Document

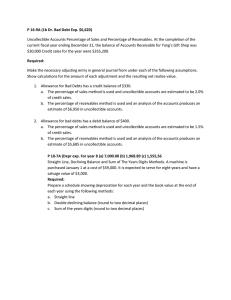

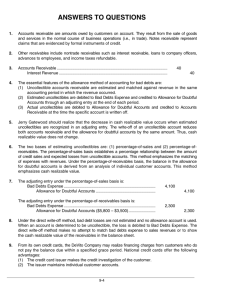

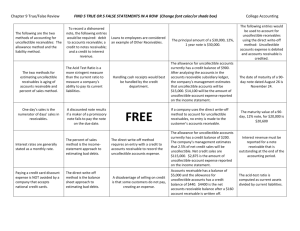

advertisement

CHAPTER 7 Selling a Product or a Service Learning Objective 1 Understand the three basic types of business activities: operating, investing, and financing. Discuss the Major Activities of a Business Operating Activities: Discuss the Major Activities of a Business Investing Activities: Discuss the Major Activities of a Business Financing Activities: Review the Three Major Activities of a Business Operating Activities Financing Activities Investing Activities Financial Statement Summary and Review Learning Objective 2 Use the two revenue recognition criteria to decide when the revenue from a sale or service should be recorded in the accounting records. Revenue Recognition When: And: Discuss Recognition Concerns As a practical matter, how do most companies handle recognition? record sales when goods are shipped to customers. recognize credit sales as revenues before cash is collected. recognize revenues from services when the service is performed, not necessarily when cash is received. Revenue Recognition On January 1, Formal Apparel sold 20 top hats for cash and another 25 for credit. Each hat sold for $200. How should the $9,000 of revenue be recorded? Credit Sale and Collection On January 10, Mountain Mining sold Edison Excavation $2,000 of equipment on account. Mountain Mining received payment on February 1. What entries are made? Learning Objective 3 Properly account for the collection of cash and describe the business controls necessary to safeguard cash. Discuss the Complications with Revenue Recognition Sales Discounts Sales Returns and Allowances Uncollectible Accounts What Do These Sales Discount Terms Mean? 2/10, n/30 1/10, n/30 2/10, EOM 1/15, EOM Credit Sale and Collection Tidy Paint Supplies sold $1,000 of equipment on account on January 3. The terms of the sales agreement are 2/10, n/30. What are the collection entries if paid on January 10 or on February 15? What Are Contra-Revenue Accounts? How Are Sales Returns and Allowances Reported? Example: Sales Return On January 10, Handy Man Hardware sold $2,500 of equipment during its annual sale. One week later, $250 of equipment was returned. What are the entries? Review the Control of Cash. Learning Objective 4 Record the losses resulting from credit customers who do not pay their bills. What Are Receivables? Example: Accounts Receivable On January 10, Carson Cameras sold $1,000 of equipment on account. The terms of the agreement are 2/10, n/30. Payment was received on January 30. What are the entries? Discuss Uncollectible Accounts. Review The Direct Write-Off Method Discuss The Allowance Method Reversing Written-off Receivables What are the entries if the credit customer eventually pays? Estimating Uncollectible Accounts Receivable What are the three methods? Explain the Percentage of Credit Sales Method Explain the Percentage of Total Receivables Method Estimating Uncollectible Accounts Receivable AS A PERCENTAGE OF CREDIT SALES AS A PERCENTAGE OF TOTAL RECEIVABLES Amount of uncollectibles = a Amount of uncollectibles = a percentage of total straight percentage of the current year’s credit sales. receivables balance at period’s end. Based on experience of prior years, modified for changes Focus is on estimating total expected in current year. bad debts existing at Any existing balance in period’s end. Allowance for Bad Debts is The ending balance in not considered in the Allowance for Bad Debts is adjusting entry to record the amount of total bad debt expense. receivables estimated to be uncollectible. Estimating Uncollectible Accounts Receivable AS A PERCENTAGE OF CREDIT SALES AS A PERCENTAGE OF TOTAL RECEIVABLES In practice, a company should consider both techniques to ensure that each yields roughly consistent results. Uncollectible Accounts Allowance Norm’s Tools had credit sales of $100,000. The current accounts receivable balance is $30,510. The allowance for bad debts balance is $350. Historically, 10 percent of the accounts receivable ending balance is not collected. What is the adjusting entry? Bad Debt Expense Allowance for Bad Debts 350 Bal. End. Bal. 2,701 3,051 End. Bal. Review Aging Accounts Receivable Uncollectible Accounts Expense Copy That had credit sales during the year of $200,000. Using the aging method and the data on the aging receivables worksheet, determine the journal entry needed. The beginning balance for Allowance for Bad Debts is $150. Aging Receivables Worksheet Age Balance Current. . . . . . . . . . $10,000 1-30 days. . . . . . . . 4,000 31-90 days. . . . . . . 2,100 Over 90 days. . . . . 1,000 $17,100 Percentage Estimated to be Uncollectible Amount 1.5% $ 150 4.0 160 20.0 420 40.0 400 $1,130 Uncollectible Accounts Expense Copy That had credit sales during the year of $200,000. Using the aging method and the data on the aging receivables worksheet, determine the journal entry needed. The beginning balance for Allowance for Bad Debts is $150. Bad Debt Expense Allowance for Bad Debts 150 Bal. End. Bal. 980 1,130 End. Bal. Learning Objective 5 Evaluate a company’s management of its receivables by computing and analyzing appropriate financial ratios. % Comment on Assessing Management of Receivables Comment on Assessing Management of Receivables Management of Receivables Adjust It Square had net credit sales of $150,000 during 2001. The accounts receivables increased $5,000 to $40,000 during the same time. Calculate the accounts receivable turnover ratio and the average collection period. Accounts Receivable Turnover: Average Collection Period: Learning Objective 6 Match revenues and expenses by estimating and recording future warranty and service costs associated with a sale. Discuss Customer Service Costs Comment on Warranty Costs Expanded Material Learning Objective 7 Reconcile a checking account. 2000 Bank Statement The Big Bank Bank Statement January 30, 2001 Cash Balance, January 1, 2001 + Deposits – Checks processed Cash Balance, January 30, 2001 2000 What Causes Differences Between the Bank Statement and the Cash Account? Define and Explain the Bank Reconciliation Bank Reconciliation Bal per bank stmt $14,422 Additions to Bank Bal Deposit in Transit 3,100 Total $17,522 Deductions from bank Balance Outstanding Checks #631 $326 #631 426 #634 185 (937) Adj. Bank Bal $16,585 Bal per Books $13,937 Additions to book bal Direct deposit $3,200 Interest 60 3,260 Total $17,197 Deductions from book bal Service charge $ 7 Bank transfer 425 Error recording Ck #630(Jones wages) 180 (612) Adj. Book Bal $16,585 This Completes Chapter 7