Bayesian Adaptive Trading with a Daily Cycle

advertisement

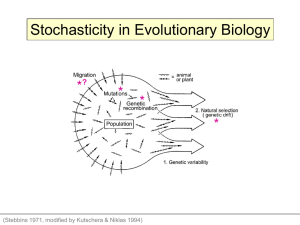

CHEN RONG ZHANG WEN JUN Introduction and Features Price model including Bayesian update Optimal trading strategies Coding Difficulties and Justification Presents a model for price dynamics and optimal trading that explicitly includes the daily trading cycle and the trader’s attempt to learn the targets of other market participants Motivation: 1. Institutional trading has an explicit daily cycle based on the assumption that at the beginning of each day each informed market participant is given a trader target exogenously. 2. Popularity of execution algorithms that adapt to changes in price of the asset being traded, either by accelerating execution when the price moves in the trader’s favor, or conversely. The informed participants do not know each others’ targets, but must guess them by observing price dynamics throughout the day. We consider they will use all available information to compete with each other. The daily cycle is an essential feature of this model. The underlying drift factor is approximately constant throughout the day. The trader must never sell as part of a buy program. Price S(t) obeying an arithmetic random walk S (t ) S0 t B(t ) for t 0 B(t ) is standard Brownian motion, σ is an absolute volatility and α a drift. Drift: N ( , 2 ) At time t, stock price trajectory : S ( ) for 0 t Conditional on the value of α,the distribution of S(t) is S (t ) S0 N (t , 2t ) After some calculation we can find the unconditional distribution S (t ) S0 ~ N (t,( v t )t ) 2 2 We then use Bayes’ rule Pr( S (t ) | ) Pr( ) Pr( | S (t )) Pr( S (t )) Obtain this conditional distribution 2 v2 (S (t ) S0 ) 2 2 ~ N( , v ) 2 2 2 2 v t v t This represents our best estimate of the true drift α Order of X shares, begins at t=0 and completed by t T Trading trajectory fn: x(t) is the shares remaining to buy with x(0)=X and x(T)=0 Corresponding trading rate v(t ) dx / dt Constraint: v (t ) 0 0 x (t ) X Use a linear market impact function to get the actual execution price: S (t ) S (t ) v(t ), 0 η is the coefficient of temporary market impact C: total cost of executing the buy program relative to the initial value T C S (t )v(t ) d t XS 0 0 T T T 0 0 0 x(t )dB (t ) v (t ) 2 dt x (t )dt C is a random variable Minimize the expectation of trading cost Conditional on the true value of α T T 0 0 E (C ) (t ) 2 dt x(t )dt Our best estimate at time t for α is: 2 2 ( S S0 ) * (t , S ) 2 2t The expected cost of the remaining program: T T t t E(t , x(t ), S , x( )) ( ) 2 d * (t, S ) x( )d Trading goal: determine x( ) for t T such that min E (t , x(t ), S , x( )) x ( ) Small perturbation: x( ) x( ) x( ) for t T x(t ) x(T ) 0 Associate trade rate perturbation: ( ) x' ( ) Perturbation in cost: T T t t E 2v( ) v( )d * x( ) d T (2 x '' ( ) * ) x( ) d t Here * * (t, S (t )) is the best available drift estimate using information at time t Unconstrained trajectories Optimizing x( ) satisfy the ODE: * x ( ) , t T 2 '' * T x(t ) ( t )(T ), t T (1) Solution : x( ) T t 4 Corresponding instantaneous rate: x(t ) * v(t , x) x ( ) | t (T t ) T t 4 ' (2) Constrained trajectories There is a critical drift value c such that If | * | c , then the constraint is not binding. The solution is the one given in (1) and (2). If * c , then the solution is the one of (1,2), with a shortened end time T* T determined by T* t 4 x ( t ) * 4 x(t ) c ( x(t ), T t ) (T t )2 If * c , then the solution is the one of (1,2), except that trading does not begin until a starting time t* t determined by: T t* 4 x(t ) * The overall trade rate formula: * c 0, x * v(t , x, S ) (T t ), |* | c T t 4 * x x * (T* t ) , * c T* t 4 (3) This is the Bayesian adaptive strategy: a specific formula for the instantaneous trade rate as a function of price, time, and shares remaining. Constrained Solution x( ) Starting at Time t with Shares x(t) and Drift Estimate α For 0 , the trajectories go below the linear profile to reduce expected purchase cost. For | | c , the constraint is not binding (shaded region). At c the solution become tangent to line x=0 at T and for larger values they hit x=0 with zero slope at T* T For c , trading does not begin until t* t Implement the price model using Bayesian adaptive strategy by MATLAB Mean 0.7 Standard deviation 1 , then N (0.7,1) Price path S (t ),0 t 1 with volatility 1.5 Initial price S0 $100 Initial shares X 1 Impact coefficient 0.07 Sample price path with initial price S0 $100 Trajectories according to sample price path In this model, the random daily drift is superimposed on the price volatility caused by small random traders. In theory, these two sources of randomness can be disentangled by measuring volatility on an intraday time scale and comparing it to daily volatility. In practice, real price processes are far from Gaussian, so it’s difficult to do this comparison with any degree of reliability. By the practical observation, some fraction of traders do express interest in using strategies similar to ours. We provide a conceptual framework for designing optimal strategies that capture this preference. Without any such framework it’s impossible to design algorithms except by completely special methods. Q&A