, the beneficiary is deemed to have predeceased the donor. Applicable in Janus and also in IN (Ind. Code § 29-2-141) UPC §§ 2-104, 2-702 (1990, rev. 2008); Uniform Simultaneous Death Act (1991): Claimant must establish survivorship by 120 hours (5 days) by clear and convincing evidence. 18 When did Stanley and Theresa die? Everyone agreed that Stanley died the evening of September 29 shortly after taking the Tylenol. There was conflicting evidence as to the timing of Theresa’s death. One expert thought she died on September 29, but other experts and the trial court concluded she died on October 1 While she had minimal signs of life, she had more signs than did Stanley (e.g., no need for a pacemaker to maintain her heartbeat, right pupil reacted minimally to light, and some activity on an EEG). 19 Did Theresa really die later than Stanley? We’ll never know for sure—this case illustrates the indirectness of methods for determining the timing of death But in the view of the court of appeals, there was sufficient evidence for the trial court to conclude that Theresa did die after Stanley Unlike some other courts, this court properly deferred to the findings of the trial court Did the intestacy statute carry out Stanley’s likely intent by distributing his property to Theresa’s family? Hence, we have the 120-hour rule. 20 Problems, page 86 1. 2. 3. There are good reasons to think that W survived H in the boating accident, but not sufficient evidence. W probably survived longer after falling into the water, but she also may have fallen in first. With the airplane crash, the carbon monoxide in the bloodstream demonstrated survival after impact. With a 120-hour rule, deaths in Janus and problem 1 would be viewed as simultaneous. Even 5 days may not be long enough, given the ability of medical technology to maintain life after a serious injury. 21 Shares of descendants Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 22 Shares of descendants (1) (p. 87) Hall 1/3 1/3 1/6 1/6 23 Competing systems of representation (p.88) English Per Stirpes Modern Per Stirpes Vertical equality – each line of descent treated equally Each line of descent treated equally beginning at first generation with a living taker 1990 UPC Horizontal equality – each taker at each generation treated equally (“equally near, equally dear”) 24 Indiana’s distribution: Modern per stirpes IC 29-1-2-1 Estate distribution Sec. 1. (a) The estate of a person dying intestate shall descend and be distributed as provided in this section. .... (d) The share of the net estate not distributable to the surviving spouse, or the entire net estate if there is no surviving spouse, shall descend and be distributed as follows: (1) To the issue of the intestate, if they are all of the same degree of kinship to the intestate, they shall take equally, or if of unequal degree, then those of more remote degrees shall take by representation. 25 Shares of descendants (2) (p.87) English per stirpes Modern per stirpes 1/2 1/3 1/3 Per capita at each generation (1990 UPC) 1/4 1/3 1/3 1/4 1/3 1/3 26 Shares of descendants (3) (p.89) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 27 Shares of descendants (4) (p.90) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 28 Shares of descendants (5) (p.90) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 29 Disinheriting a relative, (p. 92) T A 1/2 1/2 B “I hereby disinherit my brother, B” 1/2 Common Law UPC § 2-101(b) 1/4 1/4 30 Shares of ancestors and collaterals (p.92) English per stirpes Modern per stirpes UPC §2106(c) 31 Table of consanguinity (p.93) 32 Problem 1, page 96 33 Problem 2, page 96 34 Problem 3, page 96 35 Problem 1 at Page 97: Half-Bloods First Wife Second Wife F A B C D In almost all states and under the UPC, spouse (D) would take the entire share (under UPC and in many states like IN, spouse would share with living parents). In a few states, spouse (D) would share with siblings (A & B), and in the 36 majority of those states, A and B would divide equally the sibling share.