4. Pen**ní trh

advertisement

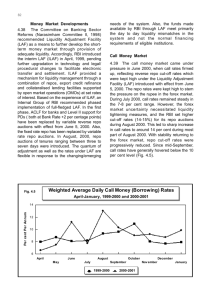

4. Money market International financial services 1 Main fields of interest • Money market architecture • Main segments of money market • Main instruments • Interest rates quotation, reference interest rates Money market structure O/N interest rate Spot yield curve Banking system liquidity management Unsecured interbank market Forward yield curve, volatility of interest rates Interest rates derivatives Monetary policy implementation Liquidity of banking system Interest rates spread Short-term securities Secured interbank market Individual liquidity Speculation Hedging Liquidity investments Unsecured interbank market • main segment of money market used for alocation liquidity among the banks and for liquidity distribution between central bank and banks • strong O/N maturity preference in liquidity managmenet and due to credit risk management • under strong impact of financial crisis, new capital base and liquidity regulation • strong preference of counterparty from home economy (inside monetary union) Maturity structure and volume of trades in EUR interbank market Structure of counterparties on Euro interbank market in 2010 Secured interbank market – repo market • repo as term deposit secured by collateral in terms of securities or as a sell and buy back transaction • main instrument for bank‘s liquidity management and short-term funds alocation • a way of financing of bond issuance, bond holding and short exposure covering in securities market • bilateral, bilateral CCPs (BrokerTec, Eurex repo a MTS) and tri-party repo trades (custodian banks) • repo rate as a price of repo trade • initial margin and haircut • preference of short-term maturity Dolar, euro and pound repo market Structure of Euro repo market according a type of trade Main interest rate derivatives FRA (OTC), 006% • FRA Interest rate swaps (OTC), 012% Interest rate options (OTC), 002% • interest rate swap • interest rate option • exchange traded futures and options Exchange traded interest rate futures and options, 080% Euromoney market • Eurointerbank market • Leading world bank‘s liquidity management • LIBOR as reference interest rate for banking loans • Eurocommercial papers and euronotes • Alternative to short-term banking loan and T-bills