Chapter 13 - Channels of Distribution

advertisement

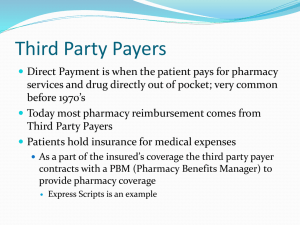

Chapter 13 Channels of Distribution Norman V. Carroll, PhD Professor of Pharmacy Administration Virginia Commonwealth University School of Pharmacy Chapter 13 slides for Marketing for Pharmacists, 2nd edition Learning Objectives Define and give examples of a channel of distribution for pharmacy products and services. Define and give examples of members of channels of distribution for pharmacy products and services. Define the term intermediary, give examples of intermediaries, and list and describe the functions intermediaries fulfill in channels of distribution. Learning Objectives (continued) Discuss the effects of customer, product, and manufacturer characteristics on channel structure and explain why different types of pharmacy products and services require different channel structures. Define and give examples of channel conflict and cooperation. List and explain the types of vertical marketing systems and discuss the need for them. Learning Objectives (continued) Explain the functions and services offered by pharmacy benefit managers and the effects these organizations have had on community pharmacy. Explain how the growth of managed care has led to increasing cooperation and consolidation among pharmacy retailers and increasing conflict between retailers and other channel members. Traditional Channels MANUFACTURER WHOLESALER PHARMACY (Retailer) CONSUMER Why have intermediaries? MANF RETAILER MANF RETAILER MANF RETAILER Efficiency MANF MANF MANF RETAILER WHLSER RETAILER RETAILER Additional functions of intermediaries Product information - safe, effective use Convenience - place and time Variety / assortment Services Repackaging Reimbursement Repair Credit Traditional Channels MANUFACTURER WHOLESALER PHARMACY (Retailer) CONSUMER Why long channels for pharmaceuticals? Customer characteristics Product characteristics Manufacturer characteristics Legal restrictions What about new types of medicines? Channel conflict - Discriminatory pricing - Limited distribution Channel cooperation - Buying groups - Prime vendors - Charge-back system NO CHARGE-BACK MANUFACTURER AWP - 20% WHOLESALER AWP - 15% PHARMACY RETAIL CHARGE-BACK SYSTEM MANUFACTURER AWP - 20% WHOLESALER AWP - 40% HMO PHARMACY AWP x 25% Vertical Marketing Systems Administered - based on power Corporate - based on ownership Contractual - license / franchise - wholesaler voluntary chains MANF Merck WHOLESALER RETAILER CONSUMER Cardinal Medco / PAID Medicine Shoppe PHYSICIANS HOSPITAL PHARMACY CONSUMER Staff Model HMO Number of Community Pharmacies Total Indeps Chains 60000 50000 40000 30000 20000 10000 0 1990 1992 1994 1996 1998 2001 2003 Source: IMS DDD Class of Trade Analysis 2005 Managed Care Enrollment (000) 250000 200000 150000 PPOs HMOs 100000 50000 0 1990 1995 2000 2003 Aventis MCD Source: Managed Care Digest HMO-PPO 2004 100 80 60 40 20 0 Govt Priv3PP 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 % of Rxs 3rd Party Payment for Rx Drugs IMS DDD Class of Trade Analysis Sales of Mail Order Pharmacies 45000 40000 35000 30000 Sales in 25000 Millions 20000 15000 10000 5000 0 43929 18512 6053 100 750 1981 1986 2113 1990 1995 Source: IMS DDD Class of Trade Analysis 2000 2005 Growth of PBMs PLAN SPONSOR Commonwealth of Virginia PBM Medco PHARMACY Rite Aid COVERED LIFE/BENEFICIARY D. Holdford Why PBMs? Growth of third-party payment Increase efficiency of payment and information flows Intermediary for payment and info Plan Sponsors General Motors BCBS Aetna Teamsters PBM Buford Rd. Pharmacy Pharmacy Benefit Manager Wal-Mart Eckerd Rite Aid PBM Services - early Claims processing Retail pharmacy network Drug cards for beneficiaries DUR and use management Utilization reports to sponsors Electronic processing On-line adjudication PBM Services - later “managing the drug benefit” Why – control drug costs What – Discount pharmacy reimbursement Mail order – the three big PBMs each own one Drug benefit design – co-pay, quantity limits, exclusions, three-tier designs Formulary Drug product rebates What is a rebate? Payment made by a manufacturer to a PBM or other entity that does NOT TAKE PHYSICAL POSSESSION OF THE DRUG Usually on patented branded products Based on use of the manufacturer’s drug Given to encourage greater use Substantial Rebate Manf Goods Wholesaler PBM Payment Pharmacy Plan Sponsor Patient Rebates PBM revenue sources Administrative fees - per claim Clear to sponsor, specified in contract Competitive Easy audit by sponsor Services - like disease management Relatively small revenues PBM revenue sources Rebates – old Somewhat hidden from sponsor Not clear in contract Difficult for sponsor to audit Mail order generics – new Retail – MAC Mail – AWP – 50% For generics AWP-50% >> MAC Effects of PBM rebates PBM incentive - maximize rebates Which products do they favor? Low cost or high rebate? Help consumer? Help plan sponsor? Pharmacists’ image? Major Pharmacy Benefit Managers PBM Rx volume (millions) Caremark Medco Express 432 397 300 Total top-3 PBMs 1,129 Total retail rx volume 3,175 Major Pharmacy Benefit Managers PBM Owner Caremark McKesson (PCS) Lilly (PCS) Rite Aid (PCS) Advance Paradigm Advance/ PCS Baxter Indep Caremark PCS/Caremark CVS Caremark Medco IndependentMerck Independent Express Independent Consolidation and Alliances Corporate chains - Consolidation (horizontal integration) - Market power - Efficiency - Vertical integration - PBM Voluntary chains (small chains and indeps) - Wholesalers - PBM functions Consolidation in Chain Pharmacy Walgreens 1990 1,525 1995 2,085 2005 4,962 Rite Aid Thrifty 2,352 1,065 2,759 1,040 3,331 (Rite Aid) CVS 801 1,366 5,400 Revco 1,870 2,169 (CVS) Hook-SuperX 1,110 (Rev) (CVS) Eckerd 1,632 1,716 (CVS/ Coutu) Thrift Drug 472 640 (CVS/ Coutu) Jean Coutu Totals 192 11,019 470 12,245 2,243 15,936 Wholesaler-Sponsored Voluntary Cooperatives Name Health Mart Valu-rite AccessHealth Sponsor No. McKesson McKesson McKesson Pharmacies 3,000 ? 3,000+ Family Pcys Amerisource- 2,500 Bergen (ABC) Good Neighbor ABC 2,500 Performance + ABC 3500+ Leader Cardinal 3,300 Retail Pharmacies - Efficiency Higher-volume outlets Economies of scale Technology Phone systems Electronic links with prescribers Robotics and automated dispensing Centralized dispensing (fill) and adjudication Web and phone-based refill services Summary - Trends Increasing third-party payment / managed care Increasing mail order sales Increasing importance of PBMs Consolidation: PBMs Chain pharmacies Sort of – community pharmacies Increased efficiency