BUA321 Chapter 9 Class notes Cost of capital

advertisement

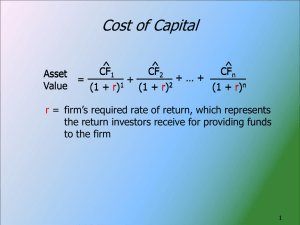

BUA321 Chapter 9 Class notes Cost of capital • http://www.youtube.com/watch? feature=player_detailpage&v=JKJ glPkAJ5o Financing • Why do companies need money? • Describe the differences between the capital structure and the financial structure. • What are the four sources of long-term capital? Risk and financing • What is business risk? • What is financial risk? • What is the impact on the costs of financing? • What does flotation cost mean for financing? Capital structure • A company has the following capital structure: – What is the market capital structure? Debt 30,000 bonds selling at par. Preferred Stock 300,000 shares at $90. Common Equity 500,000 shares at $87 Market Value Debt Preferred Stock Common Equity (RE) Common Equity (NEW) Total Market Value Weights $30,000,000.00 $27,000,000.00 $43,500,000.00 $100,500,000.00 29.85% 26.87% 43.28% Cost of Debt • A company is contemplating issuing 30-year, 6% coupon bonds with a par value of $1,000. Suppose further that the firm must sell the bonds at $970. Flotation costs are 3% or $30. The corporate tax bracket is 40%. What is the cost of debt? Bond Coupon N Price Flotation Costs ($) Tax Rate Par Value Preferred Stock 6.00% Dividend 30 Price $970.00 Flotation Costs ($) $30.00 40.00% $1,000 Market Value Weights Debt $30,000,000.00 Preferred Stock $27,000,000.00 Common Equity (RE) $43,500,000.00 Common Equity (NEW) Total Market Value $100,500,000.00 Cost of Debt (if given) Cost of Debt (before tax) Cost of Preferred Cost of RE (DIV) Cost of RE (SML) Cost of New CS After-Tax Cost 29.85% 26.87% 43.28% 3.87% 0.00% #DIV/0! #DIV/0! 6.46% 0.00% #DIV/0! 0.00% #DIV/0! Cost of Preferred Stock • A corporation is issuing preferred stock. The dividend will be fixed at $7.50 and sell at a price of $85. Flotation costs are $4.00. What is the cost of Preferred Stock? Bond Coupon N Price Flotation Costs ($) Tax Rate Par Value Preferred Stock 6.00% Dividend 30 Price $970.00 Flotation Costs ($) $30.00 40.00% $1,000 Cost of Debt (if given) $7.50 Cost of Debt (before tax) $85.00 Cost of Preferred $4.00 Cost of RE (DIV) Cost of RE (SML) Cost of New CS 6.46% 9.26% #DIV/0! 0.00% #DIV/0! Cost of Equity – RE and New CS • The corporation must raise equity. The company recently paid 4.75 in dividends. Historically dividends have grown at 8%. The company anticipates that this will continue. The most recent price for the stock has been $87. Flotation costs have been $2, but the company anticipates an additional $2 in underpricing. The risk free return is 3.75; beta is 1.25; and the stock market average is 11%. What is average cost of retained earnings? The cost of new Common Stock? Common Stock Div (D0) Growth Price Flotation Costs ($) Risk Free Rate Beta Km Div (D1) (if given) Bond Coupon N Price Flotation Costs ($) Tax Rate Par Value $ Preferred Stock 6.00% Dividend 30 Price $970.00 Flotation Costs ($) $30.00 40.00% $1,000 Market Value Weights Debt $30,000,000.00 Preferred Stock $27,000,000.00 Common Equity (RE) $43,500,000.00 Common Equity (NEW) Total Market Value $100,500,000.00 $4.75 8% $87.00 4.00 4% 1.25 11% Cost of Debt (if given) $7.50 Cost of Debt (before tax) $85.00 Cost of Preferred $4.00 Cost of RE (DIV) Cost of RE (SML) Cost of New CS After-Tax Cost 29.85% 26.87% 43.28% 3.87% 9.26% 13.35% 14.18% 6.46% 9.26% 13.90% 12.81% 14.18% Marginal Cost of Capital • The company has determined that they can borrow up to $40 million before the cost of debt would increase to 7.5% before taxes. The company forecasts that next year they will have approximately $20 million in retained earnings. Determine the marginal costs of capital for the firm. Break Point Amount Until Break Break Point Debt $40,000,000 Retained Earnings $20,000,000 First Tier Break Pt (no debt BP, no RE) Break Pt (debt BP <= EQ BP) Break Pt (Debt BP > EQ BP) Final Break Point New After Tax Cost Div (D0) 4.35% Growth Price Flotation Costs ($) Risk Free Rate Beta 9.78% Km 9.92% Div (D1) (if given) $134,000,000 $46,206,897 9.42% $ $4.75 8% $87.00 4.00 4% 1.25 11% Small business financing http://www.youtube.com/watch?feature=player _detailpage&v=31ZwhL4pgJw BUA321 Chapter 9 research 25 points • Using your company what is the market value capital structure? Use the book value of debt as the market value. • From the stock valuation chapter, what is the dividend and SML cost of retained earnings? • Assume a $5 flotation cost for new equity. What is the cost of new equity? • Predict a 5% increase in revenues next year. Given this forecast, what is your predicted retained earnings next year? Use this for the break point of equity costs. • What is the WMCC for the firm? BUA321 Exercise 33 points • Complete the following table: The current corporate tax rate is 40%. Bond Coupon Maturity Price Flotation costs A 10 15 1050 20 B 4 20 1000 30 C 7 30 975 15 Before tax Cost of debt After tax cost of debt • Complete the following table for costs of financing The current corporate tax rate is 40%. (6 points) Preferred stock Dividend Price Flotation costs A $3 $97 $3 B $4.75 $75.75 $2.50 C $7 $59 $1.75 Before tax Cost of preferred After tax cost of preferred • Complete the following table The current corporate tax rate is 40%. (9 points) Stock Dividend Price Growth rate of dividends Flotation costs A $1.75 $60 4% $2 B $2.95 $80 6% $1.75 C $3.85 $25 3.75% $1 Before tax Cost of retained earnings Before tax cost of new common stock After tax cost of new common stock WACC • Using the securities above calculate the WACC for the following companies. • Company A finances its cash needs with 30% debt, 40% preferred stock, and 30% equity. – WACC with RE – WACC with new common stock • Company B finances its cash needs with 60% debt, 10% preferred stock, and 30% equity. – WACC with RE – WACC with new common stock • Company C finances its cash needs with 20% debt, 5% preferred stock, and 75% equity. – WACC with RE – WACC with new common stock • • • Complete the following comprehensive cost of capital problem. Debt – The company is issuing 150,000 AAA rated bonds for $975. The bonds have a 30 year maturity and a 6.75% coupon. The average flotation costs for bonds is $10. The company’s corporate tax rate is 40%. If the company were to need $200,000,000 of debt the after-tax cost of financing would increase 2%. Preferred stock will be issued with a 5.25% dividend and a stock price of $85. The company is considering issuing 600,000 shares. The flotation costs are estimated to be $2. There is no additional increase in costs if the firm decides to issue more preferred. New common stock will be issued with a projected dividend of $3.75. The current stock price is $120. The company’s earnings and dividends have been growing historically at 6% The company is estimating that 2,000,000 shares will be issued with a $1 underpricing cost and a $2 underwriting fee. Retained earnings are expected to be $500,000,000. Calculations • • • • • What is the after-tax cost of debt? What is the after-tax cost of preferred? What is the cost of retained earnings? What is the cost of new common equity? What is the capital structure of the financing? (what are the proportions?) • What is the break point of debt? • What is the breakpoint of equity? • Calculate the WMCC at the breakpoints.