5 - DBFTA JPEPA - MARIA ROSARIO Acosta

advertisement

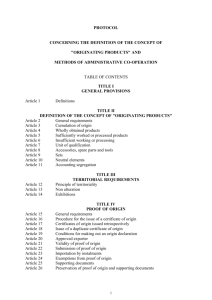

Getting A Certificate of Origin for your Product Doing Business in Japan Free Trade Area Philippine Trade Training Center November 7, 2012 Ma. Rosario V. Acosta Customs Operations Officer Bureau of Customs BENEFITS FROM JAPAN FREE TRADE AGREEMENT H.S. CODE DESCRIPTION MFN JPEPA RATE 306.17 3923.90 4418.90 6109.10 7007.19 9405.92 Frozen Shrimps Carrier Tapes Wooden Flooring Panels Cotton Underwear Tempered Glass Illuminated Sign Parts 4.00% 5.80% 3.90% 14.00% 5.30% 5.80% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% SUBJECT OUTLINE 1. What is a Certificate of Origin? 2. Rules of Origin 3. How to Get a Certificate of Origin 4. Minimum Data Requirements 5. Operational Procedures 6. Primer on Rules of Origin for PJEPA: In the Preparation for Stakeholder CERTIFICATE OF ORIGIN (CO) declaration of exporter certified by a Competent Authority (Bureau of Customs, Ministry of Trade or Department of Commerce or Chamber of Commerce) states that the export products comply with the ORIGIN REQUIREMENTS specified under bilateral, regional & multi-lateral Trading Arrangement PURPOSES OF CO Proves that the product exported is manufactured & produced in a specified country. Serves as a basis of granting preferential tariff treatment by the importing country RULES OF ORIGIN Are regulations to determine the Country of Origin “nationality of the goods” Determine whether imported products shall be subjected to a most-favoured nation (MFN) treatment or preferential treatment (e.g.,ATIGA, ACFTA, AKFTA, AIFTA, AANZFTA, PJEPA, AJCEP) Means of determining HOW & WHEN a product can be considered as ORIGINATING from a specific country RULES OF ORIGIN H.S. CODE DESCRIPTION PRODUCT SPECIFIC RULE 306.17 Frozen Shrimps Wholly Obtained 3923.90 Carrier Tapes CTC or QVC 40% 4418.90 Wooden Flooring Panels 6109.10 Cotton Underwear 7007.19 Tempered Glass CTC or QVC 40% 9405.92 Illuminated Sign Parts CTC or QVC 40% CTC CTC and imported textile from both Party or ASEAN Member “ORIGINATING” GOODS Wholly-obtained and produced goods Goods made entirely in the exporting FTA Party (e.g. the Philippines) from materials produced in that same country (e.g. goods grown, born and raised, gathered, or extracted in the Philippines) Example: The Philippines’ agricultural exports including seafood harvested within the country, and mineral goods Goods underwent substantial transformation process Products manufactured from exporting country wholly or partly from imported materials or components, including materials of undetermined or of unknown origin, are considered as ORIGINATING in that country if its materials, parts or components have undergone SUBSTANTIAL WORKING OR PROCESSING there. Raw Materials for Glass Manufactured by Asahi Silica Sand Soda Ash Dolomite Feldspar Sodium Sulfate (Salt Cake) Calumite (Azaite Slags) Cobalt Oxide Sodium Selenite Sodium Nitrate Cullet Change in – tariff classification Rule (CTC Rule) The HS code of Tempered Glass is H.S. 7007.19 and its origin rule is “A change to heading 70.02 through 70.17 from any other heading; or No required change in tariff classification to heading 70.02 through 70.17, provided that there is a qualifying value content of not less than 40%”. The rule requires that the 6-digit code of the Tempered Glass be different from those of the materials used in its production in the Phil. Exported to Japan Silica Sand H.S.2505.10 Tempered Glass H.S. 7007.19 Soda Ash H.S. 2836.20 Sodium Sulfate H.S. 2833.11 VALUE ADDED RULE (VA rule) ROO based on value-added (i.e., value-added rule) measure the extent of manufacturing or processing undertaken in a country by reference to the value added to the good. There are two requirements: • the final processing must be performed in a country; and • the value added in the country, calculated using a given formula, must satisfy the required threshold. FOB-VNM FOB The formula may measure local content based on the FOB value, the exfactory price or the ex-factory cost. Certain cost adjustments may be required. Packaging materials and containers for retail sale, if classified with the good, are included in the calculation of value-added while packing materials and shipping containers are excluded The HS code of Tempered Glass is H.S. 7007.19 and its origin rule is “A change to heading 70.02 through 70.17 from any other heading; or No required change in tariff classification to heading 70.02 through 70.17, provided that there is a qualifying value content of not less than 40%”. Raw Materials Silica Sand Soda Ash Sodium Sulfate Total F.O.B. Price Country of Origin Australia Oregon China Originating Status Non - originating Non - originating Non - originating - - F.O.B. - V.N.M. Q.V.C = × 100 F.O.B. 12.79 - 6.10 Q.V.C = × 100 = 52.30% 12.79 Value US$ 2.10 2.30 1.70 6.10 12.79 Specific Manufacturing Or Processing Operation Rule (Process Rule) ROO based on process ascertain the critical process or element in the manufacture of a good. The country where such a critical process is done or where a critical element is obtained would be the country of origin of the good. PSR Rule: A change to heading 61.01 , through 61.17 from any other chapter provided that where non-originating materials of heading 50.07,51.11 through 51.13, 52.08 through 52.12, 53.09 through 53.11, 54.07 through 54.08,55.12 through 55.16 or chapter 60 are used, each of the non-originating materials is knitted or crocheted in either Party or a non-Party which is a member country of the ASEAN. Canada Thailand Knitted Wool 51.0 1 Yarn 51.06 Sweater Chapter 61 Minimum Data Requirement for CO under Annex 3 1. Exporter’s name, address and country 2. Importer’s name, address and country 3. Certification Number 4. Origin of good (s) 5. Invoice number and date 6. Transport details (if known) 7. HS tariff classification number 8. Marks, numbers, number and kind of packages; Description of good (s) 9. Quantity (Unit) 10.Origin criterion 11.Remarks (e.g. application of de minimis, accumulation 12.Declaration by the exporter 13.Certification Minimum Data Requirement for CO under Annex 3 14 (a) With respect to good (s) of chapter 16 (i.e. sardines), materials taken by the aauthorized fishing vessels on the IOTC Record (Indian Ocean Tuna Conference), names, registered numbers and nationalities of such vessel. (b) With respect to good (s) of chapter 18 or 20 ( i.e. cocoa, fruit jams), if imported materials are used, indicate the name of the ASEAN Member company (c ) With respect to good (s) of chapter 50 or 63 ( i.e. textiles, garments and blankets), if imported materials are used, indicate the name of the ASEAN Member company, processes oroperations conducted OPERATIONAL PROCEDURES A.Issuance of a Certificate of Origin 1) Form JP should be on ISO A-4 size paper 2) H.S. Code 3) Issued by the competent authority 4) CO must bear a reference number 5) CO issued one day after the date of shipment 6) CO can be issued within 12 months and indicate “ISSUED RETROACTIVELY” in Box 9 7) Multiple items declared in the CO allowed, provided each item are qualified as originating good 8) Signature of the competent authority B. Application 1) Notice to Exporter (CMO # 27-2004) 2) Presentation of documents for the evaluation, 5 days before the shipment date 3) Plant visit as needed C. Modification In the event of loss, new certificate of origin can be issued D. Minor Error Typing errors, discrepancies or omissions E. Single Shipment Two or more invoices for one shipment can be accepted F. Invoice of a Non Party Third Party Invoicing is allowed and to be indicated in Box 9 G. Others If some goods not subject to preferential are included in the CO, the said CO is still valid. PROCEDURES: POST EXPORTATION EXPORTER: Presents CO declaration to the Export Division at the time of exportation or as soon as thereafter, with the ff. : a) Copy of Export Declaration w/ Authority to Load b) Commercial Invoice c) Commodity Clearance / Permit to Export d) Duplicate copy of B/L or AWB. PRIMER ON RULES OF ORIGIN FOR PJEPA IN THE PREPARATION FOR STAKEHOLDER Notice to readers This primer is just a reference for your understanding. If you deal with actual trade under PJEPA, you should read main body, Annexes, or Operational Procedures of the Agreement or other related domestic laws and regulations at first. In the event of any inconsistency between this primer and PJEPA (like modification or elimination of the contents or definitions of PJEPA), contents or definitions of the Agreement should prevail to the extent of the inconsistency.