Price Levels and the Exchange Rate in the Long Run

advertisement

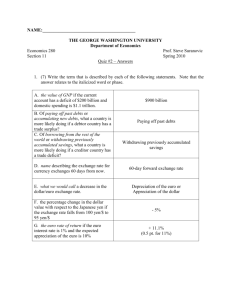

Price Levels and the Exchange Rate in the Long Run Chapter 16 International Economics Udayan Roy Overview • Long-run analysis – Real variables – Nominal variables • Flexible exchange rates – We will study fixed exchange rates in chapter 18 The Real Exchange Rate • Let us consider the price of an iPod in US and Europe: – In US, it is PUS = $200 – In Europe, it is PE = €150 – The value of the euro is E = 2 dollars per euro – So, Europe's price in dollars is E × PE = $300 – So, each iPod in Europe costs as much as 1.5 iPods in US – E × PE / PUS = 1.5 – This is the Real dollar/euro Exchange Rate for iPods The Real Exchange Rate • In general, the real exchange rate is a broad summary measure of the prices of one country’s goods and services relative to the other's. – The real dollar/euro exchange rate is the number of US reference commodity baskets—not just iPods—that one European reference commodity basket is worth: – Equation (16-6) E$ / PE q$ / PUS The Real Exchange Rate • Example: If the European reference commodity basket costs €100, the U.S. basket costs $120, and the nominal exchange rate is $1.20 per euro, then the real dollar/euro exchange rate (q$/€) is 1 U.S. basket per European basket. Real Depreciation and Appreciation • Real depreciation of the dollar against the euro – A rise in the real dollar/euro exchange rate (q$/€↑) • is a fall in the purchasing power of a dollar within Europe’s borders relative to its purchasing power within the United States • Or alternatively, a fall in the purchasing power of America’s products in general over Europe’s. • Real appreciation of the dollar against the euro is the opposite of a real depreciation: a fall in q$/€. Absolute PPP • A very simple theory of the real exchange rate is called Absolute Purchasing Power Parity • It says that: q=1 • Why? Law of One Price • Going back for a second to the iPod example, one can argue that PUS, the dollar price in the US, ought to be equal to E × PE, the dollar price in Europe. That is, • E × PE = PUS. • In general, E$/€ x PE = PUS. • Therefore, q$/€ = (E$/€ x PE)/PUS = 1. • This is the Law of One Price or Absolute Purchasing Power Parity. Prices and the Exchange Rate Prices and the Exchange Rate The Interest Rate The Interest Rate The Interest Rate: Fisher Effect The Interest Rate The Interest Rate Output • The real GDP produced when all resources are fully utilized is known by various names: – Long-run GDP – Natural GDP – Full-employment GDP – Potential GDP (Yp) • It is assumed in long-run analysis that the economy makes full use of all its resources • Therefore, in long-run equilibrium, Y = Yp. Inflation Inflation Inflation The Interest Rate, again The Price Level Appreciation Rate of the Foreign Currency The Exchange Rate: APPP version Summary: Long-Run, Flexible Exchange Rates The crucial point to note about these expressions is that the variables on the right-hand sides of these equations are all exogenous. As exogenous variables are ‘mystery variables’ about which our theory has nothing to say, the equations on this slide say all that our theory can say about the endogenous variables on the left-hand sides of these equations. Absolute PPP: logical but not factual • Despite the logical appeal of Absolute Purchasing Power Parity, available data suggests that it is not true • We need to look for another theory of the real exchange rate, q. Law of One Price for Hamburgers? The balance on a country’s current account (CA) is roughly its net exports What does CA depend on in the long run? BONUS TOPIC: THE CURRENT ACCOUNT The Current Account The Current Account The Current Account Y CA Yp + + T 0 + I, G 0 − The Long Run • The macroeconomic analysis of the long run is characterized by the concept of monetary neutrality • That is, monetary arrangements and monetary policy have no effect on the behavior of real variables • Therefore, the predictions summarized by the table on this and the previous slide are true for both the flexible exchange rate system of this chapter and the fixed exchange rate system of chapter 18 Y CA Yp + + T 0 + I, G 0 −