Zheng_Ling_Talk_0314..

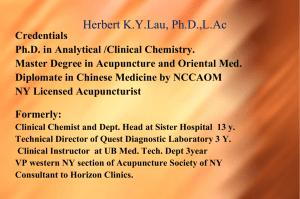

advertisement

How to deal with insurance carrier for a denied or mishandled claim ---by Ling Zheng, L.Ac. ATCMS Seminar on March 14, 2010 What Do You Need to Do Before Sending Your Bill to Insurance Company? 1.To verify your patient’s acupuncture benefits before treating for your patient. 2. To treat for your patient. 3. To complete a CMS-1500 claim form and send it to insurance company within 45 days from the date of service. I. What may happen after your claim has been submitted ? Insurance company must process your medical reimbursement within 45 days, according to New York State insurance laws. You may complain to New York State Insurance Department at website: www.ins.state.ny.us.gov, or at phone number: (800) 358-9260, in case insurance company fails to process your reimbursement on time. Insurance company may contact you via mail, fax or telephone to require for any additional information regarding your reimbursement processing. But they should not have held your reimbursement or ignore it. You may receive a letter from insurance company to require for additional information, if insurance company has any questions regarding your claim. Usually, the required information may include patient’s information (such as date of accident, cause of the injury, previous medical history, etc.); provider’s information (such as your professional status, tax ID number, or form W-2, etc.); and/or medical document(s) (such as medical necessity letter, initial physical examination report, daily progress notes, re-evaluation report, etc.). This is your professional responsibility to provider those required information within 45 days. Otherwise, your claim may be denied. II. To understand your claim Statement When you receive the payment with a claim statement, you may be very happy and exciting for your successful reimbursement. I would like to remind you to take a few minutes to review the statement carefully and make sure that you have got payment completely as you expect. Otherwise, the reimbursement process has not been done successfully. You must know how to read the statement and be able to find out the part of your reimbursement cut by insurance carrier. If you disagree with insurance carrier about the decision, you need to start your next action to get back the cut part of reimbursement from the insurance carrier. Insurance carrier recognizes that many providers don’t want to spend their time to review the claim statement carefully and fight for the unreasonable decision make by insurance carrier. They make “mistakes” for saving their medical expenses. 1. To estimate the $ amount you may get payment from insurance carrier and your patient’s responsibility: Insurance Co must pay you: A = (B – C) X D Your pt’s responsibility: E = C + (B – C) X F A is the $ amount insurance carrier must pay for your medical claim; B is the total amount you bill to insurance company; C is the patient’s deductible which the patient needs to pay for meeting the required amount.; D is the percentage of the insurance plan will cover for the procedure(s), according to the insurance policy; E is the patient’s responsibility; F is percentage that patient needs to share for the co-insurance as the policy. For example, you totally bill $1,270 to insurance company for the patient’s services (including evaluation and acupuncture) fee. The patient’s calendar year deductible is $200 for participating provider and $500 for non-participating provider, and the patient has paid $380 for the deductible during the calendar year. The plan will cover 90% for the services provided by participating provider and 70% for non-participating provider, according to the policy. If you are a non-participating provider, B = $1270, C = 500 – 380 = $120, D = 70%, F = 30%. Insurance company must pay you: A = (1270 – 120) X 70% = 805 ($) The patient’s responsibility: E = 120 + (1270 – 120) X 30% = 465 ($) If you are a participating provider, B = $1270, C = $0.00 ($200 deductible has been met), D = 90%, F = 10%. insurance company must pay you: A = (1270 – 0) X 90% = 1143 ($) The patient’s responsibility: E = 0 + (1270 – 0) X 10% = 127 ($) 2. To understand a claim statement: You need to read the claim statement , and check the payment for every item. If you get the payment as much as you expect, the reimbursement has been processed successfully! If the payment is less than what you expect, you need to read the explanation on the statement and understand why some of items have not been paid or have been paid partly only. 3. To review your benefits verification report which you made when you contacted with insurance carrier to verify the patient’s eligibility. If you consider the insurance carrier’s determination being acceptable, according to the verification report, accept it. 4. If you disagree with the determination, you may: (1) call insurance company for discussion; (2) write a letter to require for re-process the claim; (3) write a letter to appeal. Don’t be sad when your claim is denied by insurance company. Insurance carriers always try to make some troubles for your medical reimbursement. They try to find out any reasons to deny your reimbursement. They want to make you feel tire to get the payment and finally you may give up it. This is the way to save their medical expenses. It is a game. You have to be patient, know the rule, and have the right tools and enough knowledge to play the game well if you want to win it. When you deal with insurance carrier for a denied claim, you must know why your claim is denied at first. III. Most frequent reasons for the denied claims 1. The policy doesn’t cover for acupuncture procedure; The way to prevent: to verify the patient’s coverage benefits and make sure the benefit includes acupuncture, before starting the treatment; 2. The policy covers acupuncture procedure for some particular conditions which do not include the patient’s current condition; The way to prevent: to verify the patient’s acupuncture benefits and make sure the patient’s condition is one of the listed conditions to be treated with acupuncture according to the policy term, before starting the treatment; 3. The policy covers acupuncture procedure provided only by a physician certified acupuncturist. But it doesn’t cover acupuncture provided by a licensed acupuncturist; The way to prevent: to verify the patient’s acupuncture benefits and make sure the benefits will be available for licensed acupuncturist; 4. The policy covers acupuncture procedure, but acupuncture is not a medically necessary procedure for the patient; The way to prevent: to write a medical necessity letter and mail it with your initial claim form to insurance company; 5. You fail to apply for pre-authorization of acupuncture as the policy term; The way to prevent: to verify the patient’s acupuncture benefits including the pre-authorization requirement. To apply for preauthorization as the policy term; 6. You fail to have an acupuncture referring letter from the patient’s PCP, as the policy term; The way to prevent: to make sure that the referring letter is required or not – through eligibility verification, and require your patient to get one from his/her PCP if it is necessary, before starting the treatment; 7. Exceed in the number of visit or total $ amount coverage for acupuncture limited by the policy term; The way to prevent: to get the coverage information regarding the limitation when you verify the patient’s acupuncture benefits; 8.You keep on treating the patient with acupuncture treatment for long-term, insurance carrier doesn’t understand why you treat your patient endlessly and determine the procedure as “not medically necessary”; The way to prevent: to mail a re-evaluation report to insurance company when you complete a course (such as every 12 or 15 visits) of acupuncture treatment plan and start a new plan continually; 9. You fail to submit your claim within 45 days (or 90 days---depend upon the policy terms made by different insurance companies) from the date of service; The way to prevent: to complete the claim form and submit it to insurance company within 45 days from the date of service. 10. You fill out the claim form with incorrect information, such as CPT codes or ICD-9-CM codes, etc; The way to prevent: to complete the claim form carefully. In case it happens, correct the claim form and re-submit it to insurance company. IV. How to deal with insurance carrier for difficult cases 1.You don’t get any response from insurance company within 30 days after you submit your claim – pay the fees claimed, require for additional information or deny the claim. I suggest you to call insurance company to check for your claim status and make sure your claim been received, if you have not received the response after 5 weeks you mailed your claim. If they can’t find out your claim, it may be missing and you have to submit another copy. If the claim has been processed, you need to know the total amount has been paid, check number and issue day, where the check has been mail to, and when you may receive the check A few insurance companies, such as Empire Blue Cross & Blue Shield, may mail the check to patient directly if the services fee is claimed by a nonparticipating provider, for the case, you have to contact your patient to request for sending the check to you. If your claim has been received by insurance company for a while and still has not been processed, remind them that New York State insurance laws require insurance company to process the claim within 45 days. 2. You are required to submit additional information such as medical document, provider’s information or patient’s information. You have to do it within 45 days as the requirement. It is your professional responsibility. You have no choices except you give up the claim. 3. Your claim has been denied due to the coverage policy and you fail to verify the coverage benefits carefully before starting the treatment. Some insurance companies may have some very unreasonable and unfair acupuncture coverage policies. You may refuse to accept those insurance plans. But you have not enough power to make them change their policies. To fail to verify the eligibility will lead to fail in your reimbursement. It is your mistake and nobody is able to help you. Some insurance policies require a PCP referring or pre-authorization or set a limitation for acupuncture treatment. You have to follow up the policies. There are not solution ways for these denied claims. What you need to do is to prevent it through careful eligibility verification. 4. If you have verified your patient’s acupuncture coverage benefits carefully and followed up the policy, and your claim is still denied due to the information released by the representative is incorrect, you may contact (by either phone call or mail) the insurance carrier to discuss with them and tell them what happened. Insurance company should take the responsibility to solute the problem caused by its employee’s mistake(s) and re-consider for the reimbursement –-- although the policy doesn’t cover for the procedures. To win the game, you need a tool – eligibility verification report indicated the representative name and date/time when you talked with him/her over phone. 5. Sometime, insurance companies may deny your claim due to acupuncture procedure is determined as a “not medically necessary treatment” for the patient, although the patient has acupuncture coverage benefits. You need to submit a medical necessity letter with supporting evidences based medicine (the research reports of Clinical trials in relation to acupuncture treating for the same condition), to insurance company for re-process. You need to search those evidences based medicine from time to time and save the information on you computer. You always need the information for your successful medical reimbursement. This is another tool to win the insurance game. You must know which conditions are suitable to be treated with acupuncture – according to currently available evidences based medicine. When you decide to accept your patient insurance plan and complete CMS-1500 claim form, you must consider the patient’s diagnosis and the supporting scientific evidences. 6. If you recognize that your claim is denied due to insurance company’s mistake on the claim process, just call insurance carrier (claim department) to point it out and request for re-process. It will be easy for solution. 7.If your claim is denied because you complete the claim form incorrectly, you need to correct the original claim form then resubmit it to insurance company for re-process. You may get payment. But it will take a little bit longer. V. How to appeal for your denied reimbursement As my personal experience, only 60-65% of my claims submitted to insurance companies are processed and paid smoothly, although I always try my best to verify and patient’s eligibility carefully, complete CMS-1500 claim form correctly, and prepare necessary medical documents completely. Other 25-30% of my claims are processed and paid successfully after dealing with insurance carriers through the above solution ways, via phone discussion, mailing or fax the related information or documents. About 10% of the claims need to be appealed when the above efforts fail. There are three different levels of insurance appeal: (1)Internal appeal – Level 1; (2) Internal appeal – Level 2; (3) External appeal It means you have three opportunities to fight with insurance carrier for its unfair or unreasonable claim determination. You may start your appeal from any level. But I suggest you to start it from level 1, if you want to have more opportunities to win the game. You must initiate your appeal within 60 days from the date your claim is denied, if you want to do so. You may re-start the next level of appeal when you have fail on your previous appeal within 60 days. To submit your internal appeal (Level 1 or 2) letter you may find out the mailing address or fax number for appeal units of the insurance company, on the claim denied letter or statement. You may call insurance company to get the contacting information also. For external appeal, you need to submit your appeal letter to: New York State Insurance Dept., 160 West Broadway New York, NY 10013-3393, or visit the website: www.ins.state.ny.us.gov. 1. To introduce the different levels of appeal (1) Internal appeal – Level 1 The appeal will be processed by insurance company. As the requirement of insurance regulation, insurance company must have a group of people, usual is known as “Appeal Units”, to handle insured’s or provider’s appeal if they disagree with the claim determination made by claim department and request for appeal. The staff of the appeal units should be different from the group who processed the same claim in the claim department. Internal appeal – Level 1 is the primary level of the internal appeals. (2) Internal appeal – Level 2 This is the second level appeal processed by insurance company. It should be handled by the different team from who reviewed your Level 1 appeal. You may require for the appeal if you disagree with the determination made for your Level 1 appeal, if you have a strong evidences or information to fight with them. Of course, you may initiate the external appeal to New York State Insurance Department directly, if you don’t have other available evidences or information to fight with insurance company on the appeal Level 2. (3) External appeal This is a final appeal on government level. Acupuncturists may fight with insurance companies when your medical reimbursements have been processed unfairly or reasonably. You may win the case if you have never given up. It will be the pressure for insurance companies, and will be possible to make insurance carriers modify their unfair or unreasonable policy terms under the pressure. 2. Key points regarding appeal letter l (1)Basic information regarding the case: including patient’s name, birthday, insurance ID number, claim control number, and dates of services. (2) To consider your view for the appeal action, through reviewing the claim statement and all of records on your patient’s filer; (3) To mention why you disagree with the determination made by insurance company for your reimbursement, accordingly. The following key points may be useful for different cases on your appeals: (a) If your reimbursement was denied due to someone released you incorrect information when you verified the patient’s eligibility, you need to mention how the representative of insurance company mislead you with incorrect information. Insurance carrier should have taken the responsibility for their employee’s mistakes and unqualified provider services. You need to attach an eligibility verification report with the appeal letter. (b) If your reimbursement was denied due to acupuncture was determined as a “not medically necessary procedure” for the patient’s condition, you need to identify that acupuncture is a medically necessary procedure for the patient’s condition. To enclose the evidences based medicine in relation to acupuncture treating for the same condition which you treat for this patient. (c) If your reimbursement was denied due to the insurance plan covers acupuncture procedure provided by only physician certified acupuncturist, you may mention that: With New York State Education and medical practice Laws, either licensed acupuncturist or physician certified acupuncturist is legal and qualified acupuncture practitioner. Both of them should have the same professional rights in the field of practice acupuncture. Patients have rights to choice a legal and qualified acupuncture practitioner including either licensed acupuncturist or physician certified acupuncturist. The policy has limited patient’s rights to choice their acupuncture practitioner and licensed acupuncturist’s professional rights to practice acupuncture. It usurps the legitimate licensing authority of the New York State Education Department and the Board of Regents. (4) To request for re-processing and re-considering for the denied claim; (5) To enclose a copy of the claim statement sent by insurance company; (6) Print your name and professional title, then, sign on the appeal letter. VI. Case Study and Discussion …… Conclusion When you receive a check from an insurance company, don’t be too exciting. You need sitting down to review the statement and make sure the claim has been paid completely. If your claim is denied, don’t be sad. You may find out the way to get your service fee back successfully. Insurance carriers always try to make some troubles for your medical reimbursement. They try to find out any reasons to deny your reimbursement. They want to make you feel tire to get the payment and finally you may give up it. This is the way to save their medical expenses. It is a game. You have to be patient, know the rules, and have the right tools and enough knowledge to play it well if you want to win it. The following Tools You May Need 1.Insurance Benefit Verification Report Form; 2.The Evidences Based Medicine— Acupuncture for those Common Conditions; 3.Medical Documents: Including initial evaluation report, re-evaluation report, medical necessity letter, and daily office notes. Good Luck!