Competition in Healthcare

advertisement

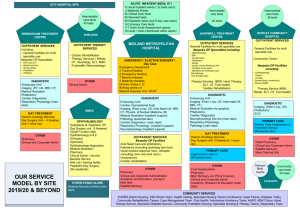

Prof Alex van den Heever W its School of Governance Alex.vandenhever@wits.ac.za COMPETITION IN THE SOUTH AFRICAN HEALTH SYSTEM Source for Content The contents of this presentation reflect a high level summary of the analysis in a report provided to the Competition Commission in 2012 http://www.compcom.co.za/assets/Healthcare-Inquiry/Reviewof-Competition-in-the-South-African-Health-System.pdf What makes markets work? • Basis for exchange • Individuals produce products and are able to exchange them for other products • Consumers • Understand the product (price/quality) • Have a choice of alternatives • Able to exercise choice When do markets fail? • Basis for exchange • Individuals produce products and are unable to exchange them for other products (absence of efficient systems of exchange – money) • Consumers • Do not understand the product (price/quality) • Have limited or no choice of alternatives • Unable to exercise choice How do consumers lose control of demand? • Product complexity • Price and quality comparisons not possible in real time • Market problems possible despite competition • Market concentration • Structural reduction in products choice • National or geographic markets • Market manipulation • Collusion to exclude competition from the market • Agreements between market participants, including the sharing of information (e.g. prices/costs) • Punishment for non-compliance • Payment of kickbacks to intermediaries able to determine demand (agents) • Market segmentation • Forcing consumers into market segments on the basis of their ability to pay Correcting dysfunctional/failing markets • Ensure an efficient basis for exchange • Put consumers rather than product suppliers in control of demand • Effective market signalling • Price • Quality • Product simplicity – remove need for advice Correcting markets is more than just about price What about efficiency? • Allocative efficiency - static • Technical efficiency - static • Dynamic efficiency - innovation ANALYSIS OF THE SOUTH AFRICAN MARKET Two key “products” • Insurance • Healthcare • What about consumers? • Don’t understand what they’re buying • Don’t understand the pricing • Have no idea about product quality • Key strategic product purchases are channelled through conflicted intermediaries Health insurance unregulated Financing and Risk Pooling Brokers Health insurance - regulated 3rd Party Administration Holding companies Diagnostic Specialists Consumer Information asymmetry General Practitioner Surgical Specialists Hospitalbased and substitute services Information asymmetry 3rd Party Managed Care Medicines and other medical products and services Health goods and services Health insurance unregulated Financing and Risk Pooling Brokers Health insurance - regulated 3rd Party Administration 3rd Party Managed Care Diagnostic Specialists Consumer Information asymmetry Gate keeper Consumer agents Possible conflicts of interest Moral hazard Anti-selection Risk-selection Commercial relationships General Practitioner Surgical Specialists Hospitalbased and substitute services Financial sector holding companies Information asymmetry Medicines and other medical products and services Health goods and services WHAT’S IN THE CONTRACT TODAY Systemic Market-related Issues What is internalised/externalised within contracts between consumers and health insurers? • Price • Cost • Quality Regulated Insurance Unregulated Insurance What is internalised/externalised within contracts between insurers and health care providers? • Price • Cost • Quality Regulated Insurance Unregulated Insurance Markets only compete on factors/signals that are transparent to relevant decisionmakers Internalised into Insurance contract – medical schemes • Risk Medium • Price Medium • Quality of coverage Medium • Quality of health care services Medium/Weak • Quality of healthcare products Medium/Weak • Regulations prevent some risks from being transferred arbitrarily back to consumers Insurance contract – other • Risk Weak • Price Weak • Quality of coverage Very weak • Quality of health care services Very weak • Quality of healthcare products Very weak Internalised into insurance contract with HC service providers • Derived from the contract between consumers and insurers • Risk Weak • Price Very weak • Quality of coverage n/a • Quality of health care services Weak • Quality of healthcare products Weak MARKET OUTCOMES scheme expenditure and GCI (2012 prices) Source: Council for Medical Schemes data from scheme audited financial statements 1990 – 2012 (adjusted for CPI) 100% 80% 60% 40% 20% 0% 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Percentage of total claims expenditure Changes in the structure of medical schemes expenditure on benefits (19812012) Year General Practitioners Source: Specialists Dentists Hospitals Medicines Other Council for Medical Schemes data from scheme audited financial statements 1981 2012 300.0 250.0 200.0 150.0 100.0 Point at which beds per 1,000 is roughly equal to the US and UK (noting that they have vastly older populations) 50.0 Hosp claims Beds/Pop HHI (lag 1 yr) 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 0.0 1997 Index with 1997 = 100 Hospital claims (real pbpa) compared to beds per 1,000 and market concentration (HHI) (for private beds) Changes in total beds in South Africa 1976 to 2010: public and private sector 140,000 120,000 100,000 80,000 60,000 40,000 20,000 Beds (pub) Beds (prv) 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 0 Return on Capital Employed (Mediclinic and Netcare) Source: Anthony Felet, Duncan Lishman and Fatima Fiandeiro, “Do hospital mergers lead to healthy profits?”, 2012, p.11 Return on Capital Employed (Mediclinic and Netcare) – 1997 - 2011 Source: Anthony Felet, Duncan Lishman and Fatima Fiandeiro, “Do hospital mergers lead to healthy profits?”, 2012, p.11 Average age of Medical Schemes 2000 2013 Average age of beneficiaries 35 30 25 20 15 10 5 0 31.2 31.6 31.6 31.9 32.0 31.7 31.6 31.4 31.5 31.6 31.5 31.6 32.0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Average age of beneficiaries Sources: CMS Annual Reports 2003-4, 2004-5, 2005-6, 2007-8, 2009-10, 2010-11, 2012-13 2001 to 2006 Real hospital cost (pbpa) changes from 2001 to 2006 (percentage) (includes medicines) 0.0% 53.9% Other causes 5.5% 5.4% 10.0% Other 20.0% 30.0% Nurse salaries 40.0% 50.0% Age 60.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% Total Non-health Source: Administration Council for Medical Schemes data from scheme audited financial statements 1974 - 2010 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 Major deregulation 1974 Percentage of GCI Non-health expenditure trends from 19742010: percentage of Gross Contribution Income (GCI) CONCLUDING REMARKS • Ensure that health insurers have the incentive to purchase efficiently • Remove conflicts of interest in markets for advice • Simplify and standardise products • Market transparency on key indicators central to consumer choice • Internalising price and quality into the contract • Deal with regulatory arbitrage • Ensure governance arrangements correctly locate the commercial imperative in the scheme • Ensure that insurer incentives cannot be undermined by anti-competitive structures and conduct on the supply side • Market transparency (price/cost/quality) • Conflicts of interest • Separate doctors from other products • Accumulation and abuse of market power • Market diversification • Penalise abuse • Collusion THANK YOU