Cash Flow Basics! - The Controllership Group

advertisement

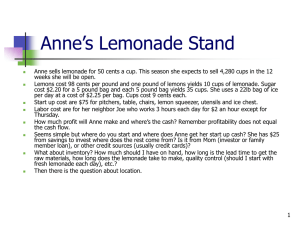

Let’s Understand How Cash Flow Works! Presented By Carl Kinker The Controllership Group 1 Reasons For Business Failure In his book Small Business Management, Michael Ames gives the following reasons for small business failure: 1:Lack of experience 2:Insufficient capital (money) 3:Poor location 4:Poor inventory management 5:Over-investment in fixed assets 6:Poor credit arrangements 7:Personal use of business funds 8:Unexpected growth Gustav Berle adds two more reasons in The Do It Yourself Business Book: 9:Competition 10:Low sales In my opinion 6 out of the first 8 have a direct tie to CASH A business can be profitable yet experience problems paying bills and meeting other obligations because it lacks cash at the right time. 2 Cash Flow Basics The basic problem is the lag time between incurring an expense and paying for it, billing a client and actually being paid. Lenders often look at cash flow projections in connection with a loan request. They want to see how they will be repaid. Cash flow is more than your checkbook. This is a start but cash flow is much more dynamic. Cash flow is the measurement of everything that either has or will turn into a cash inflow or outflow. How you manage the flow can have a significant impact on your business success or failure. 3 Cash Flow Basics continued Cash flow can presented looking back in time but more importantly you need to look forward and prepare a cash flow projection or budget to anticipate any potential problems. Basic components of cash flow projection: Cash Inflow for the month from operations Cash Outflow for the month from operations Beginning cash on hand Plus cash receipts anticipated = cash sales, credit sales, A/R collections & other receipts Total cash inflow = beginning cash + receipts Operating expenses such as wages, payroll taxes, rent, utilities, insurance, taxes, advertising, etc. (cash payments or through accounts payable) Inventory purchases (cash paid or payments via accounts payable) Other outflows expected not related to financing or investing Total up all the outflows Cash from (used) in operations = Total inflow - total outflow 4 Cash Flow Basics continued Basic components of cash flow projection continued: Cash provided (+) or used (-) from financing and investing (-) Capital expenditures for equipment, fixtures, furniture, autos, land, and buildings (-) Principal payments on loans and lines of credit (+) Borrowing on lines of credit or long term debt (+) or (-) Owners contributions or withdrawals Cash provided (used) from financing and investing = total of above items Net cash inflow (outflow) for the month = cash from (used) in operations + cash provided or (used) from financing and investing When preparing your projections try to project out at least one year. Some of your operating expenses will be fixed like rent and some variable like hourly wages. 5 Anne’s Lemonade Stand Anne sells lemonade for 50 cents a cup. This season she expects to sell 4,280 cups in the 12 weeks she will be open. Lemons cost 98 cents per pound and one pound of lemons yields 10 cups of lemonade. Sugar cost $2.20 for a 5 pound bag and each 5 pound bag yields 35 cups. She uses a 22lb bag of ice per day at a cost of $2.25 per bag. Cups cost 9 cents each. Start up cost are $75 for pitchers, table, chairs, lemon squeezer, utensils and ice chest. Labor cost are for her neighbor Joe who works 3 hours each day for $2 an hour except for Thursday. How much profit will Anne make and where’s the cash? Remember profitability does not equal the cash flow. Seems simple but where do you start and where does Anne get her start up cash? She has $25 from savings to invest where does the rest come from? Is it from Mom (investor or family member loan), or other credit sources (usually credit cards)? What about inventory? How much should I have on hand, how long is the lead time to get the raw materials, how long does the lemonade take to make, quality control (should I start with fresh lemonade each day), etc.? Then there is the question about location. 6 Anne’s Lemonade Stand Let’s Start with calculating some basic information What is Anne’s Standard cost? 5 lb of sugar yields 35 Material cost Lemons per lb $0.98 Sugar 5lb bag $2.20 Total standard material cost 1 0.098 0.06286 0.16086 per cup Bag of ice $2.25 cost per day Labor cost/hr # hrs worked Cost per day $2.00 3 $6.00 7 Anne’s Lemonade Stand Next step let’s project revenue and expenses Anne's Lemonade Stand Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Total 5% 6% 8% 10% 8% 8% 10% 10% 15% 8% 8% 5% 100% 214 257 342 428 321 321 428 428 642 342 342 215 4280 107.00 128.50 171.00 214.00 160.50 160.50 214.00 214.00 321.00 171.00 171.00 107.50 2,140.00 34.42 41.34 55.01 68.85 51.64 51.64 68.85 68.85 103.27 55.01 55.01 34.58 688.47 72.58 87.16 115.99 145.15 108.86 108.86 145.15 145.15 217.73 115.99 115.99 72.92 1,451.53 5 5 5 5 5 5 5 5 5 5 5 5 60 $6.00 Salary & Wages 24.00 24.00 24.00 24.00 24.00 24.00 24.00 24.00 24.00 24.00 24.00 24.00 288.00 $2.25 Ice 11.25 11.25 11.25 11.25 11.25 11.25 11.25 11.25 11.25 11.25 11.25 11.25 135.00 $0.09 Cups 19.26 23.13 30.78 38.52 28.89 28.89 38.52 38.52 57.78 30.78 30.78 19.35 385.20 $1.00 Wagon rental 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 60.00 1.00% Interest 0.00 1.00 0.80 0.60 0.40 0.20 0.00 0.00 0.00 0.00 0.00 0.00 3.00 Total operating ex penses 59.51 64.38 71.83 79.37 69.54 69.34 78.77 78.77 98.03 71.03 71.03 59.60 871.20 Net Profit 13.07 22.78 44.16 65.78 39.32 39.52 66.38 66.38 119.70 44.96 44.96 13.32 580.33 Cups Sold $0.50 Sales $0.16086 Cost of sales Gross Margin Assumption # day s open Operating Ex penses Other 0.00 8 Anne’s Lemonade Stand Clearly Anne made a profits with a 67.83% gross margin and low overhead but how does the cash flow look over this same time period? Many question need to be asked to project her cash flow. What inventory levels should she maintain – minimum and maximum? How much lemonade should be made each day (production)? Could profitability be enhanced by ordering bulk quantities of raw material and how would this impact liquidity? Will she have enough staff to cover peak sales periods? What other problems should she anticipate? Bad weather, bad lemons, have secondary suppliers, transportation, bad location What assets will need to be bought that effect the balance sheet and cash but not revenue and expense? Illness, vacations, no shows, unexpected sales volume Pitchers, mixing containers, cash box, cost to construct the stand, delivery vehicle Are there other cost overlooked by Anne? 9 Anne’s Cash Flow Projection Inventory cost of purchases Purchase-lemons-lbs 46.16 33.52 41.94 31.46 31.46 41.94 41.94 62.92 33.52 33.52 21.07 419.44 Purchase Sugar-5 lb bags 33.00 22.00 26.40 19.80 19.80 26.40 26.40 39.60 22.00 22.00 13.20 270.60 838.88 541.20 Total purchases 79.16 55.52 68.34 51.26 51.26 68.34 68.34 102.52 55.52 55.52 34.27 690.04 1,380.08 Lemons 47.10 34.20 42.80 32.10 32.10 42.80 42.80 64.20 34.20 34.20 21.50 Sugar 13.46 9.77 12.23 9.17 9.17 12.23 12.23 18.34 9.77 9.77 6.14 Cups of lemonade made 471 342 428 321 321 428 428 642 342 342 215 0 4,280.00 Beginning inventory $ 0.00 44.74 58.91 72.25 54.66 54.27 70.98 70.47 104.14 56.38 56.89 36.15 0 Lemons 46.16 33.52 41.94 31.46 31.46 41.94 41.94 62.92 33.52 33.52 21.07 Sugar 33.00 22.00 26.40 19.80 19.80 26.40 26.40 39.60 22.00 22.00 13.20 Inv entory purchased 79.16 55.52 68.34 51.26 51.26 68.34 68.34 102.52 55.52 55.52 34.27 0.00 690.04 Inv entory sold 34.42 41.34 55.01 68.85 51.64 51.64 68.85 68.85 103.27 55.01 55.01 34.58 688.47 Ending inventory $ 44.74 58.91 72.25 54.66 54.27 70.98 70.47 104.14 56.38 56.89 36.15 1.57 1.57 44.74 14.18 13.33 (17.59) (0.38) 16.70 (0.51) 33.67 (47.75) 0.51 (20.74) (34.58) 1.57 Production-cups 428.00 122.29 Purchases 419.44 270.60 10 Anne’s Inventory Assumptions Production and inventory calculations Raw Materials Inventory units Lemons-Beginning Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Total 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Purchase 47.10 34.20 42.80 32.10 32.10 42.80 42.80 64.20 34.20 34.20 21.50 419.44 847.44 Used in production 47.10 34.20 42.80 32.10 32.10 42.80 42.80 64.20 34.20 34.20 21.50 0.00 428.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 419.44 419.44 Lemons-Ending Sugar-Beginning 0.00 1.54 1.77 1.54 1.37 1.20 0.97 0.74 0.40 0.63 0.86 0.71 0.00 Purchase 15.00 10.00 12.00 9.00 9.00 12.00 12.00 18.00 10.00 10.00 6.00 270.60 393.60 Used in production 13.46 9.77 12.23 9.17 9.17 12.23 12.23 18.34 9.77 9.77 6.14 0.00 122.29 1.54 1.77 1.54 1.37 1.20 0.97 0.74 0.40 0.63 0.86 0.71 271.31 271.31 0.00 471.00 813.00 1,241.00 1,562.00 1,883.00 2,311.00 2,739.00 3,381.00 3,723.00 4,065.00 4,280.00 0.00 471.00 342.00 428.00 321.00 321.00 428.00 428.00 642.00 342.00 342.00 215.00 0.00 4,280.00 Sugar-Ending Finished Goods (Lemonade) Beginning Inventory Plus Production Less Cost of sales Ending Inventory Inventory usage required for sales Lemons-Lbs Sugar - 5 lb bags Sugar rounding 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 471.00 813.00 1,241.00 1,562.00 1,883.00 2,311.00 2,739.00 3,381.00 3,723.00 4,065.00 4,280.00 4,280.00 4,280.00 214 257 342 428 321 321 428 428 642 342 342 215 4,280.00 21.40 25.70 34.20 42.80 32.10 32.10 42.80 42.80 64.20 34.20 34.20 21.50 428.00 6.11 7.34 9.77 12.23 9.17 9.17 12.23 12.23 18.34 9.77 9.77 6.14 122.29 7 8 10 12 9 9 12 12 18 10 10 6 123.00 Purchase-lemons-lbs 46.16 33.52 41.94 31.46 31.46 41.94 41.94 62.92 33.52 33.52 21.07 419.44 838.88 Purchase Sugar-5 lb bags 33.00 22.00 26.40 19.80 19.80 26.40 26.40 39.60 22.00 22.00 13.20 270.60 541.20 Total purchases 79.16 55.52 68.34 51.26 51.26 68.34 68.34 102.52 55.52 55.52 34.27 690.04 1,380.08 Inventory cost of purchases Production-cups Lemons 47.10 34.20 42.80 32.10 32.10 42.80 42.80 64.20 34.20 34.20 21.50 Sugar 13.46 9.77 12.23 9.17 9.17 12.23 12.23 18.34 9.77 9.77 6.14 Cups of lemonade made Beginning inventory $ 471 342 428 321 321 428 428 642 342 342 215 428.00 122.29 0 36.15 4,280.00 0.00 44.74 58.91 72.25 54.66 54.27 70.98 70.47 104.14 56.38 56.89 0 Lemons 46.16 33.52 41.94 31.46 31.46 41.94 41.94 62.92 33.52 33.52 21.07 Sugar 33.00 22.00 26.40 19.80 19.80 26.40 26.40 39.60 22.00 22.00 13.20 Inventory purchased 79.16 55.52 68.34 51.26 51.26 68.34 68.34 102.52 55.52 55.52 34.27 0.00 690.04 Inventory sold 34.42 41.34 55.01 68.85 51.64 51.64 68.85 68.85 103.27 55.01 55.01 34.58 688.47 Ending inventory $ 44.74 58.91 72.25 54.66 54.27 70.98 70.47 104.14 56.38 56.89 36.15 1.57 1.57 44.74 14.18 13.33 (17.59) (0.38) 16.70 (0.51) 33.67 (47.75) 0.51 (20.74) (34.58) 1.57 Purchases 419.44 270.60 11 Ways To Improve Cash Flow Timely customer invoicing must be a high priority If you use billings try to understand your customer’s payment patterns Weekly follow-up on collecting receivables and monitoring your customer accounts Make sales for cash or credit card rather than invoicing Maintain reasonable inventory levels – reevaluate what is reasonable often Renegotiate payment terms with your suppliers to extend payment terms If your competition is getting deposits or money up front are you? Pay invoices or bills when they are due not as they come in 12 Ways To Improve Cash Flow Finance fixed asset purchases Apply for a working capital line of credit Be realistic in amounts you are taking out personally Consider increasing your pricing Find ways to reduce expenses Increase sales 13 Proper Use of Debt Versus Improper Use of Debt Matching type of debt with its use Short term money (line of credit and charge cards) should be matched to working capital needs short term in nature Term loans should be matched to buying a business, equipment and permanent working capital. Long term in nature. 14 Why This Is Important! 15 What Does All This Mean? Cash flow is the life blood of your business. Just like our bodies cannot allow a loss of blood on an ongoing basis neither can your business. You have to understand your cash flow or work with someone that can help you to understand it and make it work for you! 16