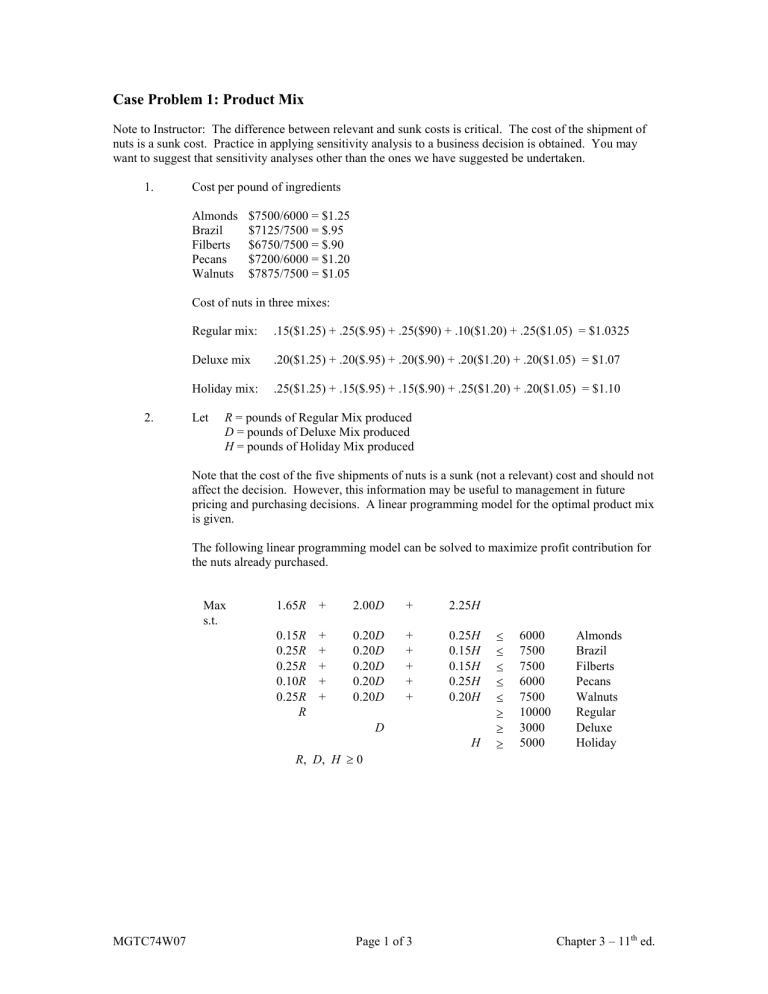

Case Problem 1: Product Mix

Case Problem 1: Product Mix

Note to Instructor: The difference between relevant and sunk costs is critical. The cost of the shipment of nuts is a sunk cost. Practice in applying sensitivity analysis to a business decision is obtained. You may want to suggest that sensitivity analyses other than the ones we have suggested be undertaken.

1. Cost per pound of ingredients

Almonds $7500/6000 = $1.25

Brazil

Filberts

Pecans

$7125/7500 = $.95

$6750/7500 = $.90

$7200/6000 = $1.20

Walnuts $7875/7500 = $1.05

Cost of nuts in three mixes:

Regular mix: .15($1.25) + .25($.95) + .25($90) + .10($1.20) + .25($1.05) = $1.0325

Deluxe mix .20($1.25) + .20($.95) + .20($.90) + .20($1.20) + .20($1.05) = $1.07

Holiday mix: .25($1.25) + .15($.95) + .15($.90) + .25($1.20) + .20($1.05) = $1.10

2. Let R = pounds of Regular Mix produced

D = pounds of Deluxe Mix produced

H = pounds of Holiday Mix produced

Note that the cost of the five shipments of nuts is a sunk (not a relevant) cost and should not affect the decision. However, this information may be useful to management in future pricing and purchasing decisions. A linear programming model for the optimal product mix is given.

The following linear programming model can be solved to maximize profit contribution for the nuts already purchased.

Max s.t.

1.65

R +

0.15

R +

0.25

R

0.25

R

0.10

R

0.25

R

R

+

+

+

+

2.00

D

0.20

D

0.20

D

0.20

0.20

D

D

0.20

D

R , D , H 0

D

+

+

+

+

+

+

2.25

H

0.25

H

0.15

H

0.15

0.25

H

H

0.20

H

H

6000

7500

7500

6000

3000

5000

Almonds

Brazil

Filberts

Pecans

7500 Walnuts

10000 Regular

Deluxe

Holiday

MGTC74W07 Page 1 of 3 Chapter 3 – 11 th ed.

The solution found using The Management Scientist is shown below.

Objective Function Value = 61375.000

Variable Value Reduced Costs

-------------- --------------- ------------------

R 17500.000 0.000

D 10624.999 0.000

H 5000.000 0.000

Constraint Slack/Surplus Dual Prices

-------------- --------------- ------------------

1 0.000 8.500

2 250.000 0.000

3 250.000 0.000

4 875.000 0.000

5 0.000 1.500

6 7500.000 0.000

7 7624.999 0.000

8 0.000 -0.175

OBJECTIVE COEFFICIENT RANGES

Variable Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

R 1.500 1.650 2.000

D 1.892 2.000 2.200

H No Lower Limit 2.250 2.425

RIGHT HAND SIDE RANGES

Constraint Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

1 5390.000 6000.000 6583.333

2 7250.000 7500.000 No Upper Limit

3 7250.000 7500.000 No Upper Limit

4 5125.000 6000.000 No Upper Limit

5 6750.000 7500.000 7750.000

6 No Lower Limit 10000.000 17500.000

7 No Lower Limit 3000.000 10624.999

8 -0.000 5000.000 9692.307

3. From the dual prices it can be seen that additional almonds are worth $8.50 per pound to

TJ. Additional walnuts are worth $1.50 per pound. From the slack variables, we see that additional Brazil nut, Filberts, and Pecans are of no value since they are already in excess supply.

4. Yes, purchase the almonds. The dual price shows that each pound is worth $8.50; the dual price is applicable for increases up to 583.33 pounds.

MGTC74W07 Page 2 of 3 Chapter 3 – 11 th ed.

Resolving the problem by changing the right-hand side of constraint 1 from 6000 to 7000 yields the following optimal solution. The optimal solution has increased in value by

$4958.34. Note that only 583.33 pounds of the additional almonds were used, but that the increase in profit contribution more than justifies the $1000 cost of the shipment.

Objective Function Value = 66333.336

Variable Value Reduced Costs

-------------- --------------- ------------------

R 11666.667 0.000

D 17916.668 0.000

H 5000.000 0.000

Constraint Slack/Surplus Dual Prices

-------------- --------------- ------------------

1 416.667 0.000

2 250.000 0.000

3 250.000 0.000

4 0.000 5.667

5 0.000 4.333

6 1666.667 0.000

7 14916.667 0.000

8 0.000 -0.033

OBJECTIVE COEFFICIENT RANGES

Variable Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

R 1.000 1.650 1.750

D 1.976 2.000 3.300

H No Lower Limit 2.250 2.283

RIGHT HAND SIDE RANGES

Constraint Lower Limit Current Value Upper Limit

------------ --------------- --------------- ---------------

1 6583.333 7000.000 No Upper Limit

2 7250.000 7500.000 No Upper Limit

3 7250.000 7500.000 No Upper Limit

4 4210.000 6000.000 6250.000

5 7250.000 7500.000 7750.000

6 No Lower Limit 10000.000 11666.667

7 No Lower Limit 3000.000 17916.668

8 0.002 5000.000 15529.412

5. From the dual prices it is clear that there is no advantage to not satisfying the orders for the

Regular and Deluxe mixes. However, it would be advantageous to negotiate a decrease in the Holiday mix requirement.

MGTC74W07 Page 3 of 3 Chapter 3 – 11 th ed.