COST OF CAPITAL

advertisement

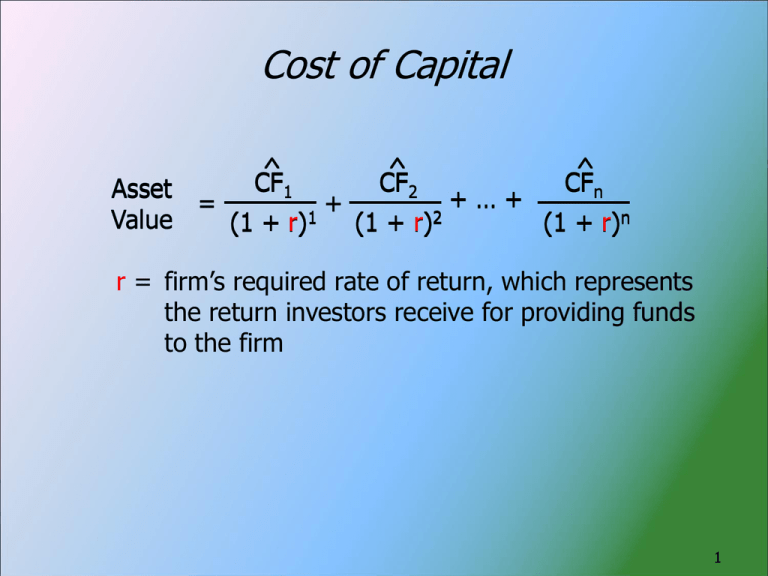

Cost of Capital ^ CF1 ^ CF2 ^ CFn Asset +…+ + = Value (1 + r)1 (1 + r)2 (1 + r)n r = firm’s required rate of return, which represents the return investors receive for providing funds to the firm 1 Chapter Essentials—The Questions What types of capital do firms use to finance investments? What is the cost of capital? How is the cost of capital used to make financial decisions? Why do funds generated through retained earnings have a cost? Who determines a firm’s cost of capital? 2 Cost of Capital Introduction Cost of Debt, rdT Cost of Equity, rps and (rs or re) Marginal Cost of Capital (MCC) MCC and Investment Opportunity (IOS) Schedules 3 Basic Definitions Capital—refers to the long-term funds used by a firm to finance its assets. Capital components—the types of capital used by a firm—longterm debt and equity Cost of capital—the cost associated with the various types of capital used by the firm, which is based on the rate of return required by the investors who provide the funds to the firm. Weighted average cost of capital, WACC—the average percentage cost, based on the proportion of each type of capital, of all the funds used by the firm to finance its assets. Capital structure—the mix of the types of capital used by the firm to finance its assets. Optimal capital structure—the mix of capital that minimizes the firm’s WACC, thus maximizes its value. 4 Weighted Average Cost of Capital (WACC)—Logic A firm generally uses different types of funds to finance its assets—that is, debt and equity. Costs associated with different types of capital (funds) usually are not the same—e.g., debt generally is cheaper than equity. The overall cost, or average, should be weighted based on the proportion of each type of funds used by the firm. Example: A firm is financed with debt and equity with the following characteristics: Cost Proportion Debt rdebt = 8% 10% Equity rstock =12% 90% The average cost of each dollar of financing is: Weighted average = 8%(0.1) + 12%(0.9) = 11.6% 5 Cost of Capital Investors who are the participants in the financial markets determine the firm’s costs of funds. The firm’s costs of funds change when conditions in the financial markets change investors’ general risk aversion changes firm’s risk changes 6 Cost of Debt, rdT rd—the before-tax cost of debt is simply the yield to maturity (YTM) of the debt YTM—bondholders’ required rate of return = rd rdT—the after-tax cost of debt rdT Tax sav ings Bondholders' required rate of return associated with debt rd rd T rd (1 T) T = marginal tax rate 7 Cost of Debt, rdT—Example A firm has debt with the following characteristics: Maturity value, M $1,000.00 Coupon rate, C 8.0% (paid semiannually) Years to maturity 6 yrs Market price $1,099.50 Marginal tax rate 40.0% Based on this information, we know that the following relationship exists: Vd $1,099.50 $40 (1 rd )1 $40 (1 rd )2 $1,040 (1 rd )12 Solving for rd gives us the YTM for this bond 8 Cost of Debt, rdT—Example Solve using: Trial-and-error process (numerical solution) approximation equation Financial calculator Spreadsheet 9 Cost of Debt, rdT—Example rd approximation Approximate yield to maturity INT M Vd N 2(Vd ) M 3 $40 $1,000 $1,099.50 12 2($1,099.50) $1,000 3 $31.71 0.0297 2.97% $1,066.33 rd/2 = 2.97% per six-month period (interest payment) rd = 2.97% x 2 = 5.94% ≈ 6% 10 Cost of Debt, rdT—Example Financial calculator N = 12 PV = -1,099.50 PMT = 40 FV = 1,000 I/Y = ? rd solution: = 6 years x 2 = (0.08 x 1,000)/2 = 3.0% per six-month period = 3.0% x 2 = 6.0% per year = YTM 11 Cost of Debt, rdT—Example Bondholders/investors demand a 6 percent rate of return to invest in this firm’s long-term debt. rd = YTM = 6% is the rate of return paid to bondholders. The firm pays $80 interest per year, which is a tax deductible expense. rd is a before-tax amount that needs to be adjusted so as to represent the actual after-tax cost to the firm—that is, the cost of the bond to the firm isn’t really 6 percent. 12 Cost of Debt, rT Tax Deductibility of Interest Example: The firm issues a new $1,000 face value bond with a 6 percent coupon rate, thus interest equal to $60 is paid each year. If the firm’s taxable income before considering the interest payment is $500 and its marginal tax rate is 40 percent, then the tax liability with and without the interest expense is: Tax without interest = $500(0.40) = $200 Tax with interest = ($500 - $60)( 0.40) = $176 Savings = $24 = $60(0.4) Net interest after tax savings = $60 - $24 = $36 After-tax cost of the new bond = $36/$1,000 = 3.6% rdT = rd x (1 – T) = 6% x (1 – 0.4) = 3.6% 13 Cost of Debt, rdT rdT = rd x (1 – T) = YTM x (1 – T) rd = before-tax cost of debt T = marginal tax rate 14 Cost of Equity The cost of equity is based on the rate of return required by the firm’s stockholders. Cost of preferred stock—dividends received by preferred stockholders represent an annuity Cost of retained earnings (internal equity)—return that common stockholders require the firm to earn on the funds that have been retained, thus reinvested in the firm, rather than paid out as dividends Cost of new (external) equity—rate of return required by common stockholders after considering the cost associated with issuing new stock (flotation costs) 15 Cost of Equity—Preferred Stock Most preferred stocks pay constant dividends, thus the dividend stream represents a perpetuity. Valuing preferred stock as a perpetuity gives: P0 Dps rps Solving for the required rate of return, rps, gives: rps Dps P0 Because flotation (issuing) costs have to be paid when preferred stock is issued, the cost of preferred stock is: Dps Dps NP0 = net proceeds from issue rps NP0 P0 (1 - F) F = flotation costs (percent) 16 Cost of Preferred Stock, rps—Example A firm has preferred stock with the following characteristics: Market price, P0 Dividend, Dps Flotation cost, F rps $75.00 $5.76 4.0% $5.76 $5.76 = 0.08 = 8.0% $75.00(1 - 0.04) $72.00 No tax adjustment, because dividends are not a tax- deductible expense. 17 Cost of Equity—Retained Earnings, rs The firm must earn a return on reinvested earnings that is sufficient to satisfy existing common stockholders’ investment demands. If the firm does not earn a sufficient return using retained earnings, then the earnings should be paid out as dividends so that stockholders can invest the funds outside the firm to earn an appropriate rate. 18 Cost of Equity—Retained Earnings, rs Assuming the stock market is at or near equilibrium, we know that the following relationship exists: Required rate of return rs rRF (rM rRF )β s rRF = risk-free rate rM = market return bs = stock’s beta coefficient Expected rate of return Dˆ 1 g rˆs P0 ˆ = next expected dividend D 1 g = constant growth rate 19 Cost of Retained Earnings, rs CAPM Approach rs rRF (rM rRF )β s If rRF = 4%, rM = 9%, and bs = 1.4 rs = 4% + (9% - 4%)1.4 = 11.0% Assumes the firm’s stockholders are very well diversified; if not, then beta probably is not the appropriate measure of risk for determining the firm’s cost of retained earnings. rRF generally is associated with with Treasury securities; there are many different rates for Treasuries that have different terms to maturity. 20 Cost of Retained Earnings, rs Bond-Yield-Plus-Risk-Premium Approach Studies have shown that the return on equity for a particular firm is approximately 3 to 5 percentage points higher than the return on its debt. As a general rule of thumb, firms often compute the YTM, or rd, for their bonds and then add 3 to 5 percent. In the current example, rd = 6.0%. As a rough estimate, then, we might say the cost of retained earnings is rs ≈ rd + 4% = 6% + 4% = 10.0% 21 Cost of Retained Earnings, rs Discounted Cash Flow (DCF) Approach If the firm is expected to grow at a constant rate, then we have the following relationship: ˆ Div idend Capital D 1 ˆ rs rs g P0 y ield gain Example: The firm, which is growing at a constant rate of 5 percent, just paid a dividend equal to $1.20; its stock currently sells for $18. rs $1.26 ) $1.20(1.05 0.05 = 0.07 + 0.05 = 0.12 = 12.0% 0.05 $18.00 $18.00 22 Cost of Retained Earnings, rs The three approaches we used to determine the cost of retained earnings give three different results. The three approaches are based on different assumptions: CAPM approach assumes investors are extremely well diversified DCF approach assumes the firms grows at a constant rate Bond-yield-plus-risk-premium approach assumes that the return on equity is related to the return on the firm’s debt Ideally all three approaches should give the same result; if not, however, we might average the results: rs = (11% + 10% + 12%)/3 = 11% 23 Cost of Equity Newly Issued Common Stock, re Rate of return required by common stockholders after considering the costs associated with issuing new stock, which are called flotation costs. Because the firm has to provide the same gross return to new stockholders as existing stockholders, when the flotation costs associated with a common stock issue are considered, the cost of new common stock always must be greater than the cost of existing stock—that is, the cost of retained earnings. Modify the DCF approach for computing the cost of retained earnings to include flotation costs 24 Cost of Newly Issued Common Stock (External Equity), re Dˆ 1 Dˆ 1 re g g P0 (1 F) NP0 NP0 = net proceeds from the sale of the stock If flotation costs equal 6 percent, then re in our example is $1.26 $1.26 re 0.05 0.05 $18(1 0.06) $16.92 0.1245 12.45% 25 Cost of Newly Issued Common Stock, re Rationale Assume a firm (different than in our example) has: total assets equal to $50,000 is financed with common stock only (5,000 shares) pays all earnings as dividends, thus g = 0 cost of retained earnings, rs = 10% = ROE Current $50,000(0.10) $5,000 income $5,000 Current D0 $1.00 dividend 5,000 Current stock $1.00 $10.00 price, P0 0.10 26 Cost of Newly Issued Common Stock, re Rationale The firm sells new common stock: 800 shares, so that 5,800 shares are outstanding after the sale market price, P0 = $10.00 net proceeds received by the firm, NP0 = $9.50 total amount received by the firm = $9.50 x 800 = $7,600 total assets after stock sale = $50,000 + $7,600 = $57,600 Cost of new equity, re $1.00 re 0 0.1053 10.53% $9.50 27 Cost of Newly Issued Common Stock, re Rationale Total assets after stock sale = $57,600 If the firm earns rs = 10% on all investments New $57,600(0.10) $5,760 income $5,760 New D $0.9931 dividend 5,800 New stock $0.9931 $9.93 price, P0 0.10 28 Cost of Newly Issued Common Stock, re Rationale Total assets after stock sale = $57,600 If the firm earns re = 10.53% on new investments Income from Income from Income existing inv estments new inv esmtents $50,000(0. 10) $7,600(0.1053) $5,800 $5,800 New D $1.00 dividend 5,800 Stock price would remain at $10, because investors require a 10 percent return; but, the firm must earn 10.53 on new investments to generate 10 percent to investor (due to flotation costs) 29 Weighted Average Cost of Capital, WACC To make decisions about capital budgeting projects, we need to combine the various costs of capital— debt, preferred stock, and common stock—into a single required rate of return. Weighted average cost of capital, or WACC—the weighted average of the component costs of capital using as the weights the proportion each type of financing makes up of the total financing of the firm. % After - tax % preferred Cost of % common Cost of WA C C cost of debt preferred stock equity common equity stock debt w r d dT w r ps ps w (r or r ) s s e 30 Weighted Average Cost of Capital, WACC Suppose our illustrative firm has the following capital structure: Type of Financing Debt, d Preferred stock, ps Common equity, s Percent of total 40.0 10.0 50.0 100.0 After-Tax Cost, r 3.6% 8.0 11.0 or 12.45 If the firm can use retained earnings to finance new projects WACC = 0.4(3.6%) + 0.1(8.0%) + 0.5(11.0%) = 7.74% If the firm has to issue new common stock to finance new projects WACC = 0.4(3.6%) + 0.1(8.0%) + 0.5(12.45%) = 8.47% 31 Marginal Cost of Capital, MCC Weighted average cost of raising additional funds. Generally, MCC often is greater than the existing WACC—that is, the cost of new funding increases— because the firm’s risk increases, which causes investors to require a higher rate of return costs of issuing new funds increase MCC schedule—a graph that shows the average cost of funds at various levels of new financing 32 MCC Schedule If the firm expects to retain $200,000 this year New WACC = MCC (%) WACC2 8.5 7.7 0 WACC1 Break Point Total of New Funds Raised ($) 400,000 CE = 400,000 x 0.5 = 200,000 33 MCC Schedule—Break Points Break points occur when WACC increases, which is caused by an increase in any of the component costs of capital debt—when rd1 < rd2 < … < rdn preferred stock—when rps1 < rps2 < … < rpsn common equity—retained earnings or new common stock There is a break point when retained earnings generated in the current period is exhausted. Once the current addition to retained earnings is exhausted, then the firm must issue new common stock to satisfy additional common equity financing requirements. Costs of funds often increase as the firm uses significantly higher amounts—risk increases. 34 MCC Schedule—Break Points Break Total amount of a given type of capital at the lower cost point Proportion of this type of capital in the capital structure Retained earnings $200,000 $400,000 Proportion of common equity 0.50 35 MCC Schedule Break Points—Example Assume the firm faces the following situation this year: Debt (40%): Amount $0 100,001 200,001 of Funds Cost of Debt, rdT - $100,000 6.0% - 200,000 6.5 7.0 Preferred Stock (10%): rps = 8.0%, no matter the amount needed Common Equity (50%): Retained earnings generated during the year = $200,000 Cost of retained earnings (internal equity), rs = 11.0% Cost of new common stock (external equity), re = 12.4%, no matter how much is needed 36 MCC Schedule Break Points—Example Debt (40%): Amount of Funds $ 0 - $100,000 100,001 - 200,000 200,001 - Cost of Debt, rdT 6.0% 7.0 7.5 If the firm needs total funds equal to $100,000 Break $250,000 $250,000, 40%, or $100,000 would be debt. Point debt1 0.40 $200,000 Break If the firm needs total funds equal to $500,000 $500,000, 40%, or $200,000 would be debt. Point debt2 0.40 37 MCC Schedule Break Points—Example Preferred Stock (10%): rps = 8.0%, no matter the amount needed Constant cost—no break due to preferred stock Common Equity (50%): Retained earnings generated during the year = $200,000 Cost of retained earnings (internal equity), rs = 11.0% Cost of new common stock (external equity), re = 12.4%, no matter how much is needed Break $200,000 $400,000 Point RE 0.50 If the firm needs total funds equal to $400,000, 50%, or $200,000 would be RE. 38 MCC Schedule—Example Funds = $0 - $250,000 Debt Preferred Stock Common Equity Amount at $250,000 $100,000 25,000 125,000 250,000 Weight 0.4 0.1 0.5 1.0 Funds = $250,001 - $400,000 Debt Preferred Stock Common Equity Amount at $400,000 $160,000 40,000 200,000 400,000 Weight 0.4 0.1 0.5 1.0 After-Tax After-Tax x Cost, rk 6.0 8.0 11.0 After-Tax x Cost, r 7.0 8.0 11.0 = WACC 2.4 0.8 5.5 8.7% = WACC1 = WACC 2.8 0.8 5.5 9.1% = WACC2 39 MCC Schedule—Example Funds = $400,001 - $500,000 Debt Preferred Stock Common Equity Amount at $500,000 $200,000 50,000 250,000 500,000 Weight 0.4 0.1 0.5 1.0 Funds = above $500,000 Debt Preferred Stock Common Equity Amount at $600,000 $240,000 60,000 300,000 600,000 Weight 0.4 0.1 0.5 1.0 After-Tax After-Tax x Cost, rk 7.0 8.0 12.4 After-Tax x Cost, r 7.5 8.0 12.4 = WACC 2.8 0.8 6.2 9.8% = WACC3 = WACC 3.0 0.8 6.2 10.0% = WACC4 40 MCC Schedule MCC (%) 11.0 10.0 WACC3 = 9.8 WACC4 = 10.0 WACC2 = 9.1 9.0 WACC1 = 8.7 8.0 0 100 200 300 BP1 = 250 400 BP2 500 Total Funds Raised ($000) BP3 41 MCC Schedule and Investment Opportunity (IOS) Schedule The firm’s capital budgeting analysis results are: Project A B C D Cost $150,000 200,000 200,000 100,000 IRR 11.0% 10.5 10.1 9.5 42 IOS Schedule IRR (%) IRRA = 11.0 11.0 IRRB = 10.5 IRRC = 10.1 10.0 IRRD = 9.5 9.0 8.0 0 100 200 300 400 500 600 700 Total Funds Raised ($000) 43 MCC Schedule MCC (%) 11.0 10.0 WACC3 = 9.8 WACC4 = 10.0 WACC2 = 9.1 9.0 WACC1 = 8.7 8.0 0 100 200 300 400 500 Total Funds Raised ($000) 44 MCC & IOS Schedules IRRA = 11.0 11.0 IRRB = 10.5 IRRC = 10.1 10.0 WACC3 = 9.8 WACC2 = 9.1 9.0 WACC1 = 8.7 100 200 IRRD = 9.5 Optimal Capital Budget = 550 8.0 0 WACC4 = 10.0 300 400 500 600 700 Total Funds Raised ($000) 45 Chapter Essentials—The Answers What types of capital do firms use to finance investments? Either debt (bond issues) or equity (preferred stock and common equity) What is the cost of capital? The average price a firm pays for the funds it uses to purchase assets How is the cost of capital used to make financial decisions? A firm should invest in projects that are expected to provide returns greater than its WACC 46 Chapter Essentials—The Answers Why do funds generated through retained earnings have a cost? Firms may retain earnings only as long as it can reinvest the earnings at a higher rate than stockholders can earn elsewhere Who determines a firm’s cost of capital? Investors 47