file pdf - Borsa Italiana

advertisement

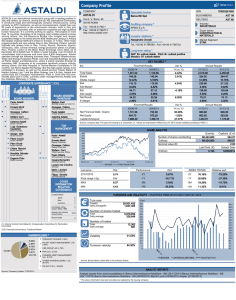

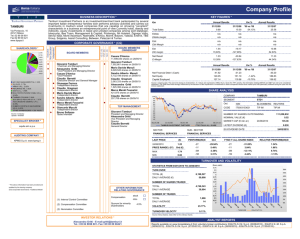

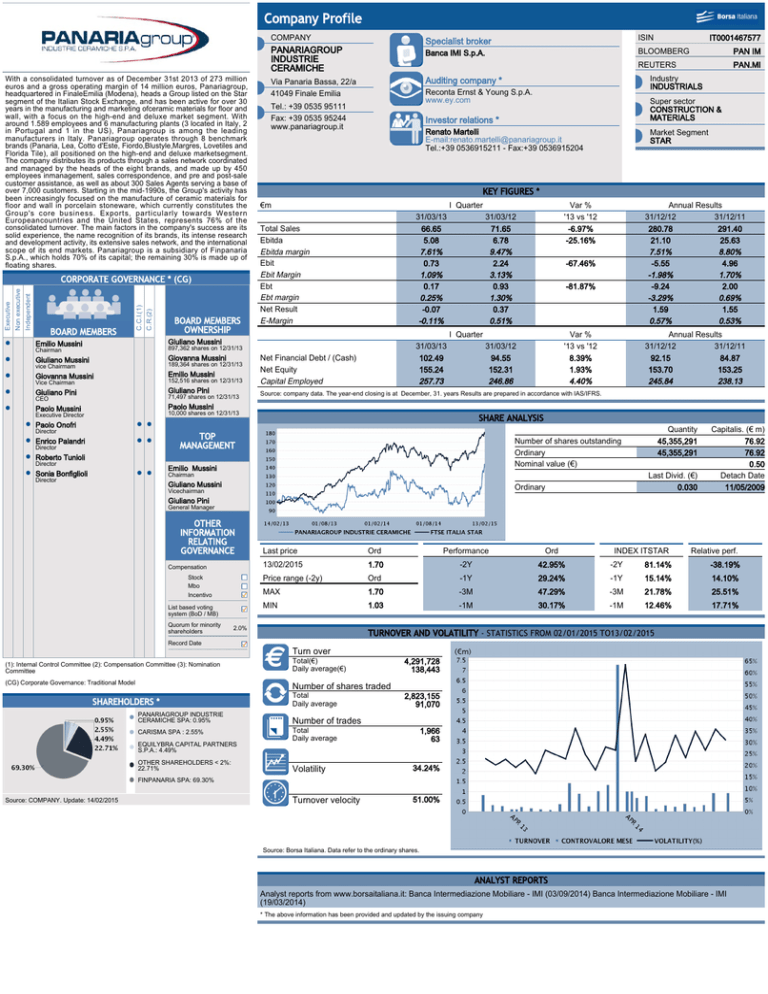

Company Profile With a consolidated turnover as of December 31st 2013 of 273 million euros and a gross operating margin of 14 million euros, Panariagroup, headquartered in FinaleEmilia (Modena), heads a Group listed on the Star segment of the Italian Stock Exchange, and has been active for over 30 years in the manufacturing and marketing ofceramic materials for floor and wall, with a focus on the high-end and deluxe market segment. With around 1.589 employees and 6 manufacturing plants (3 located in Italy, 2 in Portugal and 1 in the US), Panariagroup is among the leading manufacturers in Italy. Panariagroup operates through 8 benchmark brands (Panaria, Lea, Cotto d'Este, Fiordo,Blustyle,Margres, Lovetiles and Florida Tile), all positioned on the high-end and deluxe marketsegment. The company distributes its products through a sales network coordinated and managed by the heads of the eight brands, and made up by 450 employees inmanagement, sales correspondence, and pre and post-sale customer assistance, as well as about 300 Sales Agents serving a base of over 7,000 customers. Starting in the mid-1990s, the Group's activity has been increasingly focused on the manufacture of ceramic materials for floor and wall in porcelain stoneware, which currently constitutes the Group's core business. Exports, particularly towards Western Europeancountries and the United States, represents 76% of the consolidated turnover. The main factors in the company's success are its solid experience, the name recognition of its brands, its intense research and development activity, its extensive sales network, and the international scope of its end markets. Panariagroup is a subsidiary of Finpanaria S.p.A., which holds 70% of its capital; the remaining 30% is made up of floating shares. C.R.(2) BOARD MEMBERS C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) BOARD MEMBERS OWNERSHIP COMPANY Specialist broker ISIN PANARIAGROUP INDUSTRIE CERAMICHE Banca IMI S.p.A. BLOOMBERG PAN IM REUTERS PAN.MI Via Panaria Bassa, 22/a 41049 Finale Emilia Auditing company * Chairman 897,362 shares on 12/31/13 Giuliano Mussini Giovanna Mussini Super sector CONSTRUCTION & MATERIALS Investor relations * Renato Martelli E-mail:renato.martelli@panariagroup.it Tel.:+39 0536915211 - Fax:+39 0536915204 I Quarter Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin 31/03/13 66.65 5.08 7.61% 0.73 1.09% 0.17 0.25% -0.07 -0.11% 31/03/13 102.49 155.24 257.73 Var % '13 vs '12 -6.97% -25.16% 31/03/12 71.65 6.78 9.47% 2.24 3.13% 0.93 1.30% 0.37 0.51% -81.87% I Quarter Var % '13 vs '12 8.39% 1.93% 4.40% 31/03/12 94.55 152.31 246.86 Vice Chairman 152,516 shares on 12/31/13 Giuliano Pini Giuliano Pini Source: company data. The year-end closing is at December, 31. years Results are prepared in accordance with IAS/IFRS. 189,364 shares on 12/31/13 Giovanna Mussini Emilio Mussini CEO 71,497 shares on 12/31/13 Paolo Mussini Paolo Mussini 10,000 shares on 12/31/13 Executive Director TOP MANAGEMENT Enrico Palandri Director Emilio Mussini Sonia Bonfiglioli Chairman Director Quantity 45,355,291 45,355,291 Number of shares outstanding Ordinary Nominal value (€) Roberto Tunioli Director Annual Results 31/12/12 31/12/11 92.15 84.87 153.70 153.25 245.84 238.13 SHARE ANALYSIS Paolo Onofri Director Annual Results 31/12/12 31/12/11 280.78 291.40 21.10 25.63 7.51% 8.80% -5.55 4.96 -1.98% 1.70% -9.24 2.00 -3.29% 0.69% 1.59 1.55 0.57% 0.53% -67.46% Net Financial Debt / (Cash) Net Equity Capital Employed vice Chairmam Market Segment STAR KEY FIGURES * €m Giuliano Mussini Emilio Mussini Industry INDUSTRIALS Reconta Ernst & Young S.p.A. www.ey.com Tel.: +39 0535 95111 Fax: +39 0535 95244 www.panariagroup.it IT0001467577 Giuliano Mussini Last Divid. (€) 0.030 Ordinary Vicechairman Capitalis. (€ m) 76.92 76.92 0.50 Detach Date 11/05/2009 Giuliano Pini General Manager OTHER INFORMATION RELATING GOVERNANCE Compensation Stock Mbo Incentivo List based voting system (BoD / MB) Quorum for minority shareholders Last price Ord Performance Ord 13/02/2015 1.70 -2Y 42.95% -2Y 81.14% -38.19% Price range (-2y) Ord -1Y 29.24% -1Y 15.14% 14.10% MAX 1.70 -3M 47.29% -3M 21.78% 25.51% MIN 1.03 -1M 30.17% -1M 12.46% 17.71% 2.0% INDEX ITSTAR Relative perf. TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 Record Date Turn over (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model Total(€) Daily average(€) 4,291,728 138,443 Number of shares traded SHAREHOLDERS * PANARIAGROUP INDUSTRIE CERAMICHE SPA: 0.95% CARISMA SPA : 2.55% EQUILYBRA CAPITAL PARTNERS S.P.A.: 4.49% OTHER SHAREHOLDERS < 2%: 22.71% Total Daily average 2,823,155 91,070 Number of trades Total Daily average 1,966 63 A Volatility 34.24% FINPANARIA SPA: 69.30% A Source: COMPANY. Update: 14/02/2015 Turnover velocity 51.00% Source: Borsa Italiana. Data refer to the ordinary shares. ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Banca Intermediazione Mobiliare - IMI (03/09/2014) Banca Intermediazione Mobiliare - IMI (19/03/2014) * The above information has been provided and updated by the issuing company