3A Accounting Complex Adjusting Entries Practice Test

advertisement

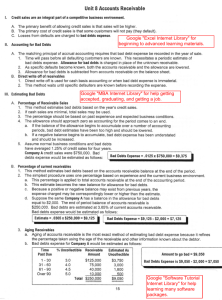

Lightstone, May 2004 3A Accounting Complex Adjusting Entries Practice Test 1. Bad Debts Expense Mike Egberts owns Mike’s Bikes on Melrose Avenue, Los Angeles. Mike's business is frequented by jobless rogues who are trying to make it big in show business. Yet, these struggling actors cannot afford to drive a car. Needless to say, many of these customers don't have a lot of cash on them, so Mike is kind enough to sell them bikes on credit. Sadly, Mike often does not receive any payment on his accounts, and must sooner or later write them off. Record the transactions outlined below within the General Journal provided. April 30: The total sales for the month of April was $26,000.00, but his total accounts receivable account currently has a balance of $3000.00. Mike uses the Balance Sheet approach to estimating bad debts expense, therefore he estimates his Bad Debts at 20% of his total accounts receivable. Make the necessary adjusting entry to record the prediction of this bad debts expense. May 16: Mike tries to phone Carlo Varone to see about his late payment, but the phone number turns out to belong to the Betty Ford Clinic. Mike writes off the entire account, totaling $400.00 May 21: Mike tries to phone Mickey Blue to see about his late payment, but the phone number turns out to be disconnected. Mike writes off the entire account, totaling $500.00 May 29: Much to his surprise, Mike receives a $300.00 payment on the Carlo Varone account - it turns out that Carlo has recovered from his illness and now has a job. Carlo apologizes for the late payment and promises to pay the balance as soon as he can. May 31: The total sales for the month of May was $26,000.00, but his total accounts receivable account currently has a balance of $3000.00. Mike uses the Balance Sheet approach to estimating bad debts expense, therefore he estimates his Bad Debts at 20% of his total accounts receivable. Make the necessary adjusting entry to record the prediction of this bad debts expense. Page 1 Lightstone, May 2004 Date April 30 Account Title and Explanation Bad Debts Expense P.R. Debit Credit 600.00 Allowance for Bad Debts 600.00 To record estimated bad debts expense. May 16 Allowance for Bad Debts 400.00 A/R - Varone 400.00 To write off account receivable. May 21 Allowance for Bad Debts 500.00 A/R - Blue 500.00 To write off account receivable. May 29 A/R - Varone 400.00 Allowance for Bad Debts 400.00 To revive the account receivable. May 29 Cash 300.00 A/R - Varone 300.00 Received payment on account. May 31 Bad Debts Expense Allowance for Bad Debts 500.00 500.00 To record estimated bad debts expense. Page 2 Lightstone, May 2004 2. Accrued Expenses The last week of May in 2000 has only three days actually falling within May. The other two days of this week fall within the month of June. Julie pays her personal assistant, Tom, a salary of $50.00 a day. However, Tom is only paid on Fridays. Within the General Journal provided, prepare the two separate entries required in order for Julie to apportion her Wages Expense correctly to each month. (Observe the diagram below for assistance.) MAY Mon. 29 50.00 Date May 31 Tue. 30 50.00 JUNE Wed. 31 50.00 Account Title and Explanation Wages Expense Thur. 1 50.00 P.R. Fri. 2 50.00 Debit Credit 150.00 Wages Payable 150.00 To adjust for three days unpaid wages. June 2 Wages Expense 100.00 Wages Payable 150.00 Cash 250.00 To record payment of one week’s wages. Page 3 Lightstone, May 2004 3. Unearned Revenue Lowell Heppner receives a total of $2,000.00 in advance for agreeing to perform two concerts at $1,000.00 each. (Owing to the fact that his talent is in high demand, payment for his work is always made in advance.) Prepare the following entries within the General Journal provided: May 3 - Record the initial receipt of the money ($2,000.00). May 23 - Lowell completes his first performance. June 11 - Lowell completes his second performance. Date May 3 Account Title and Explanation Cash P.R. Debit Credit 2,000.00 Unearned Revenue 2,000.00 To record advance payment for two gigs. May 23 Unearned Revenue 1,000.00 Fees Earned 1,000.00 To record performance of first gig. June 11 Unearned Revenue Fees Earned 1,000.00 1,000.00 To record performance of second gig. Page 4 Lightstone, May 2004 4. Disposal of Depreciated Assets Derek feels that it is time to sell his old laptop computer and get a new one. The computer cost $3,000.00 when it was new. Derek purchased the computer on March 2nd, 2002. At that time he estimated he would use it for two years, after which he would dispose of the computer for $1,000.00. The last time that depreciation was recorded was on December 31, 2003. The current date is March 4th, 2004. i) In the journal provided below, record the entry that would adjust for the last two month’s of depreciation. (2 marks) ii) In the same journal, record the entry that would show the computer being sold for $1,200.00. (4 marks) Date March 4 Account Title and Explanation Depreciation Expense P.R. Debit Credit 166.67 Accumulated Depreciation / Computer 166.67 To adjust for two months depreciation. March 4 Cash 1,200.00 Accumulated Depreciation / Computer 2,000.00 Computer Gain on Disposal of Asset 3,000.00 200.00 To record sale of computer equipment. Page 5