file pdf - Borsa Italiana

advertisement

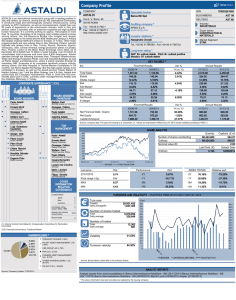

Company Profile COMPANY Specialist broker ISIN YOOX Mediobanca BLOOMBERG YOOX IM REUTERS YOOX.MI Via Nannetti, 1 40069 Zola Predosa YOOX Group is the global Internet retailing partner for leading fashion & design brands. It has established itself amongst the market leaders with the multi-brand online stores yoox.com, thecorner.com and shoescribe.com, as well as with numerous mono-brand online stores, all of which are ''Powered by YOOX Group''. The Group is also a partner of Kering, with which it has created a joint venture dedicated to the management of the mono-brand online stores of several of the Kering Group's luxury brands. The Group has offices and operations in Europe, the United States, Japan, China and Hong Kong and delivers to more than 100 countries worldwide. Listed on the Milan stock exchange, the Group posted consolidated net revenues of Euro 456 million in 2013. For further information: www.yooxgroup.com. KPMG S.p.A. www.kpmg.it C.C.I.(1) C.R.(2) C.N.(3) Executive Non executive Independent Federico Marchetti BOARD MEMBERS OWNERSHIP Federico Marchetti Chairman and CEO 3,160,449 shares on 6/5/14 Stefano Valerio Stefano Valerio Vice Chairman 114,200 shares on 6/5/14 Catherine Gérardin Vautrin Raffaello Napoleone Director 14,555 shares on 6/5/14 Mark Evans Director TOP MANAGEMENT Massimo Giaconia Director Elserino Mario Piol Director Federico Marchetti Raffaello Napoleone Founder & Chief Executive Officer Director Super sector RETAIL Investor relations * Market Segment STAR Silvia Scagnelli E-mail:investor.relations@yoox.com Tel.:+39 02 83112811 - Fax:+39 02 83112891 KEY FIGURES * €m 9 Months CORPORATE GOVERNANCE * (CG) BOARD MEMBERS Industry CONSUMER SERVICES Auditing company * Tel.: 051 6184211 Fax: 051 6184225 www.yooxgroup.com IT0003540470 Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin 30/09/14 366.27 27.15 7.41% 9.26 2.53% 7.77 2.12% 4.57 1.25% Net Financial Debt / (Cash) Net Equity Capital Employed 30/09/14 -3.13 134.75 131.62 Var % '14 vs '13 14.72% 26.26% 30/09/13 319.28 21.50 6.73% 8.02 2.51% 5.59 1.75% 3.53 1.10% Annual Results 31/12/13 31/12/12 455.59 375.92 43.06 32.08 9.45% 8.54% 23.91 18.91 5.25% 5.03% 20.16 16.56 4.42% 4.41% 12.62 10.18 2.77% 2.71% 15.47% 38.96% 29.64% 9 Months Var % '14 vs '13 30/09/13 -5.60 110.71 105.11 Annual Results 31/12/13 31/12/12 -20.50 -14.59 119.66 101.76 99.16 87.18 21.72% 25.22% Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro. Francesco Guidotti Chief Financial Officer Alberto Grignolo SHARE ANALYSIS General Manager Irene Boni Co-General Manager Quantity 61,964,032 61,964,032 Number of shares outstanding Ordinary Nominal value (€) OTHER INFORMATION RELATING GOVERNANCE Last Divid. (€) n/a Ordinary Capitalis. (€ m) 1,215.36 1,215.36 --.-Detach Date n/a Compensation Stock Mbo Incentivo List based voting system (BoD / MB) Quorum for minority shareholders 1.0% Record Date (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model Last price Ord Performance Ord 23/02/2015 19.61 -2Y 39.94% -2Y 87.27% -47.33% Price range (-2y) Ord -1Y -36.46% -1Y 15.89% -52.35% MAX 34.57 -3M 13.19% -3M 21.28% -8.10% MIN 13.49 -1M 7.60% -1M 9.07% -1.47% SHAREHOLDERS * INDEX ITSTAR Relative perf. TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO23/02/2015 YOOX S.P.A.: 0.03% NORGES BANK: 2.16% Turn over BALDERTON CAPITAL I L.P.: 3.54% Total(€) Daily average(€) CAPITAL RESEARCH AND MANAGEMENT COMPANY: 4.23% Number of shares traded FEDERATED EQUITY MANAGEMENT COMPANY OF PENNSYLVANIA: 4.46% Total Daily average MARCHETTI FEDERICO : 7.69% Number of trades RENZO ROSSO: 8.81% Total Daily average OPPENHEIMER FUNDS, INC: 9.29% OTHER SHAREHOLDERS < 2%: 59.79% 693,964,670 18,755,802 37,753,434 1,020,363 106,372 2,875 A Volatility 33.76% Source: SOCIETA' Update: 18/02/2015 A Turnover velocity 418.26% Source: Borsa Italiana. Data refer to the ordinary shares. ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Mediobanca (06/02/2015) Mediobanca (06/11/2014) Merrill Lynch (06/11/2014) Merrill Lynch (06/11/2014) Kepler (27/08/2014) * The above information has been provided and updated by the issuing company