IRPTN Hearings - Ekurhuleni - NDP

advertisement

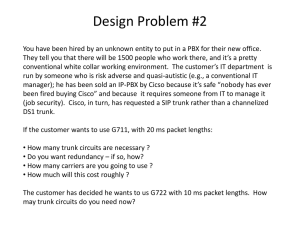

City of Ekurhuleni IRPTN Budget Proposal MTEF budget presentation 12 September 2013 Confidential Contents 1. Situation analysis and full network plan 2. Phase 1 rollout 3. Progress to date and anticipated progress 4. Financials 5. Integration & TOD Acronyms : CoE = City of Ekurhuleni DoT = National Department of Transport DTP&P = CoE’s Department of Transport Planning and Provision NT = National Treasury TOD = Transit Oriented Development Confidential 1. Situation Analysis and Full Network Plan This section provides the problem statement and the rationale for selecting the route for Phase 1. Situation Analysis - review of needs Historically Ekurhuleni comprises of 9 towns, along the east-west mining belt and includes: • the country’s highest density of passenger & freight rail network, with planned upgrades over the next two decades, servicing predominantly the mining belt and commuters along a north-south route to the west of Johannesburg; Of the population (in excess of 3 million people), the highest demand for public transport (128,629 total daily passenger trips) emanates from historically disadvantaged communities, i.e. 65% of the population, living in settlements at the four corners of the City: • 24% in the Vosloorus area; and • 15% in the growing Tembisa area. The supply of public transport is poor: • 50,000 Rail passengers (39%); • 2,237 Bus passengers, serviced by 3 municipal bus entities and 2 private subsidised bus companies (2%); • with the balance of 76,392 being filled by minibus taxis (59%) In addition there is a large flow of passengers across the municipal borders to and from City of Johannesburg and City of Tshwane. Main Mode Of Transport - All Trips Full network plan - phasing 7 trunk routes will be implemented over a number of years, in 5 phases, depending on design, financial, operational and other considerations. Trunks Phase 1 - 5 Golden Triangle City boundary Rail Main PRASA lines Phase 1 Phase 5 Phase 4 Phase 2 Phase 3 2. Phase 1 Rollout Current design and planning is for full Phase 1 route. Phase 1A includes the trunk and feeder routes as well as complementary routes from Tembisa to OR Tambo International Airport. Phase 1B includes the complementary/express route and feeder routes from OR Tambo International Airport to Boksburg. Phase 1C includes the complementary/express route from Boksburg to Vosloorus. Over time, could build extra depot and extend trunk/feeder routes. Phase 1 – key indicators 1A 1B 1C 1AA 1AAA Tembisa civic centre – OR Tambo international airport 20.45 km 22 OR Tambo international airport - Boksburg CBD (Complementary/Express) Boksburg CBD – Vosloorus (Complementary/ Express System) 12.5 km Only stops, no stations Only stops, no stations Ekurhuleni – Johannesburg Ekurhuleni - Tshwane 17 km 27 000 1 10 000 2 (holding areas) Under discussion with CoJ, linked to CoJ’s Phase 1C Under consideration Phase 1 Operations Trunk Feeders Direct/Limited stop Rail Links to CoJ & CoT City boundary 1 2 1 Depot – Tembisa 2 Holding area – Vosloorus or Kempton Park 27 Articulated buses 105 Standard buses 3 min headways in peak Total of 37 000 trips per day on full system 2 Phase 1A Operations Trunk Feeders Complementary City boundary Rail Tembisa Daily passenger trips between Tembisa and OR Tambo International Airport = 27 000 trips OR Tambo International Airport Phase 1A Infrastructure Trunk route 20,45 km Feeder routes Complementary routes 1 1 Depot – Tembisa 2 Holding area – Kempton Park or Vosloorus Trunk stations (22) 9 double modules, 13 single T Services to transfer at KP West Station to link with CoJ Phase 1C Rail R 3 333,60 million T 2 Phase 1B & 1C (Express Complementary) Operations Trunk route Feeder routes Complementary routes 2 Holding area – Kempton Park or Vosloorus Trunk stations Rail Vosloorus to Kempton Park CBD 2 • Limited stops – express/complementary service between Vosloorus and Kempton Park CBD: • Only stop locations provided, no IRPTN stations; • Peak period headways 10 minutes initially; • Service to use mixed traffic lanes between Vosloorus and OR Tambo International Airport (bus priority to be provided at traffic bottlenecks); • Service to use IRPTN lanes between OR Tambo International Airport and Kempton Park CBD; • Buses to turn around in Kempton Park CBD. Phase 1 - vehicles Articulated buses R 3 850 000 Feeder buses R 3 018 000 Tow truck R 3 159 000 Support vehicles R 228 000 Once-off driver training Licence Maintenance plan Ticket validation system Tracking system Entertainment/advertising system Transaction costs for financing vehicle (incl. transaction adviser and arranger’s commission) Interest Phase 1A Phase 1B Phase 1C 27 105 40 3. Progress to date and Anticipated Progress Overall Project: Progress to end of Aug 2013 Operations Plan - Initial 100% Completed in November 2012 - Refinement 40% Refinement has commenced, following the appointment of the Preliminary and Detail Design consultant. Business Plan Communications and Marketing 76% 100% Progressing well. Current service provider completed. New tender being advertised September 2013. Household Surveys 100% Draft report has been submitted for comment. CITP Preliminary and Detailed Design 80% Progressing well. 20% Progressing well. 90% Existing contract expires in November 2013. New Project Management Office unit to be appointed in December 2013 Project Management Attainment of UA targets 1 Universal Design Access Plan (UDAP) Development of a DoT approved plan for the municipality, for the current project phase 2 Appointment of an access consultant Appointment of a suitably qualified access consultant 3 Conforming to national legislation • • • Conforming with PTIS grant conditions Production or update of the approved UDAP and meeting minimum standards of Part S of the Building Regulations in all infrastructure elements 0 2 3 4 Conforming with the PTIS grant guidelines The requirements provided in the PTIS grant guidelines have been met 1 2 3 4 4 5 NLTA 2009 Building Regulations 2008 Promotion of Equality and Prevention of Unfair Discrimination Act 2000 Key: 0) Not achieved, 1) partially achieved, 2) halfway, 3) nearly achieved, 4) completely achieved 1 2 3 4 1 2 3 4 0 2 3 4 UA Problems and Mitigations 0 UDAP Under evaluation 1 Transport planning Station positions Evaluation of options 2 Operational context Requires further detail Detail design phase 3 Marketing and communications Need for accessible media Branding intelligibility Accessible websites under development 4 Customer care No clear customer care approach Customer care system under review 5 Fare system Subsidy structures not addressed Fare structures to be evaluated 6 Passenger information Systems need development Detail systems under development 7 Vehicles No decision on vehicle formats Formats to be evaluated in the detail design phase UA achievements 0 UDAP Initiated 1 Transport planning Ops plan reviewed 2 Operational context Ops plan reviewed 3 Marketing and communications Initiated 4 Customer care Initiated, initial feedback from stakeholders 5 Fare system Ops plan reviewed 6 Passenger information Ops plan reviewed 7 Infrastructure Ops plan reviewed, route assessed. 8 Vehicles Ops plan reviewed, feedback from stakeholders Anticipated % completion through 2013/14 Month START OF YEAR Operational 81 Status of Plans Industry Operating Preliminary Detailed Business Finance Transition Contracts Design Design % complete at start of municipal financial year 80 75 25 10 10 0 100 50 July August September October 100 100 November December January February March April May 100 50 June 50 100 Planned % complete at end of municipal financial year END OF YEAR 100 100 100 50 50 100 100 Overall project plan (Phase 1) Financial years 2013/14 2014/15 2015/16 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Project Management Business Plan Industry Transition Marketing & Comms Launch Universal Access CITP Prelim & Detail Design Construction Bus procurement ITS & Fare System Financial year Complete Business Plan. Refine Ops Plan. Design Phase 1A. Advertise & award 1A contracts. Commence with NMT and comp routes Q4 Construct Phase 1A. Completion of Phase 1A. Systems design of full Launch Phase 1A. network (integration with Advertise & award 1B rail, other metros). contracts. Design Phase 1B. Progress and Anticipated Progress (up to Dec 2013) VOC Financial Model and Project office set up VOC input costs refined Joint MOU agreed Jul-13 Household Survey Report approved Commence engagement with bus financiers Aug-13 Further discussions with PRASA Demand Model Sep-13 updated Oct-13 Nov-13 Dec-13 Money flow model finalised Final refined Ops Plan and Agreement with PRASA Affected Operators identification process commences Facilitator appointed IRPTN Unit Structure approved, Business Plan finalised Scenario/stress testing Secretariat established. Bus fleet strategy finalised Commence with construction of NMT infrastructure Negotiation Plan finalised. Bus specs finalised Preliminary Design completed Roads tender drawings docs completed for Anticipated Progress (Jan 2014 – Jun 2014) Selected Roads bids advertised Jan-14 Feb-14 Mar-14 MLTF approved Affected operators verified Apr-14 Business Plan and financial model approved Negotiation plan approved May-14 Negotiation Plan agreed with affected operators. Jun-14 Negotiating structure agreed Negotiations commence VOC Financial Model finalised. Bus tender advertised Commence with upgrade of feeder roads Balance of Roads tender drawings and docs completed Rest of Roads Bids advertised Selected Roads bids awarded EIA approvals done All other infrastructure Bids advertised Tender awarded “Roads” bids awarded (to start in July) 4. Financials Financials for previous financial year Finance details for period ending June 2013 Rands PTISG Funds received up to 30 June 2013 50 000 000.00 Rollover amount carried over from prior year 5 592 349.57 Expenditure up to 30 June 2013 -40 831 213.30 Balance of funds at 30 June 2013 14 761 136.27 % of grant funds spent up to 30 June 2013 73.4% Firm committed amounts 42 000 000.00 CITP 4 000 000 Preliminary & Detailed Design 30 000 000 Industry transition advisory 4 000 000 Business Plan 4 000 000 Rollover requested for 2013/14 14 761 136.27 Reason for under-expenditure Primarily the high (72%) discount bid by the appointed Prelim & Detail Design Service provider Actions to ameliorate under-spending Various bids advertised for PSP’s. Early commencement of certain works planned via existing contracts Projected expenditure 2013/14 (amounts in R millions) Area Planning costs Expenditure item PTI Grant PTI Grant PTI Grant PTI Grant Project Management 0.20 0.20 1.50 3.60 5.50 Operations Plan (UDAP) 0.00 0.00 0.45 0.55 1.00 Business Plan 0.96 1.44 1.44 2.16 6.00 Marketing & Comms Plan 0.00 0.84 2.66 3.50 7.00 Prelim and Detailed Design 4.80 7.20 7.20 10.80 30.00 Other (Legal: Support) 0.60 0.90 1.30 2.20 5.00 Other (CITP) 2.00 2.00 0.00 0.00 4.00 Other (Town Planning – Depots) 0.00 0.00 0.45 0.55 1.00 Other (ITS Service Provider) 0.00 0.00 1.35 1.65 3.00 Other (Universal Access Design) 0.06 0.09 0.13 0.22 0.50 0.00 8.80 33.87 104.13 146.80 Other (Industry Transition) 3.48 5.21 6.87 10.74 26.30 Other (Capacitation – ME) 1.80 2.70 3.90 6.60 15.00 14.32 29.38 60.28 146.28 251.10 Equipment costs Infrastructure costs NMT, Feeders/ Complementary, Selected Trunk sections Infrastructure maintenance costs Transitional costs Industry compensation Operating costs TOTAL Anticipated financials for this financial year (2013/14) Finance details for period ending June 2014 PTIG Funds to be received up to 30 June 2014 Rollover amount carried over from prior year Expenditure up to 30 June 2014 Balance of funds at 30 June 2014 % of grant funds spent up to 30 June 2014 Anticipated firm committed amounts Rollover to be requested for 2014/15 Rands 243 543 000.00 14 761 136.27 -251 100 000.00 7 204 136.27 97% 200 000 000.00 7 204 136.27 Cash Flow in 2013/14 Projected grant expenditure in MTEF period (amounts in R millions) Expenditure item PTI Grant PTI Grant PTI Grant 63.00 43.20 33.30 139.50 200.00 300.00 500.00 558.00 629.00 1 227.20 Top structures for stations / stops 122.00 122.00 244.00 Depots 104.00 104.00 208.00 30.00 70.00 110.00 Land and property acquisition 5.00 20.00 25.00 Other (Land Acquisition – Depot) 5.00 15.00 20.00 10.00 20.00 30.00 10.00 10.00 23.00 55.00 55.00 110.00 132.00 125.40 306.00 35.00 35.00 70.00 10.00 10.00 60.00 5.00 5.00 25.00 25.00 Planning costs Equipment costs (AFC & APTMS) Roadway civil works Control centre 40.20 10.00 Infrastructure costs Other (Move/Protection services - owners) Other (Professional fees) 3.00 Other (Feeder, Comp stops) Other (Feeder road upgrades) 48.60 Other (Holding areas) Other (NMT) Infrastructure maintenance costs Transitional costs Operating costs TOTAL 40.00 Industry compensation Other (Industry Transition) 26.30 33.80 25.80 85.90 Other (Capacitation – ME) 15.00 40.00 90.00 145.00 0 0 0 0 251.10 1 393.00 1 689.50 3 333.60 Project Funding: MTEF period and beyond The City’s IRPTN planning beyond 2015/16 is dependent on a host of variables, inter alia the extent of funding received; the extent of upgrading by PRASA; etc. The plan is to implement Phase 1A of the project in the current MTEF period and then to commence with further phases in 2016-17. Anticipated Expenditure and Funding is indicated on the following slide. Ekurhuleni Capex funding as indicated is only for the approved MTEF period. It is possible that further funding will be made available for 2016/17 and 2017/18. If insufficient funding is allocated by NT to CoE in 2014/15 and beyond: • • • Infrastructure contracts can not be awarded in 2013/14 (minimum allocation); The project will not be operationalised in 2015/16 contrary to communications made to communities and political directives (reduced allocation); CoE will fall further behind the other Metros, particularly its neighbours in Gauteng, in terms of IRPTN/BRT implementation, potentially negatively impacting on the communities within CoE Project Funding for MTEF period & beyond (Rm) (Excluding Operational Costs/Income) FUNDING EXPENDITURE Description 2013/14 2014/15 2015/16 2016/17 2017/18 Planning 63 43 33 44 43 Infrastructure (Incl. ITS) 147 1 276 1 515 1 065 1 265 Entity/Transitional Costs 41 74 141 140 140 Vehicles (buses) 414 400 Totals: 251 1 393 2 103 1 249 1 948 PTIG 257 1 182 1 430 1 249 1 549 211 259 0 0 Ekurhuleni Capex Financing (buses) Totals: 414 257 1 393 2 103 400 1 249 1 948 Summary – state of readiness We are committed to rolling the IRPTN out, and need DoT’s and NT’s continued support. • All required work streams have been appointed. The status of each has been noted below: • • • • • • • • • • Additional work streams are envisaged as follows: • • • • • • Project Management – current contract ends Nov 2013, ToR being issued for new contract; Operations Plan – final plan completed Nov 2012, currently being revised with new input; Business Plan – contracted up to Mar 2014, currently consolidating Business Plan document; Industry Transition – engaging operators through MoUs and industry transition forum, with advisors, project office and facilitator supplied by City; Communication and Marketing – contract expired Jun 2013, completed public participation and development of marketing plan; ToR for new contract in preparation Universal Access Design – appointed Jan 2013, currently developing UAD plan; Household Travel Survey – completed Jul 2013 giving us latest demand figures; Comprehensive ITP – to be concluded in Dec 2013; Preliminary & Detailed Design – appointed Apr 2013, undertaking a refinement of the Ops Plan and busy with preliminary designs. Vehicle Procurement process – to start Jan 2014; Construction of NMT infrastructure – to start in Oct 2013; Construction of Phase 1 trunk infrastructure, depot and control centre – to start in Jul 2014; ITS and fare management systems procurement – to start in Jul 2014; Systems testing (pilot) – to commence end of 2015; Launch (start of operations) is scheduled for early 2016. Summary – state of readiness (Committed) INFRASTRUCTURE READINESS AS FOLLOWS: • Roadway Infrastructure: Preliminary and Detail designs underway • NMT: Identification of routes feeding the trunks have ben identified and construction of NMT in Tembisa and Kempton Park will start in October. • TMC : site has been identified ( existing metro DEMS building) – Needs assessment for the TMC to be completed by end November and refurbishments to start early 2014. • Feeder & Comp routes : Commencement of upgrades on the routes and major intersections. • Land identification: for Depot and Holding areas process has commenced ( Combination of Municipal and Private owned land) 5. Gauteng Integration Destination Of Motorised Trips Starting In Tembisa Destination Alberton All Train Bus Taxi School bus Car 100 Bedfordview-Edenvale 3 500 Benoni 1 250 Boksburg Company transport 100 1 600 1 400 500 800 300 50 100 3 700 2 000 1 000 400 300 Brakpan 400 400 Daveyton 300 300 Duduza 104 104 Ekurhuleni East Ekurhuleni North 5 700 200 3 000 2 300 200 Germiston 4 600 1 900 2 000 500 Katlehong 600 400 200 9 200 8 700 2 000 1 800 21 200 12 800 700 800 Etwatwa Kempton Park Kwa Thema 35 300 13 600 200 200 37 000 800 200 Nigel Springs Tembisa (Internal Trips) 700 Thokoza Tsakane 200 200 Vosloorus COJ Tshwane 23 300 3 500 12 500 6 200 7 900 4 000 2 500 1 200 1 100 100 100 Integration with MSDF and CIF • Serves three Primary Nodes: Tembisa, Kempton Park and Boksburg Will serve 8 major Planned Investment Projects with “near certainty” of being built between 2013 to 2021: Tembisa 1 2 • Kempton Park 3 Aerotropolis 4 No. Benoni 5 Boksburg Development Name 1 Tembisa Urban Renewal 2 Nyoni Park Precinct 3 Aerotropolis 4 Jansen Park Extension 5 Balmoral Extension 6 Leeupoort 7 Extension of Windmill Park 8 Extension of Vosloorus & Tambokiesfontein Germiston 6 Windmill Park Dawn Park 7 Vosloorus Katlehong 8 • Aligned with the Phase 1 Densification Corridor - major housing projects and high density infill areas Rail Stations scheduled for upgrades and TOD TOD: • Kempton Park • Rhodesfield • Isando Residential TOD: • Leralla Station • Limindlela Station • Tembisa Station • (Oakmoor Station) Taxi rank option B Proposed new multi-level (2-storey) intermodal on PRASA land, long distance taxi rank on CoE land Long Distance Taxi RankCoE Land CoE Land Taxi Rank- PRASA LAND Market Square Pedestrianise Plantation Road NEW FOOD COURT NEW RETAIL New shortdistance bus terminal 2 LEVEL TAXI RANK SITE BOUNDARY LINE HOLDING FACILITIES TO BE PROVIDED OFF SITE Integration with Johannesburg’s REA VAYA Initial integration envisaged in the Tembisa / Ivory Park area affecting Johannesburg’s Phase 1C route and Ekurhuleni’s Phase 1A route. Recent engagements with the CoJ: • June 2013 – Meeting with CoJ officials was held to discuss Ekurhuleni planning process and need to understand Johannesburg Phase 1C program; – CoE would liaise with CoJ Phase 1C consulting team led by GIBB; • August 2013 (with GIBB): – Start the detailed discussions of how to integrate the planning processes; – Planning data and information would be exchanged to allow for the Ivory Park area to be included in the Ekurhuleni transportation planning model; – Data swop has started; – Interfacing of services needed to take into account the interface between the Rea Vaya high floor system and Ekurhuleni low floor system; – Phase 1C planning process to be completed in April 2014. Operations interface needs to be completed by end February 2014. Engagements with Gauteng Province 1. Ekurhuleni IRPTN is included in Gauteng’s 25-year Integrated Transport Master Plan 2. Ekurhuleni participates in the Integrated Fare Management committee under the leadership of the Gauteng Department of Roads & Transport. 3. Initial discussions held with officials from the Gauteng Department of Roads & Transport regarding the use of provincial routes for the provision of trunk bus routes. Further engagement to take place once plans have progressed. 4. Operational Plan was presented to the Gauteng Province and regular feedback is given at the HODs forum meetings and MEC/MMC meetings. 5. CoE also some of functions on transport planning to be undertaken by the proposed Gauteng Transport Commission – further engagements are in place 6. CoE is in the process of setting up the MLTF and is also moving towards investigating the best way to set up the MRE. . Capital Investment Framework AND Strategic Land Parcels in Ekurhuleni CIF - IRPTN integration Legend EMM Boundary National Roads Railways Lines IRP TN Phase 1A Buffer IRP TN Phase 1B Buffer IRP TN Phase 1C B uffer IRP TN Trunk Routes Industrial Township Regeneration Aerotropolis Core Node Primary Nodes Housing Projects (curren t) Housing Projects (propo sed) Major Investments Inland Port Kaalfontein Immediate Catchment Area Priority Water Bodies New Parks 4 R2 R2 1 R 21 Urban Edge N12 N12 M2 N3 N3 N1 SYB RAN D VA N NIE KER K o IRPTN network has been incorporated into the CIF as per the Operational Plan. o Phase 1A and B of the route are first priority. o Phase 1A and 1B - demarcated as part of GPA 1 runs from the Tembisa Civic Centre through to the O.R. Tambo International Airport (Jones Road) and through to Boksburg. o Phase 1C - demarcated as GPA 2 runs from Boksburg through to the New Natalspruit Hospital in Vosloorus. o The remaining IRPTN trunk routes demarcated as part of GPA 3, based on a 20-year timeframe for potential implementation. R21 Priority Primary Nodes N3 Blue = GPA 1 (3 years) Yellow = GPA 2 (10 years) Green = GPA 3 (20 years) 7 Proposed MSDF densities Densities in terms of the MSDF along the BRT corridor and the PRASA stations: Proposed densities per type of node Nodal Type Primary Secondary Tertiary Density targets 2025 Minimum 110 100 90 Maximum * 160 140 Proposed densities along corridors Road classification Transportation corridors Proposed densities around railway stations Distance Proposed density up to 500m from the station Density targets between 500 m & 1 000 m from the station (dwelling units per hectare (minimum – maximum) 2025 (u/ha) Activity corridors 110 – 200 90 – 160 Activity spine List of corridors Land use Albertina Sisulu Corridor; Germiston Daveyton Corridor and the IRPTN Corridor To be listed in RSDFs; mainly K-routes linking Primary Nodes To be listed in RSDFs; mainly municipal roads linking Secondary Nodes - Mixed land uses at identified intersection nodal points. Higher density residential Local nodal development Higher density residential - Residential - Business - Retail - All uses to be of a local and fine grain nature Density targets 2025 units per hectare (Minimum– Maximum) 60 – 80 110 – 130 40 – 60 Integration with MSDF and CIF • Serves three Primary Nodes: Tembisa, Kempton Park and Boksburg Will serve 8 major Planned Investment Projects with “near certainty” of being built between 2013 to 2021: Tembisa 1 2 • Kempton Park 3 Aerotropolis 4 No. Benoni 5 Boksburg Development Name 1 Tembisa Urban Renewal 2 Nyoni Park Precinct 3 Aerotropolis 4 Jansen Park Extension 5 Balmoral Extension 6 Leeupoort 7 Extension of Windmill Park 8 Extension of Vosloorus & Tambokiesfontein Germiston 6 Windmill Park Dawn Park 7 Vosloorus Katlehong 8 • Aligned with the Phase 1 Densification Corridor - major housing projects and high density infill areas Strategic Land Parcels [for potential strategic investment opportunity] Strategic land is defined as well-located land or land found in well-located area where development can be maximized and optimized: 1. Tembisa Civic Centre (Iqgaqga CBD) 2. New Natalspruit Hospital Development node/precinct (Vosloorus) 3. Dries Niemand Stadium 4. Tembisa Civic Centre (Iqgaqga CBD) 5. New Natalspruit Hospital Development node/precinct (Vosloorus) 6. Germiston-Boksburg mining belt (area around Comet Township in Boksburg) 7. Leeuwpoort Proper (East: Portions of R/113 Leeuwpoort 113 IR) 8. Leeuwpoort West (Van Dyk Park Township-73/113 Leeuwpoort 113 IR) QUESTIONS????