Improving the performance of the marketing system for

advertisement

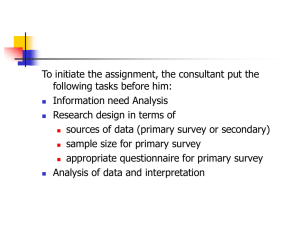

Improving the Marketing System Performance of Fruits and Vegetables in Bangladesh Professor Dr. Md. Kamrul Hassan Department of Horticulture Bangladesh Agricultural University Research Team Research Team Principal Investigator Professor Dr. Md. Kamrul Hassan Department of Horticulture, BAU, Mymensingh Co-Investigator Professor Dr. Shankar Kumar Raha Department of Agribusiness & Marketing Bangladesh Agricultural University, Mymensingh Research Assistant Nasrin Akhther Research Fellows Five Research Fellows 57 65 71 75 94 100 106 124 157 159 159 176 182 Bangladesh Cambodia Sudan Sri Lanka Myanmar Pakistan Nepal India Malaysia Vietnam Japan China Indonesia Thailand Saudia Arabia Australia New Zealand Philippines USA UK Maldives Canada Italy Sudan UK Italy USA Canada New Zealand Australia Saudia Arabia Maldives Japan India Malaysia China 249 Nepal 288 Sri Lanka 293 Thailand 302 Indonesia 303 Philippines 304 Pakistan 348 Cambodia 370 Myanmar 392 Bangladesh 426 Vietnam 300 400 500 Research Background 5 15 16 23 25 25 28 Fruits 0 100 200 Rice 85 119 155 194 210 210 214 267 282 345 353 405 417 430 438 452 0 100 200 300 400 Fruits & vegetables requirement: 400 g Fruits & vegetables availability: 281 g day-1capita-1 Postharvest loss: 24-44% (34420 million BDT = 490 million US$) (Hassan 2010) day-1capita-1 APPERENT CONSUMPTION OF FRUITS AND RICE 500 Research Background UNHYGENIC MARKET CONDITIONS (KARWAN BAZAR, DHAKA) Selected Commodities and Objectives 1 To describe actors, commodity flows and price formation in the marketing chain in Bangladesh, from main producing areas to Dhaka retail markets 2 To evaluate performance of marketing system by calculating gross and net margins for each of the five foods studied To Assess the critical factors affecting market performance and to propose policy recommendations for enhancing market performance 3 Watergourd Tomato Cauliflower Pumpkin Cabbage Arum Pointed Snake gourd Beans Cucumber gourd Ribbed goud Okra 2% Pineapple Watermelon Papaya Citrus Ber Litchi Mango Coconut 14% 1 Banana Brinjal 7% 2 Radish 3 Potato 24% Jackfruit 65% Vegetable area (2010) Fruit area (2010) OBJECTIVES AND SELECTED FRUITS AND VEGETABLES Approaches and Methodology Approaches & methodologies Secondary data Primary survey Secondary data collection Secondary data on acreage, production, prices of the selected commodity (potato, brinjal, okra, banana and mango) and important cereals (rice, wheat and maize) were collected. Time Series Analysis was used to examine changes in acreage, production and prices (nominal and real) Seasonal price variation was calculated using Moving Average Method SELECTED DISTRICTS FOR PRIMARY SURVEY Primary data collection Primary data were collected from market actors using FGD and questionnaire interview. Data were collected by trained enumerators and Research Fellows Data collection from growers Stratified random sampling were followed Leading 1-2 Districts for each commodity were selected Selected growers (N=100 per commodity) were interviewed using structured questionnaires Methodology (Data Collection) Data collection from intermediaries Respondents were Faria, Bepari, Aratdar, wholesalers, retailers Faria & Bepari were interviewed from assemble markets (N=100) Aratdar & wholesalers were interviewed from wholesale markets (N=100) Retailers were interviewed from retail markets in Dhaka and also in production area (N=100) Data collection mainly concentrated on personal information, trade volume, marketing costs, purchase & sale prices, price formation, constraints, etc. Results-Potato (Primary) DATA COLLECTION & TRAINING OF ENUMERATOR LOCATION OF PRIMARY SURVEY Commodities Respondents Growers, Faria, Bepari Survey areas Munshigonj, Bogra Brinjal Growers, Faria, Bepari Norshingdi, Jessore Okra Growers, Faria, Bepari Comilla, Chittagong Mango Growers, Faria, Bepari Banana Growers, Faria, Bepari Chapai Nowabgonj, Rajshahi Tangail, Kushtia Potato, brinjal, okra, mango, banana Aratdar, wholesalers, retailers Potato Dhaka Methodology-Marketing Performance Parameters investigated At growers’ level Data were mainly collected on age, education, land, cultivated varieties, production factors, production and marketing costs, sale price, price formation, constraints, etc. At intermediary level Marketing channels, market actor, marketing costs and margins, price determination, postharvest handling status, marketing constraints, etc. Marketing performance was evaluated using different measures of marketing efficiency Methodology-Marketing Performance a. Price spread = (Price paid by consumers – Price received by growers) b. Growers’ share = (Price received by the growers/Consumers price)*100 c. Marketing efficiency using Acharya’s formula = FP/(MC+MM) Total Marketing Cost (MC) Net Marketing Margin (MM) Prices Received by the Farmers (FP) d. Return on investment, ROC (%) = (Net margin/Total investment) Total investment = (Purchase price + marketing cost) Results: Rice (Only Secondary Data) 200 45 180 40 35 30 140 20 Retail medium (nominal) Retail medium (deflated) 5 2010-11 2009-10 2008-09 2007-08 2006-07 0 2005-06 40 10 2004-05 60 15 2003-04 80 20 2002-03 100 25 2001-02 120 Price (Tk/kg) Production (million mt) 160 PRICE VARIATION IN BANGLADESH 0 GLOBAL RANKING IN RICE PRODUCTION 108 104 102 105 104 103 CV: 2.96% 103 102 100 99 98 96 96 101 100 99 99 96 CV: 1.22% 102 101 101 101 100 101 101 100 100 100 100 94 92 y = 0.0712x2 - 1.0584x + 103.03 R² = 0.5712 102 97 99 Wholesale price 99 98 98 90 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Seasonal price index 106 Results: Rice (Only Secondary Data) y = 0.1746x2 - 2.6774x + 107.95 R² = 0.6674 98 97 96 Retail price 95 Jan Mar May Jul Sep SEASONALITY IN RICE PRICE (2000-01 to 2010-11) Nov Results: Rice (Only Secondary Data) Chart Title 1600 40 35 1200 30 108 25 106 1000 20 800 15 600 10 400 5 200 0 0 Area (000 ha) Nominal harvest price (TK/kg) Real harvest price (Tk/kg) Production (000 MT) Nominal wholesale price (TK/kg) Real wholesale price (Tk/kg) PRODUCTION & PRICE 104 102 100 98 96 94 y = 0.2637x2 - 3.3453x + 107.46 R² = 0.6284 104 CV=3.68% 104 102 103 103 102 101 99 CV: 3.68% 95 95 96 96 92 90 88 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1400 Seasonal price index (Wholesale) 1800 SEASONALITY SEASONALITY PRODUCTION AND PRICE RELATIONSHIP & SEASONALITY China India Russia Ukraine USA Germany Poland Bangladesh Belarus Netherlands France UK Malawi Turkey Canada Iran Peru Egypt Brazil Belgium Production (million mt) 80 Results: Potato (Secondary Data) 70 60 50 40 30 20 10 0 GLOBAL RANKING IN POTATO PRODUCTION Results: Potato (Secondary Data) 9000 30 8000 25 7000 Production 6000 20 5000 15 4000 3000 10 2000 5 1000 0 0 Results partially support cobweb model High production in one year causes less price in following year Potato price did not change over the last decade in real term Export of potato and potato products Limitation- absence of HACCP & standards (GAP) Production (000 MT) Nominal retail price (Tk/kg) Real retail price (Tk/kg) PRODUCTION & PRICE RELATIONSHIP (POTATO) 90 60 60 85 50 0.5968x 2 80 y= - 3.2717x + 88.942 R² = 0.5049 CV: 24.75% 40 Jan Mar May Jul Sep Months (2004-09) Nov 85 75 84 RETAIL 74 70 Dec WHOLESALE 93 91 Nov 69 95 Oct 73 70 102 100 82 80 112 110 Sep 89 105 Aug 90 106 110 Jul 100 CV: 14.13% 110 107 Jun 106 115 May 110 120 Apr Seasonal Price Indicies 116 y = -0.015x2 + 3.6458x + 77.114 117 R² = 0.7759 115 Mar 118 120 126 Feb 130 Results: Potato (Secondary Data) 128 Jan 128 Results on seasonal price variation underlined vital role of potato as a source of macro nutrients because the peak prices of rice & wheat are fairly synchronized but potato is counter synchronized. So, there are scopes to popularize potato and potato products as alternatives to main staples rice and wheat. SEASONALITY IN POTATO WHOLESALE AND RETAIL PRICES Results: Potato (Primary Survey) Potato marketing channel (Bogra-Dhaka) Farmer (conventional storage) Feb-May Farmer (early crop, net income 4.87 Tk/kg) Farmer (cold store) AugustJan (net income: 8.76 Tk/kg) Faria Net margin: 9.81% Bepari Net margin: 23.92% Aratdar Net margin: 3.35% Processing unit Wholesalers Net margin: 18.66% Retailers Net margin: 44.26% Consumers POTATO MARKETING CHANNEL (BOGRA-DHAKA) Results: Potato (Primary Survey) Retailers receive the highest net margins. However, it is worth to mention that for perishables, retailers assume more risk and their per unit marketing as well as operating costs are higher MARKETING COSTS & MARGINS Results: Potato (Primary Survey) Marketing channels Price spread (Tk. kg-1) Growers’ share (%) Marketing efficiency Bogra-Dhaka Channel Shibgonj-Karwan Bazar Shibgonj-Jatrabari Shibgonj-Mohakhali Kacha Bazar Shibgonj-Gulshan D.C.C. Market Shibgonj-Badda Kacha Bazar Kahalu-Karwan Bazar Kahalu-Jatrabari Kahalu-Mohakhali Kacha Bazar Kahalu-Gulshan D.C.C. Market Kahalu-Badda Kacha Bazar 6.30 7.50 7.50 13.50 5.75 6.30 7.50 7.50 13.50 5.75 54.35 50.00 50.00 35.71 56.60 54.35 50.00 50.00 35.71 56.60 0.816 0.794 0.727 0.695 0.824 0.819 0.807 0.776 0.709 0.842 Mean 8.11 49.33 0.781 Munshigonj-Dhaka Channel Munshigonj Sadar-Karwan Bazar Munshigonj Sadar-Jatrabari Munshigonj Sadar-Mohakhali Kacha Bazar Munshigonj Sadar-Gulshan D.C.C. Market Munshigonj Sadar-Badda Kacha Bazar Tongibari-Karwan Bazar Tongibari-Jatrabari Tongibari-Mohakhali Kacha Bazar Tongibari-Gulshan D.C.C. Market Tongibari-Badda Kacha Bazar 2.12 3.32 3.32 9.32 1.57 4.03 5.23 5.23 11.23 3.48 84.64 77.87 77.87 55.62 88.15 70.80 65.13 65.13 46.52 73.74 1.094 1.161 1.004 0.996 1.190 1.260 1.300 1.190 1.160 1.210 Mean 4.89 70.55 1.157 Results: Potato (Primary Survey) 760 750 665 690 600 620 715 665 625 650 Potato price (Tk/mound) 715 620 560 550 475 500 450 465 400 350 475 475 380 300 300 500 300 300 250 200 150 Jan Feb Mar Apr May June Jul Aug Month (2012) Lal Pakhri Cardinal Granula FARMERS’ PRICE OF DIFFERENT VARIETIES OF POTATO (2012) Results-Potato (Primary) POSTHARVEST OPERATION: WASHING (EARLY CROP) Results-Potato (Primary) POSTHARVEST OPERATION: LOADING (80 kg ) Results: Potato (Primary Survey) Sequential steps of storing of potatoes in commercial cold storage Growers (Field cured potato tubers) Private cold store Pre-cooling (10-12oC 24-48 h or no pre-cooling but held under shade for 24 h and store Storing Normal (For table purposes (AugJanuary) Pre-heating (48 h at 10-12oC for 2448 h before delivery; Aug-Jan) Marketing (Table potato: AugJan & Seed potato: October) (2.2-2.8oC and 8590% RH; Mar-Jan) Sorting shade (8 h drying under fan at normal condition before delivery; June-January) Traditional storage BADC Cold store SEQUENTIAL STEPS OF STORING POTATOES IN COMMERCIAL COLD STORES Results: Potato (Primary Survey) Shortfalls in potato cold stores 1. Erratic supply of electricity: For table potato, temperature and RH should be 35-37oF and 85-95%. Machine should operate for 17-18 h day-1 but present electricity supply is for 10-12 h day-1. For rest of the day, generator is used at a cost of approx. 100 L diesel h-1. To avoid this cost, often generator is not run or run for shorter duration that results in degraded quality. 2. Physiological disorders: Ventilation or flushing with fresh air is required. This helps reduce carbon dioxide build up inside cold store and inhibit sprouting. This is practiced in the dawn or early morning. Sometimes this is not done to save labour. 3. Less turn over: Another important practice in cold store is change in position of potato sacks (turn over or “Palat”) every 21-28 days. Again this practice is not properly followed to save cost. Results: Potato (Primary Survey) Improving cold storage facilities in Bangladesh 1. 2. 3. 4. 5. Improving the conditions of electric supply Safeguarding the interests of the growers and traders Capacity strengthening of the growers Capacity strengthening of the staff of cold storage Maintenance of multi-chambered cold storage Ideal conditions for table & seeds potatoes are 6-10oC and 85-90% and 2-4oC and 85-90% relative humidity, respectively. Therefore, commercial cold store should have different chambers with different temperature & RH conditions. 6. Increasing number of BADC cold storage Growers have strong demands for more BADC cold stores so that they can store their own seeds for at least 1-2 seasons, and thereby import of potato seed tubers is reduced and hard-earned foreign currencies are saved. The growers also have demand to introduce at least one chamber in each private cold stores specifically for seeds. Results: Brinjal (Primary Survey) 35 Harvest (nominal) price (TK/kg) Harvest (real) price (Tk/kg) Retail (nominal) price (TK/kg) Retail (real) price (Tk/kg) 30 CV = 35.75 Seasonal price indices (Wholesale) 25 20 15 10 5 0 200 180 160 140 120 y = 61.496e0.0663x R² = 0.4878 CV: 35.75% 100 80 60 40 20 0 PRICE VARIATION Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Months (2004-2009) SEASONALITY PRICE VARIATION AND SEASONALITY IN BRINJAL Results: Brinjal (Primary Survey) Norshingdi-Dhaka Jessore (Chougacha)-Dhaka Farmer Farmer Faria Net margin: 10.07% Faria Bepari Net margin: 16.77% Bepari Aratdar Net margin: 14.73% Aratdar (Dhaka) Wholesalers Net margin: 8.50% Wholesalers Retailers Net margin: 49.64% Retailers Consumers Consumers Aratdar (Jessore) MARKETING CHANNELS OF BRINJAL Results: Brinjal (Primary Survey) Retailer (Badda Kancha Bazar) Retailer (Gulshan DCC Market) Retailer (Mahakhali Kancha Bazar) 1.4 0.9 1.1 Wholesaler (Jatrabari Bazar) 1.2 Aratdar (Karwan Bazar) Bepari (Norshingdi) 3.7 1.3 Retailer (Karwan Bazar) Wholesaler (Karwan Bazar) 2.7 1.7 3.6 1.6 0.6 1.8 1.3 1.1 1.1 1.2 Faria 0.4 0.7 1 0 Marketing cost (Tk/kg) 5 4 3 2 Net marketing margin (Tk/kg) 6 MARKETING COST AND MARGINS OF BRINJAL INTERMEDIARIES Results: Brinjal (Primary Survey) Marketing channels Norshingdi-Dhaka Belabo-Karwan Bazar Belabo-Jatrabari Belabo-Mohakhali Kacha Bazar Belabo-Gulshan D.C.C .Market Belabo-Badda Kacha Bazar Raipura-Karwan Bazar Raipura-Jatrabari Raipura-Mohakhali Kacha Bazar Raipura-Gulshan D.C.C . Market Raipura-Badda Kacha Bazar Mean Jessore-Dhaka Chougacha-Karwan Bazar Chougacha-Jatrabari Chougacha-Mohakhali Kacha Bazar Chougacha-Gulshan D.C.C. Market Chougacha-Badda Kacha Bazar Mean Price spread (Tk. Kg-1) Growers’ share (%) 11.40 12.95 12.95 11.60 17.20 9.76 11.31 11.31 9.96 15.56 64.60 61.63 61.63 64.20 54.74 69.69 66.49 66.49 69.26 59.05 12.40 63.78 24.13 25.68 25.68 24.33 29.93 25.06 23.91 23.91 24.91 21.24 25.95 23.81 Results: Brinjal (Primary Survey) Marketing channels Marketing efficiency Stdev Norshingdi-Karwan Bazar 0.94 0.34 Norshingdi-Jatrabari 0.98 0.71 Norshingdi-Mohakhali Kacha Bazar 0.98 0.38 Norshingdi-Gulshan D.C.C. Market 0.92 0.51 Narshingdi-Badda Kacha Bazar 0.98 0.72 0.96 0.53 Chougacha-Karwan Bazar 0.89 0.33 Chougacha-Jatrabari 0.89 0.17 Chougacha-Mohakhali Kacha Bazar 0.83 0.53 Chougacha-Gulshan D.C.C. Market 0.80 0.13 Chougacha-Badda Kacha Bazar 0.84 0.26 0.69 0.28 Norshingdi-Dhaka Mean Jessore-Dhaka Mean Results: Okra (Primary Survey) 45 40 35 35 30 30 25 25 CV = 19.90 20 20 15 15 10 10 5 Area (000 ha) 2009-10 2008-09 2007-08 2006-07 2005-06 2004-05 2003-04 2002-03 2001-02 2000-01 0 5 0 Production (000 MT) Harvest (nominal) price (Tk/kg) Retail (nominal) price (Tk/kg) Harvest (real) price (Tk/kg) Retail (real) price (Tk/kg) AREA, PRODUCTION AND PRICE VARIATION OF OKRA Results: Okra (Primary Survey) CV: 35.75% Seasonal price variation in potato is lower due to sufficient cold stores To reduce seasonal price variation for highly perishables brinjal and okra specialized storage facilities are required Also refrigerated transport & technologies for shelf life extension are needed. SEASONALITY IN OKRA Channel (Comilla-Dhaka) Results: Okra (Primary Survey) Marketing costs and margins Farmer Retailer (Badda Kancha Bazar) Faria Net margin 8.97% Bepari Net margin: 12.75% Retailer (Gulshan DCC Market) Retailer (Mahakhali Kancha Bazar) Retailer (Karwan Bazar) Wholesaler (Jatrabari Bazar) Aratdar Net margin: 7.21% Wholesalers Net margin: 31.28% Retailers Net margin: 39.80% Consumers Wholesaler (Karwan Bazar) 1.2 2.3 1.7 3.3 1.3 3.5 1.1 3.6 1.3 2.8 1.6 2.8 Aratdar (Jatrabari Bazar) 1.1 0.7 Aratdar (Karwan Bazar) 1.2 0.6 Bepari (Nimshar, Comilla) 1.3 1.1 Faria (Comilla) 0.3 0.8 0.0 2.0 4.0 6.0 Marketing cost (Tk/kg) Net marketing margin (Tk/kg) MARKETING CHANNEL & MARKETING COST AND MARGINS (OKRA) Colombia Madagascar Dom. Rep. Tanzania Yemen Peru Mali Egypt Kenya Viet Nam Nigeria Philippines Bangladesh Brazil Indonesia Mexico Pakistan Thailand China India Production 000 mt) 18000 Results-Mango (Secondary) 16000 14000 12000 10000 8000 6000 4000 2000 0 GLOBAL RANKING IN MANGO PRODUCTION IN 2010 (FAOSTAT 2012) 1000 60 900 50 800 700 40 Production 600 500 30 400 20 300 200 10 100 0 0 Area (000 ha) Production (000 MT) Harvest (nominal) price (Tk/kg) Harvest (real) price (Tk/kg) Relationship between area, production and price (nominal and real price of mango in Bangladesh during 2004-05 to 2010-11 (BBS) Results-Mango (Primary) HARVESTING TOOLS AND METHODS (BANGLADESH & THAILAND) Results-Mango (Primary) Improved packaging (plastic crates) is used for long distance transportation of mango (from assemble market (Kansat, Shibgonj, Chapai Nowabgonj) to city wholesale market (Karwan Bazar, Dhaka). Still, some traders use bamboo basket (bamboo basket with gunny bag top) Results: Mango (Primary Survey) Owners (Give their orchard lease to other trader group or produce by themselves and subsequently sell to Faria or Bepari Producers (Produces on leased property as growers and sells mangoes to Faria or Bepari) Faria (18.95%) Bepari (25.13%) Aratdar (6.45%) Processing Wholesaler (11.86) Retailer (37.61) Consumers MARKETING CHANNEL OF MANGO Results: Mango (Primary Survey) 160 140 Price of mango (Tk/kg) 120 100 80 60 40 20 0 May Jun Jul Aug Sep May Jun Jul Aug Sep Farmers' price Retail price Khirshapat 35 45 45 50 Gopalbhog 35 40 40 45 Himsagar 35 40 50 60 Langra 40 45 75 80 Fazli 55 60 90 70 80 150 Bombai 35 30 60 55 Ashwini 30 60 90 50 100 150 MONTHLY PRICE VARIATION (2012) Results: Mango (Primary Survey) Retailer, Shambazar, Dhaka 0.7 Retailer, Gulshan, Dhaka 4.6 2.8 2.7 Retailer, Mahakhalia, Dhaka Retailer, Badamtali, Dhaka 0.6 Retailer, Jatrabari, Dhaka 4.9 4.5 3.6 1.4 Retailer, Karwan Bazar, Dhaka 4.3 2.6 Wholesaler, Badamtali, Dhaka 3.8 1.4 1.1 1.6 1.6 1.8 1.7 2.2 0.6 1.9 2.6 1.9 2.6 2.2 2.4 2.8 1.6 1.6 1.8 2.1 1.9 Wholesaler, Jatrabari, Dhaka Wholesaler, Karwan Bazar, Dhaka Aratdar, Badamtali, Dhaka Aratdar, Jatrabari, Dhaka Aratdar, Karwan Bazar, Dhaka Bepari, C. Nowabgonj Bepari, Rajshahi Faria, C. Nowabgonj Faria, Rajshahi 0 2 4 Marketing cost (Tk/kg) 6 Net margin (Tk/kg) 8 10 Results: Mango (Primary Survey) Performance of mango markets (Rajshahi and C. Nowabgonj-Dhaka City) Marketing channel Price received by Price paid by grower (Tk. Kg-1) consumers (Tk. Kg-1) Chapai Nowabgonj-Dhaka Bholahat-Karwan Bazar Bholahat-Jatrabari Bazar Bholahat-Badamtali Bholahat-Shambazar Mean Rajshahi-Dhaka Bagha-Karwan Bazar Bagha-Jatrabari Bazar Bagha-Badamtali Bagha-Shambazar Mean PREVIOUS PACKAGING Price spread (Tk. Kg-1) Growers’ share (%) 37.72 37.72 37.72 37.72 54.00 51.00 48.00 60.00 16.28 13.28 10.28 22.28 69.85 73.96 78.58 62.87 37.72 53.25 15.53 71.32 43.40 43.40 43.40 43.40 54.00 51.00 48.00 60.00 10.60 7.60 4.60 16.60 80.37 85.10 90.42 72.33 43.40 53.25 9.85 82.05 PRESENT PACKAGING Results: Mango (Primary Survey) Acharya’s marketing efficiency of various channels in mango trade (Chapai Nowabgonj-Dhaka and Rajshahi-Dhaka) Marketing channels Chapai Nowabgonj-Dhaka Bholahat-Badamtoli Bholahat-Shambazar Mean Rajshahi-Dhaka Bagha-Badamtoli Bagha-Shambazar Mean Marketing efficiency Stdev 4.08 4.14 4.11 1.31 1.04 1.18 4.35 4.21 4.28 1.28 1.31 1.30 1200 70 1000 60 Results-Banana (Secondary) 16 50 14 40 30 400 20 200 10 Production (000 MT) Area (000 ha) 2009-10 2008-09 2007-08 2006-07 2005-06 2004-05 2003-04 2002-03 0 2001-02 0 12 Harvest and retail price 600 2000-01 Production 800 10 8 6 4 2 0 Yield (MT/ha) Harvest (nominal) price (Tk/Hali) Harvest (real) price (Tk/Hali) Retail (nominal) price (Tk/Hali) Retail (real) price Tk/Hali Results-Banana (Secondary) Seasonal price variation is pronounced in banana. Indicates the need to introduce winter fruit species to reduce monthly price variation. Research is needed for developing fruit varieties for winter season Seasonality in banana prices (wholesale-Tangail) as a ratio to moving average (Sources: DAM). Results-Banana (Primary Survey) Farmer (sells to Faria or Bepari); net profit: Tk. 187.09 bunch-1 of Sabri Farm Madhupur Faria (sells to Bepari); Net margin: 6.79% Bepari (sells to wholesalers via Aratdar); Net margin: 15.21% Aratdar Karwan Bazar (commission agent); Net margin: 17.52% Dhaka Wholesaler Karwan Bazar (sells to retailers or consumers); Net margin: 27.13% Retailer Karwan Bazar (sells to consumer); Net margin: 33.33% Dhaka Consumers Results-Banana (Primary Survey) Results-Banana (Primary Survey) Marketing channels Kushtia-Dhaka Kushtia-Karwan Bazar Kushtia-Jatrabari Bazar Kushtia-Mahakhali Kushtia-Gulshan D.C.C. Mean Tangail-Dhaka Kushtia-Karwan Bazar Kushtia-Jatrabari Bazar Kushtia-Mahakhali Kushtia-Gulshan D.C.C. Mean Farmers' Retail price Price spread Growers Acharya’a price (Tk. (Tk. bunch-1) (Tk. bunch-1) share (%) efficiency bunch-1) 306.36 306.36 306.36 306.36 424.00 430.00 388.00 420.00 117.64 123.64 81.64 113.64 72.25 71.25 78.96 72.94 2.93 3.13 2.85 2.66 306.36 415.50 109.14 73.85 2.89 248.00 248.00 248.00 248.00 424.00 430.00 388.00 420.00 176.00 182.00 140.00 172.00 58.49 57.67 63.92 59.05 3.17 3.08 2.91 2.86 248.00 415.50 167.50 59.78 3.01 Price spread and growers’ share in marketing channel of banana starting from Tangail and Kushtia to Dhaka city (Variety: Sabri; Price: May 2012) Policy Implications and Recommendations 1. SAFEGURDING GROWERS’ INTEREST Encourage contract farming to increase growers’ income: Growers’ shares particularly for vegetables are less (Okra: 39.3843.72%; Brinjal: 23.81-63.78%; Potato: 49.33-70.55). Growers’ shares in fruit marketing are high (Mango: 71.32-82.09%; Banana: 59.78-73.85%). Hence, to elevate growers’ share in vegetables supply chain, contract farming should be encouraged & facilitated as a means of reducing costs of intermediation. Policy Implications and Recommendations 2. MONITORING INTERMEDIARIES IN SUPPLY CHAIN Unusually high marketing margins of retailers: Results revealed that net margins of retailers are consistently and unusually higher (33-54% of the total net margins of intermediaries) regardless of the crop. So, regular monitoring and more competition at the retail level, especially in Dhaka city are required. Price control by organized traders: Control of commodity price is a much-talked issue in marketing. Public perception is that there exists syndicate in market which actually controls prices. Our study revealed that even though there is no visible syndicate but there exists indirect price control mechanism. Policy Implications and Recommendations 3. MAINTENANCE OF QUALITY AND SAFETY IN SUPPLY CHAIN Quality and grade standard: Bangladesh lacks standardized quality assurance systems for horticultural produce. Proper arrangement should be made to develop national quality management system to train, and ultimately to accredit, growers and traders in the major international certifications, HACCP, ISO, GAP, GMP. Safe use of chemicals: Delivery of high quality and safe produce to customers is the ultimate goal of efficient marketing. There is public outcry on food safety due to perceived health risk. Therefore, use of recommended pesticides, plant growth regulators & ripening agents must be ensured. Research, training, motivation and strong media campaign are needed to improve the situation. Policy Implications and Recommendations 4. CAPACITY STRENGTHENING IN POSTHARVEST TECHNOLOGY Dissemination of appropriate technology: Government may assist disseminate technical information, e.g. cauliflower, broccoli, apples, grapes, etc. can be stored with potato due to compatibility while mango, papaya, banana can’t. This is probably more important than providing improved access to capital. Optimization of traditional storage technology: Bangladesh is facing tremendous crisis in power sector, and hence different traditional storage methods of perishable fruits and vegetables s would be researched, refined, optimized and extended. Policy Implications and Recommendations 5. IMPROVEMENT OF TRANSPORTATION SYSTEM Relocation of wholesale markets from Dhaka city: Huge wastage occurred due to restricted movement of trucks into Dhaka city. Currently, the trucks are not allowed to enter into Dhaka after 6:00 AM. If a vehicle gets late due to some unforeseen reasons, the entire products are spoiled. Smooth movement of perishables carrying trucks should be ensured to reduce wastage. Therefore, relocation of wholesale markets from the centre of Dhaka city to the nearby places would be considered. Policy Implications and Recommendations 6. IMPROVEMENT OF PACKAGING SYSTEM Introduction of affordable plastic package: For long-distance transportation, voluminous package made of bamboo baskets & gunny sacks are predominantly used, which result in high spoilage due to impact, vibration & heat generation. Recently, mango traders adopted plastic crates & postharvest loss greatly minimized. It can be used for other high value fruits & vegetables. Introduction of 50-kg net bags for potato storage: There is strong demand from cold stores to introduce 50-kg plastic net bags replacing 84-kg jute bags to facilitate handling. The presently used 84-kg jute bags are hard to carry by individual labourer, and would be hazardous to their health in longer term. Policy Implications and Recommendations 7. ESTABLISHMENT OF IMPROVED STORAGE FACILITIES Pronounced seasonality in fruits & vegetables than cereals: Seasonal price indices are lower in rice (CV 2.96%) and wheat (CV 3.68%) as compared to potato (CV 24.57%), brinjal (CV 35.75%) and okra (CV 32.71%). Lower price variation of rice and wheat is due to less perishability. By contrast, higher price variation of fruits and vegetables is due to high perishability and lack of storage. To reduce seasonal price variation, storage facilities for perishables should be created. Policy Implications and Recommendations Improvement of power supply: The most important problem in potato cold stores is the paucity of uninterrupted supply of electricity. Uninterrupted electricity supply is required, especially during loading period (March-May). Research to produce alternative energy (conversion of agro-waste to power) should also be given the top priority. Increase the number of BADC cold stores: There is high demands of BADC cold stores, especially for seeds. Presently, there are 18 BADC cold stores and 5 under construction. There are scopes to further increase the number of BADC cold stores. BADC potato seed programme is one of the very few profitable programmes of the Government of Bangladesh. Since, 80% of the potato seeds are farmers own seeds that are held in commercial cold stores the BADC staff may monitor private cold stores and issue certificates of good storage practices. Policy Implications and Recommendations 8. ADOPTION OF MODERN MARKETING Adoption of modern marketing facilities is required: Adoption of modern facilities in agricultural marketing is important. However, there is a debate on this issue whether modernization can curtail jobs. Trade-off would be a very useful alternative where the extra work force can find better option and contribute to the overall economic development of the country. Introduction of modern loading/unloading equipments: Loading and unloading by manual labour is time consuming, costly and health hazardous. Forklifts can be introduced in the local assemble and big wholesale markets. However, the economic feasibility of the new facility needs to be carefully examined prior to its introduction into Bangladesh. Policy Implications and Recommendations 9. VALUE ADDITION FOR DIVERSIFIED USE Value addition of agro-produce: Use of potatoes could be diversified to safeguard growers’ interest. Various value added products like potato flakes, dried chips, French fries, potato powder, etc. could be produced and used for domestic and international marketing. However, to access mainstream export markets the food enterprises must comply with the application of GMP, GHP and HACCP. Alternative of rice and wheat during peak price months: Result on seasonal price variation underlined the vital role of potato as a source of macro nutrients because the peak prices of rice and wheat were fairly synchronized but potato is counter synchronized to rice and wheat. So, there are ample scope to popularize potato and potato products as the alternatives of rice and wheat. Policy Implications and Recommendations 11. RAPID ACCESS TO MARKET INFORMATION Easy access to market information: Access to right information on market price and trend in market price is very important. The farmer must be aware about the prevailing prices of commodities. In this regard, board may be used to display daily prices of agricultural commodities in the market. Also DAM can send price information to farmers by SMS. Upgrading the price data in BBS & DAM: Results of primary survey demonstrated that there exists wide price variation among varieties. However, in the BBS and DAM reports, there are paucity of such valuable details. Therefore, in the BBS & DAM reports harvest, wholesale and retail prices of important varieties should be included. This could ensure better use of market information by the growers, intermediaries, researchers, extension workers and policy makers. THANK YOU