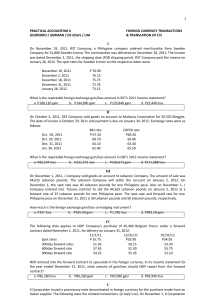

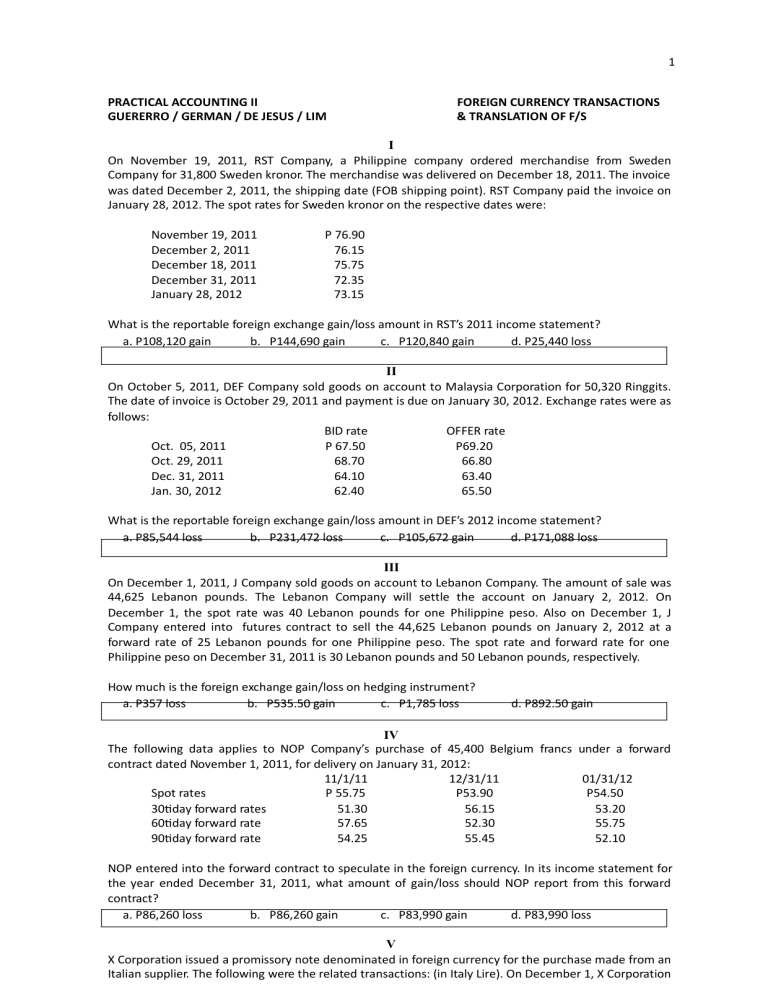

1 PRACTICAL ACCOUNTING II GUERERRO / GERMAN / DE JESUS / LIM FOREIGN CURRENCY TRANSACTIONS & TRANSLATION OF F/S I On November 19, 2011, RST Company, a Philippine company ordered merchandise from Sweden Company for 31,800 Sweden kronor. The merchandise was delivered on December 18, 2011. The invoice was dated December 2, 2011, the shipping date (FOB shipping point). RST Company paid the invoice on January 28, 2012. The spot rates for Sweden kronor on the respective dates were: November 19, 2011 December 2, 2011 December 18, 2011 December 31, 2011 January 28, 2012 P 76.90 76.15 75.75 72.35 73.15 What is the reportable foreign exchange gain/loss amount in RST’s 2011 income statement? a. P108,120 gain b. P144,690 gain c. P120,840 gain d. P25,440 loss II On October 5, 2011, DEF Company sold goods on account to Malaysia Corporation for 50,320 Ringgits. The date of invoice is October 29, 2011 and payment is due on January 30, 2012. Exchange rates were as follows: BID rate OFFER rate Oct. 05, 2011 P 67.50 P69.20 Oct. 29, 2011 68.70 66.80 Dec. 31, 2011 64.10 63.40 Jan. 30, 2012 62.40 65.50 What is the reportable foreign exchange gain/loss amount in DEF’s 2012 income statement? a. P85,544 loss b. P231,472 loss c. P105,672 gain d. P171,088 loss III On December 1, 2011, J Company sold goods on account to Lebanon Company. The amount of sale was 44,625 Lebanon pounds. The Lebanon Company will settle the account on January 2, 2012. On December 1, the spot rate was 40 Lebanon pounds for one Philippine peso. Also on December 1, J Company entered into futures contract to sell the 44,625 Lebanon pounds on January 2, 2012 at a forward rate of 25 Lebanon pounds for one Philippine peso. The spot rate and forward rate for one Philippine peso on December 31, 2011 is 30 Lebanon pounds and 50 Lebanon pounds, respectively. How much is the foreign exchange gain/loss on hedging instrument? a. P357 loss b. P535.50 gain c. P1,785 loss d. P892.50 gain IV The following data applies to NOP Company’s purchase of 45,400 Belgium francs under a forward contract dated November 1, 2011, for delivery on January 31, 2012: 11/1/11 12/31/11 01/31/12 Spot rates P 55.75 P53.90 P54.50 30-day forward rates 51.30 56.15 53.20 60-day forward rate 57.65 52.30 55.75 90-day forward rate 54.25 55.45 52.10 NOP entered into the forward contract to speculate in the foreign currency. In its income statement for the year ended December 31, 2011, what amount of gain/loss should NOP report from this forward contract? a. P86,260 loss b. P86,260 gain c. P83,990 gain d. P83,990 loss V X Corporation issued a promissory note denominated in foreign currency for the purchase made from an Italian supplier. The following were the related transactions: (in Italy Lire). On December 1, X Corporation 2 purchased merchandise from an Italian supplier for 60-day, 18% promissory note for 108,000 Italy lire, at a selling rate of 1FC to P74.20. On December 31, the selling spot rate is 1FC to P74.85. On January 30, the selling spot rate is 1FC to P75.75. On the settlement date, how much is the foreign exchange gain/loss? a. P98,658 loss b. P172,422 gain c. P100,116 loss d. P172,422 loss VI M Company sold merchandise for 111,200 rupees to a customer in India on November 02, 2011. Collection in India rupees was due on January 31, 2012. On the same date, to hedge this foreign currency exposure, M Company entered into a futures contract to sell 111,200 rupees to a bank for delivery on January 31, 2012. Exchange rates for rupees on different dates are as follows: Nov. 2 Dec. 31 Jan. 31 Strike price P 81.8 P81.8 P81.8 Bid spot rate 81.9 80.7 80.1 Offer spot rate 81.7 80.5 80.3 30-day futures 82.3 80.4 83.9 60-day futures 81.8 80.3 82.6 90-day futures 80.6 81.6 83.4 120-day futures 80.1 81.4 82.8 1. What is the reportable sales amount in the December 31, 2011 income statement? a. P9,096,160 b. P9,085,040 c. P8,962,720 d. P9,107,280 2. How much is the foreign exchange gain/loss due to hedged item in the December 31, 2011 profit and loss statement? a. P22,240 loss b. P133,440 gain c. P133,440 loss d. P22,240 gain 3. What is the reported value of the receivable from the customer at December 31, 2011? a. P8,940,480 b. P8,937,840 c. P8,951,600 d. P9,096,160 4. How much is the foreign exchange gain/loss due to hedged instrument in the 2012 profit and loss statement? a. P33,360 gain b. P66,720 gain c. P11,120 gain d. P66,720 loss 5. What is the balance of the Forward Contract Payable account as of December 31, 2011? a. P8,937,840 b. P8,962,720 c. P8,940,480 d. P8,929,360 6. What was the net impact in M Company’s income in 2012 as a result of this hedging activity? a. P11,120 gain b. P33,360 loss c. P33,360 gain d. P11,120 loss VII R Company acquired machinery for 169,200 lira from a vendor in Turkey on December 1, 2011. Payment in Turkey lira was due on March 31, 2012. On the same date, to hedge this foreign currency exposure, R entered into a futures contract to purchase 169,200 lira from a bank for delivery on March 31, 2012. Exchange rates for pounds on different dates are as follows: Dec. 1 Dec. 31 Mar. 31 Strike price P 41.5 P41.5 P41.5 Buying spot rate 41.6 42.5 43.4 Selling spot rate 41.4 42.3 43.7 30-day futures 42.3 41.8 43.2 60-day futures 41.8 42.2 42.6 90-day futures 40.6 42.5 43.4 120-day futures 42.2 42.8 42.9 1. What amount is the capitalizable cost of the machinery? a. P7,021,800 b. P7,038,720 c. P7,004,880 d. P7,140,240 3 2. How much is the foreign exchange gain/loss due to hedged item in the 2012 profit and loss statement? a. P236,880 loss b. P236,880 gain c. P152,280 gain d. P152,280 loss 3. What is the reported value of the payable to the vendor at December 31, 2011? a. P7,004,880 b. P7,021,800 c. P7,157,160 d. P7,191,000 4. How much is the foreign exchange gain/loss due to hedging instrument in the December 31, 2011 profit and loss statement? a. P50,760 gain b. P16,920 loss c. P16,920 gain d. P50,760 loss 5. What is the balance of the Forward Contract Receivable account as of December 31, 2011? a. P7,140,240 b. P7,191,000 c. P7,157,160 d. P7,021,800 6. What was the net impact in R Company’s income in 2011 as a result of this hedging activity? a. P101,520 gain b. P33,840 gain c. P33,840 loss d. P101,520 loss VIII On November 1, S Company entered into a firm commitment to acquire a machinery from United Arab Emirates Company. Delivery and passage of title would be on February 28, 2012 at the price of 37,800 dirhams, accounted for as fair value hedge. On the same date, to hedge against unfavorable changes in the exchange rate, S entered into a 120-day contract with a bank for 37,800 dirhams. Exchange rates were as follows: Spot Rate Forward Rate Nov. 01, 2011 P 96.50 P94.30 Dec. 31, 2011 97.25 96.50 Feb. 28, 2011 99.70 99.70 1. The December 31, 2011 foreign exchange gain/loss on hedging instrument amounted to: a. P83,160 gain b. P83,160 loss c. P28,350 loss d. P28,350 gain 2. The Firm Commitment account balance as shown in the December 31, 2011 statement of financial position amounted to: (Indicate whether asset or liability) a. P28,350 asset b. P83,160 liab c. P83,160 asset d. P28,350 liab IX On October 1, 2011, HIJ Philippines took delivery from Bahrain firm of inventory costing 1,140,000 dinar. Payment is due on January 30, 2012. Concurrently, HIJ Philippines paid P15,700 cash to acquire an atthe-money call option for 1,140,000 Bahrain Dinar. Strike price is P12.40. 10/1/2011 12/31/2011 1/30/2012 Market price P 12.40 P12.423 P12.427 Fair value of call option P28,200 P30,780 1. The foreign exchange gain/loss on hedging instrument due to change in the ineffective portion on December 31, 2011 if changes in the time value will be excluded from the assessment of hedge effectiveness should be: a. P26,220 loss b. P26,220 gain c. P13,720 loss d. P12,500 gain 2. The foreign exchange gain/loss on hedging instrument due to change in the effective portion on December 31, 2011 if changes in the time value will be excluded from the assessment of hedge effectiveness should be: a. P4,560 gain b. P2,580 gain c. P1,980 loss d. P4,560 loss 3. The December 31, 2011 net foreign exchange gain/loss in the hedging activity amounted to: a. P13,720 gain b. P13,720 loss c. P38,720 loss d. P38,720 gain