Cash Flows

advertisement

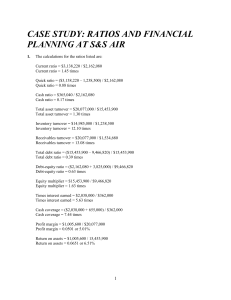

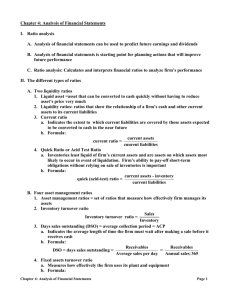

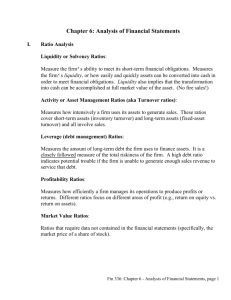

Financial Statements The Big Three Accounting Statements 1. 2. 3. The Balance Sheet The Income Statement The Statement of Cash Flows 2 1) The Balance Sheet LHS A snapshot of the firm Assets ≡ Liabilities + Stockholder’s Equity Current Assets Left Hand Side must balance with the Right Hand Side Fixed Assets Tangible Intangible RHS Current Liabilities Long-Term Debt Shareholder Equity 3 Balance Sheet Analysis When analyzing a balance sheet, the Finance Manager should be aware of three concerns: 1. 2. 3. Liquidity Debt versus Equity Value versus Cost 4 Liquidity Refers to the ease & quickness that an assets can be converted to cash without a significant loss in value Generally the more liquid the asset the lower the rate of return The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term cash obligations (Ex. payroll) A profitable but illiquid firm will experience financial distress Current assets are more liquid than fixed assets 5 Debt versus Equity Debt → Liability Promise Equity is the residual Assets to payout cash, an IOU – Liabilities ≡ Equity Debt represents a senior claim on firm assets If the firm goes bankrupt debt holders get paid before equity holders 6 Value versus Cost Cost: What did we pay for it Accountants are historians GAAP requires assets be recorded at cost Book value Market value: What would it cost TODAY Cost and Market Value are two completely different concepts What did we pay for it, versus what can we sell it for 7 2) The Income Statement Income ≡ Revenue – Expenses Measure how the company has performed over some period of time Generally comprised of four parts: Operating 2. Non-Operating 3. Taxes 4. Bottom Line 1. 8 U.S.C.C. Income Statement Total operating revenues Cost of goods sold Selling, general, and administrative expenses Depreciation Operating income Other income Earnings before interest and taxes Interest expense Pretax income Taxes Current: $71 Deferred: $13 Net income $2,262 1,655 327 90 $190 29 $219 49 $170 84 $86 9 Income Statement Analysis There are several things to keep in mind when analyzing an income statement: INCOME IS NOT CASH 2. Matching Principal 3. Non-Cash Items 1. 10 Matching GAAP requires that revenues be recorded along with the expenses incurred to produce them Thus, income may be reported even though no cash has changed hands 11 Non-Cash Items The income statement will also record expenses, where no money is exchanged Depreciation is the simplest example No firm ever writes a check for “depreciation.” 12 Taxes “In this world nothing is certain but death and taxes.” Ben Franklin Taxes represent a major cost to the firm Taxes are subject to political, not economic forces Therefore taxes do not need to make economic sense Companies are subject to two different tax rates Marginal – the percentage paid on the next Average – the tax bill / taxable income dollar earned 13 Marginal versus Average Rates Suppose your firm earns $4 million in taxable income. What is the firm’s tax liability? .15(50,000) + .25(75,000 – 50,000) + .34(100,000 – 75,000) + .39(335,000 – 100,000) + .34(4,000,000 – 335,000) = $1,356,100 Rate from table 2.3 What is the average tax rate? What is the marginal tax rate? If you are considering a project that will increase the firm’s taxable income by $1 million, what tax rate should you use in your analysis? 14 3) The Statement of Cash Flows The three components are: Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Attempts to change Net Income to a Cash number 15 U.S.C.C. Cash Flow from Operations Start with net income, and then add back non-cash expenses , and changes in accounts Operations Net Income Depreciation Deferred Taxes Changes in Assets and Liabilities Accounts Receivable Inventories Accounts Payable Accrued Expenses Notes Payable Other Total Cash Flow from Operations $86 90 13 -24 11 16 18 -3 -8 $199 16 U.S.C.C. Cash Flow from Investing Cash flows from the acquisition sales of fixed assets (i.e., net capital expenditures). The cash from sales of our fixed assets minus the cost of fixed assets we bought Acquisition of fixed assets Sales of fixed assets Total Cash Flow from Investing Activities -$198 25 -$173 17 U.S.C.C. Cash Flow from Financing Cash flows to and from equity and debt investors in the firm Retirement of debt (includes notes) Proceeds from long-term debt sales Dividends Repurchase of stock Proceeds from new stock issue Total Cash Flow from Financing -$73 86 -43 -6 43 $7 18 Finance and the Accounting Finance is concerned with: Market Values and Cash Flows Accounting: Care about historical costs Accounting numbers (NOT CASH) But Accounting is often called the language of finance 19 Quick Quiz 1. 2. 3. 4. What is the difference between book value and market value? Which should we use for decision making purposes? What is the difference between accounting income and cash flow? Which do we need to use when making decisions? What is the difference between average and marginal tax rates? Which should we use when making financial decisions? How do we determine a firm’s cash flows? What are the equations, and where do we find the information? 20 Financial Statements Analysis and LongTerm Planning Chapter 3 Financial Statement Analysis Attempts to compare different companies and/or to track how a company is developing Relies of their financial statements Generally follows 1 of 2 methods 22 1) Common-Size Statements Report everything as a percent the top number Total assets for the Balance Sheet Sales for the Income Statement 23 2) Ratio Analysis Ratio of one financial number to another Ask yourself: How is the ratio computed? What is the ratio trying to measure and why? What does the value indicate? How can we improve the company’s ratio? 24 Categories of Financial Ratios Short-term solvency (liquidity ratios) Long-term solvency (financial leverage ratios) Asset management (turnover ratios) Profitability ratios Market value ratios 25 Liquidity Ratios How easily can the firm meet its short term obligations Why Current Ratio = CA / CL 708 / 540 = 1.31 times Quick Ratio (Acid Test) =(CA – Inventory) / CL (708 is this important? - 422) / 540 = 0.53 times Cash Ratio = Cash / CL 98 / 540 = 0.18 times 26 Leverage Ratios How easily can the firm meet its long term obligations Why is this important? Total Debt Ratio = (TA – TE) / TA (3588 Debt/Equity = TD / TE (3588 - 2591) / 3588 = 28% – 2591) / 2591 = 38.5% Equity Multiplier = TA / TE = 1 + D/E 1 + .385 = 1.385 27 Coverage Ratios How easily can the firm payoff its debt holders Why Times Interest Earned = EBIT / Interest 691 is this important? / 141 = 4.9 times Cash Coverage= (EBIT + Depreciation)/Interest (691 + 276) / 141 = 6.9 times 28 Inventory Ratios How efficiently is the firm managing inventory Why Inventory Turnover = Cost of Goods Sold / Inventory 1344 is this important? / 422 = 3.2 times Days’ Sales in Inventory = 365 / Inventory Turnover 365 / 3.2 = 114 days 29 Receivables Ratios How quickly does the firm get paid Why Receivables Turnover = Sales / Accounts Receivable 2311 is this important? / 188 = 12.3 times Days’ Sales in Receivables = 365 / Receivables Turnover 365 / 12.3 = 30 days 30 Total Asset Turnover How efficient is the firm turning assets into sales Why Total Asset Turnover = Sales / Total Assets 2311 is this important? / 3588 = 0.64 times It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets. Why? 31 Profitability Measures How efficient is the firm’s operations Why Profit Margin = Net Income / Sales 363 / 2311 = 15.7% Return on Assets (ROA) = Net Income / Total Assets 363 is this important? / 3588 = 10.1% Return on Equity (ROE) = Net Income / Total Equity 363 / 2591 = 14.0% 32 Breaking Down ROE If we break down ROE we can see how firms generate returns for investors ROE = NI / TE →PM * TAT * EM Aside: Algebra ROE = NI / TE ROE = (NI / TE) (TA / TA) ROE = (NI / TA) (TA / TE) = ROA * EM ROE = (NI / TA) (TA / TE) (Sales / Sales) ROE = (NI / Sales) (Sales / TA) (TA / TE) ROE = PM * TAT * EM 33 Where are returns generated ROE = PM * TAT * EM Profit margin: How well does the firm controls costs Total asset turnover: How well does the firm manages its assets Equity multiplier: How levered is the firm The better the managers handle these aspects of the firm the greater the return generated 34 Market Value Measures How do people feel about the firm Why PE Ratio = Price per share / Earnings per share 88 is this important? / 11 = 8 times Market-to-book ratio = market value per share / book value per share 88 / (2591 / 33) = 1.12 times 35 Using Financial Statement Analysis Ratios by themselves are not very useful Is a profitability ratio of 9% good? Time-Trend Analysis Compare this years ratios to prior ratios Peer Group Analysis Compare your ratios to other firms in the industry 36 Issues with Financial Statement Analysis There is no definitive way to run the analysis It’s hard to find the right benchmarking Especially for diversified firms Firms use different accounting procedures, and year ends Extraordinary, or one-time, events 37 Long-Term Financial Planning These are the big decisions, planning where the company is going Capital budgeting: Does Nike start a magazine? Capital structure: Do we issue stock or bonds? Generally these decisions are based on pro forma financial statement Financial statements based on what we think will happen in the future 38 External Financing and Growth At low levels of growth a company can use the cash it generates to meet its investment requirements At higher levels of growth the company’s cash on hand will not be enough to finance all the investments the company wants, it now has to go to the capital market Sell Stock or Bonds External financing helps a firm grow faster than relying on internal funds alone 39 The Internal Growth Rate This is how fast the company can grow using only the money it makes IGR = (ROA * b )/ (1 – ROA * b) b is the plowback ratio Measure how much of net income is reinvested in the firm b = Addition to Retained Earnings / Net Income 40 Calculating the Internal Growth Rate Using the information from the Hoffman Co. ROA = 66 / 500 = 0.132 b = 44/ 66 = .66700 Internal Growth Rate * b )/ (1 – ROA * b) (0.132 * 0.667) / (1 – 0.132 * 0.667 )= 0.0965 Hoffman Co. can grow at 9.65% using only internal funds (ROA 41 The Sustainable Growth Rate This is how fast the firm can grow using internal funds and external funds, but leaving the D/E ratio the same Will this be higher or lower than the IGR? SGR = (ROE * b )/ (1 – ROE * b) 42 Calculating the Sustainable Growth Rate Using the Hoffman Co. ROE = 66 / 250 = 0.264 b = 0.667 Sustainable Growth Rate * b )/ (1 – ROE * b) (0.264 * 0.667) / (1 – 0.264 * 0.667 )= 0.214 Hoffman Co. can grow at 21.4% without changing its capital structure (ROE 43 Long-term Planning Caveats Our financial planning models cannot tell us what is the best policy to follow Our models are simplifications of the real world, and as such can miss important aspects of a situation However, firms need to have a long-term plan 44 Quick Quiz 1. 2. 3. 4. 5. How do you standardize balance sheets and income statements? Why is standardization useful? What are the major categories of financial ratios? How do you compute the ratios within each category? What are some of the problems associated with financial statement analysis? 45 Quick Quiz 6. 7. 8. 9. 10. 11. What is the purpose of long-range planning? What are the major decision areas involved in developing a plan? What is the percentage of sales approach? What is the internal growth rate? What is the sustainable growth rate? What are the major determinants of growth? 46