Session 1B. CONCEPTS

advertisement

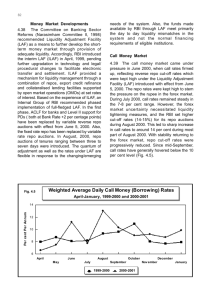

Session 1B. CONCEPTS 1 CONCEPTS Consumption: Direct and final use of goodsdestruction of utility. Savings are that part of the income which is not used for current consumption- i.e., Postponement of current consumption S = Y-C 2 Investment: Savings when mobilised and converted into real physical assets Production: Creation or addition of utility Productive activity: Any activity undertaken with the objective of earning an economic reward 3 CONCEPTS Factors of production Land • All natural resources lying on, above or below the earth’s surface • Heterogeneous • Geographically immobile but occupationally mobile • Passive factor of production 4 CONCEPTS Factors of production Labour • Physical or mental exertion by a human being in the process of production • Heterogeneous • Inseparable from the labourer • Active factor of production 5 CONCEPTS Factors of production Capital • Produced means of production • Factories, machines, tools, buildings etc • Derived demand • Subject to depreciation Money Capital: Money funds at the disposal of a firm or individual Real capital: Physical assets. E.g., machines, buildings, etc Human capital: Skills, knowledge and health of labour as a factor of production 6 CONCEPTS Factors of production • Enterprise & Organization: Newer concepts • Identifying potential sources of production, collecting them in required quantities, assigning them specific tasks as per skills is the role of Organisation. • Using these factors for economic activities, without any certainty of returns is the function of the entrepreneur. 7 CONCEPTS Concept of scarcity- Scarcity of resources and multiplicity of wants- Choice Opportunity Cost: Benefits foregone from the alternatives that are not selectedarises from scarcity and versatility of resources 8 PPC/PPF or Transformation Curve Production Possibility Curve/ Frontier • A graph that shows the different combinations of the quantities of two goods that can be produced (or consumed) in an economy, subject to availability of resources 9 PPC/PPF or Transformation Curve • PPC represents opportunity cost concept and measures it (through the slope) • Highlights significance of scarcity of resources • Shows trade-off “Substitution is the law of life in a full employment economy. The PPC depicts the society’s menu of choices”Samuelson 10 11 PPC/PPF or Transformation Curve Imagine an economy that can produce only wine and cotton. According to the PPF, points A, B and C - all appearing on the curve - represent the most efficient use of resources by the economy. Point X represents an inefficient use of resources, while point Y represents the goals that the economy cannot attain with its present levels of resources. 12 PPC/PPF or Transformation Curve Assumptions: • Economy is operating at full employment • Factors of production fixed in supply; but can be reallocated between uses • Technology unchanged • For simplification, considers only 2 commodities Based on these assumptions, society is faced with a fundamental problem of choice 13 PPC/PPF or Transformation Curve • PPC measures the best combination of outputs that can be achieved from a given number of inputs. • Downward sloping . Why? • Concave to the origin (bowed outside)- As we produce more units of a commodity, we have to give up more and more units of the other commodity 14 Shifts in PPC 15 PPF • When the PPF shifts to the right (outwards) , it shows there is growth in an economy.. Reasons: • Technology • Factor Endowments (shale Gas) 16 PPC • When the PPF shifts inwards, it indicates that the economy is shrinking. • A shrinking economy could be a result of huge ecological disaster , social unrest or deficiency in technology 17 PPC • An economy can be producing on the PPF curve only in theory. In reality, economies constantly struggle to reach an optimal production capacity. 18 Firm • An entity or organization that combines and organizes resources for the purpose of producing goods and /or services for sale. • Identify- collect -and assign resources • Types: proprietorships, partnerships, and corporations 19 Sole Proprietorship Firm Sole Proprietorship Firm/ Proprietary Single owner -Invests own/borrowed capital uses his own skills in management, solely responsible for results of operations -Profits / losses not shared by anybody 20 Advantages: • Simple form • Easy to start and exit • Undivided profits • Secrets of Trade • Prompt decision making • Personal touch to business 21 • Disadvantages: • • • • No separate entity of the firm Unlimited liability Limited availability of funds Uncertain life of business after the owner 22 2. PARTNERSHIP • Association of two or more persons • Agreement/ contract to start the firm and to share profits (& losses) • Individually partners , collectively firm • Heir does not automatically become partner • All partners are bound by a decision or act by any one of them. • A partnership firm can not become a member of another firm, though partners can join another firm 23 PARTNERSHIP • Partnership Deed- as partnership is created by agreement - Easy to form - Strong credit position - Shared Risk - Shared resources 24 PARTNERSHIP • Uncertain life -Can be broken any time and reconstituted • Unlimited liability- if a partner can not repay loan, creditors can claim it from the his personal assets. • No legal framework for defining partners’ roles- Distrust can destroy • Fund availability related to partners’ creditworthiness 25 JS/ LTD COMPANY Most common type of business organisation Legal entity Perpetual Existence- independent of its members MOA and Articles of Association to registrar 26 Private and Public Ltd Co Private LTD Co: -Max 50 share holders -Shares transferable only among members - Cant issue a prospectus Public Ltd Co: Minimum 7 members, no max 27 Business Cycles • Widespread contraction and expansion in most sectors of the economy. Peak Trough Time 28 Phases of Business Cycles Phases of Business Cycles • Expansion • Peak of boom or prosperity • Recession or downturn • Trough, the bottom of the depression • Recovery and expansion 29 • Business cycles are marked by widespread expansion and contraction in most sectors of the economy • Major phases of a business cycle are recession and expansion (or prosperity). • Peak and trough are the turning points of the phases. • If recession is severe in terms of scale and longer in duration, it is termed depression 30 Causes of Cycles • Inflationary/ deflationary pressures on price-cost relationships • Agricultural and meteorological factors • Aggregate demand and under consumption • Monetary factors • Savings-investment gap or over investment 31 Causes of Cycles • • • • Technological innovation General over production Psychological factors Risk and uncertainty factors 32 Characteristics of Recession • Fall in consumers purchase • Fall in demand for labour and other inputs. • Fall in output and increase in inventories. • Fall in investments and demand for credit • Fall in profits • General pessimism Increase in the above factors describes the phase of expansion 33 Characteristics of Recession • • • • • • • The Great Recession: Fall in Durable consumer goods demand Freeze on new recruitments Job cuts and pay cuts Unsold houses (Foreclosures) Bankruptcies Stock market slide and falling investor confidence • General mood of pessimism 34 Global Recovery?? • US sub prime lending • Each phase carries the seeds of its own destruction • Jobless recovery?? • Double Dip?? • European crisis: Sovereign Debt Crisis 35 Signs of Economic Recovery 1. Unemployment figures • Non-farm payrolls • ASA Staffing Index: Measures the temporary staffing activity. After a recession, employers add temporary workers first so as to avoid the commitments and expenses of adding fulltime workers until they are sure that business has improved. A rising ASA Staffing Index can signal that a recovery is36 Signs of Economic Recovery 2. Consumer spending 37 Signs of Economic Recovery 3. Consumer Sentiment Surveys ask people how they feel about the economy in near-term and their own individual or family prospects. • Consumer sentiment indicators like the Consumer Confidence Index (CCI) and the Michigan Consumer Sentiment Index do seem to correlate with reality more often than not. 38 Signs of Economic Recovery 4. Bank Lending 39 5.Purchasing Managers Index (PMI) • The Institute for Supply Management (ISM) calculates the Purchasing Managers Index (PMI) • Composite index of five "sub-indicators", based on surveys of more than 400 purchasing managers from around the USA • whether businesses are seeing new orders, higher production levels, timely deliveries from suppliers and increasing 40 Signs of Economic Recovery • Production level • New orders (from customers) • Supplier deliveries - (are they coming faster or slower?) • Inventories • Employment level 41 Signs of Economic Recovery • Questions have only three options; "better", "same", or "worse“ (As the manager sees it) • PMI figure ranges from 0 to 100 • PMI reading of 50 would indicate an equal number of respondents reporting "better conditions" and "worse conditions". 42 Signs of Economic Recovery 6. Cass Freight Index and the American Trucking Association's Truck Tonnage Index. (because these show that goods are being delivered to satisfy consumer orders) • In India also truck sales are taken as an important indicator 43 Contra Cyclical Policy Contra-cyclical or Counter-cyclical Measures (Measures to control business cycles) A) Monetary Policy for Tackling Recession– Designed by the central bank of the country. (RBI in India) Monetary measures control liquidity and availability of credit . Need to increase liquidity through: • Repo and reverse Repo rates • CRR decrease • SLR decrease • OMO: Selling securities Moral suasion and other44 qualitative credit controls B) Fiscal Policy for Tackling Recession Measures by the government- Emphasised by • • • • J. M. Keynes during Great Depression Reduce tax rates Increase subsidies Increase public expenditure Debt polices. 45 Fiscal measures directly affect • Prices • Consumers’ disposable income • Money supply • Supply of goods and commodities - which in turn affect the movements of business cycles 46 3.Other measures – Buffer stock operations Declaration of minimum procurement price etc are used to stabilize prices in agriculture 47 Inflation • Demand pull/ Cost- push • WPI: 435 commodities tracked- time lag of only e weeks- revision later • CPI is a better index as it captures cost of living, but it comes with a time lag • 4 types of CPI- Industrial workers, urban Non manual workers, AL, rural labor 48 Monetary Policy • Repo rate : Rate of interest charged by central bank when banks borrow money from it • Tool through which RBI infuses funds into the system by lending to banks against pledging of securities 49 Monetary Policy • Reverse repo: Rate which RBI offers to banks when they deposit funds with it. • RBI drains out liquidity from the financial system through reverse repo by releasing bonds to the banks. This is a daily operation by the Bank to manage liquidity. Over a longer period, RBI can also manage liquidity through OMO. 50 Monetary Policy • When liquidity is tight and banks need short term funds from RBI to manage mismatches, then repo rate emerges as the effective policy rate. • But if liquidity returns to the system reverse repo rate would become the operative rate as RBI would be draining out funds from the system, 51 Monetary Policy • . In US there is a single Fed Fund Rate. This is the key interest rate and short term funds are available to eligible borrowers at this rate. 52 Policy Rates • SLR• Every bank in India has to maintain a minimum proportion of their net demand and time liabilities as liquid assets in the form of cash, gold and unencumbered approved securities. • Statutory Liquidity Ratio (SLR). Simply put, SLR is the percentage of total deposits banks have to invest in government bonds and other approved securities • • 53 • The maximum limit of SLR is 40% and minimum limit of SLR is 25%. It’s 25% now. This restriction is imposed by RBI on banks to make funds available to customers on demand as soon as possible. (Gold and G Secs (or Gilts) are included along with cash because they are highly liquid and safe assets.) 54 CRR, or cash reserve ratio, is the portion of deposits that the banks have to maintain with the RBI. Higher the ratio, the lower is the amount that banks will be able to use for lending and investment 55 Difference between SLR and CRR: • To meet SLR, banks can use cash, gold or approved securities - CRR has to be only cash. • CRR is maintained in cash form with RBI, where as SLR is maintained in liquid form with banks themselves. 56 Reverse logic in recession • A cut in SLR means that the home, car and commercial loan rates will go down. • 57 Find out Policy Rates as in Sep. 2010 • Repo Rate: • Reverse Repo: • CRR: • SLR: 58 FISCAL MEASURES Recession: • Increase government spending (stimulus packages) • Reduce taxes 59 ROLE PLAY • Company XYZ earns 70% of its revenue from exports to USA. • Of late export orders have fallen , leading to fall in revenues. • A meeting is called to find out solutions to the crisis. 60 Role Play • The HR manager wants to cut jobs • Finance department does not want to cut jobs as he does not want to lose trained manpower who will be handy in the case of a recovery. 61 • Product manager wants to create new products by investing in R& D • The Marketing Department is not sure new products can be sold in a recession. they have 2 suggestions: A) more advertisements for the old products • B) Concentrating on domestic demand 62 • The IT Department wants to keep more people ready for future demand • How will a decision be arrived at? 63 END of SESSION 64 Indian Economy,2010 Performance & Prospects • All round prosperity - Wealth effect of rising prices of most assets-real estate, gold, stocks -Up to 30% hike in MSP of food grains Farm loan waivers Increasing private sector salaries -Higher than ever hike in PSU salaries in the past 5 years (14% in 2006-07, 26% in 2007-08, 31.2% in 2008-09) Family incomes have risen faster than individual 65 incomes because of spread of service sector • Rise in the number of double income families 66 According to NCAER • How India Earns, Spends & saves by Rajesh Shukla: • Rising middle class numbers • Rural jobs growing (Expenditure on NREGA : • 07-08: Rs.15,857 • 09-10: Rs. 37, 938 • 10-11: Rs. 40,100 • NREGA wage rates have gone up from Rs.80 to Rs. 100 67 • Rural economy is no more synonymous with agriculture • Every new car creates 5 new jobscleaner, driver, parking attendant, mechanic & auto insurance surveyor 68 • According to Morgan Stanley report, the Indian economy will start growing faster than China in 2013. • Reason : demographic dividend- India will see a declining trend in the share of non-working population and add 136 mn to working population over the next 10 years; China, only 23 mn. 69 • India’s savings rate will go up, while share of consumption in China’s GDP will go up • Assumptions: • Sustained increase in India’s infra spending, • Educational levels • Fiscal consolidation. 70 Read Raghuram Part II 71 Raghuram Rajan: Fault Lines: How Hidden Fractures Still Threaten the World Economy • We must create real jobs,- not make-work jobsto increase productivity of rural worker to the levels of manufacturing/ service workers His prescription for population dividend: • Infrastructure • Education • Health • Financial Inclusion- credit only one aspect 72 ET’s warning: • Need inclusive growth and internal security. • To tackle the second, you need inclusive growth 73 On china (From Economist 19/08/10) 2010 (2nd quarter) output: US: $ 3.522 trillion China: $1.337 trillion Japan: $ 1,288 trillion China is now world’s 2nd largest economy, having surpassed Japan in the 2nd quarter of 2010 74 75 76 China- Some Facts • • • • • World’s largest population World’s largest exporter World’s largest car market World’s largest consumer of energy World’s largest carbon emitter 77 • • • • • • • • China’s problems: Inequality All areas not fully developed Rural neglect Absence of democracy Trade wars with Us Strikes in plants Housing bubble? 78 79 Role Play Company XYZ is an exporter whose major profits come from the US market. Of late, it has been facing falling demand and dropping profits. A meeting is called to discuss the problem: The HR head wants to reduce manpower to revive profits. The operations head wants to have a stable workforce which is well-trained and highly skilled so that resources do not migrate to competitors and morale is not 80 The Product Development head wants increased R&D spending so that new product lines can help beat the falling demand. The Finance Head wants to avoid any new investments because the company has limited capital and will be hit hard if new products do not do well. 81 The Marketing Head has two alternatives : Either explore new foreign markets or to launch an exciting campaign to rejuvenate domestic demand. What should the Managerial Economist Do? What lessons did you learn? 82