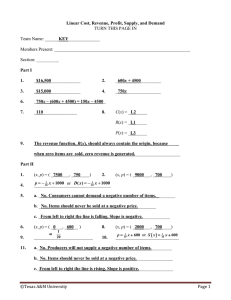

If your annual turnover rate is 4 times, which inventory stock level

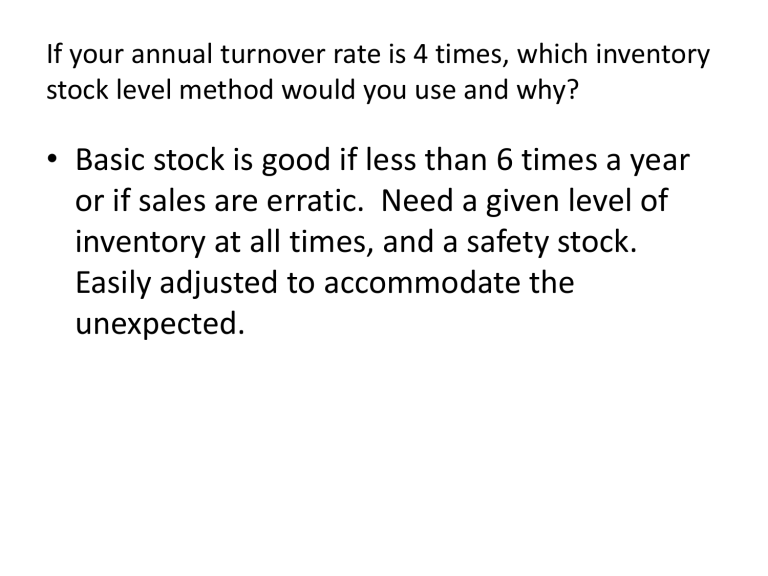

If your annual turnover rate is 4 times, which inventory stock level method would you use and why?

• Basic stock is good if less than 6 times a year or if sales are erratic. Need a given level of inventory at all times, and a safety stock.

Easily adjusted to accommodate the unexpected.

The Corner Hardware Store is attempting to develop a merchandise budget for the next 12 months. To assist in this process, the following data have been developed. The target inventory turnover is 4.8 and forecast sales are:

5

6

7

8

9

10

11

12

3

4

1

2

Month

Sales

Forecast

$27,000

26,000

20,000

34,000

41,000

40,000

28,000

27,000

38,000

39,000

26,000

28,000

374,000

Basic Stock Method

Average Stock = Sales/turnover = 374k/4.8

= 77,916.67

Basic stock = 77,915.67 - 31,166.67 = 46,749

B.O.M. = 46,749 + 27k = 73,749

= 46,749 + 26k = 72,749

= 46,749 + 20k = 66,749

= 46,749 + 34k = 80,749

= 46,749 + 41k = 87,749

= 46,749 + 40k = 86,749

= 46,749 + 28k = 74,749

= 46,749 + 27k = 73,749

= 46,749 + 38k = 84,749

= 46,749 + 39k = 85,749

= 46,749 + 26k = 72,749

= 46,749 + 28k = 74,749

The Corner Hardware Store is attempting to develop a merchandise budget for the next 12 months. To assist in this process, the following data have been developed. The target inventory turnover is 4.8 and forecast sales are:

7

8

9

10

11

12

5

6

3

4

1

2

Month

Sales

Forecast

$27,000

26,000

20,000

34,000

41,000

40,000

28,000

27,000

38,000

39,000

26,000

28,000

Percentage Variation

Average Stock = Sales/turnover = 374k/4.8

= 77,916.67

Average sales = 31,166.67

B.O.M. = 77,916.67 X .5(1+(27k/31,166.67))

(Per. 1 and 8)

= 77,916.67 X .5(1+.86) = 72,708

2 and 11 = 71,458

3 = 63,958

4 = 81,458

5 = 90,208

6 = 88,958

7 and 12 = 73,958

9 = 86,458

10 = 87,708

A buyer is going to market and needs to compute the open-to-buy. The relevant data are as follows: planned stock at the end of March, $319,999 (at retail prices); planned March sales, $ 149,999 ; current stock-on-hand (March

1), $274,000 ; merchandise on order for delivery, $17,000 ; planned reductions, $11,000 . What is the buyer’s open-to-buy?

EOM = 319,999

Planned Sales = 149,999

Pld Reductions = 11,000

Requirements = 480,998

BOM = 274,000

Planned purch.= 206,998

On Order = 17,000 300,000

OTB = 189,998 -93,000

If a vendor ships you $1,000 worth of merchandise on

April 27 with terms of 3/20, net 30 EOM, how much should you pay the vendor on June 8?

If after the 25 th , is considered part of the next month so counting begins the end of May.

3% discount if pay before June 20. Total due on

June 30

June 8 th would pay 1000-(1000*.03) or

1000-30 = 970

A retailer purchases goods that have a list price of $7,500. The manufacturer allows a trade discount of 40 -25-10 and a cash discount of 2/10, net 30. If the retailer takes both discounts, how much is paid to the vendor?

7500 –(.4*7500) = 7500 – 3000 = 4500

(25 and 10 go to others between the retailer and manufacturer)

4500- (.02 * 4500) = 4500 – 90 = 4410

4500- (0.2*7500) = 4500 – 150 = 4350