Open Market operation

advertisement

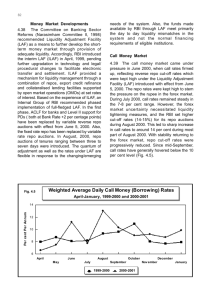

Money market some other issues Some terms used in Money Market: Open Market operation: It refers to the sale and purchase of the Central and state Government and Treasury Bills Objective: i. To control in the amount of bank credit and money supply ii. To make bank rate policy more effective iii. To support government borrowing program iv. To smoothen the seasonal flow of banks credit market. Bank Rate: The BR is the standard rate at which the RBI buys/rediscounts bills of exchange/other eligible commercial papers. It is also the rate which the RBI charges on certain collateral to banks RBI uses it as a signal to reflect the monitory policy and bank uses it to signal to change the price of their loan. Refinance: The RBI uses this instrument to relive liquidity shortage in the system, control monitory and credit conditions and direct credit to the selective sectors. Cash Reserve Ratio (CRR): It refers to the cash which banks have to maintain with the RBI, as a percentage of their demand and time liabilities. Statutory Liquidity Ratio (SLR): It is reserve the bank has to maintain with the RBI for a period ( daily basis) in order to restrict credit and ensure solvency. Cash + Bal in current account + Gold and unencumbered approved securities SLR = -------------------------------------------Demand + Time liability Liquidity Adjusted Facility (LAF): It provide for Collateralized Lending Facility By RBI to Banks up to .25 percent of fortnightly average outstanding deposit. It acts over and above the other instruments like SLR and CLR. Repos and Reverse Repos: It is a transaction in which two parties agree to sell and repurchase the same security. The seller specified securities with an agreement to repurchase the same at a mutually decided future date and price. Like wise the buyer purchases the securities with an agreement to resell the same to the seller on an agreed date and at a predetermined price. The same transaction is Repo from the view point of the seller and Reverse repo from the view point of the buyer of the securities. The condition of repo or reverse repo will be depended on the counterpart who initiate it. Repos and Reverse Repo helps in: i. Meet short fall in the cash position ii. Increase return on funds yield iii. Borrow securities to meet regulatory requirement and, iv. By the RBI to adjust liquidity in the financial year. There are two legs in the repo transaction: i. First Leg or step: Total Consideration: Deal rate X Face value + Accrued Interest ii. Second leg: (here the repo rate is adjusted with the interest earned on the security during the holding period, to arrive at the reversal price. Reversal Price: Deal Rate x Face value +(interest for holding period-Interest paid at repo rate)/face value Eg: Bank X entered into a repo for 14 days with bank Y for Rs.10 crore. The security chosen is 13.6% GS -2010. The repo rate is 5 percent. The agreed purchase price is Rs.1,01,12,00,000. The last coupon was paid 30 days ago. Calculation of first leg: Sale price: Rs.1,01,12,00,000 Accrued Interest (30 days) Rs. 11,33,300 -----------------------Net Cash Outflow Rs. 1,01,23,33,300 Calculation for second leg: Repo interest income (Rs.101,23,33,300 x 0.05 x 14/365) = 19,41,461 Cash Inflow (Rs.101,23, 33,333 + 19,41,461) = 1,01,32,52,838 Less Accrued Interest (44 days) = 1,63,945 -----------------------Purchase Price: = 1,01,30,88,893 ----------------------Rate = 1,01,30,88,893/10000000= Rs.101.31 Yield Calculation: (100 – P) x 365 x 100 Y = ------------------------------PxD Where; Y = Discounted yield P = Price D = Days to maturity Eg: SBI wants to purchase 91 days T Bill maturing on Dec 6, 2009 on October 12, 2009. The rate quoted by PNB Guilt's is Rs. 99.1489 ( Rs.100 face value). The YTM = (Rs.100 – Rs.99.1489) x 365 x 100 /99.1489 x 55) = 5.70 per cent.